Podcast: Low Inflation - Opportunities And Challenges

Table of Contents

Understanding Low Inflation and its Causes

Defining Low Inflation

What constitutes "low inflation"? Generally, central banks target a low, positive inflation rate, typically around 2%, aiming for price stability. Low inflation differs significantly from deflation, which represents a sustained decline in the general price level. Deflation is generally considered far more harmful to an economy than low inflation. Historically, periods of low inflation have been interspersed with periods of higher inflation, reflecting the cyclical nature of economic activity.

- Target Inflation Rates: Major central banks, such as the Federal Reserve (US) and the European Central Bank (ECB), typically aim for inflation rates between 1.5% and 2%. These targets are regularly reviewed and adjusted based on economic conditions.

- Key Indicators: The Consumer Price Index (CPI) and the Producer Price Index (PPI) are key metrics used to measure inflation. CPI tracks changes in the price of goods and services purchased by consumers, while PPI measures changes in the prices of goods and services at the wholesale level. Different measurement methods can yield slightly different inflation figures. Understanding these nuances is critical for interpreting inflation data.

Factors Contributing to Low Inflation

Several economic forces contribute to the current environment of low inflation:

- Globalization and Increased Competition: Globalization has intensified competition, putting downward pressure on prices for many goods and services. Increased access to cheaper imports from developing economies impacts domestic price levels.

- Technological Advancements: Technological progress, including automation and increased productivity, has reduced production costs, leading to lower prices for consumers. This is particularly evident in sectors like electronics and manufacturing.

- Changes in Consumer Behavior: Shifts in consumer preferences, such as increased demand for value-oriented products and services, also contribute to keeping inflation low. The rise of online shopping and increased price transparency also allows consumers to make more informed purchasing decisions leading to pricing pressure.

- Monetary Policies: Central bank policies, such as low interest rates and quantitative easing (QE), have played a significant role in keeping inflation low. These policies, aimed at stimulating economic growth, can have unintended consequences on inflation.

- Global Economic Slowdown: Periods of slower global economic growth can lead to lower demand, impacting prices and contributing to low inflation, even disinflationary pressures in certain sectors.

Opportunities Presented by Low Inflation

Increased Purchasing Power

Low inflation translates to increased purchasing power for consumers. With prices rising slowly, consumers can stretch their budgets further.

- Impact on Spending: Consumers are more likely to increase spending when their purchasing power is high, which stimulates economic activity.

- Savings Rates: Low inflation encourages saving, as the real return on savings is higher when prices aren't rising rapidly.

- Debt Management: The real burden of debt is reduced when inflation is low, making it easier to manage outstanding loans.

Favorable Investment Climate

A low inflation environment can present attractive investment opportunities:

- Long-Term Bonds: Low inflation makes long-term bonds more appealing, as the real return is higher.

- Real Estate: Real estate can be a good hedge against inflation, although appreciation may be slower in a low-inflation environment.

- Equities: While equity performance isn't directly tied to inflation, a stable price environment can positively impact investor sentiment and long-term growth.

- Business Opportunities: Businesses benefit from lower borrowing costs and the ability to plan long-term projects with greater certainty.

Stimulating Business Growth

Low inflation can foster a positive environment for business expansion:

- Lower Borrowing Costs: Low interest rates make it cheaper for businesses to borrow money for investment and expansion.

- Increased Consumer Demand: Increased purchasing power often leads to higher consumer demand, boosting sales for businesses.

- Improved Profitability: Lower input costs and stable pricing contribute to improved business profitability.

Challenges Posed by Low Inflation

Deflationary Risks

While low inflation is generally preferable to high inflation, it carries the risk of tipping into deflation, a dangerous economic spiral:

- The Vicious Cycle: Deflation encourages consumers to postpone purchases, anticipating lower prices in the future. This reduced demand leads to further price reductions, creating a negative feedback loop that can be difficult to break.

- Impact on Confidence: Deflation erodes consumer and business confidence, hindering investment and growth.

- Debt Burden: In a deflationary environment, the real value of debt increases, making it harder for individuals and businesses to service their loans.

Monetary Policy Limitations

Central banks face significant challenges in managing low inflation:

- Near-Zero Interest Rates: When interest rates are already near zero, central banks have limited room to further stimulate the economy through interest rate cuts.

- Quantitative Easing (QE) Limitations: QE, which involves injecting money into the economy by purchasing assets, can be less effective in stimulating inflation and may lead to asset bubbles.

- Unintended Consequences: Monetary policies aimed at combating low inflation can have unintended consequences, such as increased asset price inflation or excessive risk-taking.

Stagnant Wage Growth

Low inflation can be associated with stagnant wage growth:

- Impact on Consumer Spending: Stagnant wages limit consumer spending, potentially hindering economic growth.

- Economic Inequality: Stagnant wages can exacerbate income inequality, leading to social and political instability.

- Worker Morale and Productivity: Low wage growth can negatively impact worker morale and productivity.

Conclusion

Low inflation presents a complex economic landscape, offering both opportunities and challenges. While increased purchasing power and favorable investment climates can stimulate growth, the risks of deflation, monetary policy limitations, and stagnant wage growth must be carefully considered. Proactive strategies, including diversification of investments and prudent fiscal policies, are essential for navigating this environment effectively. Careful risk management and a keen understanding of the forces driving low inflation are crucial for businesses, investors, and consumers alike.

Call to Action: Stay informed about the ever-evolving dynamics of low inflation by exploring further resources on economic trends. Understanding and adapting to the nuances of low inflation is crucial for navigating today's complex economic landscape. Continue your exploration into this critical topic – learn more about specific investment strategies in a low-inflation environment.

Featured Posts

-

Watch Tracker Season 2 Episode 13 Live Guide To Cbs And Online Streaming

May 27, 2025

Watch Tracker Season 2 Episode 13 Live Guide To Cbs And Online Streaming

May 27, 2025 -

The Rise And Fall Of Michelle Mone A Tv Story

May 27, 2025

The Rise And Fall Of Michelle Mone A Tv Story

May 27, 2025 -

Where To Watch Fulham Vs Chelsea Live Stream Tv Channel And Time

May 27, 2025

Where To Watch Fulham Vs Chelsea Live Stream Tv Channel And Time

May 27, 2025 -

Ghost Season 4 Finale Your Guide To Free And Paid Streaming

May 27, 2025

Ghost Season 4 Finale Your Guide To Free And Paid Streaming

May 27, 2025 -

Game Face Your Preview Of Tonights Matlock Episode S01 E15

May 27, 2025

Game Face Your Preview Of Tonights Matlock Episode S01 E15

May 27, 2025

Latest Posts

-

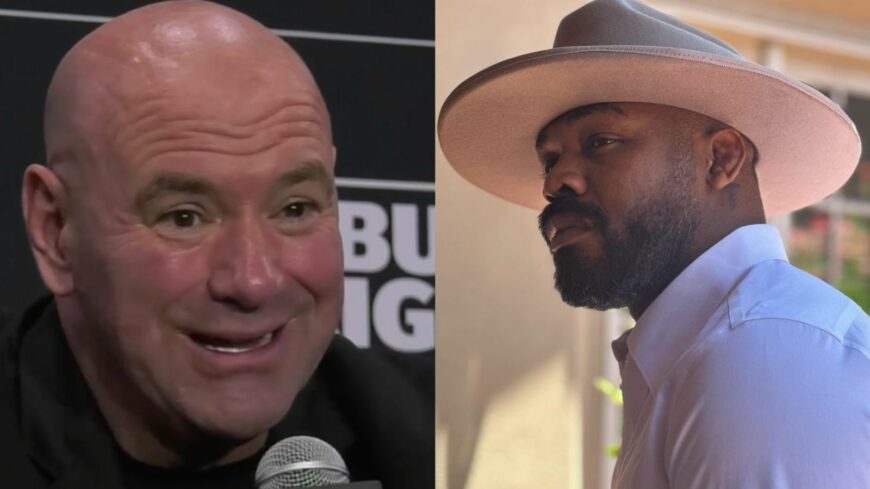

Jon Jones Discusses Injury Sustained While Training With Hasbulla

May 30, 2025

Jon Jones Discusses Injury Sustained While Training With Hasbulla

May 30, 2025 -

Hasbulla Fight Jon Jones Details Injury

May 30, 2025

Hasbulla Fight Jon Jones Details Injury

May 30, 2025 -

Jon Joness Hasbulla Fight The Injury Revealed

May 30, 2025

Jon Joness Hasbulla Fight The Injury Revealed

May 30, 2025 -

French Open Djokovic Secures Opening Round Win

May 30, 2025

French Open Djokovic Secures Opening Round Win

May 30, 2025 -

Djokovics Winning Start At The French Open

May 30, 2025

Djokovics Winning Start At The French Open

May 30, 2025