Point72's Departure Signals Shift In Emerging Markets Investment

Table of Contents

Analyzing Point72's Reasons for Withdrawal

Point72's decision to reduce its exposure to emerging markets is likely driven by a confluence of factors. Understanding these reasons is crucial for gauging the broader implications for the investment community.

-

Increased Volatility in Emerging Markets: The inherent volatility of emerging markets, exacerbated by recent global events, may have prompted Point72 to reassess its risk profile. Fluctuations in currency values, political instability, and economic uncertainty contribute to higher risk levels.

-

Concerns about Regulatory Changes: Changes in regulatory environments within specific emerging markets can significantly impact investment returns and create uncertainty for investors. Navigating complex and evolving regulations adds another layer of complexity.

-

Shift in Investment Strategy: Point72's internal restructuring or a shift towards other asset classes deemed more promising might explain the reduction in emerging markets exposure. This could reflect a reallocation of capital based on internal assessments of risk and return.

-

Performance of Specific Emerging Market Investments: Underperformance of specific investments in certain emerging markets could contribute to the decision. A thorough review of past performance and future projections likely influenced the strategic shift.

-

Difficulty in Finding Attractive Risk-Adjusted Returns: The challenge of identifying investments offering sufficient risk-adjusted returns in emerging markets may have played a significant role. The search for higher returns often requires accepting increased risk, a balance Point72 may have found less appealing.

Impact on Emerging Market Investment Landscape

Point72's move sends ripples across the emerging markets investment landscape, prompting broader questions about investor sentiment and capital flows.

Will other hedge funds follow suit? The decision may signal a broader trend of risk aversion among institutional investors, leading to reduced investment volume in certain sectors. This could particularly impact smaller or less-established companies in emerging markets.

-

Reduced Investment Volume in Certain Sectors: A decreased appetite for risk could lead to reduced investments in specific sectors traditionally favored by hedge funds.

-

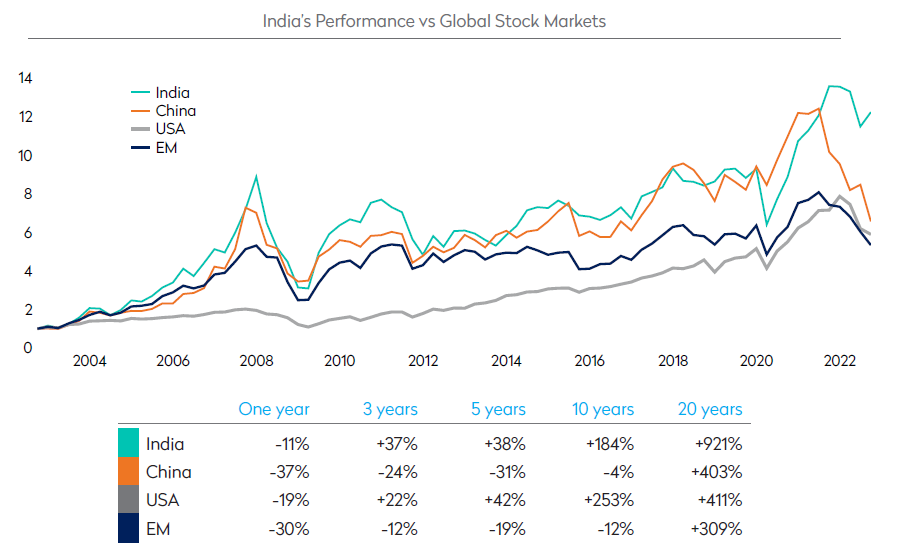

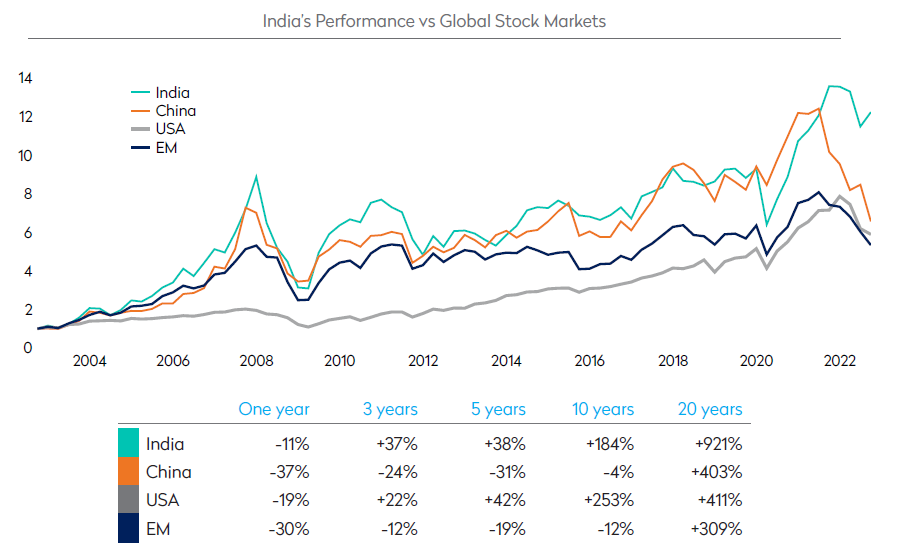

Potential Impact on Valuations of Emerging Market Assets: Lower investment volumes could potentially depress valuations of emerging market assets, creating both opportunities and challenges for investors.

-

Increased Risk Aversion Among Investors: Point72's decision might signal increased caution among other investors, leading to a more conservative approach to emerging markets investments.

-

Opportunities for Other Investors to Fill the Void: The departure of a major player like Point72 might open doors for other investors willing to take on increased risk in search of potentially higher returns.

Potential Opportunities and Risks Arising from the Shift

Point72's departure presents a complex scenario, simultaneously offering opportunities and exacerbating risks in emerging markets.

Opportunities:

-

Lower Valuations Creating Buying Opportunities: Reduced investor interest might lead to lower valuations for certain assets, potentially creating attractive buying opportunities for those with a higher risk tolerance.

-

Potential for Higher Returns Due to Increased Risk: The increased risk associated with the shifting landscape could translate into potentially higher returns for investors willing to take on greater exposure.

Risks:

-

Increased Volatility: The uncertainty surrounding the future of emerging markets investment could lead to increased market volatility, making it more challenging to predict market movements.

-

Difficulty in Predicting Market Movements: The complex interplay of economic, political, and social factors makes accurate forecasting extremely difficult in emerging markets.

-

Geopolitical Instability: Geopolitical events and tensions can significantly impact market stability and returns in emerging markets.

The Future of Emerging Markets Investment: Predictions and Outlook

Predicting the future of emerging markets investment is inherently challenging. However, considering Point72's departure alongside broader market trends offers some insights.

-

The Role of Technological Advancements: Technological innovations will continue to reshape emerging markets, creating new opportunities and potentially disrupting existing industries.

-

The Influence of Global Economic Conditions: Global economic growth or contraction significantly impacts capital flows into emerging markets.

-

The Impact of Climate Change on Investment Decisions: Climate change poses both risks and opportunities, influencing investment decisions in sectors like renewable energy and sustainable infrastructure.

-

The Growth of Sustainable Investment in Emerging Markets: Growing investor interest in environmental, social, and governance (ESG) factors will shape investment strategies in emerging markets.

Conclusion: Navigating the New Landscape of Emerging Markets Investment

Point72's retreat from significant emerging markets investment underscores the evolving dynamics and inherent risks within this sector. While opportunities exist for those willing to accept higher risk, a cautious approach is warranted. The implications of this shift are multifaceted, affecting valuations, investor sentiment, and capital flows. Investors must carefully consider the potential opportunities and risks before committing capital. Conduct thorough research, seek professional advice, and stay informed on the latest developments in emerging markets investment and adapt your strategy accordingly to navigate this evolving landscape. Understanding the changing landscape of investing in emerging markets is crucial for long-term success.

Featured Posts

-

Meester De Lente Leer De Taal Van Het Voorjaar

Apr 26, 2025

Meester De Lente Leer De Taal Van Het Voorjaar

Apr 26, 2025 -

Greenland False News Denmark Points Finger At Russia In Us Related Dispute

Apr 26, 2025

Greenland False News Denmark Points Finger At Russia In Us Related Dispute

Apr 26, 2025 -

Mission Impossible The Final Reckoning Behind The Scenes Svalbard Filming

Apr 26, 2025

Mission Impossible The Final Reckoning Behind The Scenes Svalbard Filming

Apr 26, 2025 -

Us Port Fees To Wallop Auto Carrier With 70 Million Hit

Apr 26, 2025

Us Port Fees To Wallop Auto Carrier With 70 Million Hit

Apr 26, 2025 -

Damen And Fugro Deliver Enhanced Marine Security For Royal Netherlands Navy

Apr 26, 2025

Damen And Fugro Deliver Enhanced Marine Security For Royal Netherlands Navy

Apr 26, 2025

Latest Posts

-

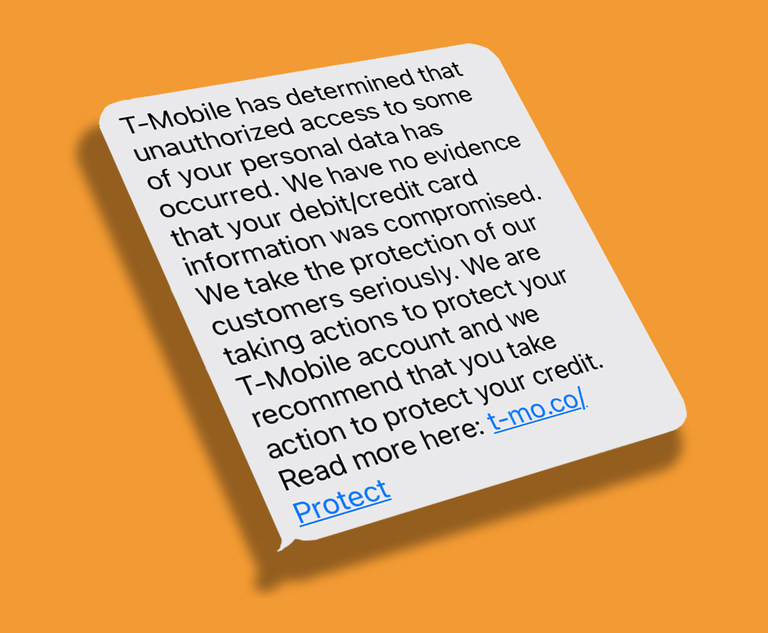

T Mobile Hit With 16 Million Fine Over Three Year Data Breach

Apr 27, 2025

T Mobile Hit With 16 Million Fine Over Three Year Data Breach

Apr 27, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 27, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 27, 2025 -

Repetitive Documents Ai Creates A Compelling Poop Podcast

Apr 27, 2025

Repetitive Documents Ai Creates A Compelling Poop Podcast

Apr 27, 2025 -

Ai Digest How To Create A Podcast From Repetitive Scatological Data

Apr 27, 2025

Ai Digest How To Create A Podcast From Repetitive Scatological Data

Apr 27, 2025 -

From Scatological Documents To Engaging Podcast Ais Role In Content Transformation

Apr 27, 2025

From Scatological Documents To Engaging Podcast Ais Role In Content Transformation

Apr 27, 2025