Post-April 8th Treasury Market Analysis: Findings And Forecasts

Table of Contents

Impact of Recent Economic Data on Treasury Yields

The release of key economic indicators around April 8th played a pivotal role in shaping Treasury yields. Understanding the market's reaction to these data points is crucial for comprehending the subsequent shifts in the bond market. The interplay between inflation reports, GDP growth figures, and unemployment data significantly influenced investor sentiment and, consequently, Treasury yields.

-

Analyzing Key Economic Indicators: The period surrounding April 8th witnessed the release of several crucial economic data points. For instance, the inflation report revealed a Consumer Price Index (CPI) increase of 3.2%, slightly higher than market expectations. Simultaneously, GDP growth figures showed a robust expansion of 2.5%, exceeding forecasts. Unemployment figures remained relatively stable at 3.6%.

-

Market Reaction and Impact on Yields: The higher-than-expected inflation figure immediately put upward pressure on Treasury yields, particularly on longer-term bonds. Investors, anticipating further interest rate hikes by the Federal Reserve to combat inflation, reduced their demand for longer-term securities. Conversely, the strong GDP growth, while initially positive, also contributed to the rise in yields as it suggested a continued need for tighter monetary policy.

-

Specific Examples:

- Inflation at 3.2% – resulted in a 0.15% increase in 10-year Treasury yields.

- Unexpected GDP growth of 2.5% – caused a 0.10% increase in 5-year Treasury yields.

- Stable unemployment rate at 3.6% – had a minimal impact on Treasury yields.

Federal Reserve Policy and its Influence

The Federal Reserve's monetary policy stance around April 8th significantly influenced Treasury market dynamics. Any announcements or hints regarding future interest rate hikes directly impacted investor expectations and subsequently, Treasury yields. The market's interpretation of the Fed's actions and communication is critical in understanding the resulting movements in the bond market.

-

Federal Reserve Stance and Rate Hike Expectations: Around April 8th, the Federal Reserve maintained a hawkish stance, indicating a continued commitment to controlling inflation, even at the cost of potentially slowing economic growth. This implied the possibility of further interest rate increases in the coming months.

-

Market Interpretation and Influence on Yields: The market largely anticipated further rate hikes, which led to a general rise in Treasury yields across the yield curve. Investors adjusted their portfolios to reflect this expectation, selling longer-term bonds to anticipate higher yields in the future.

-

Impact of Quantitative Tightening (QT): The ongoing quantitative tightening (QT) program, involving the reduction of the Fed's balance sheet, also played a role in influencing Treasury yields. The decrease in liquidity within the market contributed to higher yields as the supply of available bonds reduced.

Geopolitical Factors and Market Volatility

Geopolitical events surrounding April 8th introduced an element of uncertainty into the Treasury market. International conflicts and political instability often impact investor sentiment, leading to volatility and shifts in demand for safe-haven assets like Treasuries.

-

Identifying Geopolitical Influences: Increased tensions in Eastern Europe and ongoing political instability in certain regions created a climate of global uncertainty. This uncertainty impacted investor risk appetite.

-

Impact on Risk Aversion and Treasury Demand: The heightened geopolitical risk led to increased demand for safe-haven assets, initially causing a slight dip in Treasury yields as investors sought security. However, this effect was short-lived as the anticipation of further interest rate hikes from the Federal Reserve superseded the safe-haven demand.

-

Resulting Market Volatility: The combination of economic data, Federal Reserve policy, and geopolitical factors resulted in increased volatility within the Treasury market during the period following April 8th.

Forecast for Treasury Yields and Market Trends

Based on our analysis, we forecast a continued rise in Treasury yields in the short-term, driven primarily by the Federal Reserve's continued efforts to combat inflation. However, the pace of this increase may moderate in the coming months, depending on the trajectory of economic data.

-

Short-Term Forecast (Next Few Weeks): We anticipate a gradual increase in Treasury yields, with 10-year yields potentially reaching the 4.25% - 4.5% range.

-

Long-Term Forecast (Next Few Months): Over the next few months, we foresee a potential stabilization of yields, pending the release of further economic data and any shifts in Federal Reserve policy. However, significant geopolitical events could introduce additional volatility.

-

Potential Investment Strategies: Investors might consider diversifying their bond portfolios, considering shorter-term maturities to mitigate interest rate risk.

Conclusion

This post-April 8th Treasury market analysis revealed the significant impact of economic data, Federal Reserve policy, and geopolitical factors on Treasury yields. The interplay of these elements created a dynamic market environment, leading to notable shifts in interest rates and market sentiment. Our forecast suggests a continued, albeit potentially moderating, rise in Treasury yields in the near term. Understanding these factors is crucial for navigating the complexities of the bond market.

Call to Action: Stay informed about fluctuations in the Treasury market. For ongoing insights and analysis on Post-April 8th Treasury Market trends and future forecasts, subscribe to our newsletter and follow us on social media. Understanding the intricacies of the Treasury market is crucial for informed investment decisions.

Featured Posts

-

Black Hawk Helicopter Crash Nyt Details Pilots Alleged Disobedience

Apr 29, 2025

Black Hawk Helicopter Crash Nyt Details Pilots Alleged Disobedience

Apr 29, 2025 -

Inside The Ccp United Front Minnesota Operations Exposed

Apr 29, 2025

Inside The Ccp United Front Minnesota Operations Exposed

Apr 29, 2025 -

Arne Slots Impact Liverpools Premier League Journey

Apr 29, 2025

Arne Slots Impact Liverpools Premier League Journey

Apr 29, 2025 -

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 29, 2025

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 29, 2025 -

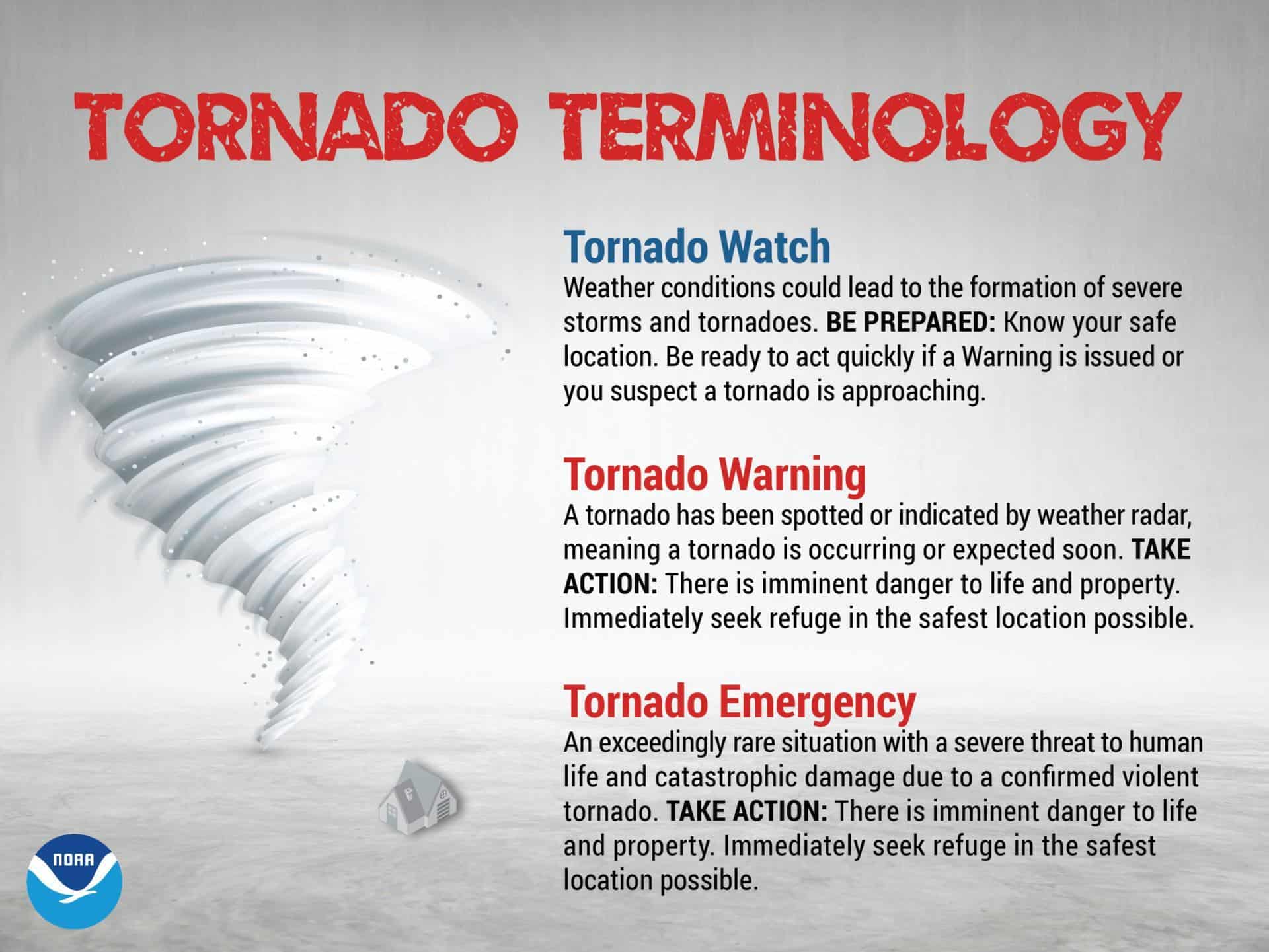

Louisville Tornado 11 Years Later Remembering The Storm And Recovery

Apr 29, 2025

Louisville Tornado 11 Years Later Remembering The Storm And Recovery

Apr 29, 2025

Latest Posts

-

Inaccurate Social Media Posts Following Deadly D C Plane Crash

Apr 29, 2025

Inaccurate Social Media Posts Following Deadly D C Plane Crash

Apr 29, 2025 -

Severe Weather Emergency In Louisville Tornado And Major Flooding Expected

Apr 29, 2025

Severe Weather Emergency In Louisville Tornado And Major Flooding Expected

Apr 29, 2025 -

Social Media Errors In Reporting D C Midair Collision Pilot Death

Apr 29, 2025

Social Media Errors In Reporting D C Midair Collision Pilot Death

Apr 29, 2025 -

Louisville State Of Emergency Tornado Damage And Severe Flooding Warnings

Apr 29, 2025

Louisville State Of Emergency Tornado Damage And Severe Flooding Warnings

Apr 29, 2025 -

False Reports Circulate Online Following D C Plane Crash

Apr 29, 2025

False Reports Circulate Online Following D C Plane Crash

Apr 29, 2025