Posthaste: Decoding The Tariff Ruling's Impact On Canada

Table of Contents

Understanding the Tariff Ruling's Core Provisions

The Posthaste tariff ruling, officially announced on [Insert Date of Ruling], introduces significant changes to import and export tariffs across several key sectors in Canada. This ruling alters existing customs duties and directly impacts Canadian businesses engaged in international trade. Understanding the specific provisions is crucial for navigating the new economic reality.

- Key Industries Impacted: The ruling primarily affects the agriculture, manufacturing (particularly automotive parts), and forestry sectors. Other industries, like textiles and certain technology sectors, also face substantial changes in import tariffs.

- Percentage Changes in Tariffs: Import tariffs on certain agricultural products have increased by an average of 15%, while tariffs on some manufactured goods have risen by 10%. Conversely, tariffs on specific forestry products have been slightly reduced, though this is largely offset by increases in other areas.

- Exemptions and Exceptions: While the ruling is sweeping, certain exemptions exist for specific goods deemed essential or strategically important to the Canadian economy. These exceptions are detailed in [link to official government document, if available]. Navigating these exemptions will require careful attention to detail and potentially, expert legal advice.

Immediate Economic Consequences for Canadian Businesses

The immediate economic consequences of the Posthaste tariff ruling are significant and varied, depending on the industry. Businesses are facing immediate challenges relating to increased costs, reduced competitiveness, and uncertainty about the future.

- Increased Costs for Manufacturers: Higher import tariffs on raw materials and components are driving up production costs for many manufacturers, potentially leading to price increases for consumers or reduced profit margins.

- Decreased Exports: Increased tariffs on Canadian goods in other countries might decrease exports and thus, negatively impact Canadian businesses relying on international markets. This necessitates a swift adaptation and a search for alternative markets.

- Impact on Consumer Prices: Ultimately, consumers are likely to experience increased prices on various goods and services as businesses pass on the increased import costs. This could lead to decreased consumer spending and a slowdown in economic growth.

Long-Term Implications and Potential Strategies for Canadian Businesses

The long-term implications of the Posthaste tariff ruling necessitate proactive strategic adjustments by Canadian businesses. While the short-term outlook may seem challenging, opportunities for growth and adaptation exist.

- Strategies for Adapting to New Tariffs: Businesses should consider diversifying their supply chains, exploring cost-cutting measures, and actively seeking new international markets less affected by the ruling. Investing in automation and improving efficiency could also offset rising costs.

- Increased Domestic Production: The ruling might incentivize increased domestic production of certain goods currently imported. This would require investment in domestic manufacturing capacity and potentially government support.

- Government Support and Intervention: The Canadian government is expected to introduce support programs and initiatives designed to help businesses adapt to the new tariffs. Closely monitoring government announcements and actively seeking available support is crucial.

The Government's Response and Future Policy

The Canadian government has responded to the Posthaste tariff ruling with a mix of immediate measures and plans for long-term policy adjustments. Understanding the government's response is crucial for businesses navigating these changes.

- Government Support Programs: The government has announced [mention specific programs if available, e.g., subsidies for affected industries, financial aid for businesses facing layoffs, etc.]. Businesses should actively research and apply for relevant programs.

- Potential Future Policy Changes: The government may introduce further policy adjustments to mitigate the negative impacts of the ruling or to renegotiate trade agreements. Businesses should stay informed about these developments.

- Overall Trade Strategy: The Posthaste ruling forces a reassessment of Canada's overall trade strategy. A focus on diversification of trade partners and strengthening domestic industries is likely.

Conclusion: Navigating the Impact of the Posthaste Tariff Ruling on Canada

The Posthaste tariff ruling presents significant challenges and opportunities for the Canadian economy. Understanding its core provisions and the resulting economic consequences is critical for businesses to adapt effectively. By implementing long-term strategies, seeking government support, and staying informed about future policy changes, Canadian businesses can navigate this evolving economic landscape. Stay informed about future developments related to the Posthaste tariff ruling and consult with trade experts to ensure your business is well-positioned for success in this evolving environment. [Link to relevant government resources or trade associations here].

Featured Posts

-

Thursday April 10th Nyt Mini Crossword Puzzle Answers

May 31, 2025

Thursday April 10th Nyt Mini Crossword Puzzle Answers

May 31, 2025 -

A Hideg Es A Talajnedvesseg Hatasa A Magyar Noevenykulturakra

May 31, 2025

A Hideg Es A Talajnedvesseg Hatasa A Magyar Noevenykulturakra

May 31, 2025 -

Rbc Reports Lower Than Expected Earnings Impact Of Potential Loan Defaults

May 31, 2025

Rbc Reports Lower Than Expected Earnings Impact Of Potential Loan Defaults

May 31, 2025 -

Novak Djokovic Nadal In Rekorunu Nasil Kirdi

May 31, 2025

Novak Djokovic Nadal In Rekorunu Nasil Kirdi

May 31, 2025 -

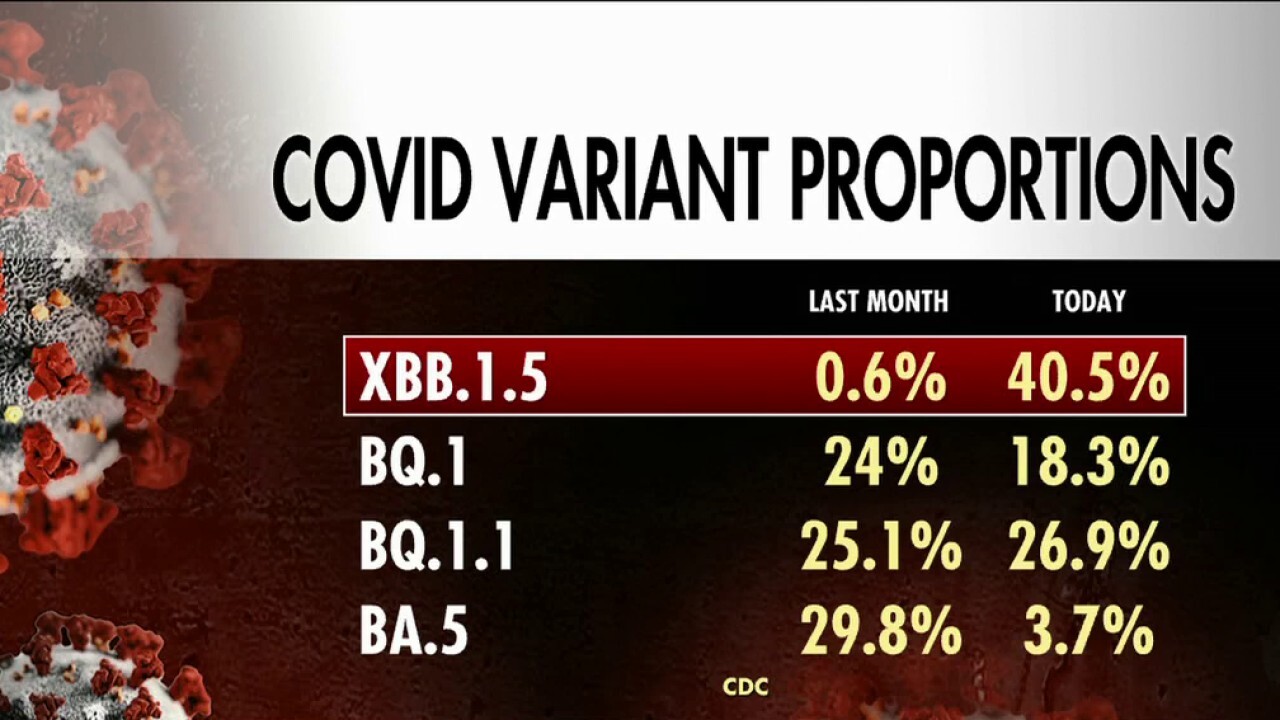

National Surge In Covid 19 Cases New Variant A Concern

May 31, 2025

National Surge In Covid 19 Cases New Variant A Concern

May 31, 2025