Posthaste: High Down Payments – A Barrier To Canadian Homeownership

Table of Contents

The Current State of Canadian Housing Affordability

Soaring Home Prices and Their Impact

Canadian home prices have skyrocketed in recent years, far outpacing wage growth. This widening gap between income and housing costs makes saving for a down payment an almost insurmountable challenge for many.

- Income-to-price ratios in major cities like Toronto and Vancouver are significantly higher than the national average, exceeding 10 in some areas. This means a household would need to earn ten times the average income to afford a median-priced home.

- Cities with particularly high prices: Toronto, Vancouver, and even smaller cities like Victoria and Halifax are experiencing dramatic increases, making homeownership a distant dream for many potential buyers.

The Role of Interest Rates

Rising interest rates further complicate the affordability crisis. Higher borrowing costs mean that even with a large down payment, monthly mortgage payments become significantly more expensive, stretching household budgets to their limits.

- Mortgage stress tests: While designed to protect borrowers, these tests often make it harder for first-time homebuyers to qualify for a mortgage, particularly when dealing with higher interest rates and a large down payment.

- Variable vs. fixed-rate mortgages: The choice between a variable and fixed-rate mortgage adds another layer of complexity. While variable rates might initially offer lower payments, they are susceptible to unpredictable increases, potentially leading to mortgage stress.

The Impact of High Down Payments on First-Time Homebuyers

Saving for a Large Down Payment

Saving for a 20% down payment—often considered the minimum for avoiding CMHC insurance premiums—is a significant financial undertaking for first-time homebuyers.

- Time to save: In many Canadian cities, it can take years, even a decade or more, to accumulate a 20% down payment on a median-priced home, particularly for those with student loan debt or other financial obligations.

- Competing financial priorities: Young Canadians often face competing financial priorities, such as student loan repayments, car payments, and saving for retirement, making saving for a substantial down payment a particularly challenging task.

Limited Access to Affordable Housing Options

The high down payment requirement acts as a significant barrier to entry for many Canadians seeking affordable housing.

- Limited availability of starter homes: The lack of affordable starter homes in many areas forces potential buyers to either delay homeownership indefinitely or compromise on location, size, or quality.

- Impact on diversity and social mobility: High down payments disproportionately affect lower and middle-income earners, hindering social mobility and reducing diversity in homeownership.

Potential Solutions and Government Initiatives

Government Programs and Incentives

Several government programs aim to assist first-time homebuyers, such as the First-Time Home Buyers' Incentive. However, their effectiveness is debatable.

- Evaluation of existing programs: These programs can be beneficial but often fall short of addressing the scale of the affordability problem. Eligibility requirements and limitations on the amount of assistance can restrict their impact.

- Suggested improvements: Increased funding, broadened eligibility criteria, and innovative program designs could significantly improve their effectiveness in making homeownership more attainable.

The Role of Financial Institutions

Financial institutions can also contribute to improved access to homeownership.

- Alternative mortgage options: Exploring alternative mortgage options, such as shared equity mortgages or innovative financing solutions, could lessen the burden of high down payments.

- Innovative financing solutions: Lenders could introduce more flexible mortgage products tailored to the needs of first-time homebuyers facing high down payment requirements, including programs that focus on building equity over time.

Conclusion: Addressing the Barrier of High Down Payments for Canadian Homeownership

High down payments are a significant barrier to Canadian homeownership. Soaring housing costs, coupled with rising interest rates, create an immense challenge for first-time buyers. Limited access to affordable housing options and the substantial time required to save for a large down payment exacerbate the problem. While government programs and incentives exist, their impact is often limited. Financial institutions need to explore alternative and innovative financing solutions to make homeownership more accessible. Understanding the challenges of high down payments is crucial. Learn more about available resources and advocate for policies that make Canadian homeownership more accessible for all. Let's work together to find solutions that address the issue of high down payments and promote affordable housing for all Canadians.

Featured Posts

-

Thailands Transgender Community A Fight For Equality

May 10, 2025

Thailands Transgender Community A Fight For Equality

May 10, 2025 -

Beyonces Cowboy Carter Doubled Streams Post Tour Debut

May 10, 2025

Beyonces Cowboy Carter Doubled Streams Post Tour Debut

May 10, 2025 -

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Hqayq Warqam

May 10, 2025

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Hqayq Warqam

May 10, 2025 -

First Hand Accounts Nottingham Attack Survivors Recount Experiences

May 10, 2025

First Hand Accounts Nottingham Attack Survivors Recount Experiences

May 10, 2025 -

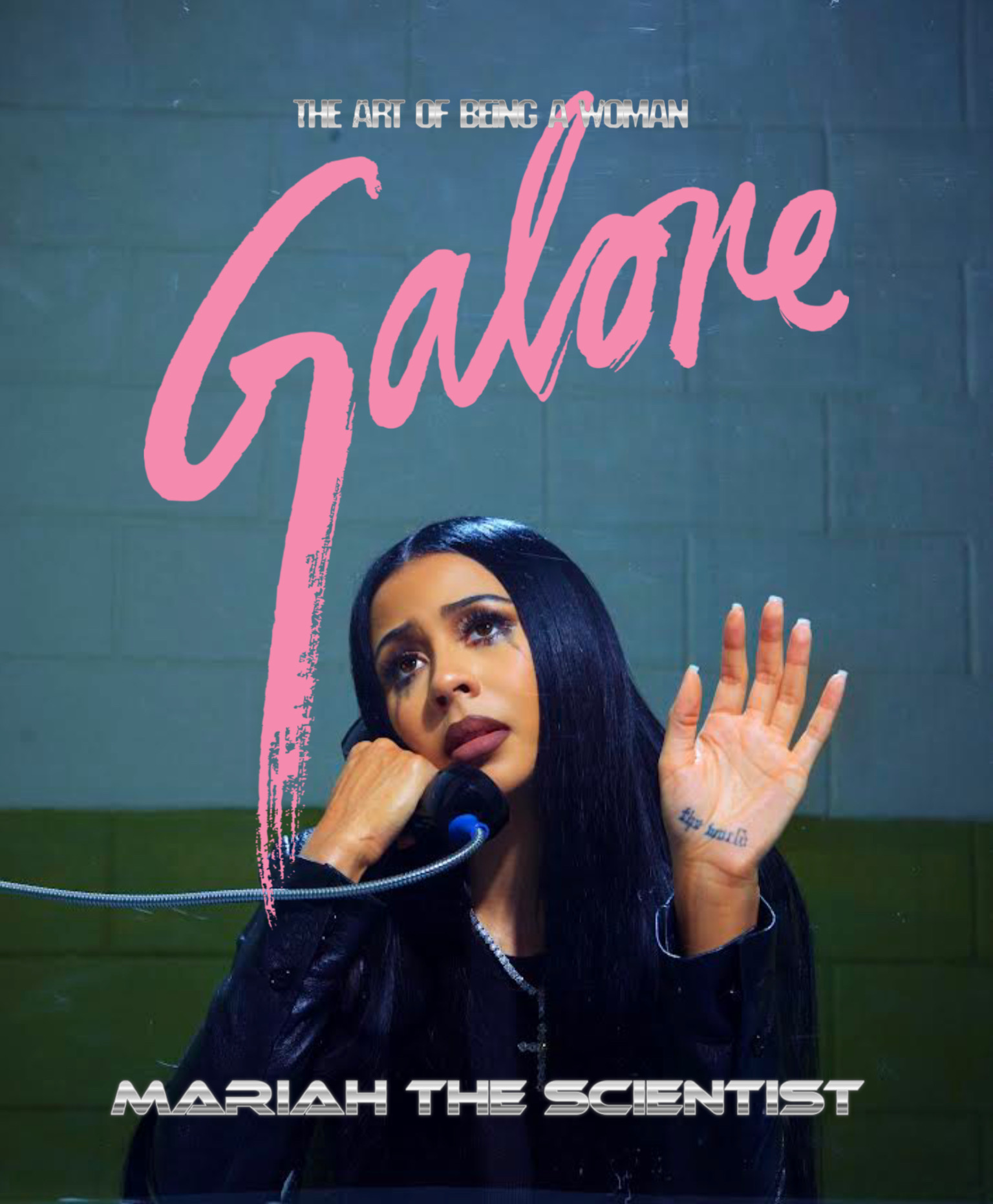

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Revealed

May 10, 2025

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Revealed

May 10, 2025