Posthaste: Trouble Brewing In The Global Bond Market

Table of Contents

Rising Interest Rates: The Primary Culprit

Central banks across the globe are aggressively implementing interest rate hikes as a key component of their monetary policy to combat stubbornly high inflation. This decisive action, while aimed at stabilizing prices, has a direct and significant impact on the global bond market. Higher interest rates make newly issued bonds more attractive than existing ones with lower yields. This dynamic leads to a decline in the prices of existing bonds, creating challenges for investors holding these assets.

- Higher interest rates lead to lower bond prices: As interest rates rise, the present value of future bond payments decreases, resulting in a decline in the market price of bonds. This inverse relationship is fundamental to understanding bond market behavior.

- The yield curve inversion signals potential economic slowdown: A flattening or inversion of the yield curve (where short-term interest rates exceed long-term rates) is often seen as a predictor of an upcoming economic slowdown or recession. This is a significant warning sign for bond investors.

- Investors face capital losses in existing bond portfolios: Investors holding bonds purchased at higher prices will experience capital losses as interest rates rise and bond prices fall. This is a crucial risk factor to consider.

- Central bank actions are creating uncertainty in the market: The unpredictable nature of central bank decisions and the varying responses across different economies contribute to overall market uncertainty and volatility.

Inflation's Persistent Grip

High and persistent inflation is another major factor contributing to the current instability in the global bond market. Inflation erodes the purchasing power of fixed-income investments, meaning that the real return on bonds – the return after adjusting for inflation – diminishes significantly. This forces investors to demand higher yields to compensate for the increased inflation risk, creating further downward pressure on bond prices.

- Inflation reduces the real return on bonds: If inflation rises faster than the bond's yield, investors experience a negative real return, essentially losing purchasing power.

- Investors seek higher-yielding assets to maintain purchasing power: To protect against inflation erosion, investors are increasingly shifting towards assets that offer higher yields, putting pressure on the demand for bonds.

- Inflation expectations significantly impact bond markets: Market participants' expectations regarding future inflation levels directly influence bond yields and prices. Higher expected inflation translates to higher demanded yields.

- TIPS (Treasury Inflation-Protected Securities) offer some inflation protection: TIPS are designed to adjust their principal value based on inflation, offering a hedge against this specific risk.

Recessionary Fears: A Looming Threat

The prospect of a global economic recession or a significant economic slowdown is casting a long shadow over the global bond market. This fear heightens concerns about the creditworthiness of borrowers, increasing the likelihood of defaults, particularly in the corporate bond market. This uncertainty leads to a "flight to safety," where investors flock to government bonds perceived as less risky, further impacting corporate bond yields and prices.

- Recessionary fears increase the demand for safe-haven assets: Government bonds, especially those issued by countries with strong credit ratings, are seen as safe havens during economic downturns.

- Corporate bond yields rise reflecting increased default risk: The probability of corporate defaults increases during a recession, leading investors to demand higher yields to compensate for this elevated risk.

- Sovereign bond yields may fall as investors seek safety: The increased demand for government bonds can push their prices up and yields down.

- Economic forecasts play a crucial role in market sentiment: Market sentiment and investor behavior are significantly influenced by the prevailing economic forecasts and predictions.

Diversification and Risk Management in a Turbulent Bond Market

Given the current volatility and uncertainty in the global bond market, investors need a robust investment strategy that prioritizes diversification and effective risk management. This requires a multi-faceted approach encompassing various strategies.

- Diversify across different bond types and maturities: Spreading investments across different bond types (government, corporate, municipal) and maturities reduces overall portfolio risk.

- Consider inflation-protected securities to mitigate inflation risk: TIPS and other inflation-linked bonds offer a degree of protection against inflation's eroding effects.

- Implement hedging strategies to reduce potential losses: Hedging techniques, such as using derivatives, can help mitigate potential losses from interest rate or inflation fluctuations.

- Consult with a financial advisor to develop a suitable investment plan: Seeking professional financial advice is crucial for developing a personalized investment strategy aligned with your risk tolerance and financial goals.

Conclusion

The global bond market is currently navigating a challenging landscape marked by rising interest rates, persistent inflation, and growing recessionary fears. These interconnected factors are creating significant volatility and uncertainty, demanding a cautious and well-informed approach from investors. Understanding the nuances of the global bond market and the interplay of these factors is critical for navigating this turbulent environment. Stay informed about the latest economic developments, carefully evaluate your risk tolerance, and consider seeking professional financial guidance to effectively manage your investments within the global bond market. Don't underestimate the risks; proactively manage your exposure to the global bond market and protect your portfolio.

Featured Posts

-

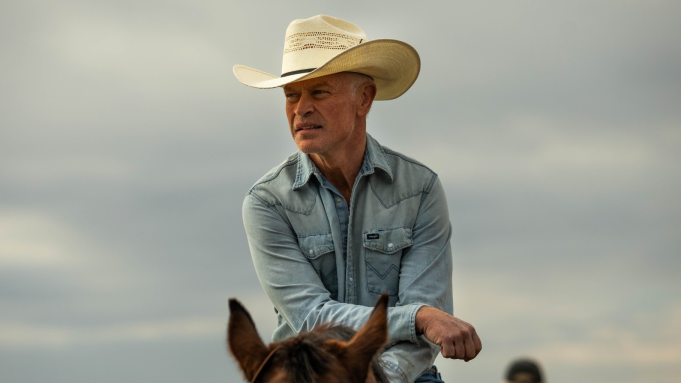

The Last Rodeo Neal Mc Donoughs Leading Role

May 23, 2025

The Last Rodeo Neal Mc Donoughs Leading Role

May 23, 2025 -

Grand Ole Opry Goes Global First Ever International Broadcast From Londons Royal Albert Hall

May 23, 2025

Grand Ole Opry Goes Global First Ever International Broadcast From Londons Royal Albert Hall

May 23, 2025 -

The 3 Billion Question Sses Spending Cuts And Future Outlook

May 23, 2025

The 3 Billion Question Sses Spending Cuts And Future Outlook

May 23, 2025 -

Kevin Pollaks Role In Tulsa King Season 3 Will He Confront Sylvester Stallone

May 23, 2025

Kevin Pollaks Role In Tulsa King Season 3 Will He Confront Sylvester Stallone

May 23, 2025 -

Quotas De Contenu Francophone Le Quebec Regit Les Plateformes De Diffusion

May 23, 2025

Quotas De Contenu Francophone Le Quebec Regit Les Plateformes De Diffusion

May 23, 2025

Latest Posts

-

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025 -

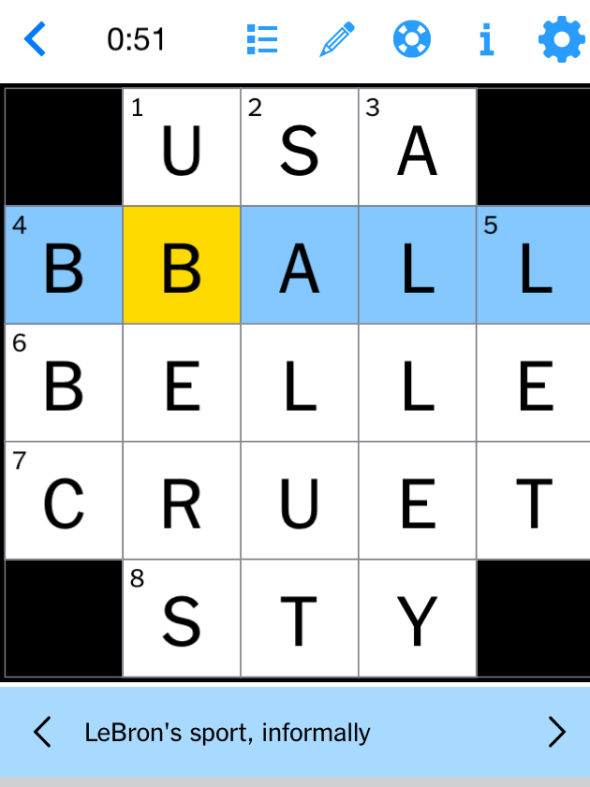

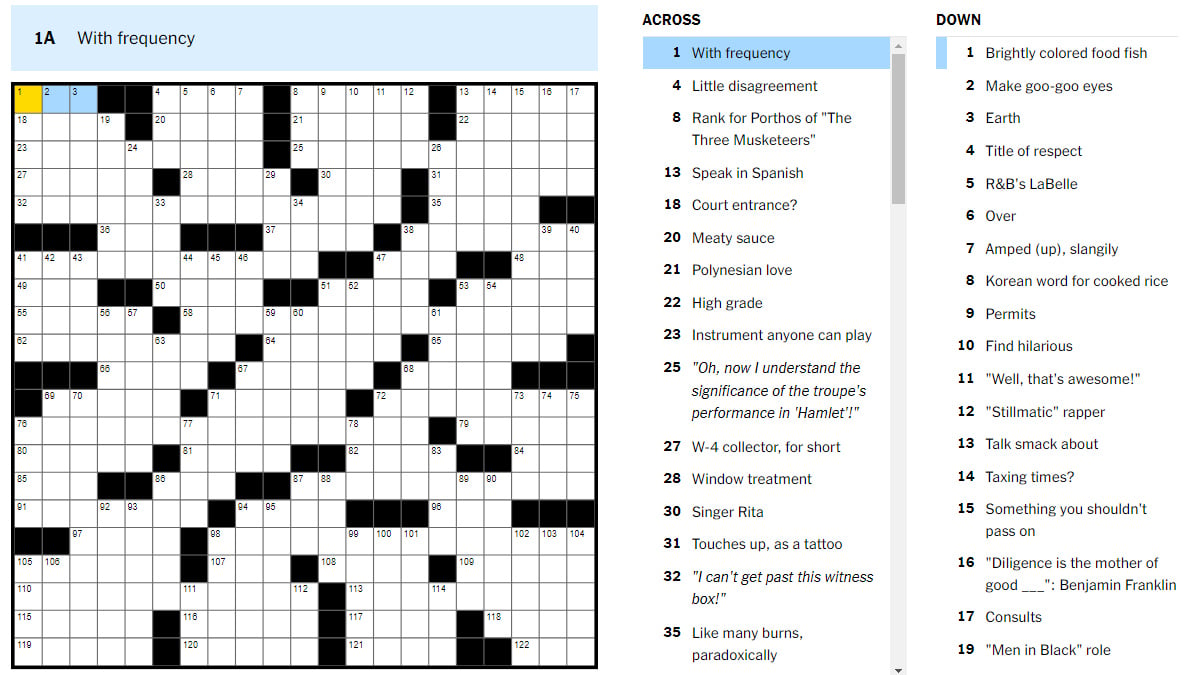

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 24, 2025

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 24, 2025 -

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025 -

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

Essen Diese Eissorte Liegt In Nrw Ganz Vorn

May 24, 2025

Essen Diese Eissorte Liegt In Nrw Ganz Vorn

May 24, 2025