Pound Rises As Traders Reduce Bank Of England Rate Cut Expectations

Table of Contents

Diminishing Inflation Concerns Fuel Pound Rise

Recent economic data reveals a slowdown in inflation in the UK, a key factor influencing the BoE's monetary policy decisions. Lower-than-expected inflation figures suggest that the pressure on the central bank to aggressively cut interest rates is easing. This positive development has sparked a positive market reaction, boosting confidence in the pound.

- Lower-than-expected inflation figures: The latest CPI (Consumer Price Index) and RPI (Retail Price Index) reports indicate a deceleration in the rate of inflation, signaling a potential peak.

- Easing pressure on the Bank of England to cut rates aggressively: With inflation showing signs of cooling, the urgency for the BoE to stimulate the economy through rate cuts diminishes.

- Positive market reaction to reduced inflation risks: Investors perceive lower inflation as a positive sign for economic stability, leading to increased demand for the pound.

- Impact on GBP/USD and GBP/EUR exchange rates: The GBP has strengthened against both the USD and EUR, reflecting the increased investor confidence.

Shifting Market Sentiment and Trader Behavior

The recent rise in the pound reflects a tangible shift in market sentiment. Traders are increasingly optimistic about the UK's economic outlook, reducing their expectations of further BoE rate cuts. This change in sentiment has directly impacted trading strategies.

- Increased demand for the pound among investors: The reduced expectation of rate cuts has led to increased demand for the pound, pushing its value higher.

- Short covering (closing of bearish positions) contributing to the rise: Traders who had bet against the pound (short positions) are now closing their positions, adding to the upward pressure on the GBP.

- Impact of algorithmic trading and high-frequency trading: Automated trading systems have likely amplified the price movements, contributing to the speed and magnitude of the pound's rise.

- Analysis of trading volumes and price volatility: Increased trading volumes and relatively lower price volatility suggest a degree of market stability amidst the pound's appreciation.

Geopolitical Factors and Their Influence on the Pound

Geopolitical factors continue to play a role in the pound's performance. While the reduced rate cut expectations are the primary driver of the recent surge, broader global economic conditions and specific events continue to exert influence.

- Impact of global economic uncertainty on the GBP: Global economic uncertainty can impact investor confidence, affecting the demand for the pound. However, the current trend suggests that the UK's domestic economic news is outweighing these broader concerns.

- Influence of Brexit-related developments: While Brexit-related uncertainties have subsided to some extent, ongoing negotiations and trade agreements could still impact the GBP's value.

- The role of international trade and investment flows: The UK's trade relationships and levels of foreign direct investment continue to be important factors shaping the currency's performance.

- Comparison with other major currencies' performance: The pound's recent performance against other major currencies needs to be viewed in the context of their own economic and political environments.

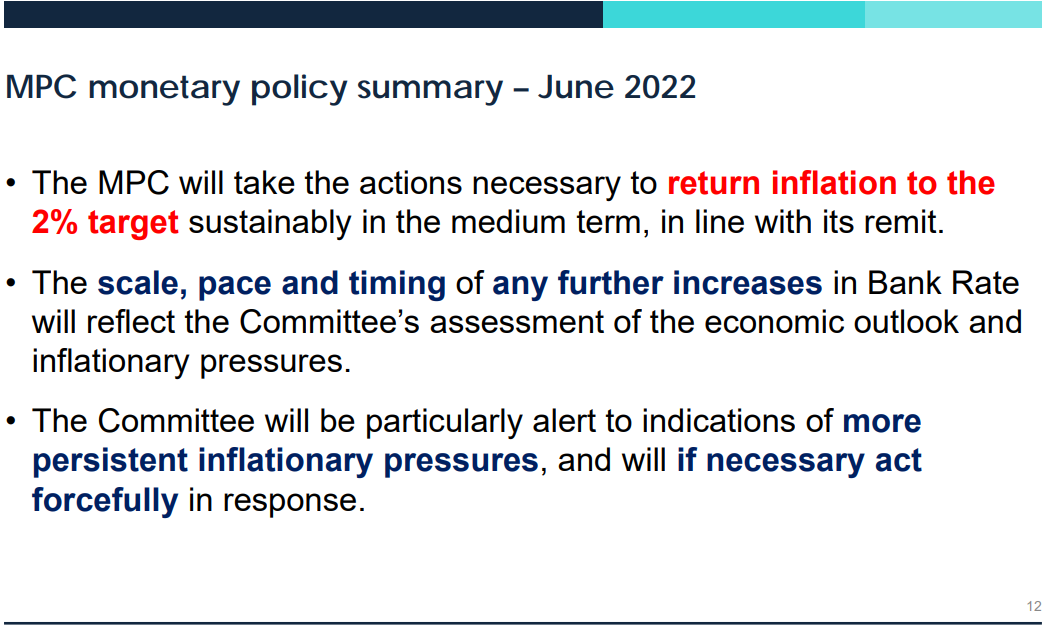

Analysis of Bank of England's Forward Guidance

The Bank of England's communication regarding its future monetary policy plays a crucial role in shaping market expectations. Recent statements and announcements have hinted at a less aggressive approach to rate cuts than previously anticipated.

- Key quotes from Bank of England officials: Statements by the Governor and other Monetary Policy Committee (MPC) members regarding inflation and economic growth are carefully scrutinized by market participants.

- Interpretation of the minutes from recent meetings: The minutes of the MPC meetings provide further insights into the reasoning behind the BoE's decisions.

- Market reaction to the Bank of England's communication: The market's response to the BoE's communication reflects the degree of confidence in the central bank's approach.

- Potential future scenarios based on current projections: Analyzing the BoE's projections allows for the formation of potential scenarios for the future trajectory of interest rates and the pound's value.

Pound's Strength and Future Outlook – What to Expect Next

The recent appreciation of the pound is largely due to diminished expectations of further Bank of England rate cuts, driven by easing inflation concerns and shifting market sentiment. While the current trend is positive, the future performance of the GBP will depend on various evolving economic and political factors. It's crucial to monitor developments closely.

Stay updated on the latest developments affecting the Pound Sterling and understand how the Bank of England's actions impact currency markets. Monitor the GBP exchange rate and make informed decisions based on the evolving market landscape.

Featured Posts

-

Indonesia Classic Art Week 2025 Eksibisi Porsche Dan Karya Seni

May 25, 2025

Indonesia Classic Art Week 2025 Eksibisi Porsche Dan Karya Seni

May 25, 2025 -

Mwshr Daks Alalmany Ytjawz Aela Mstwa Lh Fy Mars

May 25, 2025

Mwshr Daks Alalmany Ytjawz Aela Mstwa Lh Fy Mars

May 25, 2025 -

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025 -

Mia Farrow Michael Caine And A Very Unexpected On Set Encounter

May 25, 2025

Mia Farrow Michael Caine And A Very Unexpected On Set Encounter

May 25, 2025 -

Police Helicopter Pursuit Drivers Text And Refuel At 90mph

May 25, 2025

Police Helicopter Pursuit Drivers Text And Refuel At 90mph

May 25, 2025

Latest Posts

-

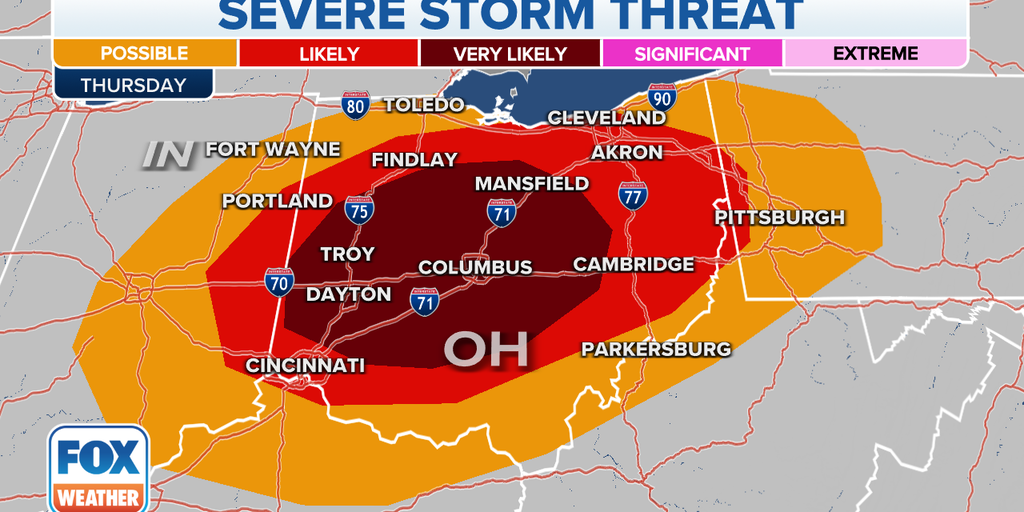

Flood Advisory Update Severe Storms Impacting Miami Valley

May 25, 2025

Flood Advisory Update Severe Storms Impacting Miami Valley

May 25, 2025 -

Miami Valley Residents Urged To Heed Flood Advisories Amid Severe Storms

May 25, 2025

Miami Valley Residents Urged To Heed Flood Advisories Amid Severe Storms

May 25, 2025 -

Urgent Flood Advisory In Effect For Miami Valley Following Severe Weather

May 25, 2025

Urgent Flood Advisory In Effect For Miami Valley Following Severe Weather

May 25, 2025 -

South Florida On High Alert Flash Flood Warning In Effect

May 25, 2025

South Florida On High Alert Flash Flood Warning In Effect

May 25, 2025 -

Flash Flood Warning South Florida Residents Urged To Take Precautions

May 25, 2025

Flash Flood Warning South Florida Residents Urged To Take Precautions

May 25, 2025