Pound Strengthens As Traders Reduce Expectations Of Bank Of England Rate Cuts

Table of Contents

Market Sentiment Shift: From Rate Cuts to Stability

The recent strengthening of the pound reflects a notable change in market sentiment regarding the Bank of England's (BoE) monetary policy. Previously, expectations were widespread for further interest rate cuts to stimulate economic growth. However, a confluence of factors has led to a reassessment of this outlook, suggesting a move towards greater stability, if not a potential tightening of monetary policy.

This shift can be attributed to several key developments:

-

Improving Economic Indicators: Recent data suggests a more robust UK economy than previously anticipated. GDP growth has exceeded forecasts, unemployment figures remain relatively low, and while inflation remains a concern, the rate of increase has shown signs of slowing.

-

Bank of England Statements: Recent statements and press conferences from the Bank of England have hinted at a less dovish stance than previously indicated. While the BoE continues to monitor economic conditions closely, the tone suggests a greater willingness to maintain current interest rates or even consider a future increase, depending on economic data.

-

Analyst Predictions: Numerous financial analysts have revised their predictions for the BoE's future actions, reflecting a growing consensus that rate cuts are less likely in the near term. These revised forecasts contribute to the market’s renewed confidence in the Sterling.

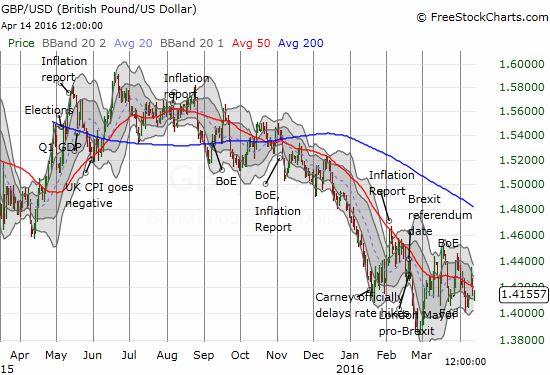

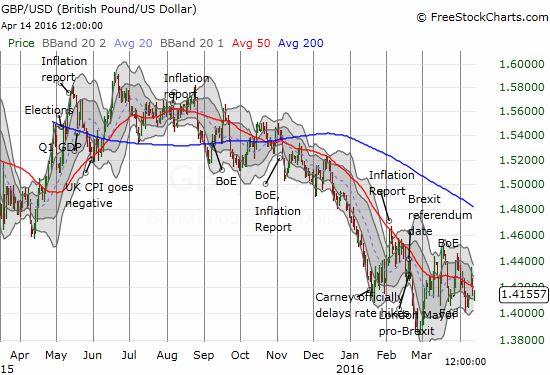

Impact on GBP Exchange Rates: A Stronger Pound

The reduced expectation of further Bank of England rate cuts has directly translated into a stronger pound. The GBP has seen notable gains against major currencies such as the US dollar (USD), the Euro (EUR), and the Japanese Yen (JPY).

-

Specific Exchange Rate Figures: For example, the GBP/USD exchange rate has appreciated from [Insert recent low value] to [Insert recent high value], representing a significant increase in the pound's value. Similar gains have been observed against the EUR and JPY. (Note: Include a relevant chart or graph illustrating GBP performance against major currencies here)

-

Implications for Traders and Investors: This strengthening of the GBP presents both opportunities and challenges for currency traders and investors. Those holding GBP-denominated assets have seen increased value, while those trading against the pound may face losses.

-

Volatility and Future Projections: While the GBP has strengthened, it's important to acknowledge potential future volatility. Geopolitical events and unexpected economic data could still impact the pound's value. Short-term fluctuations are expected, but the overall trend suggests continued strength, barring unforeseen circumstances.

Implications for the UK Economy: Opportunities and Challenges

A stronger pound has significant implications for the UK economy, presenting both opportunities and challenges.

-

Positive Effects: Cheaper imports will reduce inflationary pressure for consumers. This will contribute to lower prices for a range of goods, benefiting consumers' purchasing power.

-

Negative Effects: Conversely, a stronger pound can make UK exports less competitive in global markets, potentially impacting businesses reliant on international trade. This could lead to decreased export revenue and a slowdown in certain sectors.

-

Impact on Businesses and Consumers: UK businesses involved in importing goods will benefit from lower costs, while those focused on exports might face reduced demand due to higher prices for foreign buyers. Consumer spending could also see a boost from lower import prices, although the impact on tourism may be mixed. Increased foreign investment is also a potential upside of a stronger pound.

Looking Ahead: Future Predictions for the Pound and Bank of England Policy

Predicting the future direction of the pound and the Bank of England's policy remains challenging, but several factors warrant consideration.

-

Upcoming Economic Data: Key economic data releases, such as inflation figures, employment reports, and GDP growth data, will continue to influence market sentiment and the GBP's value.

-

Geopolitical Events: Global geopolitical events, such as international trade disputes or global economic instability, can also significantly impact the pound's strength and the BoE's policy decisions.

-

Overall Outlook: The current trend suggests a continued period of GBP strength, provided that economic data remains positive and the BoE maintains its relatively cautious stance on interest rate cuts. However, unexpected shocks could reverse this trend.

Conclusion: Navigating the Strengthening Pound: What Next for GBP Investors?

In summary, the pound's recent strengthening is primarily driven by reduced market expectations of further Bank of England rate cuts. This shift reflects improving economic indicators, evolving BoE communication, and revised analyst forecasts. This has positive and negative consequences for the UK economy, influencing import costs, export competitiveness, and consumer spending.

To navigate this evolving landscape, investors and businesses need to closely monitor the pound's strength and stay updated on Bank of England announcements. While the current trend is positive, the GBP remains susceptible to unexpected economic or geopolitical shifts. It's crucial to conduct thorough research and, if necessary, consult financial professionals before making any significant investment decisions based on GBP fluctuations. Make informed decisions about GBP investments by staying informed about the latest developments.

Featured Posts

-

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Bwtshytynw

May 22, 2025

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Bwtshytynw

May 22, 2025 -

Senat S Sh A Ta Lindsi Grem Pidtrimka Novikh Sanktsiy Proti Rf

May 22, 2025

Senat S Sh A Ta Lindsi Grem Pidtrimka Novikh Sanktsiy Proti Rf

May 22, 2025 -

Peppa Pigs Mummy Is Pregnant A Baby Gender Reveal

May 22, 2025

Peppa Pigs Mummy Is Pregnant A Baby Gender Reveal

May 22, 2025 -

Dissecting The Recent Allegations Involving Blake Lively

May 22, 2025

Dissecting The Recent Allegations Involving Blake Lively

May 22, 2025 -

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 22, 2025

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 22, 2025