Powell And Trump: The High-Stakes Game Of Interest Rate Cuts

Table of Contents

Trump's Pressure on the Fed to Cut Interest Rates

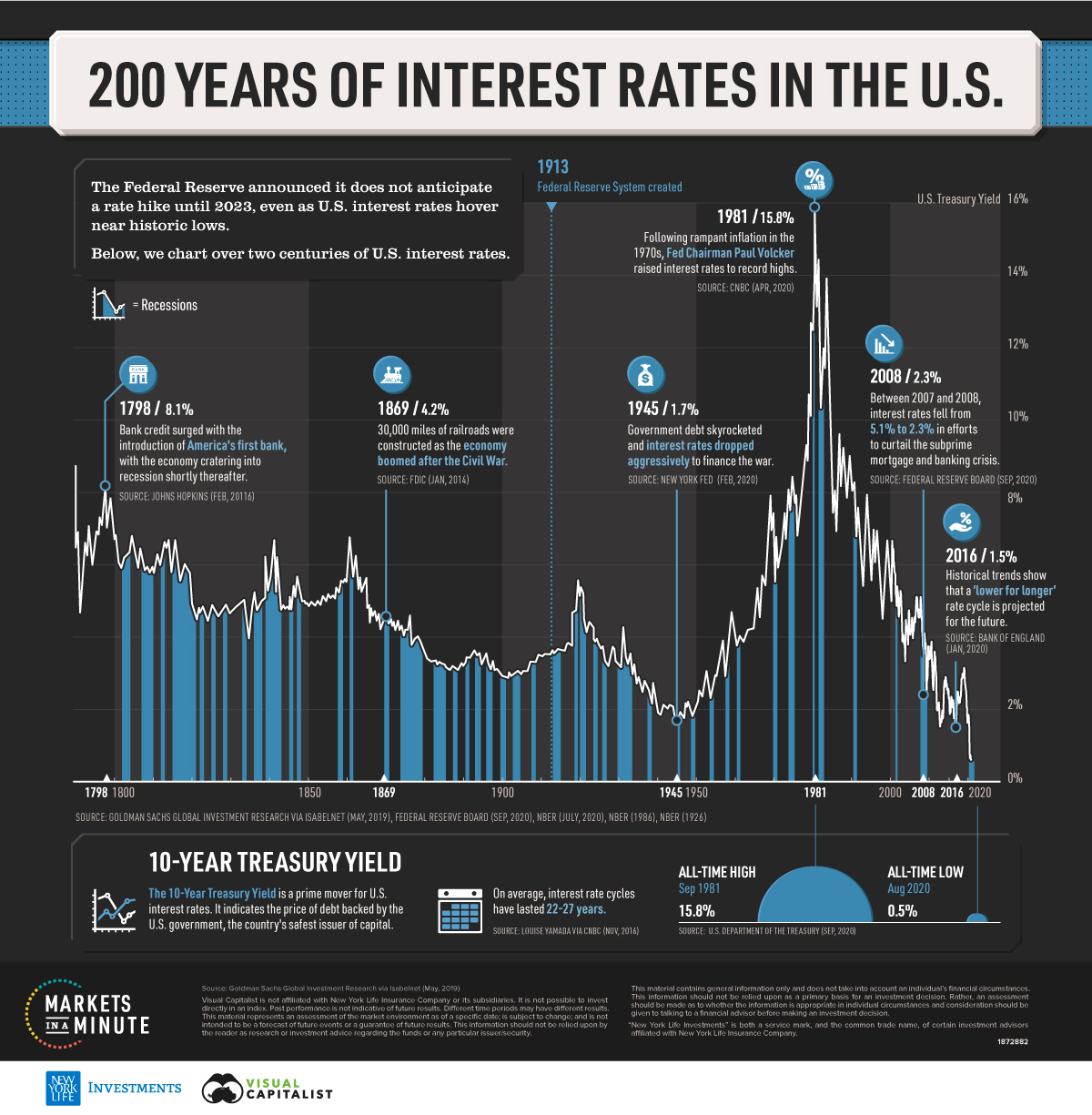

Trump's relentless push for lower interest rates stemmed from his desire to boost economic growth and bolster stock market performance ahead of the 2020 election. He viewed lower borrowing costs as a means to fuel economic expansion and, consequently, improve his chances of re-election. However, his actions were also driven by political motivations, viewing the Federal Reserve as a tool to manipulate the economy for short-term political gain.

- Public Criticism: Trump frequently voiced his displeasure with Powell's interest rate decisions through public statements, tweets, and interviews, calling for significant rate cuts. He labeled Powell's policies as "too tight" and detrimental to the economy.

- Legislative Threats: While Trump lacked the direct authority to control the Fed's actions, his administration explored options to exert influence, hinting at potential legislative changes or even personnel changes at the Federal Reserve. These threats underscored the political pressure being applied.

- Risks of Political Interference: The potential risks associated with political interference in monetary policy are substantial. A politically influenced central bank could lead to inflationary pressures, asset bubbles, and ultimately, economic instability. Decisions made for short-term political advantage can undermine the long-term health of the economy.

Powell's Response and the Independence of the Federal Reserve

Despite the significant pressure from the White House, Jerome Powell steadfastly defended the Federal Reserve's independence from political influence. He argued that the Fed's primary mandate is to maintain price stability and maximum employment, and that succumbing to political pressure would jeopardize these goals. Powell consistently warned of the dangers of excessively low interest rates, citing the potential for increased inflation and the formation of unsustainable asset bubbles.

- Defense of Autonomy: Powell's public statements consistently emphasized the importance of the Fed's independence, highlighting the need to make decisions based on economic data and analysis, rather than political considerations.

- Resisting Pressure: Powell resisted Trump's calls for significant rate cuts, opting for a more measured approach based on his assessment of the economic situation. This decision demonstrated a commitment to the principles of independent central banking.

- Long-Term Implications: The long-term implications of a politically influenced central bank are severe. Loss of public trust in the Fed's ability to act impartially could undermine its effectiveness and destabilize the financial system.

Economic Consequences of the Interest Rate Decisions

The actual impact of the interest rate cuts during this period on various economic indicators was complex and multifaceted. While the rate cuts did stimulate some economic growth, they also contributed to rising inflation and increased concerns about asset bubbles.

- Economic Growth: Data from the period shows a mixed picture, with some periods of economic expansion, but also vulnerabilities in certain sectors. The relationship between interest rate changes and subsequent growth is never straightforward and depends on multiple economic factors.

- Inflation: Inflation rates rose steadily in the period following the interest rate cuts, underscoring the risk of excessive monetary stimulus. This highlighted the challenge of balancing economic growth with price stability.

- Stock Market Performance: The stock market generally responded positively to the initial interest rate cuts, though the impact was ultimately limited by other factors, including geopolitical events and uncertainty surrounding the pandemic.

Long-Term Implications and Lessons Learned

The power struggle between the executive branch and the Federal Reserve under Trump and Powell offers valuable lessons about the importance of central bank independence. Maintaining a robust and independent central bank is critical for ensuring macroeconomic stability.

- Risks of Future Interference: The episode serves as a warning against future attempts to politicize monetary policy. Such actions can undermine the credibility and effectiveness of the Federal Reserve.

- Safeguarding Independence: Strengthening the legal and institutional frameworks that protect the Fed's independence is crucial. This includes clearly defining the Fed's mandate and ensuring transparency in its decision-making processes.

- Balancing Act: The episode highlights the delicate balancing act between political pressures and economic stability. Decisions about monetary policy should be guided by economic fundamentals and not short-term political expediency.

Conclusion: Understanding the Dynamics of Powell and Trump's Interest Rate Battles

The "Powell and Trump: Interest Rate Cuts" saga underscores the importance of an independent Federal Reserve in navigating complex economic challenges while maintaining resistance to political pressures. Trump's attempts to influence interest rate decisions, Powell's unwavering defense of the Fed's autonomy, and the resulting economic consequences offer valuable insights into the dynamics of monetary policy and its political implications. Understanding this relationship is essential for navigating the complexities of the modern economy. To further your understanding of this crucial topic, delve deeper into research papers from the Federal Reserve, reputable financial news sources, and academic journals focusing on monetary policy and central bank independence. Continue researching "Powell and Trump: Interest Rate Cuts" to stay informed about the ongoing evolution of monetary policy and its intricate relationship with the political landscape.

Featured Posts

-

Rihannas Third Child Updates And Details On Her Pregnancy

May 07, 2025

Rihannas Third Child Updates And Details On Her Pregnancy

May 07, 2025 -

Exploring Nhl 25s Arcade Mode A Players Perspective

May 07, 2025

Exploring Nhl 25s Arcade Mode A Players Perspective

May 07, 2025 -

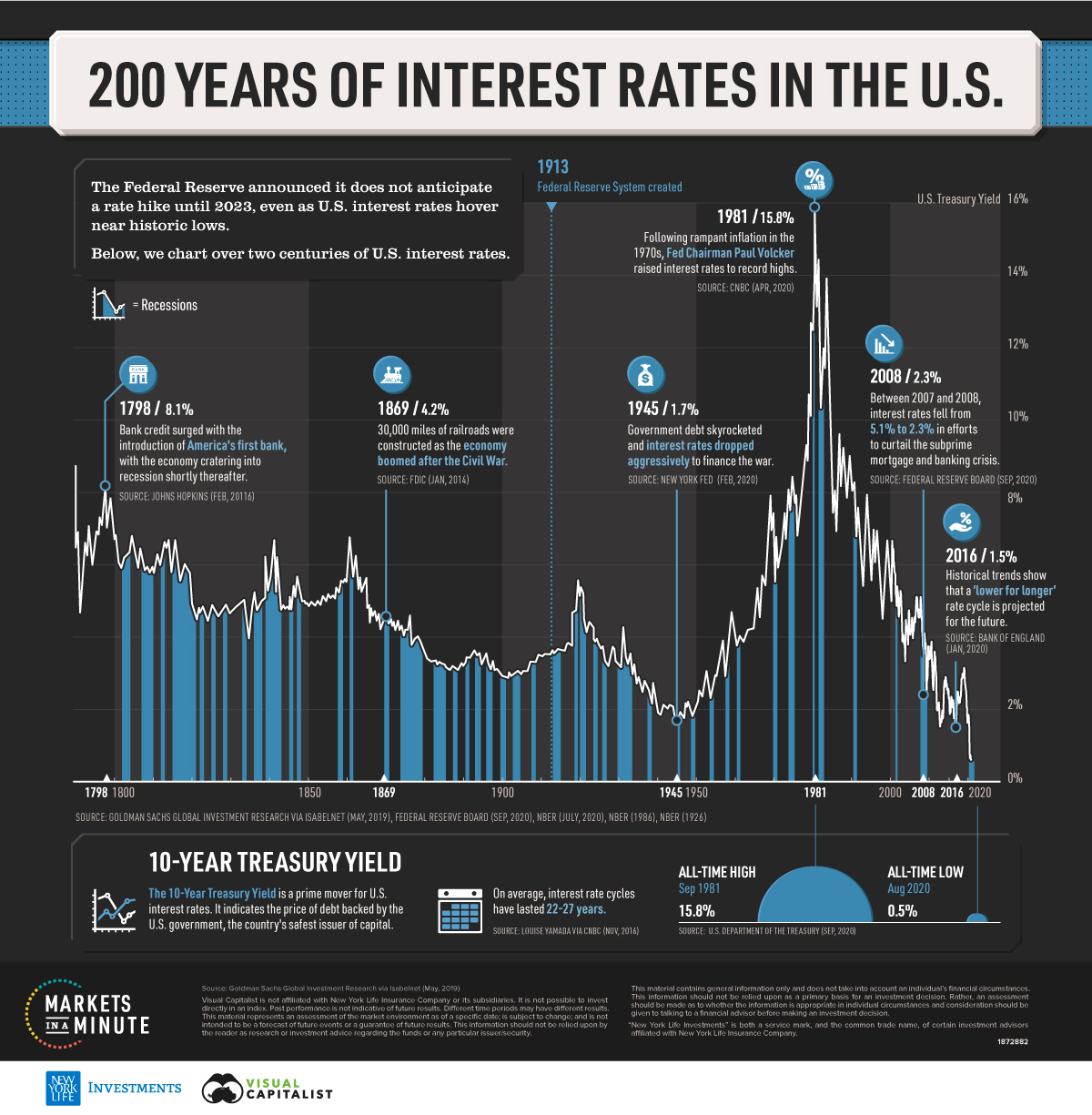

James Gunns Superman Movie New Hawkgirl Wing Information

May 07, 2025

James Gunns Superman Movie New Hawkgirl Wing Information

May 07, 2025 -

Xrp News Sec Commodity Classification Regulatory Uncertainty And Debate

May 07, 2025

Xrp News Sec Commodity Classification Regulatory Uncertainty And Debate

May 07, 2025 -

Aktuelle Lottozahlen 6aus49 12 April 2025

May 07, 2025

Aktuelle Lottozahlen 6aus49 12 April 2025

May 07, 2025

Latest Posts

-

Progress Towards Ldc Graduation Governments Commitment To Success

May 07, 2025

Progress Towards Ldc Graduation Governments Commitment To Success

May 07, 2025 -

Commerce Advisor Highlights Governments Role In Ldc Graduation

May 07, 2025

Commerce Advisor Highlights Governments Role In Ldc Graduation

May 07, 2025 -

Building A Resilient Future Outcomes From The Third Ldc Future Forum

May 07, 2025

Building A Resilient Future Outcomes From The Third Ldc Future Forum

May 07, 2025 -

Third Ldc Future Forum A Roadmap For Building Resilience

May 07, 2025

Third Ldc Future Forum A Roadmap For Building Resilience

May 07, 2025 -

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025