Powell's Warning: How Tariffs Could Jeopardize The Fed's Objectives

Table of Contents

Inflationary Pressures from Tariffs

Tariffs, essentially taxes on imported goods, directly impact inflation and the Fed's ability to control it. This is a key component of Powell's warning.

Increased Prices for Consumers

Tariffs increase the cost of imported goods, leading to higher prices for consumers. This reduces consumer purchasing power and potentially slows down economic growth.

- Examples: Tariffs on steel and aluminum have increased the cost of automobiles, construction materials, and various consumer goods.

- Statistics: Studies have shown a direct correlation between tariff increases and consumer price inflation, with some estimates suggesting a significant impact on the Consumer Price Index (CPI).

- Impact on Consumer Spending: Higher prices reduce disposable income, leading to decreased consumer spending, a crucial driver of economic growth. This dampening effect further complicates the Fed's task of maintaining economic stability.

Impact on Supply Chains

Tariffs disrupt global supply chains, creating shortages and further fueling price increases. Businesses relying on imported components face increased costs and potential production delays.

- Examples: Disruptions in the supply of essential components for manufacturing have led to production slowdowns and increased prices across multiple sectors.

- Impact on Businesses: Businesses face increased uncertainty, forcing them to absorb higher costs or pass them on to consumers, further contributing to inflation.

- Ripple Effect: The ripple effect of supply chain disruptions can spread throughout the economy, impacting various sectors and exacerbating inflationary pressures. This makes the Fed's job of navigating the economy exponentially more difficult.

Uncertainty and Investment Slowdown

The uncertainty created by tariffs undermines business confidence and slows down investment, a critical element of Powell's concerns.

Reduced Business Confidence

The unpredictable nature of tariff policies discourages businesses from investing and expanding. Uncertainty about future trade relations makes long-term planning and investment decisions riskier.

- Statistics: Studies show a negative correlation between tariff uncertainty and business investment. Many businesses postpone or cancel investment projects in the face of tariff-related uncertainty.

- Anecdotal Evidence: Numerous businesses have reported delaying investment plans due to the uncertainty surrounding tariffs and trade wars.

- Implications for Job Creation: Reduced investment directly impacts job creation, hindering the Fed's goal of maximum employment.

Impact on Economic Growth

Reduced investment and uncertainty negatively impact overall economic growth. Lower business investment translates to slower GDP growth and reduced employment opportunities.

- Projected GDP Growth: Economic models suggest that tariffs could significantly reduce projected GDP growth compared to a scenario without tariffs.

- Impact on Employment Numbers: Slower economic growth directly translates to lower job creation and potentially higher unemployment rates.

- Overall Effect on the Economy: The combined effects of reduced investment, slower growth, and increased inflation create a challenging economic environment for the Fed to manage.

The Fed's Tightrope Walk

Tariffs complicate the Fed's mandate to maintain price stability and full employment, forcing the central bank into a difficult balancing act. This is a crucial aspect of understanding Powell's warning.

Conflicting Policy Objectives

Balancing inflation control with the need to stimulate economic growth becomes significantly more challenging when tariffs introduce unpredictable inflationary pressures. The Fed may need to choose between fighting inflation, which could stifle growth, or supporting growth, which could exacerbate inflation.

- Potential Policy Responses: The Fed might respond with interest rate hikes to curb inflation, but this could further slow down economic growth and investment.

- Trade-offs: The Fed faces difficult trade-offs, as any policy response carries potential risks and unintended consequences.

Diminished Effectiveness of Monetary Policy

The unpredictability introduced by tariffs can reduce the effectiveness of monetary policy tools. The Fed's ability to accurately predict and control inflation is compromised when external factors, such as tariffs, introduce significant volatility.

- Impact of Interest Rate Changes: The effect of interest rate changes on the economy could be muted or even counterproductive if the inflationary pressures from tariffs are significant.

- Challenges in Steering the Economy: The increased uncertainty makes it more difficult for the Fed to accurately steer the economy toward its objectives of stable prices and maximum employment.

Conclusion

Tariffs create inflationary pressures, increase uncertainty, and complicate the Fed's ability to manage the economy effectively. They directly undermine Chairman Powell's stated objectives of price stability and maximum employment. Understanding Powell's warning about the dangers of tariffs is crucial. Stay informed about the economic effects of trade policy and advocate for policies that promote sustainable economic growth. Learn more about the impact of tariffs on the US economy by researching publications from the Federal Reserve and other reputable economic institutions.

Featured Posts

-

Apple Confirms I Phone Feature F1 Fans Will Love

May 26, 2025

Apple Confirms I Phone Feature F1 Fans Will Love

May 26, 2025 -

Rtbf Liege Le Futur De Ses Anciens Locaux Au Palais Des Congres

May 26, 2025

Rtbf Liege Le Futur De Ses Anciens Locaux Au Palais Des Congres

May 26, 2025 -

Formula 1 And Apple The New I Phone Feature You Need To Know About

May 26, 2025

Formula 1 And Apple The New I Phone Feature You Need To Know About

May 26, 2025 -

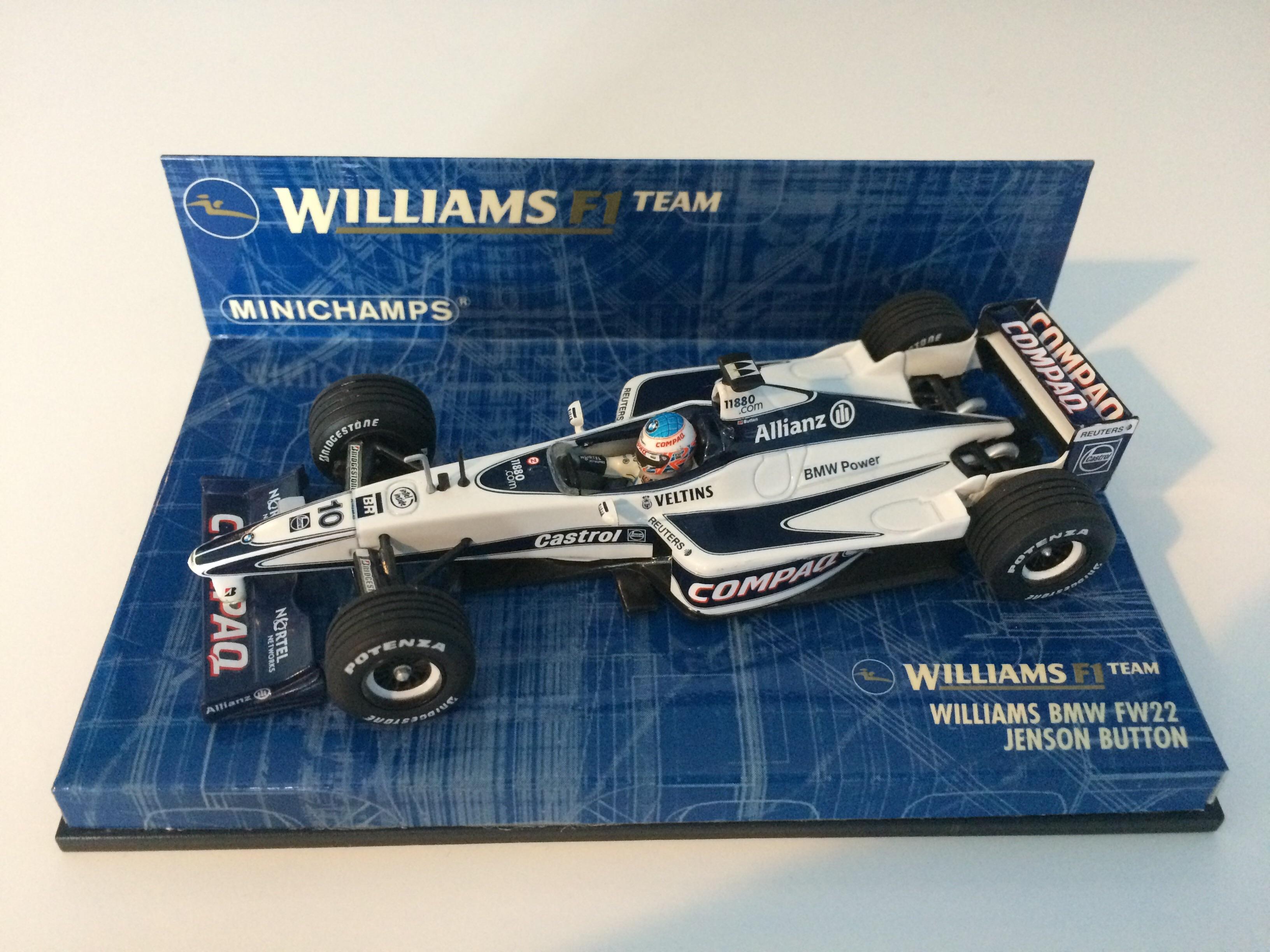

Jenson And The Fw 22 Extended A Detailed Analysis

May 26, 2025

Jenson And The Fw 22 Extended A Detailed Analysis

May 26, 2025 -

La Querelle Ardisson Baffie Cons Et Machos Une Animosite Tenace

May 26, 2025

La Querelle Ardisson Baffie Cons Et Machos Une Animosite Tenace

May 26, 2025