Power Finance Corporation's FY25 Dividend: Expected Cash Reward On March 12, 2025

Table of Contents

Understanding Power Finance Corporation (PFC) and its Dividend History

Power Finance Corporation Limited is a leading Indian non-banking financial company (NBFC) specializing in financing power projects across the country. PFC plays a crucial role in the Indian power sector, providing long-term financial assistance for the development and expansion of power generation, transmission, and distribution infrastructure. Understanding its dividend history is key to anticipating the FY25 payout.

PFC has a track record of distributing dividends to its shareholders, although the specific amount varies from year to year depending on several factors. Analyzing past trends helps investors form reasonable expectations.

- Past dividend yields: [Insert data on past dividend yields, ideally with a table or chart showing year, dividend per share, and yield]. This data will illustrate the historical trend and provide a basis for comparison.

- Historical dividend growth rate: [Insert data or calculation on the historical growth rate of PFC dividends, if applicable. Mention any periods of consistent growth or significant changes]. Understanding this trend can inform projections for the FY25 dividend.

- Key factors affecting dividend decisions: PFC's dividend policy is influenced by factors such as its profitability, debt levels, regulatory environment, and overall financial health. A strong financial year typically translates into a higher dividend payout.

Expected Dividend Amount for FY25 and its Implications

While the exact amount of the FY25 PFC dividend remains to be officially announced, market analysts and experts offer predictions based on the company's financial performance. [Include a range of predictions from credible sources, citing them appropriately].

The FY25 dividend will significantly impact PFC shareholders' returns. A higher-than-expected dividend will boost investor confidence and potentially increase the stock price. Conversely, a lower-than-expected payout could lead to a temporary dip.

- Range of expected dividend per share: [State the predicted range, citing sources]. This range provides a realistic outlook for investors.

- Potential impact on shareholder returns: The dividend will directly increase shareholder returns, contributing to their overall investment profitability. [Explain how the predicted dividend amount would impact different investment levels].

- Expected ex-dividend date: [State the anticipated ex-dividend date, if known. Otherwise, mention when it's typically announced]. Knowing this date is crucial for investors planning their trades.

How to Receive Your Power Finance Corporation Dividend

Receiving your Power Finance Corporation dividend is a straightforward process, primarily dependent on whether your shares are held in a dematerialized (demat) account or physical form. For demat account holders, the dividend will be credited directly to their bank accounts linked to their demat accounts. For physical certificate holders, the process might involve additional steps as outlined by PFC.

It's crucial to ensure your shareholder information is up-to-date with PFC to avoid delays or issues with receiving your dividend.

- Steps to ensure timely dividend receipt: Verify your registered address and bank account details with PFC. [Provide links to PFC's investor relations pages or relevant contact information].

- Contact information for inquiries: [Provide contact information for PFC investor relations or help desk]. Don’t hesitate to reach out if you have any questions or concerns.

- Deadlines for updating shareholder details: [If deadlines exist for updating information, specify them here]. Staying informed about these deadlines is critical.

Tax Implications of the PFC Dividend

The tax implications of the PFC dividend vary depending on the shareholder's residential status (Indian resident or non-resident) and the applicable tax laws. Indian resident shareholders will be subject to dividend distribution tax (DDT) at the applicable rate. Non-resident shareholders may face different tax rates and regulations depending on their country of residence and any tax treaties between India and their country.

- Tax rates for dividend income: [Provide a brief overview of applicable tax rates for Indian resident shareholders. For non-residents, mention that tax implications can vary significantly, advising consultation with a tax professional].

- Tax deduction at source (TDS) implications: TDS will be deducted at source by PFC before the dividend is disbursed. [Briefly explain TDS and how it impacts the net dividend received].

- Relevant tax forms and procedures: [Mention any relevant tax forms or procedures for reporting dividend income].

Conclusion: Maximize Your Returns with the Power Finance Corporation FY25 Dividend

The Power Finance Corporation FY25 dividend, scheduled for March 12, 2025, presents a significant opportunity for investors. We've explored the expected payout, the process of receiving your dividend, and the associated tax implications. Remember to update your shareholder information with PFC to ensure timely receipt of your cash reward. By proactively managing your investment and understanding the tax implications, you can maximize your returns from this PFC dividend. Consult your financial advisor to develop a comprehensive PFC dividend strategy tailored to your specific investment goals.

Featured Posts

-

Celebrating A Happy Day February 20 2025

Apr 27, 2025

Celebrating A Happy Day February 20 2025

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025 -

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025 -

El Regreso Triunfal De Bencic Campeona A Nueve Meses De Ser Madre

Apr 27, 2025

El Regreso Triunfal De Bencic Campeona A Nueve Meses De Ser Madre

Apr 27, 2025

Latest Posts

-

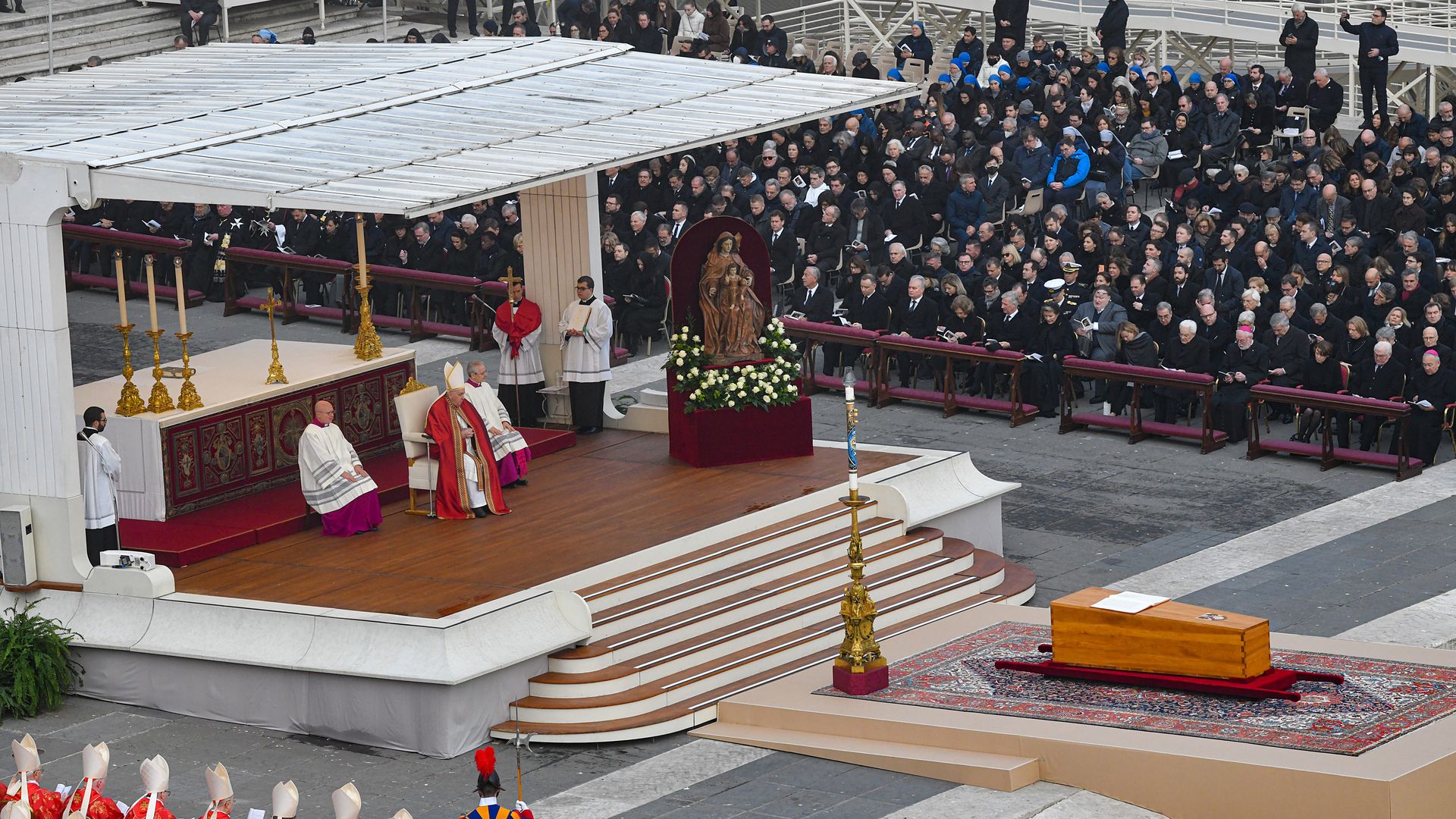

Observing Trump At The Popes Funeral A Blend Of Politics And Religious Observance

Apr 27, 2025

Observing Trump At The Popes Funeral A Blend Of Politics And Religious Observance

Apr 27, 2025 -

Trumps Conduct At Pope Benedicts Funeral A Controversial Display

Apr 27, 2025

Trumps Conduct At Pope Benedicts Funeral A Controversial Display

Apr 27, 2025 -

A Study Of Trumps Appearance At Pope Benedict Xvis Funeral Mass

Apr 27, 2025

A Study Of Trumps Appearance At Pope Benedict Xvis Funeral Mass

Apr 27, 2025 -

The Funeral Of Pope Benedict Trumps Attendance And Its Political Implications

Apr 27, 2025

The Funeral Of Pope Benedict Trumps Attendance And Its Political Implications

Apr 27, 2025 -

Trump And The Popes Funeral Analyzing The Intersection Of Politics And Faith

Apr 27, 2025

Trump And The Popes Funeral Analyzing The Intersection Of Politics And Faith

Apr 27, 2025