Pre-Market Jump For Live Music Stocks Following Market Turbulence

Table of Contents

Increased Investor Confidence in the Post-Pandemic Recovery of the Live Music Industry

The post-pandemic resurgence of live music events has played a pivotal role in boosting investor confidence in live music stocks. The pent-up demand for live experiences, coupled with strong financial performances from major players, has significantly impacted market sentiment.

Resurgence of Concert Attendance and Ticket Sales

- Record-breaking ticket sales: Numerous concerts and festivals have reported record-breaking ticket sales in recent months, exceeding pre-pandemic levels in many cases. Data from Ticketmaster and other major ticketing platforms show a significant uptick in sales.

- Sold-out tours: High-profile tours by artists like Beyoncé and Taylor Swift have consistently sold out stadiums and arenas, demonstrating the intense demand for live performances. These successful tours translate directly into increased revenue for live music companies.

- Pent-up demand: After years of lockdowns and restrictions, there's a significant pent-up demand for live music experiences. Fans are eager to attend concerts and festivals, driving up ticket sales and boosting the financial health of the industry.

- Market research: Recent market research indicates a strong positive outlook for the live music industry, projecting continued growth in concert attendance and revenue over the next few years. These reports contribute to increased investor optimism.

Strong Financial Performance of Major Live Music Companies

Major live music companies have reported improved financial results, reflecting the industry's robust recovery. This positive financial performance has directly fueled investor confidence in live music stocks.

- Increased revenue streams: Many companies have diversified their revenue streams, incorporating merchandise sales, sponsorships, and VIP experiences, leading to improved profitability.

- Cost-cutting measures: Companies implemented cost-cutting strategies during the pandemic, allowing them to emerge stronger and more efficient.

- Improved profitability: Live Nation Entertainment, for example, reported significantly improved profits in their most recent quarterly earnings report, a key factor driving up its stock price. Similar positive financial results from other major players support the upward trend in live music stocks.

- Stock performance charts: (Insert chart illustrating the stock performance of key live music companies, comparing their performance to broader market indices.)

Strategic Investments and Acquisitions Fueling Growth in Live Music Stocks

Strategic investments and acquisitions are further contributing to the growth of the live music sector and the associated stock prices. This proactive approach demonstrates confidence in the industry's future and attracts further investment.

New Partnerships and Collaborations

- Synergistic ventures: Several live music companies have formed strategic partnerships with technology companies to enhance the fan experience and expand their reach. These collaborations contribute to increased revenue and market share.

- Cross-promotional opportunities: Partnerships with brands in related industries create exciting cross-promotional opportunities, further boosting revenue and brand visibility. This enhanced market presence adds to investor confidence.

- Examples: (Cite specific examples of successful partnerships, mentioning the companies involved and the positive outcomes.)

Expansion into New Markets and Technologies

Live music companies are actively expanding into new geographic markets and embracing new technologies to capture a wider audience and enhance the fan experience.

- Global expansion: Many companies are expanding their operations into emerging markets with high growth potential, increasing their overall revenue and market share.

- Technological integration: The adoption of new technologies, such as virtual concerts and live streaming, provides new revenue streams and expands accessibility to a global audience.

- Examples: (Cite examples of successful market expansions and technological integrations.)

Positive Market Sentiment and Speculative Investing in the Live Music Sector

Positive market sentiment and speculative investing have also contributed to the recent surge in live music stock prices. A combination of analyst upgrades, increased retail investor interest, and even the potential for short squeezes (if applicable) are factors at play.

Analyst Upgrades and Positive Ratings

- Positive outlook: Several financial analysts have upgraded their ratings on live music stocks, citing the industry's strong recovery and growth potential.

- Analyst quotes: (Include quotes from relevant financial analysts supporting their positive outlook.)

Increased Retail Investor Interest

- Social media impact: Social media and online investment communities have played a significant role in driving retail investor interest in live music stocks.

- Meme stock effect (if applicable): If applicable, mention any potential connections to meme stock trends or similar phenomena.

Short-Squeeze Potential (if applicable)

(If relevant, discuss the possibility of a short squeeze contributing to the price jump and explain its mechanics.)

Conclusion: Navigating the Future of Live Music Stocks

The pre-market jump in live music stocks reflects a combination of factors: the post-pandemic recovery of the live music industry, strategic investments and acquisitions, and positive market sentiment. While the future remains uncertain, the current trajectory suggests continued growth potential. However, investors should remain cautious, considering the inherent volatility of the stock market.

Investment Considerations: Before investing in any live music stock, conduct thorough due diligence, research the specific company's financial performance, and consider the broader market conditions.

Call to Action: Stay tuned for further updates on the exciting developments in the live music stocks market. Conduct your own due diligence before investing in any live music stock. The future of live music stocks promises to be dynamic; stay informed to capitalize on potential opportunities.

Featured Posts

-

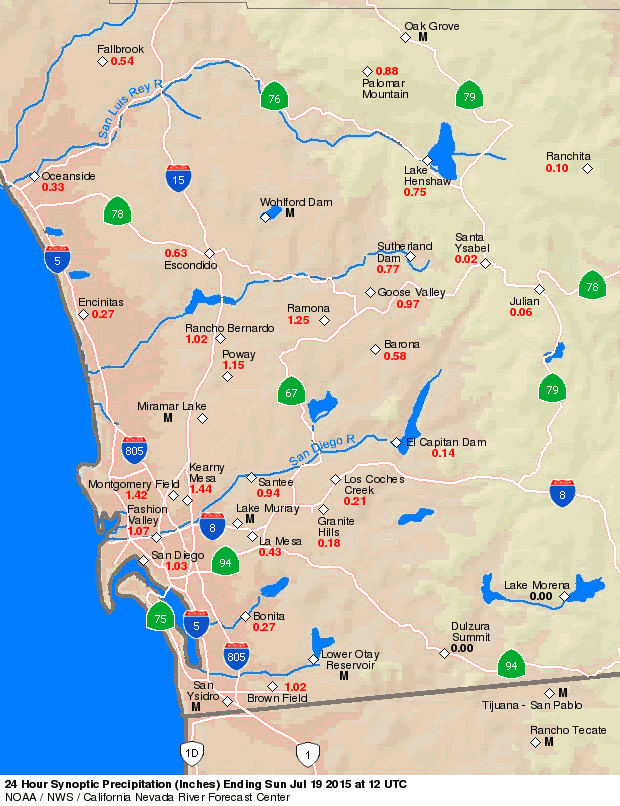

Cbs 8 Com Your Source For San Diego Rain Totals

May 30, 2025

Cbs 8 Com Your Source For San Diego Rain Totals

May 30, 2025 -

Mada Preduprezhdaet Ekstremalnye Pogodnye Yavleniya V Izraile Trebuyut Ostorozhnosti

May 30, 2025

Mada Preduprezhdaet Ekstremalnye Pogodnye Yavleniya V Izraile Trebuyut Ostorozhnosti

May 30, 2025 -

Bts V And Jungkooks Post Military Fitness Viral Gym Photos Spark Fan Frenzy

May 30, 2025

Bts V And Jungkooks Post Military Fitness Viral Gym Photos Spark Fan Frenzy

May 30, 2025 -

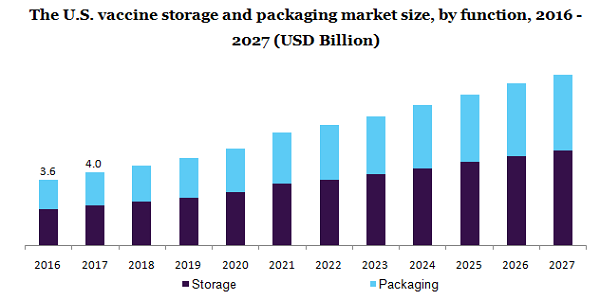

Vaccine Packaging Market A Rapidly Expanding Industry

May 30, 2025

Vaccine Packaging Market A Rapidly Expanding Industry

May 30, 2025 -

Grand View Universitys 2024 Commencement Boesen To Speak

May 30, 2025

Grand View Universitys 2024 Commencement Boesen To Speak

May 30, 2025