Predicting Ethereum's Future: A Comprehensive Market Analysis

Table of Contents

Current Market Conditions and Ethereum's Position

Ethereum Price Analysis

Ethereum's price has experienced significant fluctuations in recent months. Analyzing current price trends, support and resistance levels, and recent price movements is crucial for any Ethereum price prediction.

- Recent Price Movements: [Insert chart showing recent price fluctuations, highlighting key support and resistance levels]. The price has shown [describe recent trend - e.g., a period of consolidation followed by a breakout].

- Trading Volume and Market Capitalization: Trading volume has been [high/low/moderate], suggesting [interpret the significance of the trading volume - e.g., increased investor interest or decreased market activity]. The market capitalization currently stands at [current market cap], indicating [its position relative to other cryptocurrencies].

- Factors Driving Price Action: Recent price action is largely influenced by [mention specific factors, e.g., the success of new DeFi projects built on Ethereum, regulatory news, overall market sentiment, and the progress of Ethereum 2.0]. Positive news regarding Ethereum 2.0 often leads to price increases, while negative regulatory developments can trigger sell-offs.

Ethereum's Technological Advancements

Ethereum's future is inextricably linked to its ongoing technological development. Upgrades like Ethereum 2.0 promise to revolutionize the network's capabilities.

- Ethereum 2.0 and Sharding: The implementation of sharding is expected to significantly improve scalability, reducing transaction fees and increasing transaction throughput.

- EIP-1559: This upgrade introduced a fee-burning mechanism, potentially decreasing the supply of ETH over time.

- Rollups and Layer-2 Solutions: These scaling solutions aim to improve transaction speeds and reduce costs without compromising security.

- Impact on Value: These advancements are expected to make Ethereum more efficient, secure, and attractive to developers and users, potentially driving long-term value appreciation. The success of these upgrades is a key factor in any accurate Ethereum price prediction.

Factors Influencing Ethereum's Future Price

Adoption and Development

The widespread adoption of Ethereum across various sectors is a key driver of its price. The thriving DeFi ecosystem and the booming NFT market are prime examples.

- DeFi Growth: The total value locked (TVL) in Ethereum-based DeFi protocols continues to grow, demonstrating strong user demand and network adoption. [Insert statistics on DeFi market capitalization and growth rate].

- NFT Market: The NFT market, largely built on Ethereum, has experienced explosive growth, showcasing the potential of blockchain technology in digital asset management. [Insert statistics on NFT sales volume and market trends].

- Developer Activity: A vibrant developer community contributes significantly to Ethereum's growth and innovation. The number of active developers on the Ethereum network remains high, indicating continued development and improvement. [Insert statistics on the number of active Ethereum developers].

Regulatory Landscape and Governmental Policies

Governmental regulations and policies significantly influence the cryptocurrency market. Uncertainty surrounding regulations can impact Ethereum's price and adoption.

- Varying Regulatory Approaches: Different countries are adopting different approaches to regulating cryptocurrencies, creating a complex and evolving regulatory landscape. Some countries are embracing cryptocurrencies, while others are imposing strict regulations or outright bans.

- Impact on Adoption: Clear and supportive regulatory frameworks could accelerate Ethereum's adoption, while restrictive regulations could hinder growth and negatively impact the price.

- Tax Implications: Tax policies surrounding cryptocurrency transactions also affect investor behavior and market sentiment.

Competition and Alternative Blockchains

Ethereum faces competition from other blockchain platforms offering similar functionalities. Its ability to maintain its market dominance is a crucial factor in predicting its future.

- Competitors: Several blockchain platforms, such as Solana, Cardano, and Polkadot, offer features that compete with Ethereum.

- Comparative Analysis: While Ethereum excels in its established ecosystem and developer community, competitors sometimes offer advantages in areas like transaction speed and scalability.

- Maintaining Market Dominance: Ethereum's ability to innovate and adapt to evolving technological advancements will play a critical role in determining its long-term market position.

Potential Future Scenarios for Ethereum

Bullish Scenario

A bullish scenario for Ethereum involves several positive factors converging: widespread adoption across diverse sectors, successful implementation of Ethereum 2.0, and a supportive regulatory environment. This could result in significant price appreciation.

Bearish Scenario

Conversely, a bearish scenario could result from factors such as heightened regulatory uncertainty, intense competition from rival blockchains, or a broader cryptocurrency market downturn. This scenario could lead to a decline in Ethereum's price.

Neutral Scenario

A neutral scenario would involve moderate growth or sideways price movement, neither a significant bull run nor a substantial price drop. This could occur if the positive and negative factors influencing Ethereum's price roughly balance each other out.

Conclusion

Predicting Ethereum's future requires a holistic understanding of its current market position, technological roadmap, and the broader regulatory and competitive landscape. While a definitive prediction is impossible, analyzing these factors reveals potential bullish, bearish, and neutral scenarios. The success of Ethereum 2.0, widespread adoption, and the regulatory environment will be crucial in shaping Ethereum's future. Continue your research on predicting Ethereum's future to make informed investment decisions. Learn more about Ethereum's potential and improve your ability to predict Ethereum's future by staying updated on market trends and technological advancements.

Featured Posts

-

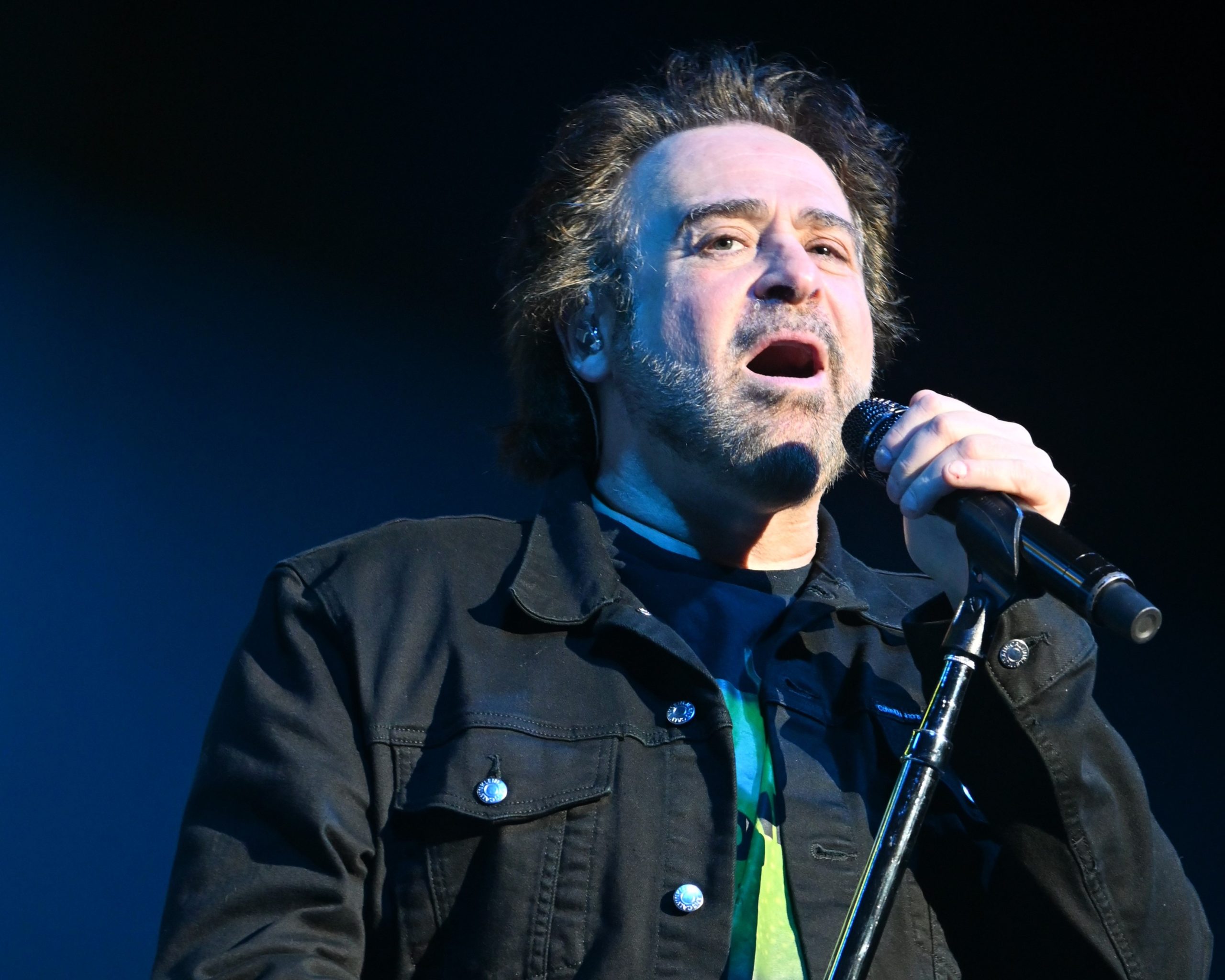

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025 -

Rogue The Savage Land 2 Preview Ka Zars Perilous Situation

May 08, 2025

Rogue The Savage Land 2 Preview Ka Zars Perilous Situation

May 08, 2025 -

360

May 08, 2025

360

May 08, 2025 -

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025 -

The Post Roe Landscape Examining The Implications Of Otc Birth Control

May 08, 2025

The Post Roe Landscape Examining The Implications Of Otc Birth Control

May 08, 2025

Latest Posts

-

Xrp Rising The Trump Factor And Ripples Future

May 08, 2025

Xrp Rising The Trump Factor And Ripples Future

May 08, 2025 -

Xrp Price Surge Is President Trump The Reason

May 08, 2025

Xrp Price Surge Is President Trump The Reason

May 08, 2025 -

Ripples Xrp Three Factors Pointing To Potential Growth Plus Remittix Ico Update

May 08, 2025

Ripples Xrp Three Factors Pointing To Potential Growth Plus Remittix Ico Update

May 08, 2025 -

Xrp And Ripple Recent Developments And Market Analysis

May 08, 2025

Xrp And Ripple Recent Developments And Market Analysis

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Ripple Vs Remittix Analyzing The Ico Success

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Ripple Vs Remittix Analyzing The Ico Success

May 08, 2025