Principal Financial Group (PFG) Stock: 13 Analyst Ratings Analyzed

Table of Contents

Summary of Analyst Ratings: A Diverse Range of Opinions

Analyzing 13 analyst ratings on Principal Financial Group (PFG) stock reveals a diverse range of opinions regarding its future performance. The ratings span the spectrum, reflecting the complexities and uncertainties inherent in the financial services sector.

- Buy: 4 analysts

- Hold: 7 analysts

- Sell: 2 analysts

The average rating, calculated using a standardized scale (e.g., Buy = 2, Hold = 1, Sell = 0), provides a useful summary of the overall sentiment. In this case, the average suggests a cautiously optimistic outlook. However, it’s crucial to note that the average alone doesn't tell the whole story.

Significant outliers exist. One analyst issued a strongly bullish "Buy" rating, citing PFG's strong potential for growth in emerging markets. Conversely, one analyst issued a "Sell" rating, expressing concern over potential regulatory headwinds.

| Analyst | Rating | Price Target | Rationale Snippet |

|---|---|---|---|

| Analyst A | Buy | $80 | Strong growth potential in Asia |

| Analyst B | Hold | $75 | Stable performance, moderate growth |

| Analyst C | Sell | $65 | Regulatory concerns |

| ... | ... | ... | ... |

(Insert Bar Chart Here showing distribution of Buy, Hold, Sell ratings)

Keywords: PFG stock rating, analyst recommendations, PFG stock price forecast, buy/sell recommendations PFG

Key Factors Influencing Analyst Ratings of PFG Stock

Several key factors influence the analyst ratings for Principal Financial Group (PFG) stock. Understanding these factors is vital to interpreting the ratings and forming your own informed opinion.

Financial Performance and Profitability

PFG's recent financial results are a significant driver of analyst sentiment. Key metrics such as earnings per share (EPS) growth, dividend yield, and return on equity (ROE) provide insights into the company's financial health and profitability.

- EPS Growth: Examine the trend of EPS growth over the past few quarters and years. Consistent growth is generally viewed favorably by analysts.

- Dividend Yield: A high and consistent dividend yield can attract income-seeking investors and boost ratings.

- Return on Equity (ROE): ROE indicates how effectively PFG is using its shareholders' equity to generate profit. A high ROE is generally a positive indicator.

Recent financial news and announcements, such as earnings reports or acquisitions, also significantly impact analyst ratings.

Industry Trends and Competition

The competitive landscape of the financial services industry significantly influences PFG's performance and analyst sentiment.

- Comparison to Competitors: Analyze PFG's performance relative to its key competitors, such as MetLife, Prudential, and Northwestern Mutual. Market share trends and competitive advantages are key considerations.

- Industry Trends: Factors like interest rate changes, regulatory changes (e.g., new capital requirements), and technological advancements (e.g., fintech disruption) significantly impact the industry and PFG's prospects.

Economic Outlook and Market Conditions

Macroeconomic factors play a crucial role in shaping analyst expectations for PFG's future performance.

- Inflation and Recessionary Fears: High inflation and recessionary fears can negatively impact investor confidence and reduce demand for financial services, potentially affecting PFG's stock price.

- Risk and Opportunities: Analyze the potential risks and opportunities associated with the current economic climate. For example, rising interest rates could benefit PFG's investment income but may also reduce demand for certain products.

Keywords: PFG stock market analysis, macroeconomic factors, PFG stock investment risks

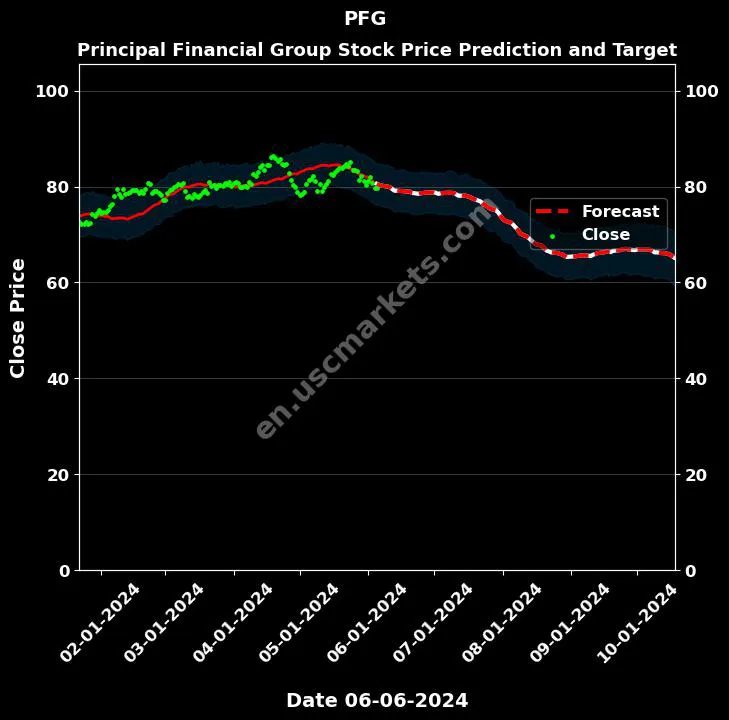

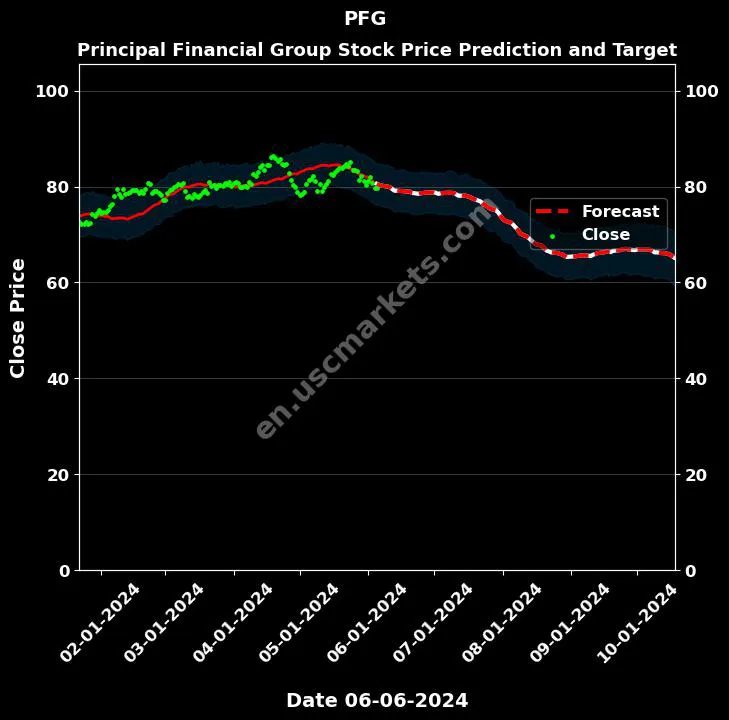

Analyzing the Price Target for PFG Stock

Analysts typically provide price targets for PFG stock, representing their estimates of the stock's future value. Analyzing these price targets can provide insights into potential returns.

The average price target among the 13 analysts offers a consensus view. However, it's important to consider the range of price targets, from the most optimistic to the most pessimistic. This range reflects the uncertainty surrounding PFG's future performance. Comparing the average price target to the current market price allows you to assess the potential upside or downside based on analyst predictions.

Keywords: PFG stock price target, PFG stock valuation, PFG potential returns

Considering Risk and Reward in Investing in PFG Stock

Investing in PFG stock, like any investment, involves both risks and rewards.

- Market Volatility: The stock market is inherently volatile, and PFG stock price is subject to fluctuations influenced by various factors.

- Company-Specific Risks: Company-specific risks include operational challenges, management changes, and unforeseen events.

- Regulatory Changes: Changes in regulations can significantly impact the financial services industry and PFG's operations.

The potential rewards of investing in PFG stock, as suggested by the analyst ratings and price targets, must be carefully weighed against these risks. A balanced assessment of these factors is crucial before making any investment decisions.

Keywords: PFG stock risks, PFG stock investment analysis, PFG return on investment

Conclusion: Making Informed Decisions About Principal Financial Group (PFG) Stock

This analysis of 13 analyst ratings on Principal Financial Group (PFG) stock reveals a mixed but generally cautiously optimistic outlook. The range of opinions, from "Buy" to "Sell," highlights the complexities of predicting future performance in the financial services sector. Key factors influencing these predictions include PFG's financial performance, industry trends, and the overall economic outlook. Remember, this analysis is for informational purposes only. It's crucial to conduct thorough research, considering your own risk tolerance and financial goals, before making any investment decisions related to Principal Financial Group (PFG) stock. By understanding these varied perspectives on Principal Financial Group (PFG) stock, you can make a more informed investment decision. Continue your due diligence and consider incorporating PFG into your diversified portfolio. Remember to always consult with a qualified financial advisor before making any investment decisions.

Keywords: Principal Financial Group (PFG) stock investment, PFG stock analysis, PFG stock outlook, PFG stock portfolio

Featured Posts

-

Best Online Casinos In New Zealand Top Real Money Casino Sites Reviewed

May 17, 2025

Best Online Casinos In New Zealand Top Real Money Casino Sites Reviewed

May 17, 2025 -

Retrieving New York Daily News Back Pages From May 2025

May 17, 2025

Retrieving New York Daily News Back Pages From May 2025

May 17, 2025 -

Top Rated Crypto Casinos In The United States Is Jackbit Number 1

May 17, 2025

Top Rated Crypto Casinos In The United States Is Jackbit Number 1

May 17, 2025 -

0 0 Everton Vina Y Coquimbo Unido Empatan Resumen Y Estadisticas Del Juego

May 17, 2025

0 0 Everton Vina Y Coquimbo Unido Empatan Resumen Y Estadisticas Del Juego

May 17, 2025 -

Live Stream Celtics Vs Knicks Free Online And Tv Broadcast Details

May 17, 2025

Live Stream Celtics Vs Knicks Free Online And Tv Broadcast Details

May 17, 2025