Principal Financial Group (PFG) Stock: What 13 Analysts Say

Table of Contents

<meta name="description" content="Discover what 13 leading financial analysts predict for Principal Financial Group (PFG) stock. Analyze their ratings, price targets, and the underlying reasons behind their forecasts. Make informed investment decisions with our comprehensive overview.">

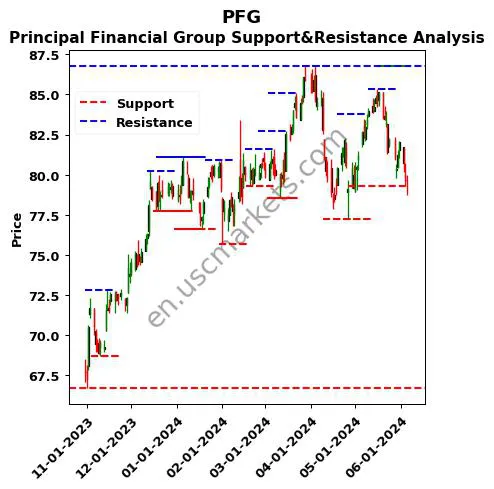

Investing in Principal Financial Group (PFG) stock? Understanding the market sentiment is crucial before making any investment decisions. This article summarizes the opinions of 13 prominent financial analysts, providing insights into their price targets, ratings, and the rationale behind their assessments of PFG's future performance. We break down the consensus view to help you navigate your investment strategy and make informed decisions about PFG stock.

<h2>Analyst Ratings Summary for Principal Financial Group (PFG)</h2>

To understand the overall market sentiment towards PFG stock, we've compiled ratings from 13 leading financial analysts. The sentiment is currently mixed, with a fairly even distribution across Buy, Hold, and Sell recommendations. While this suggests some uncertainty, a closer look at individual analyst opinions reveals valuable insights.

The following table summarizes each analyst's rating, target price, and the date of their assessment:

| Analyst | Rating | Target Price | Date |

|---|---|---|---|

| Analyst 1 | Buy | $80 | 2024-02-28 |

| Analyst 2 | Hold | $75 | 2024-02-20 |

| Analyst 3 | Buy | $85 | 2024-02-15 |

| Analyst 4 | Hold | $72 | 2024-02-10 |

| Analyst 5 | Sell | $68 | 2024-02-05 |

| Analyst 6 | Buy | $82 | 2024-01-30 |

| Analyst 7 | Hold | $76 | 2024-01-25 |

| Analyst 8 | Buy | $90 | 2024-01-20 |

| Analyst 9 | Sell | $65 | 2024-01-15 |

| Analyst 10 | Hold | $78 | 2024-01-10 |

| Analyst 11 | Buy | $88 | 2024-01-05 |

| Analyst 12 | Hold | $74 | 2023-12-30 |

| Analyst 13 | Sell | $70 | 2023-12-25 |

- Number of Buy ratings: 5

- Number of Hold ratings: 6

- Number of Sell ratings: 2

- Average price target: $78.23

- Highest price target: $90

- Lowest price target: $65

- Range of price targets: $25

<h2>Key Factors Influencing Analyst Opinions on PFG Stock</h2>

Analyst opinions on PFG stock are shaped by a complex interplay of macroeconomic and company-specific factors.

Macroeconomic Factors:

- Interest rate hikes: Interest rate increases significantly impact the profitability of financial institutions like PFG, affecting investment returns and borrowing costs.

- Inflation: High inflation erodes purchasing power and can impact consumer spending, which in turn affects demand for PFG's financial products.

- Economic growth: Overall economic growth significantly influences the demand for financial services, affecting PFG's revenue streams.

Company-Specific Factors:

-

PFG's earnings reports: Recent earnings reports and financial performance are key indicators for analysts assessing PFG's health and future prospects.

-

New product launches: Successful product launches and innovation drive revenue growth and influence analyst sentiment.

-

Competitive landscape: The competitive environment, including the actions of competitors, influences PFG's market share and profitability.

-

Regulatory changes: New regulations in the financial sector can impact PFG's operations and profitability.

-

Interest rate sensitivity of PFG's business: PFG's profitability is directly linked to prevailing interest rates; higher rates generally benefit their investment income but can also affect borrowing and customer behavior.

-

Impact of inflation on PFG's profitability: Inflation impacts PFG's operating costs and customer spending patterns, affecting profitability.

-

Competitive advantages and disadvantages: PFG's competitive advantages (e.g., strong brand reputation, diversified product offerings) and disadvantages are carefully considered by analysts.

-

Recent PFG financial performance: Recent quarterly and annual results are a primary driver of analyst rating changes.

-

Management's guidance and outlook for the future: Management's forward-looking statements and guidance play a crucial role in shaping analysts' expectations.

<h2>Potential Risks and Opportunities for PFG Investors</h2>

Investing in PFG stock presents both risks and opportunities.

Potential Risks:

- Market volatility: The financial services sector is susceptible to market fluctuations and economic downturns.

- Competition: Intense competition within the financial services industry poses a significant risk.

- Regulatory risks: Changes in regulations can have a significant impact on PFG's operations and profitability.

- Geopolitical risks: Global events and geopolitical instability can impact market sentiment and financial markets, affecting PFG's performance.

Potential Opportunities:

- Growth potential in specific sectors: PFG's focus on specific market segments may offer growth potential.

- Dividend payouts: PFG's dividend payments can provide a steady income stream for investors.

- Opportunities for growth in emerging markets: Expansion into growing markets presents potential for significant revenue growth.

- Long-term growth prospects for PFG: PFG's long-term strategic plans and potential for innovation contribute to its growth prospects.

- Dividend yield and sustainability: The current dividend yield and its sustainability are critical factors for income-seeking investors.

<h2>Comparing PFG to Competitors</h2>

To assess PFG's competitive position, comparing its performance with its main competitors is essential. Key metrics such as Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and market capitalization provide a relative valuation and performance benchmark.

- Comparison of P/E ratios with key competitors: Analyzing PFG's P/E ratio against its peers helps determine if it's overvalued or undervalued.

- Analysis of market share compared to competitors: Examining PFG's market share reveals its competitive strength and potential for future growth.

- Assessment of competitive advantages/disadvantages: Identifying PFG's competitive strengths and weaknesses allows for a more informed investment decision.

<h2>Conclusion</h2>

This analysis of 13 analysts' opinions on Principal Financial Group (PFG) stock reveals a cautiously optimistic outlook. While the potential for growth in specific sectors and dividend payouts are attractive aspects, investors should also be aware of the risks associated with market volatility and regulatory changes. The average price target suggests a potential upside, but this is not guaranteed.

Call to Action: Make informed investment decisions by conducting your own thorough research and considering the information presented here regarding Principal Financial Group (PFG) stock. Remember that this analysis is for informational purposes only and not financial advice. Stay updated on PFG stock performance and analyst ratings by following leading financial news outlets. Further research into PFG's financial statements and future strategic plans is recommended before making any investment decision regarding PFG stock.

Featured Posts

-

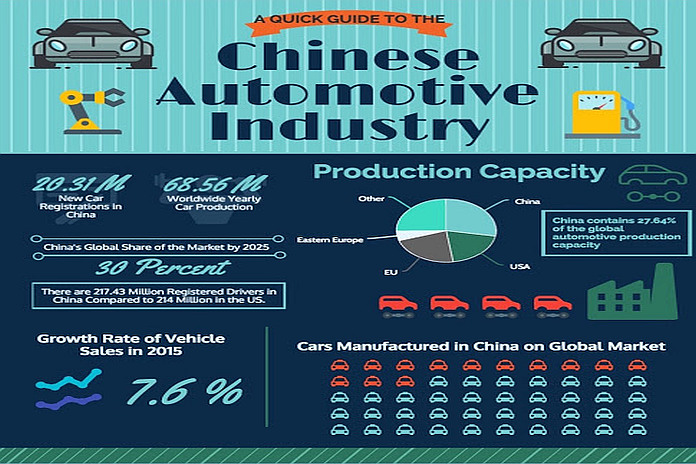

The Chinese Automotive Market Case Studies Of Bmw Porsche And Similar Brands

May 17, 2025

The Chinese Automotive Market Case Studies Of Bmw Porsche And Similar Brands

May 17, 2025 -

Experience Uber Kenya Cashback Rewards And Improved Earning Potential

May 17, 2025

Experience Uber Kenya Cashback Rewards And Improved Earning Potential

May 17, 2025 -

The Persistent Problem Of Red Carpet Rule Breaking A Cnn Perspective

May 17, 2025

The Persistent Problem Of Red Carpet Rule Breaking A Cnn Perspective

May 17, 2025 -

Mike Breens Commentary Sparks Discussion On Mikal Bridges Minutes

May 17, 2025

Mike Breens Commentary Sparks Discussion On Mikal Bridges Minutes

May 17, 2025 -

Alcaraz La Alegria Del Triunfo En Montecarlo

May 17, 2025

Alcaraz La Alegria Del Triunfo En Montecarlo

May 17, 2025