Private Credit Jobs: 5 Crucial Do's And Don'ts For Success

Table of Contents

Do's for Success in Private Credit Jobs

1. Master the Fundamentals of Private Credit

Understanding the intricacies of private credit is paramount. This involves more than just basic finance knowledge; you need a deep understanding of the various strategies employed within the private debt market.

- Understand different private credit strategies: Gain expertise in direct lending, mezzanine financing, and distressed debt strategies. Each involves unique risk-reward profiles and requires specialized knowledge.

- Develop expertise in financial modeling, valuation, and credit analysis: Proficiency in building sophisticated financial models, conducting thorough valuations, and performing rigorous credit analysis is crucial for evaluating potential investments. These are core skills for any private credit analyst.

- Stay updated on market trends and regulatory changes: The private credit industry is dynamic. Keep abreast of the latest market trends, economic shifts, and regulatory changes impacting private debt investments through industry publications and networking.

- Keywords: Direct Lending, Mezzanine Financing, Distressed Debt, Financial Modeling, Credit Analysis, Private Debt Market, Private Equity Investments.

2. Build a Strong Network

Networking is invaluable in the finance industry, and the private credit space is no exception. Building relationships can open doors to unadvertised opportunities and provide invaluable insights.

- Attend industry conferences and networking events: These events offer unparalleled opportunities to connect with professionals in the private credit industry and learn about emerging trends.

- Connect with professionals on LinkedIn and other platforms: Actively engage with professionals on LinkedIn, participate in relevant groups, and initiate conversations.

- Informational interviews are key: Reach out to people working in private credit roles for informational interviews. This helps you learn about specific roles, firms, and the industry culture.

- Keywords: Networking, Private Credit Networking, Industry Conferences, LinkedIn, Informational Interviews, Finance Professionals, Private Equity Networking.

3. Tailor Your Resume and Cover Letter

Your application materials are your first impression. Generic applications won't cut it in the competitive private credit job market.

- Highlight relevant skills and experience: Focus on skills and experiences directly relevant to private credit, such as financial modeling, credit analysis, and deal execution.

- Quantify your achievements: Instead of simply stating responsibilities, quantify your achievements whenever possible. For instance, "increased portfolio yield by 15%" is far more impactful than "managed portfolio investments."

- Customize your application materials: Tailor your resume and cover letter to each specific job description, highlighting the skills and experiences most relevant to the role.

- Keywords: Resume, Cover Letter, Job Application, Private Credit Resume, Finance Resume, Skills, Achievements, Private Debt Resume, Alternative Investments Resume.

4. Ace the Interview

The interview stage is critical. Preparation and confidence are key to making a strong impression.

- Practice your behavioral and technical interview skills: Practice answering common behavioral questions and prepare for technical questions related to financial modeling, valuation, and credit analysis. Mock interviews with peers can be helpful.

- Demonstrate your understanding of private credit principles: Show your understanding of different private credit strategies, risk assessment, and deal structuring.

- Research the firm thoroughly: Understand the firm's investment strategy, recent deals, and culture. Ask insightful questions demonstrating your genuine interest.

- Keywords: Interview Skills, Private Credit Interview, Behavioral Interview, Technical Interview, Finance Interview, Private Equity Interview, Alternative Investments Interview.

5. Develop Specialized Skills

Continuous learning and skill development are essential in the ever-evolving private credit industry.

- Consider pursuing relevant certifications: Certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) demonstrate your commitment to the field and enhance your credibility.

- Learn specialized software: Become proficient in financial modeling software (e.g., Bloomberg Terminal, Argus) and other tools commonly used in private credit.

- Develop expertise in a specific niche: Focusing on a particular niche, such as distressed debt or real estate private credit, can make you a more attractive candidate.

- Keywords: CFA, CAIA, Bloomberg Terminal, Argus, Specialized Skills, Private Credit Certifications, Private Debt Certifications.

Don'ts for Private Credit Job Seekers

1. Neglecting Fundamental Financial Skills

A strong foundation in accounting and finance is non-negotiable. Lack of proficiency in these areas will significantly hinder your chances of success.

- Don't underestimate the importance of strong accounting and finance knowledge: A solid understanding of financial statements, accounting principles, and corporate finance is fundamental.

- Lack of proficiency in financial modeling will hinder your success: Mastering financial modeling is crucial for analyzing investment opportunities and making informed decisions.

- Keywords: Financial Modeling, Accounting, Finance Fundamentals, Financial Statement Analysis.

2. Ignoring Networking Opportunities

Networking is not optional; it's essential. Actively seeking out networking opportunities dramatically increases your chances of landing a job.

- Don't underestimate the power of networking: Leverage your existing network and actively expand it through industry events and online platforms.

- Avoid passively waiting for job postings: Proactively reach out to firms and individuals within the private credit industry.

- Keywords: Networking, Job Search, Private Credit Careers, Private Debt Careers.

3. Submitting Generic Applications

A generic application demonstrates a lack of interest and effort. Take the time to tailor your application to each specific opportunity.

- Don't send the same resume and cover letter to every firm: Each application should be customized to reflect the specific requirements and priorities of the target firm and role.

- Tailoring your application shows genuine interest: Demonstrating genuine interest in a specific firm and role significantly increases your chances.

- Keywords: Job Application, Resume, Cover Letter, Targeted Applications.

4. Failing to Prepare for Interviews

Thorough interview preparation is crucial. Going in unprepared significantly reduces your chances of success.

- Don't go into an interview unprepared: Practice answering common interview questions, research the firm and interviewers, and prepare thoughtful questions to ask.

- Research the firm and the interviewers: Demonstrating your knowledge of the firm and interviewer’s background shows initiative and genuine interest.

- Keywords: Interview Preparation, Interview Skills, Private Credit Interview.

5. Underestimating the Importance of Continuous Learning

The private credit industry is constantly evolving. Continuous learning is not just beneficial; it's essential.

- Don't stop learning after you secure a job: Stay informed about industry trends, new regulations, and innovative investment strategies.

- Continuously improve your skills and knowledge: Seek opportunities for professional development, attend webinars, and stay updated on market news.

- Keywords: Continuing Education, Professional Development, Private Credit Industry, Private Debt Industry.

Conclusion

Securing a position in the competitive world of private credit jobs requires dedication, preparation, and a strategic approach. By following these do's and don'ts – mastering the fundamentals, building a strong network, crafting compelling applications, acing interviews, and continuously improving your skill set – you significantly increase your chances of success. Don't delay your pursuit of a rewarding career in private credit; start implementing these strategies today! Begin your journey to a successful career in private credit jobs now!

Featured Posts

-

Philips Shareholders Meeting Important Updates And Announcements

May 25, 2025

Philips Shareholders Meeting Important Updates And Announcements

May 25, 2025 -

Sutton Hoos Sixth Century Vessel New Insights Into Burial Rituals

May 25, 2025

Sutton Hoos Sixth Century Vessel New Insights Into Burial Rituals

May 25, 2025 -

Beruehrende Ereignisse In Essen Naehe Uniklinikum

May 25, 2025

Beruehrende Ereignisse In Essen Naehe Uniklinikum

May 25, 2025 -

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 25, 2025

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 25, 2025 -

Yevrobachennya Doli Peremozhtsiv Za Ostanni 10 Rokiv

May 25, 2025

Yevrobachennya Doli Peremozhtsiv Za Ostanni 10 Rokiv

May 25, 2025

Latest Posts

-

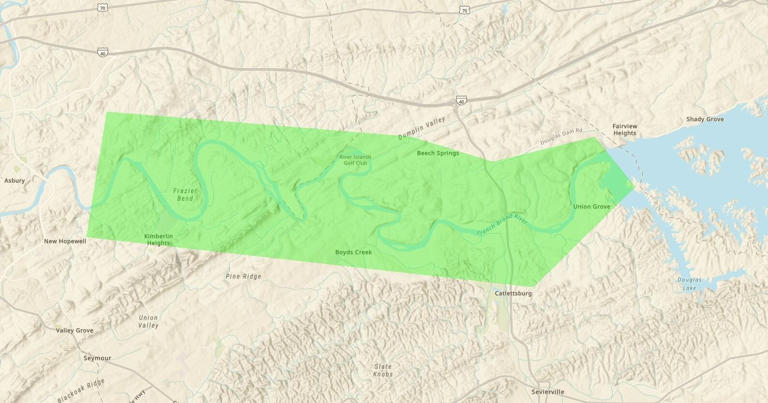

Flash Flood Emergencies Causes Impacts And Safety Precautions

May 25, 2025

Flash Flood Emergencies Causes Impacts And Safety Precautions

May 25, 2025 -

What Is A Flash Flood Emergency A Guide To Preparedness And Response

May 25, 2025

What Is A Flash Flood Emergency A Guide To Preparedness And Response

May 25, 2025 -

Nws Flood Warning Protecting Yourself And Your Property

May 25, 2025

Nws Flood Warning Protecting Yourself And Your Property

May 25, 2025 -

See The Worlds Largest Rubber Duck And Learn Water Safety In Myrtle Beach

May 25, 2025

See The Worlds Largest Rubber Duck And Learn Water Safety In Myrtle Beach

May 25, 2025 -

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025