Private Credit Jobs: 5 Do's And Don'ts For Success

Table of Contents

5 Do's for Securing Private Credit Jobs

Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit world. Don't underestimate the power of personal connections. A robust network can open doors to unadvertised opportunities and provide valuable insights into the industry.

- Attend industry conferences and events: SuperReturn, PEI conferences, and smaller, specialized events are excellent places to meet professionals. Actively participate in discussions and workshops.

- Leverage LinkedIn: Optimize your LinkedIn profile to highlight your private credit skills and experience. Connect with professionals at target firms and engage with their content.

- Informational interviews are key: Reach out to professionals for 15-20 minute informational interviews. Ask about their career path, the industry, and their firm's culture. This shows initiative and genuine interest.

- Join relevant professional organizations: The CFA Institute, AMAs, and other finance-focused organizations offer networking opportunities and access to industry experts.

- Develop a strong online presence: Share insightful articles, participate in relevant online forums, and establish yourself as a thought leader in private credit.

Do 2: Master Essential Private Credit Skills

Private credit demands a specialized skill set. Generic finance knowledge is insufficient; you need in-depth expertise.

- Develop strong financial modeling skills: Proficiency in Excel, discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation techniques is crucial.

- Gain expertise in credit analysis, underwriting, and portfolio management: Understand credit risk assessment, due diligence processes, and portfolio construction strategies.

- Understand different private credit strategies: Familiarize yourself with direct lending, mezzanine finance, distressed debt, and other investment strategies within private credit.

- Become proficient in legal and regulatory aspects of private credit: Understanding compliance requirements and legal frameworks is essential.

- Demonstrate knowledge of various asset classes: Private credit encompasses various asset classes; show your understanding of real estate, infrastructure, and other relevant areas.

Do 3: Tailor Your Resume and Cover Letter for Each Private Credit Job Application

A generic application won't cut it in the competitive private credit market. Each application must be meticulously tailored to the specific job description and the target firm.

- Highlight relevant experience and skills: Focus on achievements directly related to the job requirements.

- Quantify your achievements: Use metrics and numbers to showcase your impact (e.g., "Increased ROI by 15%").

- Use keywords from the job description: Incorporate relevant keywords naturally into your resume and cover letter to improve your chances of applicant tracking system (ATS) matches.

- Showcase your understanding of the target firm's investment strategy: Research the firm thoroughly and demonstrate your knowledge of their investment thesis and portfolio companies.

- Proofread meticulously: Errors in grammar and spelling can undermine your credibility.

Do 4: Ace the Private Credit Job Interview

Private credit interviews are rigorous and demanding. Preparation is key to success.

- Practice your behavioral interview responses (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions.

- Prepare for technical questions about financial modeling and credit analysis: Be ready to demonstrate your understanding of key concepts and your ability to solve complex problems.

- Research the firm thoroughly: Demonstrate genuine interest by showing your understanding of their investment strategy, recent transactions, and team members.

- Ask insightful questions: Prepare thoughtful questions to show your engagement and understanding of the firm and the role.

- Follow up with a thank-you note: A prompt and personalized thank-you note reinforces your interest and professionalism.

Do 5: Obtain Relevant Certifications and Education

Furthering your education and obtaining relevant certifications can significantly enhance your candidacy for private credit jobs.

- Consider pursuing the CFA charter or other relevant financial certifications: The CFA charter is a highly regarded credential in the finance industry.

- An MBA or Master's in Finance can significantly enhance your credentials: An advanced degree demonstrates your commitment to the field and provides specialized knowledge.

- Highlight any specialized training in private credit or related areas: Mention any relevant courses, workshops, or seminars you've attended.

- Continuously update your knowledge: Stay current with industry trends and developments by reading industry publications and conducting research.

- Participate in relevant professional development opportunities: Attend webinars, workshops, and conferences to expand your knowledge and network.

5 Don'ts for Private Credit Job Seekers

Don't 1: Neglect Networking: Networking is crucial; a passive approach will significantly hinder your job search.

Don't 2: Lack Specific Private Credit Knowledge: Generic finance skills are insufficient; you need in-depth private credit expertise.

Don't 3: Submit Generic Applications: Tailor each application; a one-size-fits-all approach won't impress private credit firms.

Don't 4: Underprepare for Interviews: Private credit interviews are rigorous; thorough preparation is essential.

Don't 5: Fail to Follow Up: Following up shows initiative and strengthens your candidacy.

Conclusion

Securing a fulfilling and successful career in private credit jobs requires a dedicated approach. By following these five "do's" and avoiding the five "don'ts," you can dramatically increase your chances of landing your dream role. Remember to network strategically, master essential skills, tailor your applications, ace your interviews, and pursue relevant credentials. Start building your path to a successful career in private credit jobs today!

Featured Posts

-

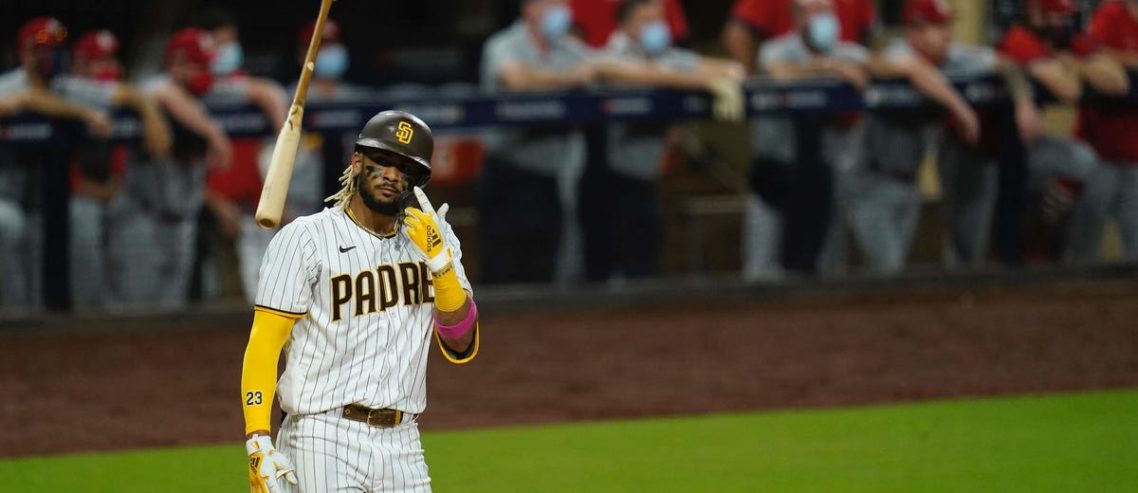

Examining The Impact Of Michael Kays Comments On Juan Sotos Performance

May 11, 2025

Examining The Impact Of Michael Kays Comments On Juan Sotos Performance

May 11, 2025 -

Life Under Siege Examining The Humanitarian Crisis In Gaza

May 11, 2025

Life Under Siege Examining The Humanitarian Crisis In Gaza

May 11, 2025 -

Bilan D Audience La Roue De La Fortune D Eric Antoine Sur M6 Apres 3 Mois

May 11, 2025

Bilan D Audience La Roue De La Fortune D Eric Antoine Sur M6 Apres 3 Mois

May 11, 2025 -

Trumps Trade War Implications For The Commercial Aircraft And Engine Sector

May 11, 2025

Trumps Trade War Implications For The Commercial Aircraft And Engine Sector

May 11, 2025 -

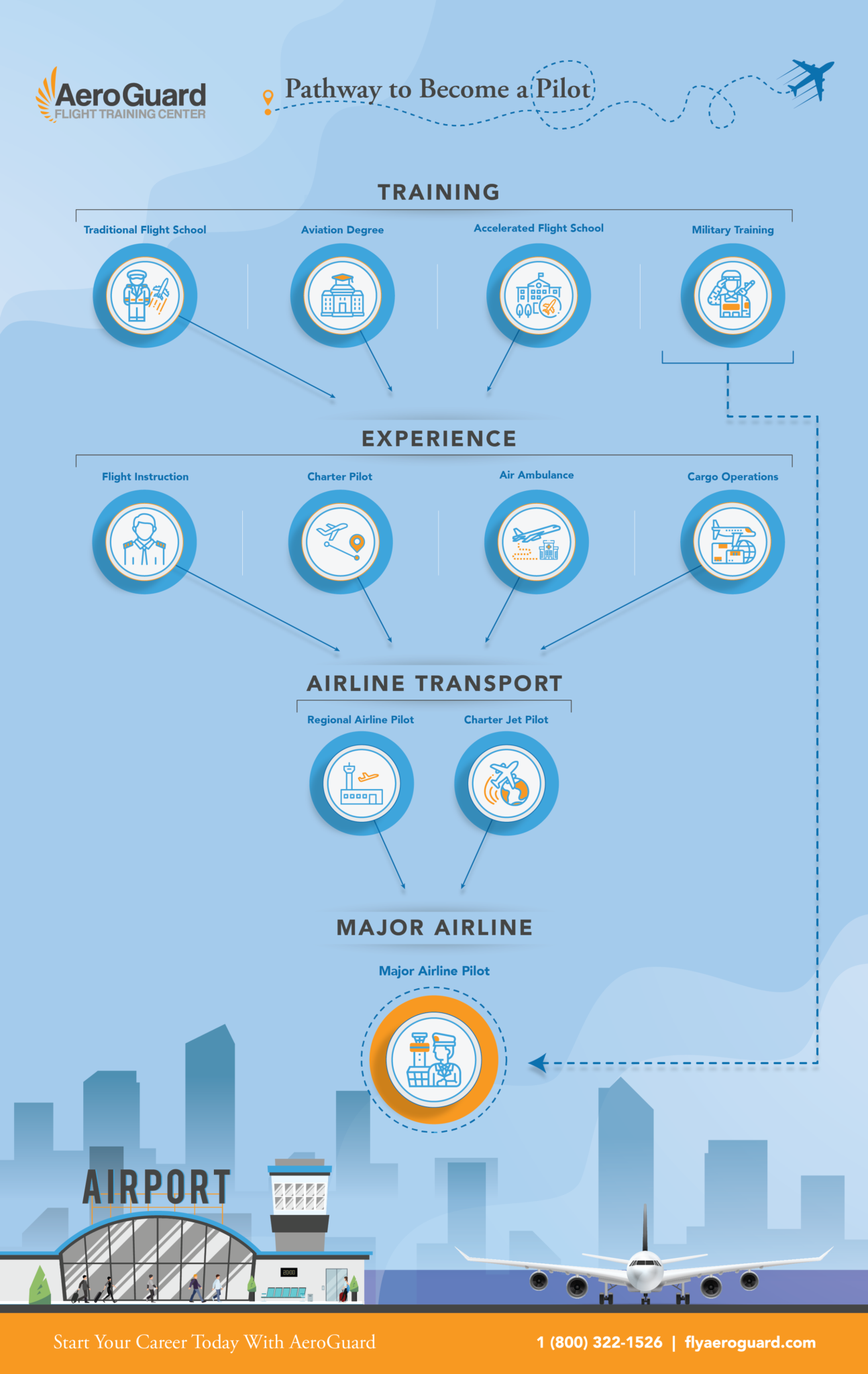

From Cabin Crew To Captain One Womans Path To Becoming A Pilot After Singapore Airlines

May 11, 2025

From Cabin Crew To Captain One Womans Path To Becoming A Pilot After Singapore Airlines

May 11, 2025

Latest Posts

-

Positive Movement In Us China Trade Discussions Bessents Statement

May 12, 2025

Positive Movement In Us China Trade Discussions Bessents Statement

May 12, 2025 -

Gambling On Catastrophe The Los Angeles Wildfire Betting Phenomenon

May 12, 2025

Gambling On Catastrophe The Los Angeles Wildfire Betting Phenomenon

May 12, 2025 -

Us And China Make Headway In Trade Talks Bessents Assessment

May 12, 2025

Us And China Make Headway In Trade Talks Bessents Assessment

May 12, 2025 -

Understanding The Countrys Shifting Business Landscape A Location Map

May 12, 2025

Understanding The Countrys Shifting Business Landscape A Location Map

May 12, 2025 -

Wildfire Woes Exploring The Market For Los Angeles Wildfire Bets

May 12, 2025

Wildfire Woes Exploring The Market For Los Angeles Wildfire Bets

May 12, 2025