Private Credit Jobs: 5 Do's And Don'ts To Secure Your Next Role

Table of Contents

5 DO's to Land Your Dream Private Credit Job

Landing a coveted position in the private credit sector requires more than just a strong resume. It demands a proactive and strategic approach. Here are five essential "do's" to increase your chances of success.

Do 1: Network Strategically Within the Private Credit Sector

Networking is paramount in the close-knit world of private credit. Building genuine relationships can significantly boost your job prospects.

- Expand your network: Connect with professionals in private equity, hedge funds, and credit funds. Attend industry events like SuperReturn, PEI conferences, and smaller, specialized gatherings.

- Leverage LinkedIn: Optimize your profile to highlight your relevant skills and experience. Actively engage with industry leaders and recruiters, joining relevant groups and participating in discussions.

- Informational interviews: Reach out to professionals for informational interviews. These conversations provide invaluable insights into specific roles, companies, and the industry overall. They are a powerful tool for building relationships and demonstrating your genuine interest in private credit jobs.

Do 2: Tailor Your Resume and Cover Letter for Specific Private Credit Roles

Generic applications rarely succeed in a competitive market like private credit. Each application should be meticulously tailored to the specific job description.

- Highlight relevant experience: Emphasize skills like financial modeling, credit analysis, due diligence, and portfolio management. Quantify your achievements whenever possible.

- Keyword optimization: Incorporate keywords from the job description to improve your chances of passing through Applicant Tracking Systems (ATS). This ensures your resume gets seen by a human recruiter.

- Craft compelling cover letters: Each cover letter should showcase your unique skills and experiences in relation to the specific role and company. Demonstrate your understanding of their investment strategy and target market.

Do 3: Master the Art of the Private Credit Interview

The interview process for private credit jobs is rigorous. Preparation is key to demonstrating your expertise and professionalism.

- Master behavioral questions: Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result).

- Technical prowess: Demonstrate a deep understanding of financial statements, credit analysis techniques, and relevant financial ratios (e.g., DSCR, LTV, IRR).

- Prepare insightful questions: Asking thoughtful questions showcases your interest and understanding of the firm and the role.

- Thorough research: Research the firm's investment strategy, recent transactions, and the interviewer's background.

Do 4: Showcase Your Financial Modeling and Analytical Skills

Proficiency in financial modeling and analysis is crucial for private credit jobs. Showcase your abilities through a well-prepared portfolio.

- Build a strong portfolio: Develop LBO models, DCF analyses, and other relevant financial models to demonstrate your skills.

- Software proficiency: Highlight your expertise in Excel, Bloomberg Terminal, and other relevant financial software.

- Credit analysis expertise: Be prepared to discuss your approach to credit analysis, risk assessment, and due diligence. Demonstrate understanding of covenant compliance and credit risk mitigation strategies.

- Key metrics understanding: Showcase your knowledge of key private credit metrics like IRR, LTV, DSCR, and leverage ratios.

Do 5: Highlight Your Understanding of Private Credit Market Trends

Staying abreast of current market conditions and regulatory changes is essential in the dynamic world of private credit.

- Market awareness: Stay updated on current economic conditions, interest rate changes, and regulatory developments impacting the private credit market.

- Investment strategy knowledge: Demonstrate familiarity with various private credit strategies, such as direct lending, mezzanine financing, distressed debt, and special situations investing.

- Analyze market data: Show your ability to analyze market data, draw insightful conclusions, and discuss the implications for investment decisions.

- Current events: Discuss current events impacting the private credit industry and explain how these events affect investment strategies and risk assessments.

5 DON'Ts When Applying for Private Credit Jobs

Avoiding common pitfalls can significantly improve your chances of securing a private credit job. Here are five crucial "don'ts" to keep in mind.

Don't 1: Submit Generic Applications

Each application should be unique and tailored to the specific requirements of the job description. Avoid using the same resume and cover letter for multiple applications. This demonstrates a lack of effort and genuine interest.

Don't 2: Overlook Networking Opportunities

Networking is crucial in private credit. Don't underestimate the power of building relationships with professionals in the industry. Attend industry events, leverage LinkedIn, and pursue informational interviews.

Don't 3: Underestimate the Importance of Technical Skills

Strong financial modeling and analytical skills are non-negotiable. Focus on developing and showcasing your proficiency in these areas. A strong foundation in accounting and finance is critical.

Don't 4: Neglect Market Research

Stay informed about industry trends, regulatory changes, and economic conditions. Demonstrate your understanding of the current market landscape and its implications for private credit investments.

Don't 5: Lack Enthusiasm and Passion

Demonstrate your genuine interest in the private credit industry and the specific role you're applying for. Your passion will shine through in your applications and interviews.

Securing Your Future in Private Credit Jobs

Securing a rewarding career in private credit jobs requires a strategic approach that combines networking, strong technical skills, and a deep understanding of market trends. By following these "do's" and avoiding the "don'ts," you can significantly increase your chances of landing your dream role. Start networking today, update your resume and cover letter, and actively pursue your ideal private credit job. Good luck! (Consider adding links to relevant job boards here).

Featured Posts

-

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025 -

Dr Sanjay Gupta On The Potential Ban Of Food Dyes

Apr 26, 2025

Dr Sanjay Gupta On The Potential Ban Of Food Dyes

Apr 26, 2025 -

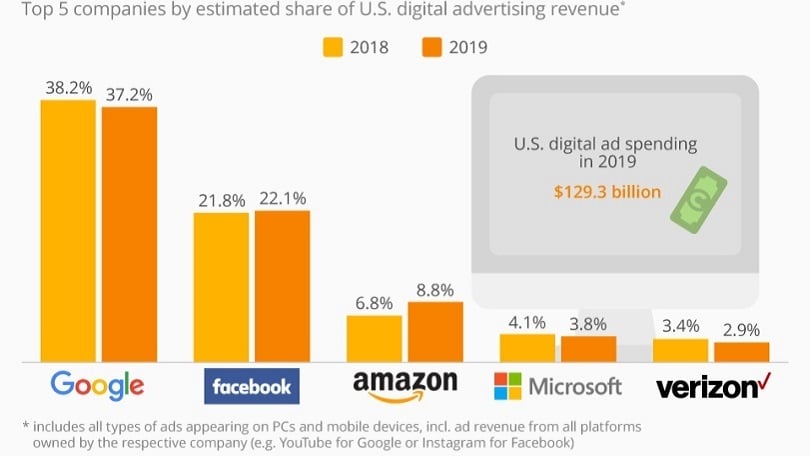

How Tariffs Are Slowing Down Big Techs Advertising Growth

Apr 26, 2025

How Tariffs Are Slowing Down Big Techs Advertising Growth

Apr 26, 2025 -

Ajax Stunned By Eintracht Frankfurt In Crucial Europa League Leg

Apr 26, 2025

Ajax Stunned By Eintracht Frankfurt In Crucial Europa League Leg

Apr 26, 2025 -

First Water Test Damen Csd 650 Engineered By Soltan Kazimov

Apr 26, 2025

First Water Test Damen Csd 650 Engineered By Soltan Kazimov

Apr 26, 2025

Latest Posts

-

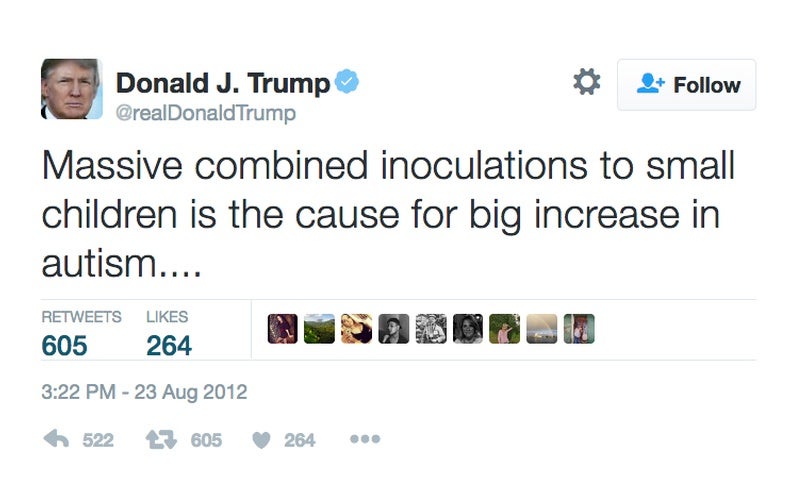

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025