Private Credit Jobs: 5 Essential Dos And Don'ts To Get Hired

Table of Contents

DO: Network Strategically within the Private Credit Industry

Networking is crucial in the private credit industry. Building relationships can open doors to unadvertised roles and provide valuable insights.

Attend Industry Events and Conferences

Actively participate in private credit conferences, seminars, and workshops. These events offer invaluable opportunities to connect with professionals.

- Target specific events: Focus on conferences and workshops related to your area of interest within private credit, such as distressed debt, mezzanine financing, or leveraged buyouts.

- Engage actively: Don't just attend; actively participate in discussions, ask insightful questions, and engage with speakers.

- Follow up: After the event, send personalized emails to individuals you connected with, reiterating your interest and sharing relevant information.

Leverage LinkedIn for Targeted Connections

LinkedIn is an invaluable tool for connecting with professionals in the private credit space.

- Optimize your profile: Use relevant keywords like "private credit," "credit analysis," "portfolio management," "debt financing," and "leveraged lending" throughout your profile.

- Engage in groups: Participate in relevant LinkedIn groups, sharing insights and engaging in discussions to showcase your expertise.

- Connect with recruiters: Connect with recruiters who specialize in private credit placements. They often have exclusive access to unadvertised roles.

Informational Interviews

Informational interviews allow you to learn directly from professionals and build relationships.

- Research thoroughly: Identify professionals working in roles you aspire to and reach out to request a brief informational interview.

- Prepare questions: Prepare insightful questions demonstrating your knowledge of the industry and your genuine interest.

- Follow up: Send a thank-you note and stay in touch. These relationships can lead to referrals or future job opportunities.

DO: Showcase Your Financial Modeling and Analytical Skills

Private credit firms require candidates with strong analytical and financial modeling skills. Demonstrating these skills is key to securing a position.

Master Financial Modeling Software

Proficiency in financial modeling software is essential.

- Excel mastery: Go beyond basic Excel; develop expertise in advanced functions, including VBA and various financial modeling techniques such as discounted cash flow (DCF) analysis and LBO modeling.

- Specialized software: Familiarize yourself with industry-standard software like Argus, Bloomberg Terminal, or other relevant platforms.

- Showcase your work: Create a portfolio showcasing your modeling skills and include relevant projects in your resume.

Highlight Analytical Capabilities

Beyond software, highlight your analytical thinking and problem-solving abilities.

- Credit analysis expertise: Emphasize your experience in credit analysis, due diligence, and valuation techniques.

- Financial statement analysis: Show your ability to thoroughly analyze financial statements, identifying key investment risks and opportunities.

- Quantify your results: Wherever possible, use data and metrics to demonstrate the impact of your work.

DO: Tailor Your Resume and Cover Letter to Each Application

Generic applications rarely succeed. Each application should be tailored to the specific job description and firm.

Customize Your Resume

Your resume should be tailored to each job application.

- Keyword optimization: Use keywords from the job description to increase the chances of your resume passing through Applicant Tracking Systems (ATS).

- Highlight relevant skills: Only include skills and experiences directly relevant to the specific job description.

- Quantify achievements: Use numbers and data to demonstrate the impact of your accomplishments.

Craft a Compelling Cover Letter

The cover letter is your opportunity to showcase your personality and enthusiasm.

- Personalize: Address the specific requirements and challenges mentioned in the job description and demonstrate your understanding of the firm’s investment strategy.

- Show your research: Demonstrate your knowledge of the firm, its portfolio companies, and recent transactions.

- Express your passion: Convey your genuine interest and enthusiasm for the private credit industry and the specific role.

DON'T: Neglect the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial in the private credit industry.

Communication and Teamwork

Effective communication and teamwork are vital for success.

- Verbal and written communication: Highlight your ability to communicate effectively both verbally and in writing.

- Teamwork experience: Showcase experiences where you collaborated effectively within a team to achieve common goals.

- Pressure handling: Demonstrate your ability to handle pressure and work effectively in a fast-paced environment.

Problem-Solving and Critical Thinking

Analytical abilities and problem-solving skills are highly valued.

- Showcase critical thinking: Provide examples where you used critical thinking to identify and solve complex problems.

- Risk mitigation: Demonstrate your ability to identify and mitigate risks associated with investments.

- Decision-making: Showcase your ability to make informed decisions based on available data and analysis.

DON'T: Underestimate the Value of Due Diligence

Thorough research demonstrates your professionalism and commitment.

Research the Firm Thoroughly

Before applying, research the firm in detail.

- Investment strategy: Understand the firm's investment strategy, target market, and typical investment sizes.

- Portfolio companies: Familiarize yourself with the firm's portfolio companies and their performance.

- Recent transactions: Research recent transactions and investments to demonstrate your understanding of the firm’s activities.

Prepare for Behavioral Interview Questions

Behavioral interview questions assess your past behavior to predict future performance.

- STAR method: Practice answering behavioral interview questions using the STAR method (Situation, Task, Action, Result).

- Reflect on past experiences: Identify relevant experiences that highlight your skills and accomplishments.

- Address potential weaknesses: Prepare to address potential weaknesses honestly and demonstrate how you are working to improve.

Conclusion:

Securing a rewarding position in the dynamic field of private credit jobs requires a strategic and multifaceted approach. By following these essential dos and don'ts, emphasizing your financial acumen, networking effectively, and showcasing your soft skills, you can significantly improve your chances of success. Remember to tailor your applications, conduct thorough research, and showcase your passion for the industry. Don't delay – start implementing these strategies today to land your dream private credit job!

Featured Posts

-

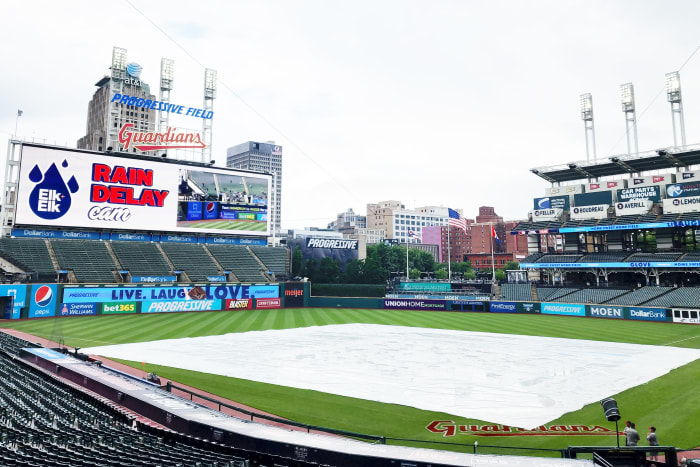

Postponed Game Leads To Tigers Doubleheader Full Schedule Announced

May 31, 2025

Postponed Game Leads To Tigers Doubleheader Full Schedule Announced

May 31, 2025 -

Drought Concerns Rise Spring 2024 Mirrors 1968s Conditions

May 31, 2025

Drought Concerns Rise Spring 2024 Mirrors 1968s Conditions

May 31, 2025 -

Banksys Art Dubai Showcases Works For The First Time

May 31, 2025

Banksys Art Dubai Showcases Works For The First Time

May 31, 2025 -

Plan De Comidas Para Emergencias 4 Recetas Sin Luz Ni Gas

May 31, 2025

Plan De Comidas Para Emergencias 4 Recetas Sin Luz Ni Gas

May 31, 2025 -

Banksys Mysterious Artwork Unveiling The Tag And Sale

May 31, 2025

Banksys Mysterious Artwork Unveiling The Tag And Sale

May 31, 2025