Protecting Your Portfolio: S&P 500 Downside Insurance Strategies

Table of Contents

Understanding S&P 500 Volatility and Downside Risk

Before diving into specific portfolio protection strategies, it's crucial to understand the inherent risks associated with investing in the S&P 500.

Historical Performance and Market Corrections

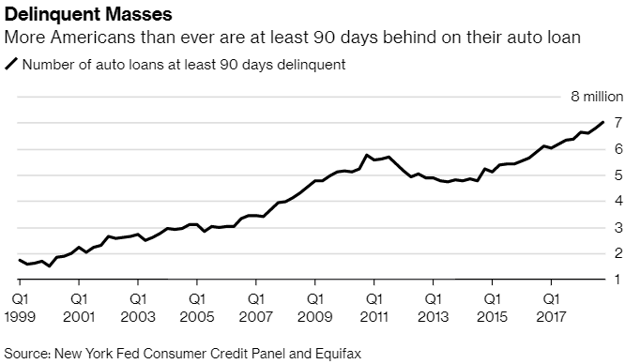

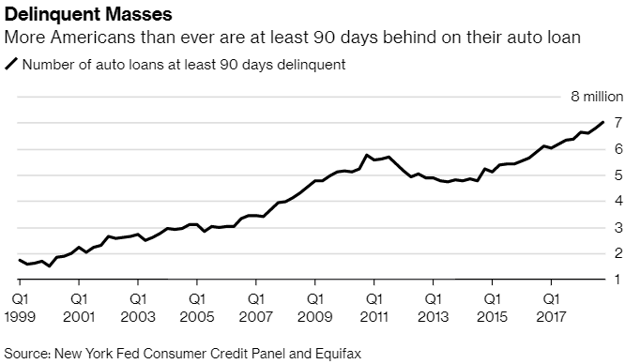

The S&P 500 has experienced numerous market corrections and bear markets throughout its history. These events, characterized by sharp declines in market value, highlight the unpredictable nature of the stock market. For example, the 2008 financial crisis saw the S&P 500 plummet by over 50%, a stark reminder of the potential for significant losses. Analyzing historical data on S&P 500 market correction frequency and depth provides valuable context for understanding the potential for future downturns. (Insert chart or graph illustrating historical S&P 500 volatility here) Understanding this historical volatility is vital for effective downside risk mitigation.

Identifying Your Risk Tolerance

Implementing effective S&P 500 risk management begins with a clear understanding of your own risk tolerance. A risk tolerance questionnaire can help determine your comfort level with potential losses. Your investor profile, including your age, financial goals, and investment timeline, significantly impacts your risk tolerance. A well-defined risk management plan forms the foundation of any successful investment strategy.

- Short-term vs. Long-term Goals: Short-term goals require a more conservative approach, while long-term investors can generally tolerate more risk.

- Asset Allocation Strategy: The proportion of your portfolio allocated to different asset classes directly influences your overall risk exposure. A heavily stock-weighted portfolio carries higher risk than a diversified one.

- Emotional Aspect of Market Downturns: Market downturns can trigger emotional responses leading to impulsive decisions. Maintaining a long-term perspective is crucial for weathering market volatility.

Diversification: A Cornerstone of Downside Protection

Diversification is a fundamental principle of S&P 500 downside insurance. By spreading investments across various asset classes and geographies, you reduce your overall portfolio's vulnerability to market fluctuations.

Asset Class Diversification

Asset allocation plays a critical role in portfolio diversification. Investing in a mix of asset classes such as stocks, bonds, real estate, and commodities helps reduce the impact of any single asset class underperforming. This risk diversification is essential for creating a more resilient portfolio.

Geographic Diversification

International diversification reduces exposure to country-specific risks. Investing in companies and markets across different regions, including emerging markets, provides a buffer against economic or political instability in a single country. This form of global diversification is particularly important in a globalized economy.

- Historical Correlations: Understanding the historical correlations between different asset classes can help optimize your portfolio's diversification.

- Effective Portfolio Diversification: Consider using a mix of stocks, bonds, and alternative investments to achieve a balanced portfolio.

- ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds offer convenient and cost-effective ways to achieve broad diversification.

Options Strategies for S&P 500 Downside Protection

Options trading offers powerful tools for S&P 500 downside insurance. However, it's essential to understand the complexities involved.

Protective Puts

Protective put options are a popular strategy to limit potential losses. By purchasing put options on the S&P 500, you gain the right to sell your holdings at a predetermined price, providing a safety net against market declines. While this offers protection, it comes at a cost – the premium paid for the put options.

Collars

A collar strategy involves simultaneously buying put options and selling call options on the same underlying asset. This strategy limits both potential gains and losses, creating a defined risk profile. The covered call writing aspect generates income but limits upside potential. The effectiveness of a collar depends on its specific parameters and market conditions.

- Calculating Costs: Understanding how to calculate the cost of protective puts and collars is crucial for effective implementation.

- Option Pricing and Risk: A thorough understanding of option pricing models and the inherent risks associated with options trading is paramount.

- Tax Implications: The tax implications of options strategies vary depending on the specific strategy and holding period.

Other S&P 500 Downside Insurance Strategies

Beyond options, other strategies contribute to downside risk mitigation.

Stop-Loss Orders

Stop-loss orders automatically sell your holdings when the price drops to a predetermined level. This helps limit losses but doesn't entirely eliminate the risk of sudden market drops. Different types of stop-loss orders, such as trailing stop-loss orders, offer variations on this basic strategy. However, they are not foolproof and should be used carefully.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy reduces the impact of market timing and minimizes the risk of investing a large sum at a market peak. The DCA strategy is a long-term approach that benefits from averaging the purchase price over time.

- Types of Stop-Loss Orders: Different types of stop-loss orders offer varying degrees of protection and flexibility.

- DCA and Market Timing: DCA helps mitigate the risks associated with attempting to time the market.

- Psychological Benefits of DCA: DCA can provide a sense of stability and discipline during market fluctuations.

Conclusion

Protecting your portfolio from the potential downsides of the S&P 500 requires a multifaceted approach. We’ve explored various S&P 500 downside insurance strategies, from diversification and options strategies to stop-loss orders and dollar-cost averaging. Each strategy has its own advantages and disadvantages, and the best approach depends on your individual risk tolerance, investment goals, and financial situation. Remember, understanding your risk tolerance and having a well-defined investment plan is paramount. Start protecting your portfolio today by exploring these effective S&P 500 downside insurance strategies and building a more resilient investment plan. (Include a link to relevant resources here)

Featured Posts

-

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025 -

Million Pound Giveaway Scandal Investigation Into Michael Sheen And Channel 4s Involvement

May 01, 2025

Million Pound Giveaway Scandal Investigation Into Michael Sheen And Channel 4s Involvement

May 01, 2025 -

Frances Convincing Win Sets Up Ireland Six Nations Clash

May 01, 2025

Frances Convincing Win Sets Up Ireland Six Nations Clash

May 01, 2025 -

Analyzing Dragons Den Pitches A Framework For Investors

May 01, 2025

Analyzing Dragons Den Pitches A Framework For Investors

May 01, 2025 -

Schoolgebouw Kampen Duurzaamheidsproject Vertraagd Door Stroomprobleem

May 01, 2025

Schoolgebouw Kampen Duurzaamheidsproject Vertraagd Door Stroomprobleem

May 01, 2025

Latest Posts

-

Alex Ovechkin Ties Gretzkys Nhl Goal Record

May 01, 2025

Alex Ovechkin Ties Gretzkys Nhl Goal Record

May 01, 2025 -

Nhl News Ovechkin Matches Gretzkys Record Setting 894 Goals

May 01, 2025

Nhl News Ovechkin Matches Gretzkys Record Setting 894 Goals

May 01, 2025 -

Ovechkins 894th Goal Nhl Record Tied With Gretzky

May 01, 2025

Ovechkins 894th Goal Nhl Record Tied With Gretzky

May 01, 2025 -

Cavs 10 Game Winning Streak Continues Overtime Victory Against Portland

May 01, 2025

Cavs 10 Game Winning Streak Continues Overtime Victory Against Portland

May 01, 2025 -

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025