Public Investment Fund (PIF) Suspends PwC Advisory Work For 12 Months

Table of Contents

Reasons Behind the PIF's Decision to Suspend PwC

The PIF's decision to suspend PwC’s advisory services stems from a number of serious concerns. While the exact details remain partially undisclosed, reports suggest the suspension is a direct consequence of alleged breaches of regulations and potential conflicts of interest. The investigation likely involves a thorough review of PwC’s performance on various projects undertaken for the PIF, including financial audits and strategic advisory work. This scrutiny highlights the increasing emphasis on transparency and accountability in government contracts, particularly those involving substantial public funds.

- Violation of ethical guidelines: Allegations of PwC violating its own ethical guidelines and those imposed by Saudi Arabian regulatory bodies are central to the investigation. This could include issues related to objectivity, independence, and the handling of confidential information.

- Conflicts of interest related to other PIF investments: The investigation may have uncovered potential conflicts of interest arising from PwC's engagements with other entities linked to the PIF's investment portfolio. This raises concerns about potential bias in providing advice.

- Failure to meet contractual obligations: PwC may have failed to fulfill certain contractual obligations with the PIF, leading to delays or unsatisfactory outcomes in significant investment projects.

- Concerns regarding the quality of financial audits or advisory services: The quality of financial audits and advisory services provided by PwC to the PIF may have fallen below the expected standards, leading to questions about the accuracy and reliability of the information provided.

Impact of the Suspension on PwC

The suspension of PwC's advisory services by the PIF carries significant consequences for the global accounting and consulting giant. The loss of such a major client represents a substantial financial blow, affecting revenue projections and potentially impacting shareholder value. Furthermore, the reputational damage inflicted could prove even more detrimental in the long run, potentially affecting PwC's ability to secure future large-scale government contracts and private sector clients who value ethical conduct and regulatory compliance.

- Loss of a significant client: The PIF is a cornerstone client, and losing this relationship represents a substantial loss of revenue and prestige.

- Reputational damage impacting future bids: The negative publicity surrounding the suspension will likely impact PwC's ability to compete for similar high-profile contracts, both in Saudi Arabia and internationally.

- Potential legal ramifications: The investigation could lead to further legal actions, resulting in significant financial penalties and further damage to PwC's reputation.

- Impact on employee morale and stability: The suspension will undoubtedly affect employee morale and potentially lead to job losses or internal restructuring within PwC.

Implications for the Public Investment Fund (PIF)

The PIF's decision, while drastic, reflects a commitment to rigorous oversight and a desire to maintain the highest standards of integrity in its investment operations. Finding a suitable replacement firm will be a crucial step, requiring a thorough vetting process to ensure the new advisor aligns with the PIF's investment goals and ethical standards. Moreover, the suspension could lead to short-term delays in some projects, but it also presents an opportunity for the PIF to refine its investment procedures and strengthen its internal governance frameworks.

- Need to find a replacement advisory firm: The PIF needs to identify a reputable and trustworthy firm to replace PwC, a process that will require time and careful consideration.

- Potential delays in investment projects: The suspension could lead to temporary delays in some investment projects while the PIF transitions to a new advisory firm.

- Impact on PIF's overall investment strategy: The suspension may require the PIF to reassess its investment strategy and strengthen its risk management processes.

- Increased scrutiny of PIF's investment processes: The event may lead to increased scrutiny of the PIF's investment processes, pushing for greater transparency and accountability.

The Broader Context: Government Oversight and Corporate Accountability

The PIF's action underscores the growing importance of corporate accountability and government oversight within the global financial sector. This case highlights the need for robust regulatory frameworks and ethical guidelines, particularly in the context of public-private partnerships. Increased transparency and stricter enforcement of ethical standards are crucial in building trust and ensuring responsible investment practices.

- Increased focus on corporate governance: The incident emphasizes the need for strong corporate governance practices within both public and private organizations.

- Importance of transparency and accountability in government contracts: The case underscores the importance of transparency and accountability in government contracts to safeguard public funds and ensure responsible spending.

- Strengthening regulatory frameworks: The suspension highlights the need for stronger regulatory frameworks to prevent similar incidents and ensure ethical conduct in the financial sector.

Conclusion: Understanding the Public Investment Fund (PIF)'s Suspension of PwC – What's Next?

The PIF's suspension of PwC’s advisory services represents a significant development with far-reaching consequences for both organizations and the broader financial landscape. The alleged breaches of regulations, potential conflicts of interest, and concerns about the quality of services highlight the critical need for ethical conduct, transparency, and robust regulatory frameworks in managing large-scale government contracts. The impact on PwC's reputation and future prospects, alongside the PIF's need to restructure its advisory arrangements, underscore the gravity of the situation. The ripple effect will likely be felt across the global financial community, emphasizing the importance of corporate accountability and strong government oversight. Stay updated on the evolving situation between the Public Investment Fund and PwC by following reputable financial news sources for further analyses and updates on this significant development.

Featured Posts

-

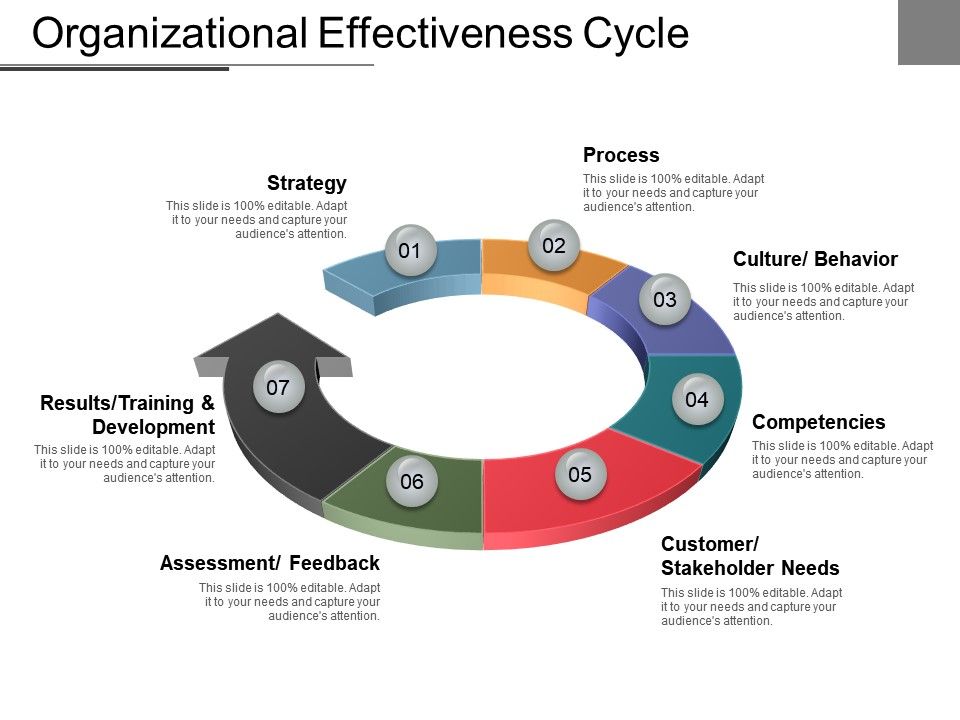

Middle Management An Essential Link In Organizational Effectiveness

Apr 29, 2025

Middle Management An Essential Link In Organizational Effectiveness

Apr 29, 2025 -

North Carolina University Shooting Results In One Death Six Injuries

Apr 29, 2025

North Carolina University Shooting Results In One Death Six Injuries

Apr 29, 2025 -

Kentucky Storm Damage Assessments Delays And Reasons Explained

Apr 29, 2025

Kentucky Storm Damage Assessments Delays And Reasons Explained

Apr 29, 2025 -

Covid 19 Pandemic Lab Owner Convicted Of Falsified Test Results

Apr 29, 2025

Covid 19 Pandemic Lab Owner Convicted Of Falsified Test Results

Apr 29, 2025 -

Merd Fn Abwzby Yntlq Rsmya Fy 19 Nwfmbr

Apr 29, 2025

Merd Fn Abwzby Yntlq Rsmya Fy 19 Nwfmbr

Apr 29, 2025

Latest Posts

-

Charles Barkley And A Ru Pauls Drag Race Star A Connection You Wont Believe

Apr 30, 2025

Charles Barkley And A Ru Pauls Drag Race Star A Connection You Wont Believe

Apr 30, 2025 -

Obnovyavane Na Trakiyski Khramove Kmett Na Khisarya Otpravya Iskane

Apr 30, 2025

Obnovyavane Na Trakiyski Khramove Kmett Na Khisarya Otpravya Iskane

Apr 30, 2025 -

Unexpected Family Nba Legend And Ru Pauls Drag Race Star

Apr 30, 2025

Unexpected Family Nba Legend And Ru Pauls Drag Race Star

Apr 30, 2025 -

Zaschita Na Kulturnoto Nasledstvo Kmett Na Khisarya Trsi Sredstva Za Trakiyskite Khramove

Apr 30, 2025

Zaschita Na Kulturnoto Nasledstvo Kmett Na Khisarya Trsi Sredstva Za Trakiyskite Khramove

Apr 30, 2025 -

Charles Barkleys Unforeseen Relationship With A Ru Pauls Drag Race Star

Apr 30, 2025

Charles Barkleys Unforeseen Relationship With A Ru Pauls Drag Race Star

Apr 30, 2025