PwC's Strategic Retrenchment: Analyzing The Withdrawal From 12+ Countries

Table of Contents

Reasons Behind PwC's Strategic Retrenchment

PwC's decision to withdraw from multiple countries is a multifaceted one, driven by a confluence of factors impacting its global operations and profitability.

Market Volatility and Profitability Concerns

Economic downturns and intensified competition have significantly impacted PwC's profitability in several markets. Decreased client demand, particularly in sectors heavily impacted by economic uncertainty, has squeezed margins. Simultaneously, aggressive pricing strategies from competitors have created significant pricing pressure, further eroding profitability. Rising operational costs, including salaries, technology investments, and regulatory compliance expenses, have also contributed to these challenges.

- Decreased client demand: Reduced spending by businesses in response to economic slowdowns.

- Pricing pressure from competitors: Intense competition forcing lower fees and reduced margins.

- Rising operational costs: Increased expenses impacting profitability across various markets.

- Specific countries affected: While PwC hasn't disclosed a complete list, reports indicate significant challenges in several emerging markets and regions experiencing economic instability.

Regulatory Scrutiny and Compliance Costs

The increasing regulatory burden and associated compliance costs in certain regions have played a significant role in PwC's strategic retrenchment. Stringent new regulations necessitate substantial investments in compliance infrastructure, personnel, and processes. The potential for hefty fines and penalties associated with non-compliance adds another layer of complexity and risk.

- Increased compliance requirements: Stringent regulations demanding greater oversight and documentation.

- Potential for fines and penalties: Significant financial risks associated with regulatory violations.

- Substantial investment in compliance infrastructure: High costs associated with building and maintaining robust compliance systems.

- Examples of impacting regulations: Changes in data privacy laws (like GDPR), anti-money laundering regulations, and tax regulations have added to compliance costs.

Focus on Core Markets and Strategic Growth Areas

PwC's retrenchment strategy also reflects a shift towards prioritizing its most profitable and strategically important markets. This involves a strategic reallocation of resources, focusing on high-growth sectors and regions offering significant long-term potential. This consolidation allows PwC to invest more heavily in digital transformation initiatives and strengthen its position in key markets.

- Prioritization of high-growth sectors: Investing in areas such as technology, sustainability, and data analytics.

- Investment in digital transformation: Modernizing services and processes to improve efficiency and client offerings.

- Consolidation of operations: Focusing resources on key regions to achieve greater efficiency and market penetration.

- Key markets for growth: PwC is likely to strengthen its presence in major economies and regions with robust growth prospects.

Impact of the Withdrawal on Clients and Employees

PwC's strategic retrenchment has significant implications for both its clients and its employees in the affected countries.

Client Service Continuity

PwC is actively working to ensure a smooth transition for clients in the countries from which it is withdrawing. This involves developing comprehensive transition plans, providing client support services, and potentially establishing partnerships with local firms to maintain service continuity. However, potential disruptions and challenges for clients remain, including finding suitable alternative service providers and potential delays in project completion.

- Transition plans: Structured processes to ensure a seamless transfer of services to alternative providers.

- Client support services: Continued support to address client queries and concerns during the transition.

- Potential partnerships with local firms: Collaborations to ensure continued access to quality professional services.

- Potential disruptions: Potential delays, service interruptions, and challenges in finding suitable replacements.

Employee Implications

The withdrawal from multiple countries inevitably leads to job losses for PwC employees in those locations. While PwC is likely to offer severance packages and explore relocation opportunities for some employees, the impact on affected individuals is considerable. Support programs for job displacement and career transition will be crucial in mitigating the negative consequences for affected staff.

- Job losses: Reductions in workforce in affected countries.

- Relocation opportunities: Potential opportunities for employees to relocate to other PwC offices.

- Severance packages: Financial support for employees losing their jobs.

- Support programs: Career counseling, job placement assistance, and other support mechanisms.

Long-Term Implications for PwC's Global Strategy

PwC's strategic retrenchment is not an isolated event but rather a significant element of its broader strategic goals.

Restructuring and Realignment

This retrenchment is a key part of PwC's effort to restructure its global operations, improve efficiency, and enhance profitability. By focusing on core competencies and high-growth markets, PwC aims to increase its overall market share and maintain its competitive edge in the long term.

- Increased efficiency: Streamlining operations to reduce costs and improve productivity.

- Improved profitability: Focusing on high-margin businesses and markets.

- Enhanced focus on core competencies: Concentrating resources on areas where PwC possesses a competitive advantage.

- Impact on global market share: The long-term impact on PwC's global market share will depend on its ability to effectively execute its strategy.

Adapting to Changing Market Dynamics

The changing landscape of the professional services industry, characterized by technological advancements, evolving client needs, and increased competition, necessitates strategic adaptation. PwC's retrenchment demonstrates a proactive approach to addressing these challenges and positioning itself for future success.

- Technological advancements: Adopting new technologies to improve service delivery and efficiency.

- Evolving client needs: Adapting services to meet the changing demands of clients.

- Increased competition: Responding to increased pressure from competitors in the market.

- Preparedness for future challenges: The extent of PwC's preparedness will determine its success in navigating future challenges.

Conclusion

PwC's strategic retrenchment marks a significant shift in the firm's global strategy. While the withdrawal from multiple countries presents challenges for clients and employees, it also reflects a proactive effort to adapt to evolving market dynamics and ensure long-term sustainability. The reasons behind this decision are multifaceted, encompassing profitability concerns, regulatory pressures, and a focus on core markets. Understanding the implications of this PwC strategic retrenchment is crucial for stakeholders across the professional services landscape. Further analysis will be needed to fully assess the long-term effects of this decision. To stay updated on the evolving impact of this significant corporate restructuring, continue following news and analyses surrounding PwC's strategic retrenchment and its evolving global strategy.

Featured Posts

-

President Trumps Potential Pardon Of Baseball Legend Pete Rose

Apr 29, 2025

President Trumps Potential Pardon Of Baseball Legend Pete Rose

Apr 29, 2025 -

The Pete Rose Posthumous Pardon Examining Trumps Statement

Apr 29, 2025

The Pete Rose Posthumous Pardon Examining Trumps Statement

Apr 29, 2025 -

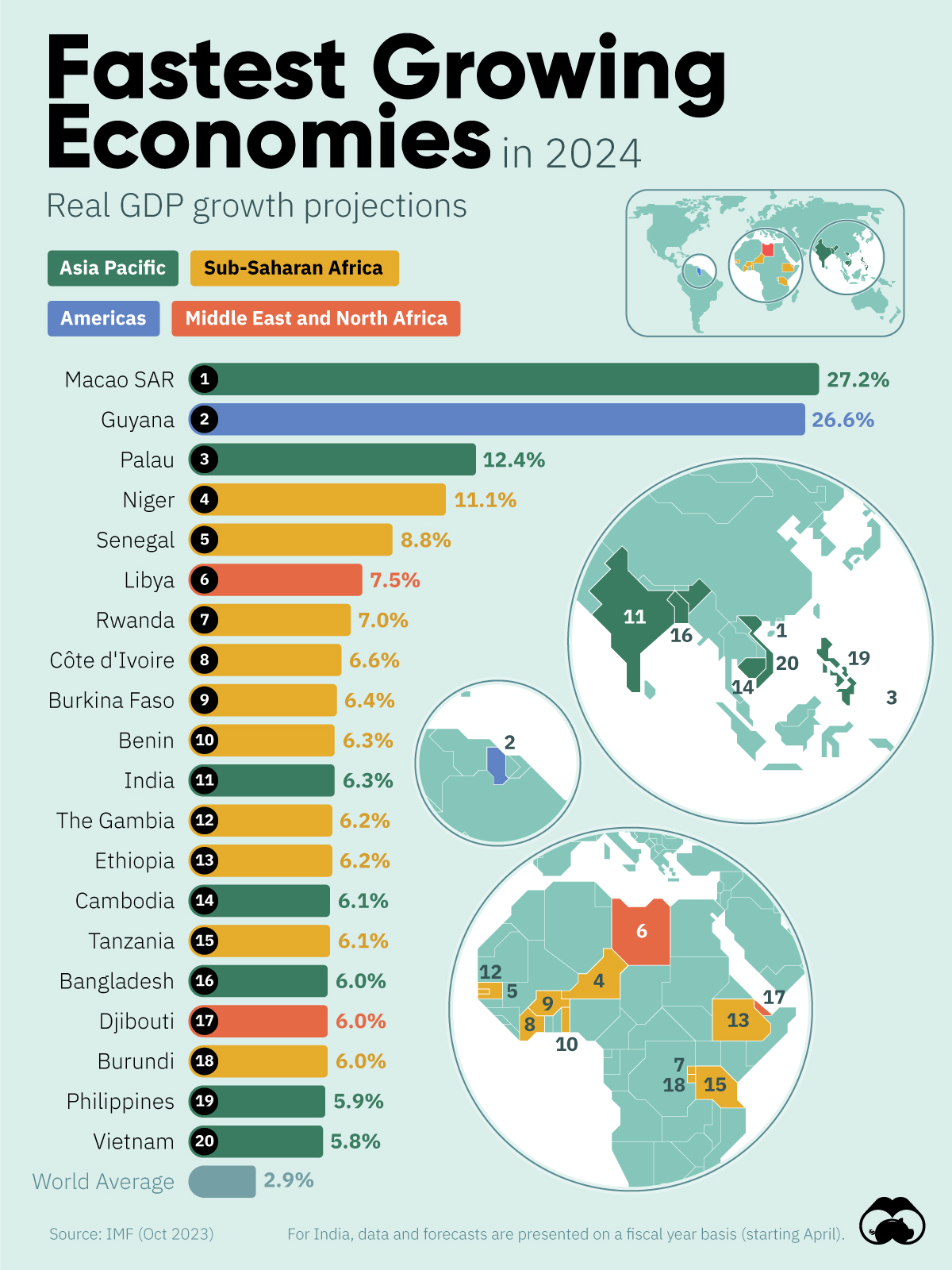

The Countrys Fastest Growing Business Regions A Comprehensive Guide

Apr 29, 2025

The Countrys Fastest Growing Business Regions A Comprehensive Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 How To Buy Tickets From Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 How To Buy Tickets From Braintree And Witham

Apr 29, 2025 -

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Triumph

Apr 29, 2025

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Triumph

Apr 29, 2025

Latest Posts

-

Ru Pauls Drag Race Live Celebrates 1000 Shows With Global Livestream

Apr 30, 2025

Ru Pauls Drag Race Live Celebrates 1000 Shows With Global Livestream

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Spoilers

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Spoilers

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Predictions

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Predictions

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Preview A Wicked Good Time

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Preview A Wicked Good Time

Apr 30, 2025 -

Things Get Fishy A Guide To Ru Pauls Drag Race Season 17 Episode 6

Apr 30, 2025

Things Get Fishy A Guide To Ru Pauls Drag Race Season 17 Episode 6

Apr 30, 2025