QBTS Stock: Predicting The Earnings Reaction

Table of Contents

Analyzing QBTS's Past Earnings Performance

Historical Earnings Trends

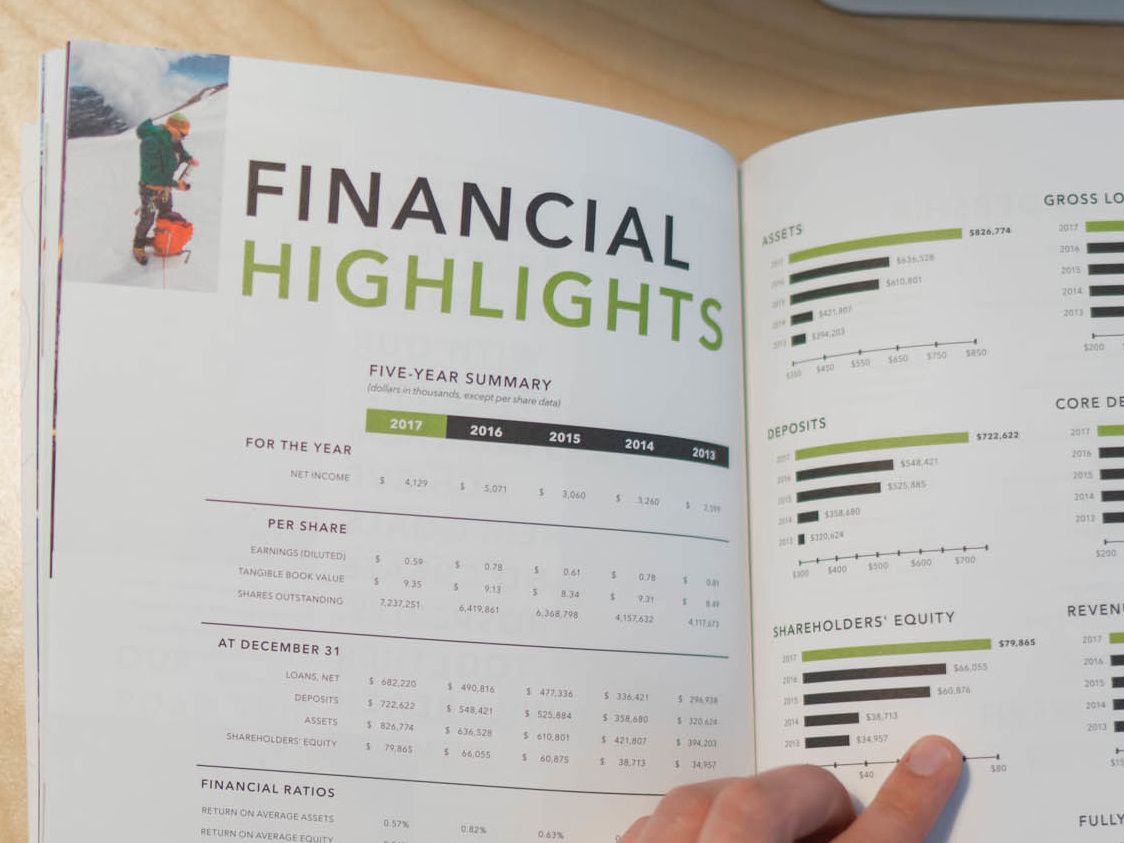

Analyzing QBTS's earnings history is the first step in predicting future performance. This involves examining key metrics such as Earnings Per Share (EPS) growth, revenue growth, and the company's track record of beating or missing analysts' expectations. Looking at QBTS earnings history reveals valuable patterns. [Insert chart visualizing QBTS EPS growth over the last 5 years]. [Insert chart visualizing QBTS revenue growth over the last 5 years]. Notice the seasonal peaks in Q4 – a trend that investors should be aware of. Identifying recurring patterns or seasonality allows for more accurate predictions. Analyzing "QBTS EPS growth" and "QBTS revenue trends" over time provides a robust foundation for future forecasts.

Key Performance Indicators (KPIs)

Beyond simple revenue and EPS, examining QBTS's key performance indicators offers a more nuanced view. Crucial "QBTS KPIs" include:

- Gross Margin: This indicates QBTS's pricing power and efficiency in production. A declining gross margin might signal increasing production costs or pricing pressure.

- Operating Margin: This reflects QBTS's operational efficiency after accounting for operating expenses. Improving operating margins suggest cost-cutting measures or increased sales volume.

- Net Income: The bottom line, reflecting profitability after all expenses are considered. Consistent increases in net income indicate a healthy and growing business.

- Debt-to-Equity Ratio: This measures QBTS's financial leverage. A high ratio may signal increased financial risk.

Analyzing how these "QBTS KPIs" have performed historically is essential for evaluating the company's overall financial health and predicting future earnings. Tracking "QBTS financial performance" across these metrics allows for a comprehensive assessment.

Understanding Market Sentiment Towards QBTS

News and Analyst Sentiment

Market sentiment plays a significant role in influencing the QBTS stock price reaction to earnings announcements. Analyzing news articles, analyst ratings, and social media sentiment can provide valuable insights. Recent press releases, analyst upgrades or downgrades, and overall media coverage heavily influence investor expectations. Utilizing tools like Google Trends to analyze search interest in "QBTS stock" provides a quantitative measure of public interest. Understanding the prevailing "QBTS analyst ratings" is crucial.

Competitor Analysis

A thorough "QBTS competitive landscape" analysis is vital. By comparing QBTS's performance with its competitors, you can identify its relative strengths and weaknesses. For instance, [mention key competitors and their recent performance]. Assessing "QBTS competitors" reveals opportunities and challenges QBTS might face. This comparative analysis helps to contextualize QBTS's performance within its industry. A detailed "QBTS industry analysis" will strengthen your prediction.

Factors Influencing the Earnings Reaction

Guidance and Future Outlook

Management's "QBTS earnings guidance" for future quarters is a crucial factor. Any significant changes compared to previous expectations will significantly influence investor sentiment. Analyzing the market's reaction to past guidance updates provides valuable insights. Paying close attention to "QBTS management commentary" during earnings calls provides context and clarity. Examining their "QBTS future outlook" helps in predicting near-term market response.

Macroeconomic Factors

Broader economic trends significantly impact QBTS's performance. Factors such as interest rates, inflation, and overall economic growth can all influence investor sentiment. For example, [explain how a potential recession might impact QBTS]. Understanding how these "QBTS macroeconomic factors" affect the company is critical for accurate predictions. The sensitivity of QBTS to "QBTS market conditions" should be a core part of your analysis.

Conclusion: Predicting the QBTS Stock Earnings Reaction and Next Steps

Predicting the QBTS stock price reaction to earnings announcements requires a holistic approach. Analyzing past performance, market sentiment, competitor analysis, and macroeconomic factors all contribute to a more accurate prediction. Remember, even with thorough analysis, stock market investments carry inherent risks. Diversification and thorough due diligence are crucial. Continue your research on "QBTS stock" and use the insights gained here to make informed investment decisions. Monitor "QBTS earnings" announcements closely and adjust your strategy accordingly. Remember to always consult with a financial advisor before making any investment decisions. The information provided in this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Gospodin Savrseni Nove Fotografije Vanje I Sime Reakcije Obozavatelja

May 21, 2025

Gospodin Savrseni Nove Fotografije Vanje I Sime Reakcije Obozavatelja

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025 -

Ings 2024 Form 20 F Key Highlights From The Annual Report

May 21, 2025

Ings 2024 Form 20 F Key Highlights From The Annual Report

May 21, 2025 -

British Ultrarunner Challenges Australian Cross Country Speed Record

May 21, 2025

British Ultrarunner Challenges Australian Cross Country Speed Record

May 21, 2025 -

Former 4 Star Admiral Found Guilty In Bribery Scandal

May 21, 2025

Former 4 Star Admiral Found Guilty In Bribery Scandal

May 21, 2025