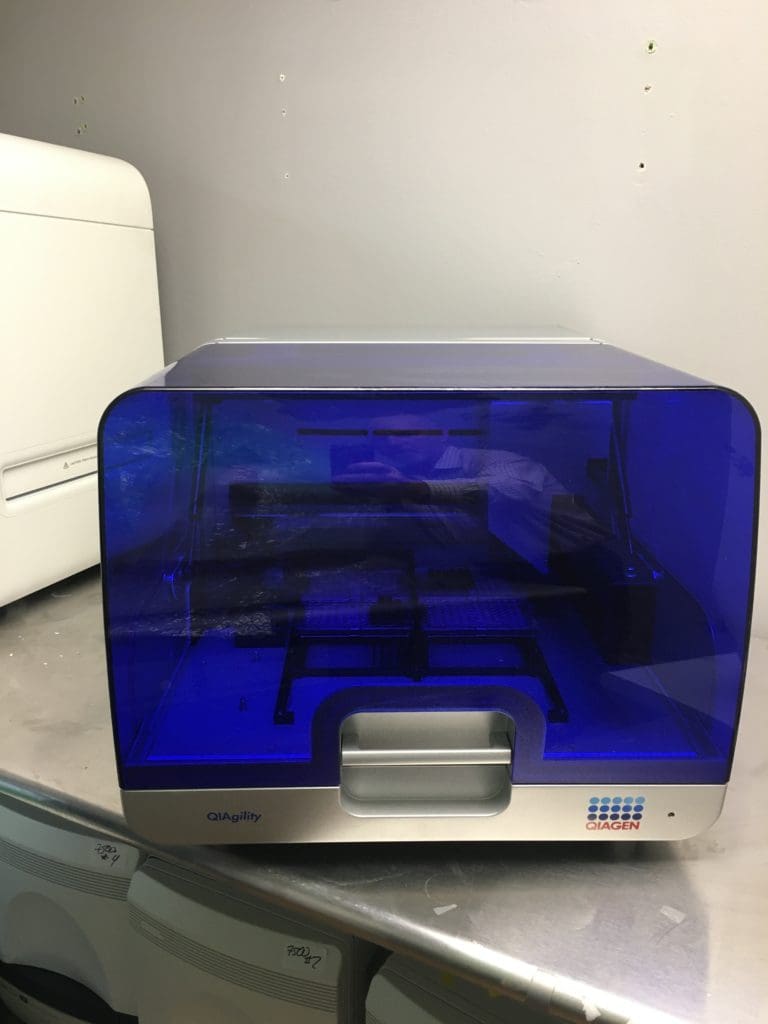

QIAGEN's Strong Q1 2025 Performance Drives Upward Revision Of Full-Year EPS Guidance

Table of Contents

Exceptional Q1 2025 Revenue Growth

QIAGEN's Q1 2025 revenue growth was exceptional, surpassing analyst predictions and setting the stage for the upward revision of the full-year EPS guidance. This success is attributable to a combination of factors, including increased demand, successful product launches, and strategic partnerships.

Breakdown of Revenue Streams

QIAGEN's diverse product portfolio contributed significantly to the overall revenue growth. Here's a breakdown:

- Sample Technologies: This segment experienced a [insert percentage]% growth, driven by strong demand for QIAGEN's innovative sample preparation solutions. This growth reflects the increasing importance of efficient and reliable sample handling in various research and diagnostic applications.

- Assay Technologies: This segment showcased a [insert percentage]% increase, fueled by the successful launch of [mention specific new products] and increased adoption of QIAGEN's PCR and NGS platforms. This underscores QIAGEN's leadership in the development and commercialization of cutting-edge assay technologies.

- Bioinformatics and Data Analytics: This segment experienced [insert percentage]% growth, reflecting the growing need for sophisticated data analysis tools to interpret the massive datasets generated by next-generation sequencing technologies.

Geographic Performance

QIAGEN's Q1 2025 revenue growth was geographically diverse, with strong performances across several key markets.

[Insert a world map or table visually representing regional revenue performance. Highlight key regions and their percentage growth. For example: North America (+15%), Europe (+12%), Asia-Pacific (+10%), etc.]

This demonstrates QIAGEN's ability to capitalize on global market opportunities.

Factors Driving Revenue Growth

Several key factors contributed to QIAGEN's exceptional revenue growth in Q1 2025:

- Increased Market Demand: Growing demand for QIAGEN's products across various sectors, including life sciences research, academic institutions, pharmaceutical companies, and diagnostic labs.

- Successful Product Launches: The successful introduction of innovative products, which met significant unmet market needs and expanded QIAGEN's product portfolio.

- Strategic Partnerships: Strengthened collaborations with key partners, leading to increased market access and expanded distribution channels.

- Market Share Gains: QIAGEN's continued success in gaining market share, reflecting the company’s strong brand reputation and high-quality products.

Increased Full-Year EPS Guidance

The strong Q1 2025 performance has led QIAGEN to significantly increase its full-year EPS guidance.

Revised EPS Forecast

QIAGEN's previous full-year EPS guidance was [insert previous EPS guidance]. This has now been revised upward to [insert new, upwardly revised EPS guidance], representing a [insert percentage]% increase.

Reasons for Upward Revision

The increased confidence in QIAGEN's full-year outlook stems from several factors:

- Strong Sales Pipeline: A robust sales pipeline indicates continued strong demand for QIAGEN's products throughout the remainder of the year.

- Robust Market Demand: The sustained high demand for QIAGEN's innovative solutions across its core markets.

- Efficient Operations: QIAGEN's efficient operational structure and cost-management strategies.

- Successful Product Launches (continued): The continued success of recently launched products.

Impact on Investor Confidence

The upward revision of the EPS guidance has been met with positive market reaction. [Insert information regarding stock price movements and analyst commentary, including links to relevant financial news sources.] This reflects investor confidence in QIAGEN's future growth prospects.

Future Outlook and Strategic Initiatives

QIAGEN is well-positioned for continued growth, driven by its robust strategy and market position.

Growth Strategies

QIAGEN plans to sustain its positive trajectory through several key initiatives:

- Increased R&D Investment: Continued investment in research and development to drive innovation and expand its product portfolio.

- New Product Development: A pipeline of new products to address emerging market needs and further strengthen its competitive position.

- Strategic Acquisitions: Potential acquisitions to expand its market reach and capabilities.

- Market Penetration Strategies: Aggressive strategies to further penetrate existing markets and expand into new geographic regions.

Challenges and Risks

While the outlook is positive, QIAGEN acknowledges potential challenges:

- Intense Competition: Competition from other players in the life sciences industry.

- Regulatory Hurdles: Potential delays or challenges in obtaining regulatory approvals for new products.

- Economic Fluctuations: The impact of macroeconomic factors on market demand.

Long-Term Growth Prospects

QIAGEN's long-term growth prospects remain strong, driven by the growing demand for molecular diagnostics, personalized medicine, and advanced life sciences research. The company's continued innovation, strategic partnerships, and strong market position suggest a promising future.

Conclusion

QIAGEN's exceptional Q1 2025 performance, highlighted by significant revenue growth and the substantial upward revision of full-year EPS guidance, underscores the company's strength and market leadership. The positive market reaction reflects investor confidence in QIAGEN's ability to deliver sustained growth. This strong performance is driven by a combination of increased market demand, successful product launches, efficient operations, and strategic partnerships. Stay informed about QIAGEN's continued strong performance and explore the investment opportunities presented by this upward revision of the full-year EPS guidance. Visit QIAGEN's investor relations website for more details on their financial reports and future growth strategies. Consider QIAGEN stock as part of a diversified investment portfolio.

Featured Posts

-

Le Pen Calls Conviction A Political Decision At Paris Rally

May 29, 2025

Le Pen Calls Conviction A Political Decision At Paris Rally

May 29, 2025 -

Drast Hwl Alatfaqyat Almayyt Alardnyt Alswryt Frs Alteawn Wthdyat Altnfydh

May 29, 2025

Drast Hwl Alatfaqyat Almayyt Alardnyt Alswryt Frs Alteawn Wthdyat Altnfydh

May 29, 2025 -

Air Jordan Releases June 2025 Must Know Information For Sneakerheads

May 29, 2025

Air Jordan Releases June 2025 Must Know Information For Sneakerheads

May 29, 2025 -

Stranger Things Characters Join Avengers In Doomsday Marvels Official Announcement

May 29, 2025

Stranger Things Characters Join Avengers In Doomsday Marvels Official Announcement

May 29, 2025 -

Aprovacao Da Cidade Space X Moradores Dao Sinal Verde Ao Projeto Nos Eua

May 29, 2025

Aprovacao Da Cidade Space X Moradores Dao Sinal Verde Ao Projeto Nos Eua

May 29, 2025

Latest Posts

-

Uerduen Uen Gazze Den Kanser Hastasi Cocuklara Saglik Hizmeti Sunumu

May 30, 2025

Uerduen Uen Gazze Den Kanser Hastasi Cocuklara Saglik Hizmeti Sunumu

May 30, 2025 -

Gazze Den Kanser Hastasi Cocuklar Icin Uerduen Uen Destegi

May 30, 2025

Gazze Den Kanser Hastasi Cocuklar Icin Uerduen Uen Destegi

May 30, 2025 -

Uerduen Gazze Deki Kanser Hastasi Cocuklari Kabul Ediyor Bir Umut Isigi

May 30, 2025

Uerduen Gazze Deki Kanser Hastasi Cocuklari Kabul Ediyor Bir Umut Isigi

May 30, 2025 -

Uerduen Gazze Den Tahliye Edilen Kanser Hastasi Cocuklara Kapilarini Aciyor

May 30, 2025

Uerduen Gazze Den Tahliye Edilen Kanser Hastasi Cocuklara Kapilarini Aciyor

May 30, 2025 -

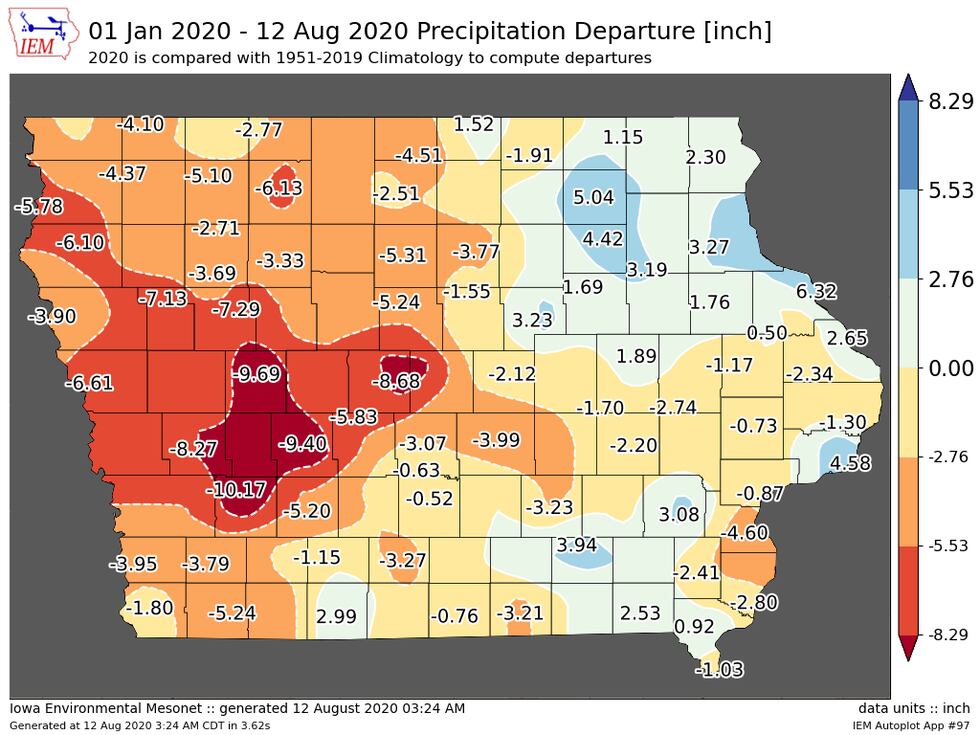

Rainfall In March Below Average Water Deficit Remains

May 30, 2025

Rainfall In March Below Average Water Deficit Remains

May 30, 2025