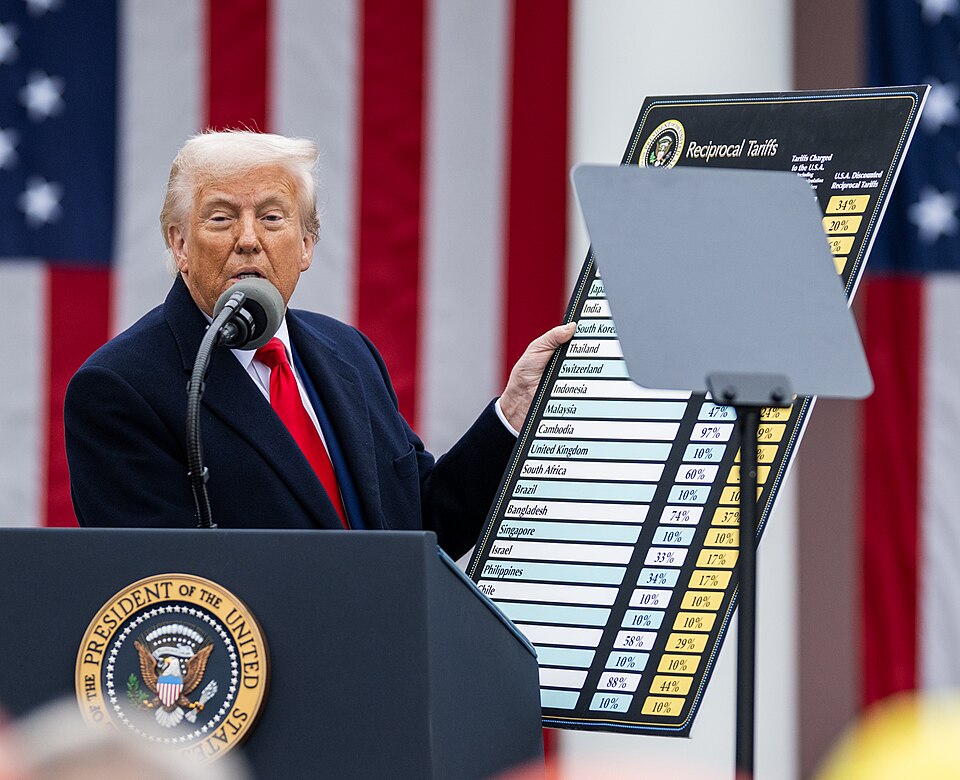

Reciprocal Tariffs: Assessing Second-Order Risks To Key Indian Industries

Table of Contents

Impact of Reciprocal Tariffs on the Indian Textile Industry

The Indian textile industry, a significant contributor to the nation's GDP and employment, is particularly vulnerable to the disruptive effects of reciprocal tariffs.

Increased Costs and Reduced Competitiveness

- Reliance on Exports: A substantial portion of Indian textile production is geared towards exports. Retaliatory tariffs from major trading partners like the US and EU can drastically reduce the competitiveness of Indian textile exports in these crucial markets. This can lead to a significant decline in textile exports and threaten the livelihood of millions.

- Raw Material Costs: Increased import tariffs on raw materials like cotton and synthetic fibers will directly increase production costs for Indian textile manufacturers. This rise in cost will make it harder to compete with manufacturers in countries that do not face such tariffs, reducing profitability.

- Supply Chain Disruption: The imposition of reciprocal tariffs can create significant supply chain disruption, affecting the timely availability of raw materials and impacting production schedules. This disruption can further exacerbate the negative impact on global competitiveness.

- Job Losses: The combined effect of reduced competitiveness, higher costs, and market share loss can lead to substantial job losses within the Indian textile industry and related ancillary sectors. This has severe socioeconomic consequences.

Shifting Global Demand and Market Share Loss

- Market Share Erosion: Facing higher tariffs, Indian textile manufacturers may find it increasingly difficult to compete with manufacturers in countries that enjoy preferential access to major markets. This could lead to a significant loss of market share in the global textile market.

- Decline in Export Revenue: Reduced export volumes resulting from tariff barriers will translate into a significant decline in export revenue, impacting the overall profitability and growth of the Indian textile industry. This reduced revenue will have further knock-on effects throughout the industry.

- Global Competition: The global textile market is highly competitive. Reciprocal tariffs will intensify this competition, making it harder for Indian manufacturers to maintain their position in the international market.

Pharmaceutical Sector Vulnerability to Reciprocal Tariffs

India's pharmaceutical industry, renowned for its generic drug production, also faces considerable vulnerability to reciprocal tariffs.

Increased Prices of Raw Materials and Active Pharmaceutical Ingredients (APIs)

- API Imports: A significant portion of the API imports used in Indian pharmaceutical manufacturing comes from China and other countries. The imposition of tariffs on these APIs will directly increase production costs for Indian manufacturers.

- Generic Drugs: The impact on generic drugs is particularly significant, as increased production costs will translate into higher drug prices, potentially affecting affordability and access to essential medicines for consumers. This directly impacts the accessibility and affordability of medicines for the general population.

- Pharmaceutical Pricing: Increased pharmaceutical pricing due to tariff-related cost pressures could lead to social unrest and negatively impact public health outcomes.

Impact on Export-Oriented Pharmaceutical Companies

- Pharmaceutical Exports: Export-oriented Indian pharmaceutical companies will face challenges in maintaining their competitive edge in the global market. Retaliatory tariffs will make their products more expensive, leading to potential loss of market share.

- Global Market Access: Reduced global market access resulting from tariffs will constrain the growth potential of the Indian pharmaceutical sector and severely limit its ability to tap international markets.

- Competitive Advantage: The competitive advantage of Indian pharmaceutical companies based on cost-effectiveness will be diminished, making it harder for them to compete with manufacturers in other countries.

Agricultural Sector and the Ripple Effect of Reciprocal Tariffs

India's agricultural sector, crucial for food security and rural livelihoods, is also susceptible to the negative impact of reciprocal tariffs.

Reduced Demand for Agricultural Exports

- Agricultural Exports: Tariffs on key agricultural products like rice, spices, and tea can significantly reduce the demand for these exports in international markets, impacting the income of farmers. This also affects the overall trade balance and GDP growth.

- Farmer Income: Reduced export demand directly impacts farmer income, potentially leading to distress among rural communities and affecting their overall economic well-being.

- Rural Economy: The agricultural sector is a cornerstone of the rural economy. Disruptions in this sector will have significant ripple effects, potentially increasing rural poverty and inequality.

Supply Chain Disruptions and Price Volatility

- Agricultural Supply Chain: Tariffs can disrupt the agricultural supply chain, impacting the timely availability of inputs and creating uncertainty for producers and consumers alike.

- Price Volatility: Supply chain disruptions can contribute to price volatility in agricultural markets, making it difficult for farmers to plan and potentially hurting consumers with unpredictable food prices.

- Food Security: Disruptions to agricultural production and supply can negatively affect food security, particularly in vulnerable populations. This can potentially lead to shortages and social unrest.

Mitigation Strategies and Policy Recommendations

To mitigate the risks posed by reciprocal tariffs, the Indian government needs to implement proactive strategies, including:

- Trade Diversification: Exploring and developing new export markets to reduce dependence on countries imposing tariffs is crucial. This can help to reduce reliance on single markets and build resilience.

- FTA Negotiations: Actively negotiating and expanding Free Trade Agreements (FTAs) with countries that offer market access can help to offset the impact of tariffs imposed by other nations.

- Domestic Manufacturing: Investing in domestic manufacturing capabilities for key inputs and intermediate goods can reduce reliance on imports and make Indian industries less susceptible to tariff impacts.

Conclusion: Navigating the Risks of Reciprocal Tariffs in India

The imposition of reciprocal tariffs presents significant second-order risks to key Indian industries, particularly the textile, pharmaceutical, and agricultural sectors. The potential for reduced export competitiveness, increased production costs, job losses, and disruptions to supply chains is substantial. Proactive policy responses are essential to mitigate these risks. This includes diversifying export markets, negotiating FTAs, and strengthening domestic manufacturing capabilities. We encourage further research into the specific impacts of reciprocal tariffs on various sectors and urge advocacy for policies that promote resilient and diversified trade strategies for India’s continued economic growth. Ongoing monitoring of reciprocal tariff developments and their consequences for the Indian economy is paramount.

Featured Posts

-

Dijital Veri Tabani Kullanimiyla Isguecue Piyasasi Rehberi Ledra Pal Carsamba

May 15, 2025

Dijital Veri Tabani Kullanimiyla Isguecue Piyasasi Rehberi Ledra Pal Carsamba

May 15, 2025 -

Las Mejores Euforias Deleznables Una Guia Completa

May 15, 2025

Las Mejores Euforias Deleznables Una Guia Completa

May 15, 2025 -

Maye Musk On Elon Musks Wealth Years Of Hard Work And Building An Empire

May 15, 2025

Maye Musk On Elon Musks Wealth Years Of Hard Work And Building An Empire

May 15, 2025 -

How A Friendship Between Kim And Snell Supports Korean Players Success In Mlb

May 15, 2025

How A Friendship Between Kim And Snell Supports Korean Players Success In Mlb

May 15, 2025 -

Podarok Ot Kinopoiska Soski S Izobrazheniem Ovechkina V Chest Rekorda N Kh L

May 15, 2025

Podarok Ot Kinopoiska Soski S Izobrazheniem Ovechkina V Chest Rekorda N Kh L

May 15, 2025