Recordati's M&A Approach: Navigating Tariff Volatility In The Italian Pharmaceutical Market

Table of Contents

Recordati, a leading Italian pharmaceutical company, has skillfully navigated the complexities of the Italian pharmaceutical market, a landscape significantly impacted by fluctuating tariffs and regulatory changes. Their success is largely attributable to a shrewd and strategic approach to mergers and acquisitions (M&A). This article delves into Recordati's M&A activities, examining how they've mitigated risks and fueled growth in this challenging environment.

Recordati's M&A History and Strategy

Recordati's M&A strategy isn't simply about acquiring companies; it's about strategically enhancing their existing capabilities and expanding into lucrative market segments. This targeted approach has proven highly effective in a volatile market.

Key Acquisitions and Their Impact

Recordati's history is marked by several significant acquisitions that have reshaped their market position and strengthened their product portfolio. These acquisitions weren't random; they were carefully selected based on strategic fit, market potential, and synergistic benefits.

- List of Key Acquisitions (Illustrative Examples – replace with actual Recordati acquisitions and data):

- Acquisition X (Year): Expanded into the cardiovascular therapeutic area, increasing market share by 15% and generating €50 million in additional revenue within two years. This acquisition also brought valuable expertise in clinical trials.

- Acquisition Y (Year): Strengthened presence in the central nervous system (CNS) therapeutics market, adding a best-selling drug to their portfolio and significantly increasing profitability.

- Acquisition Z (Year): Provided access to a state-of-the-art manufacturing facility, enhancing production capacity and reducing reliance on third-party manufacturers.

The due diligence process employed by Recordati is known to be rigorous, focusing on financial health, regulatory compliance, and the potential for synergistic integration with existing operations. Post-acquisition integration is managed smoothly, ensuring a swift and efficient transition.

Focusing on Specific Therapeutic Areas

Recordati’s M&A strategy is characterized by a focused approach to specific therapeutic areas. This targeted approach minimizes risk and maximizes return on investment in a volatile market.

- Prioritized Therapeutic Areas (Illustrative Examples – replace with actual Recordati focus areas):

- Cardiovascular Diseases: High prevalence and ongoing demand for innovative treatments.

- Central Nervous System (CNS) Disorders: Growing market driven by an aging population and increasing awareness of mental health issues.

- Endocrinology: Significant unmet medical needs and substantial growth potential.

This focused strategy allows Recordati to leverage existing expertise, build specialized teams, and establish strong market positioning within their chosen therapeutic niches. This specialization minimizes exposure to market fluctuations affecting other areas.

Mitigating Tariff Volatility Through Strategic M&A

Recordati's M&A strategy plays a crucial role in mitigating the impact of tariff volatility on their business. This is achieved through both geographic diversification and strengthening of their supply chain.

Diversification and Geographic Reach

Acquisitions have been instrumental in expanding Recordati's geographic reach, reducing reliance on the Italian market and its inherent tariff risks.

- Examples of Acquisitions Expanding Geographic Reach (Illustrative Examples – replace with actual Recordati acquisitions):

- Acquisition of Company A in Germany expanded their presence in the German pharmaceutical market, diversifying revenue streams and reducing dependence on the Italian market.

- Acquisition of Company B in France further broadened their European footprint.

This geographical diversification creates a more resilient business model, less vulnerable to fluctuations in specific regional markets or tariff changes affecting a single country. The impact is a more stable and predictable revenue stream.

Securing Supply Chains and Manufacturing Capabilities

Strategic acquisitions have reinforced Recordati's supply chain resilience. By securing manufacturing capabilities and access to key raw materials, they've decreased vulnerability to external factors influenced by tariffs.

- Examples of Acquisitions Enhancing Manufacturing or Supply Chain (Illustrative Examples – replace with actual Recordati acquisitions):

- Acquisition of Company C provided access to a reliable supply of active pharmaceutical ingredients (APIs), reducing dependence on potentially volatile external suppliers.

- Acquisition of Company D expanded manufacturing capacity, allowing for increased production and reduced reliance on external contract manufacturers.

Vertical integration, achieved through these acquisitions, significantly reduces their exposure to price increases or supply disruptions caused by tariff changes or other external factors.

Navigating the Italian Regulatory Landscape

The Italian regulatory environment presents unique challenges for pharmaceutical companies. Recordati’s M&A strategy helps them navigate this complexity effectively.

Regulatory Expertise and Compliance

Recordati’s acquisitions have brought in-house regulatory expertise, streamlining the approval process for new products and reducing delays.

- Streamlining Regulatory Approvals (Illustrative Examples – replace with actual Recordati experiences):

- Acquisitions have provided access to pre-existing regulatory approvals, accelerating the launch of new products in the Italian market.

- Acquired companies brought expertise in navigating complex regulatory hurdles, reducing time and cost associated with new product launches.

This acquisition-based approach minimizes regulatory delays and reduces the risk of non-compliance penalties.

Building Relationships with Italian Healthcare Authorities

Recordati’s acquisitions have strengthened its network within the Italian healthcare system, enhancing market access for their products.

- Strengthening Relationships (Illustrative Examples – replace with actual Recordati experiences):

- Acquisitions have provided access to established relationships with key opinion leaders (KOLs) and healthcare providers, improving market penetration.

- Expanded network facilitated collaborations with research institutions and government agencies.

These strengthened relationships are invaluable in navigating the complexities of the Italian healthcare system and improving market access for Recordati's products.

Conclusion

Recordati’s success in navigating the volatile Italian pharmaceutical market underscores the power of a well-defined M&A strategy. By focusing on specific therapeutic areas, diversifying geographically, and securing supply chains through strategic acquisitions, Recordati has demonstrated a resilient and adaptable business model. Their approach offers valuable insights for other pharmaceutical companies seeking to thrive in similarly challenging environments. To learn more about effective M&A strategies within the pharmaceutical industry, explore further case studies on successful mergers and acquisitions.

Featured Posts

-

Agha Syd Rwh Allh Mhdy Bharty Hkwmt Ky Kshmyr Palysy Pr Tnqyd

May 01, 2025

Agha Syd Rwh Allh Mhdy Bharty Hkwmt Ky Kshmyr Palysy Pr Tnqyd

May 01, 2025 -

Trump Administrations Action Against University Of Pennsylvania Transgender Swimmers Record Deletion

May 01, 2025

Trump Administrations Action Against University Of Pennsylvania Transgender Swimmers Record Deletion

May 01, 2025 -

Hollywood Mourns The Loss Of Actress Priscilla Pointer At 100

May 01, 2025

Hollywood Mourns The Loss Of Actress Priscilla Pointer At 100

May 01, 2025 -

Shrimp Ramen Stir Fry A Step By Step Guide

May 01, 2025

Shrimp Ramen Stir Fry A Step By Step Guide

May 01, 2025 -

Prince William And Kates Initiative Announces New Partnership

May 01, 2025

Prince William And Kates Initiative Announces New Partnership

May 01, 2025

Latest Posts

-

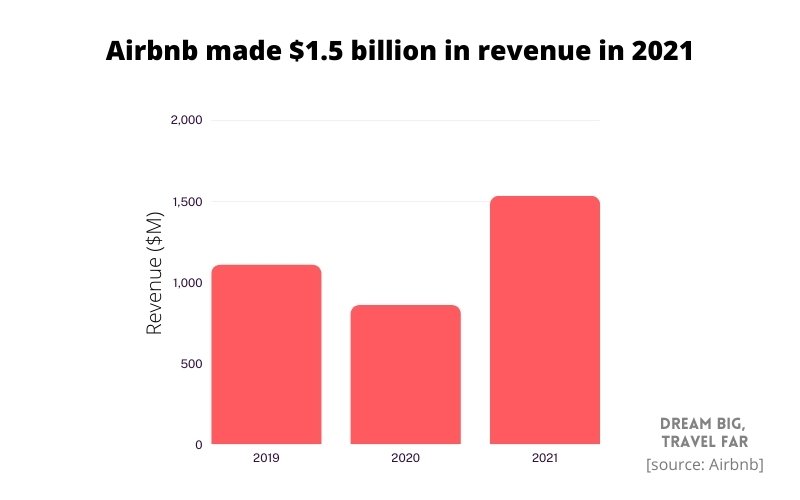

20 Jump In Canadian Airbnb Bookings A Look At The Domestic Travel Trend

May 01, 2025

20 Jump In Canadian Airbnb Bookings A Look At The Domestic Travel Trend

May 01, 2025 -

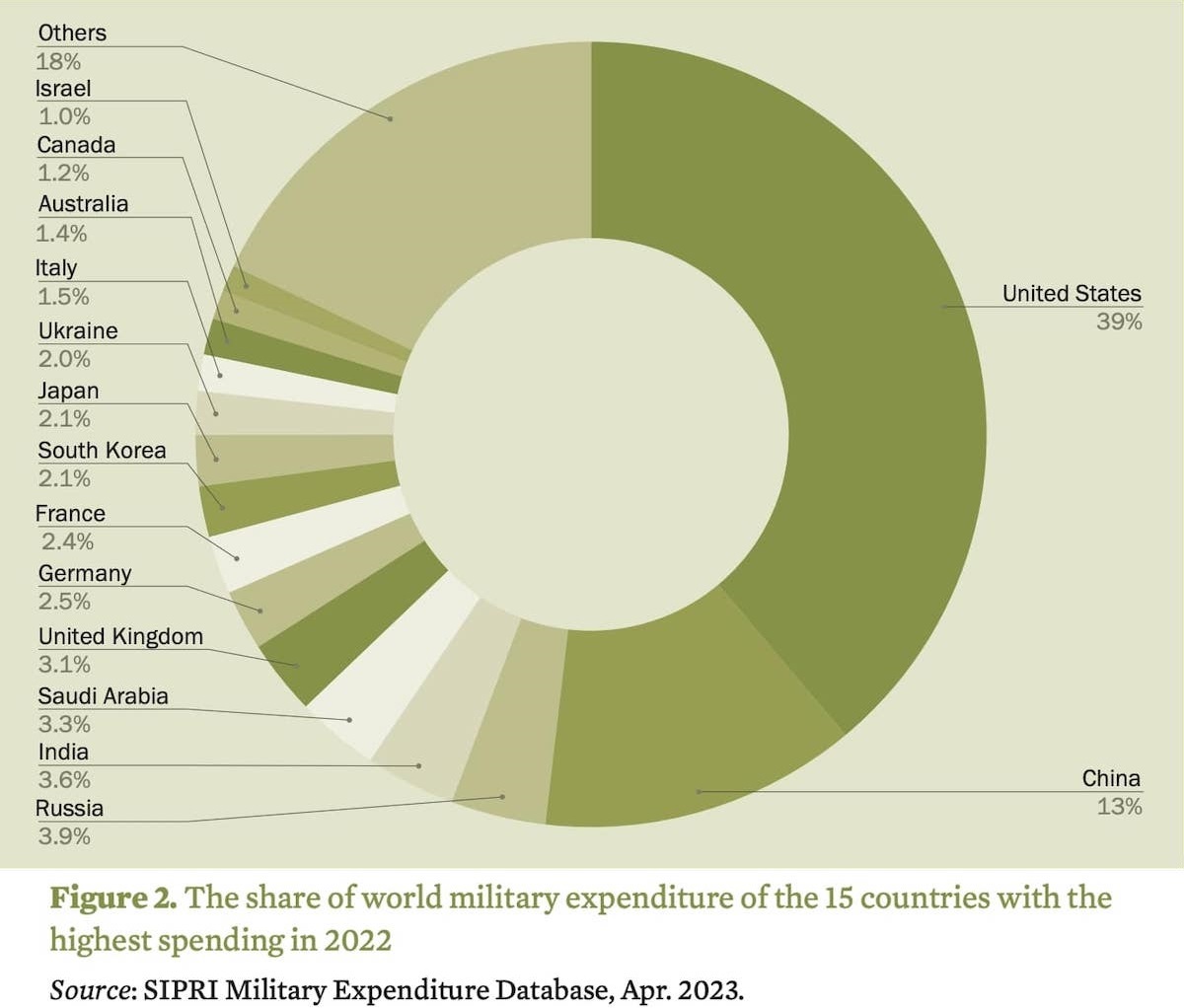

Global Military Spending Europes Response To The Russian Threat

May 01, 2025

Global Military Spending Europes Response To The Russian Threat

May 01, 2025 -

Avoid These Packing Mistakes On Your Cruise Vacation

May 01, 2025

Avoid These Packing Mistakes On Your Cruise Vacation

May 01, 2025 -

Canadians Drive 20 Surge In Airbnb Domestic Searches

May 01, 2025

Canadians Drive 20 Surge In Airbnb Domestic Searches

May 01, 2025 -

Essential Cruise Packing Tips What To Leave At Home

May 01, 2025

Essential Cruise Packing Tips What To Leave At Home

May 01, 2025