Recordati's M&A Push: Navigating Tariff Volatility In The Italian Pharmaceutical Market

Table of Contents

Understanding the Italian Pharmaceutical Market's Tariff Volatility

The Italian pharmaceutical market is characterized by significant tariff volatility, creating a challenging environment for pharmaceutical companies. This instability directly impacts pricing, profitability, and overall market dynamics.

Fluctuating Regulations and Their Impact

The Italian government frequently adjusts pharmaceutical pricing regulations, leading to unpredictable changes in reimbursement rates. These fluctuations significantly impact a company's bottom line.

- Example 1: In 2020, a significant reduction in reimbursement rates for certain drug classes led to immediate profit margin squeezes for several pharmaceutical companies.

- Example 2: Changes to the AIFA (Agenzia Italiana del Farmaco) approval process have introduced delays and uncertainties, impacting the launch timelines of new products.

These regulatory shifts are often influenced by:

- Budgetary constraints: The Italian government aims to control healthcare spending, leading to periodic price reductions.

- Political pressures: Lobbying groups and public opinion can influence policy decisions regarding drug pricing.

- European Union regulations: Harmonization efforts within the EU can impact national pharmaceutical policies.

These factors create an environment where long-term strategic planning becomes particularly crucial.

Competitive Landscape and Market Share

The Italian pharmaceutical market is highly competitive, with both domestic and international players vying for market share. Recordati's market position, while strong, is constantly challenged by competitors.

- Recordati faces competition from large multinational pharmaceutical companies with extensive resources and established market presence.

- Tariff changes often exacerbate competition, as companies scramble to adjust their pricing strategies to maintain profitability.

- This competitive pressure necessitates a proactive approach to maintaining and expanding market share, with M&A being a key strategic tool.

Recordati's M&A Strategy: A Detailed Look

Recordati's M&A strategy isn't a reactive measure; it's a proactive approach to solidify its position in the face of tariff volatility. The company targets acquisitions that complement its existing portfolio and enhance its long-term prospects.

Key Acquisitions and Their Rationale

Recordati has demonstrated a clear pattern in its acquisitions, focusing on companies with:

- Specialized therapeutic areas: Acquisitions often expand Recordati's presence in niche therapeutic areas, reducing reliance on highly regulated and volatile segments.

- Strong product portfolios: The acquired companies often bring a collection of established products with proven market success, immediately contributing to revenue streams.

- Synergies with existing operations: Recordati prioritizes acquisitions that can leverage its existing infrastructure and distribution networks.

For example, the acquisition of [Insert Specific Example of Recordati Acquisition] allowed Recordati to expand into [mention specific therapeutic area] and gain access to [mention specific drug or technology].

Integration Strategies and Synergies

Recordati's success depends not only on identifying suitable acquisition targets but also on effectively integrating them into its operations. This includes:

- Streamlining operations: Identifying and eliminating redundancies to achieve cost efficiencies.

- Leveraging expertise: Combining the acquired company's knowledge with Recordati's existing resources.

- Expanding distribution networks: Improving market reach through broader distribution channels.

The successful integration of acquisitions is vital for realizing the full potential of the M&A strategy and mitigating potential risks.

Mitigating Risks Associated with M&A in a Volatile Market

The inherent risks in M&A are amplified in a volatile market like the Italian pharmaceutical industry. Recordati employs several strategies to mitigate these risks.

Due Diligence and Risk Assessment

Thorough due diligence is paramount to the success of Recordati's M&A activities. This involves:

- Detailed financial analysis: Assessing the target company's financial stability and future projections.

- Regulatory review: Evaluating potential regulatory hurdles and their impact on the acquisition.

- Market analysis: Understanding the competitive landscape and potential market risks.

Recordati utilizes expert legal and financial advisors to conduct comprehensive due diligence and risk assessments before finalizing any acquisition.

Strategic Planning and Adaptability

Recordati's M&A strategy is not static; it's a dynamic approach that adapts to the evolving regulatory environment. This adaptability is crucial for navigating tariff volatility:

- Flexible deal structures: Negotiating deal terms that allow for adjustments based on future tariff changes.

- Continuous market monitoring: Constantly tracking changes in regulations and market dynamics.

- Scenario planning: Developing contingency plans to address different potential regulatory scenarios.

This proactive and adaptable approach allows Recordati to remain competitive and capitalize on opportunities in a constantly changing market.

Conclusion

Recordati's proactive M&A strategy is a crucial response to the volatile nature of the Italian pharmaceutical market. By carefully selecting acquisitions and effectively integrating new assets, Recordati aims to mitigate risks associated with fluctuating tariffs and strengthen its market position. The company's success hinges on its ability to adapt to ongoing changes and capitalize on emerging opportunities. Its strategic acquisitions reflect a calculated effort to navigate the challenges and achieve sustainable growth within the Italian pharmaceutical landscape.

Call to Action: To stay informed on the latest developments in Recordati's M&A activities and the Italian pharmaceutical market's tariff volatility, continue to follow our updates and analysis of Recordati's strategic moves. Learn more about Recordati's strategic acquisitions and the ongoing impact of tariff volatility on the Italian pharmaceutical industry.

Featured Posts

-

Iva I Siyana Podgotveni Za Predizvikatelstvata

Apr 30, 2025

Iva I Siyana Podgotveni Za Predizvikatelstvata

Apr 30, 2025 -

Tramp I Kanada Analiz Zayavleniya Nazvavshego Trampa Zlobnym Samovlyublennym Sliznyakom

Apr 30, 2025

Tramp I Kanada Analiz Zayavleniya Nazvavshego Trampa Zlobnym Samovlyublennym Sliznyakom

Apr 30, 2025 -

Sud Rozhodne O Obnove Konania V Unose Studentky Sony V Stredu

Apr 30, 2025

Sud Rozhodne O Obnove Konania V Unose Studentky Sony V Stredu

Apr 30, 2025 -

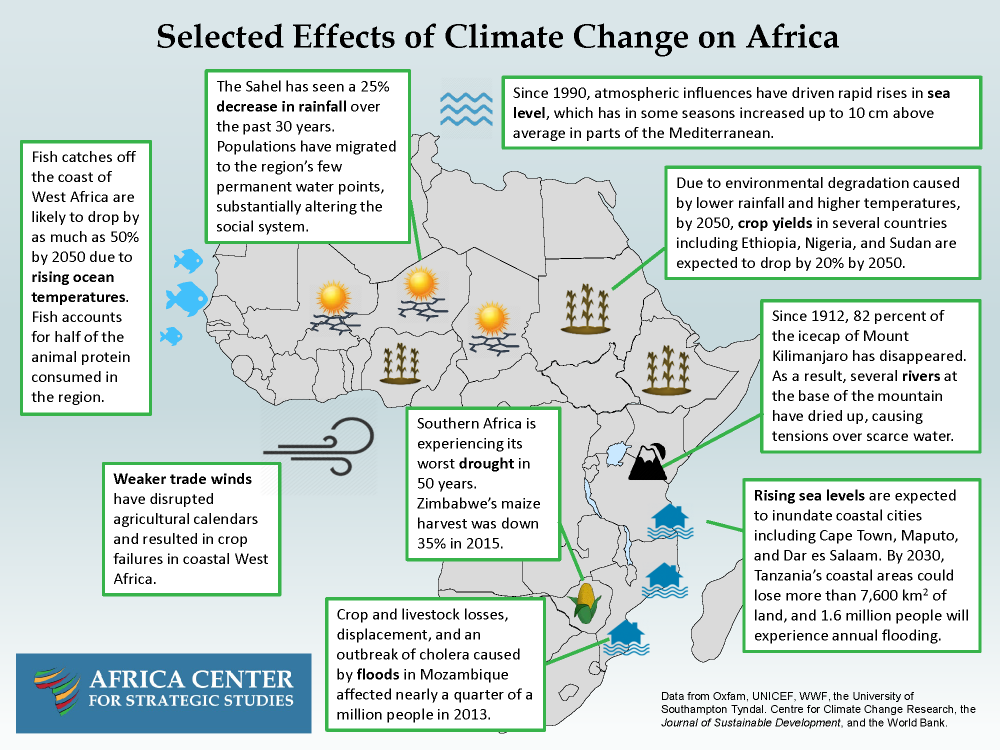

Addressing Climate Change In Africa Schneider Electrics Village Initiative

Apr 30, 2025

Addressing Climate Change In Africa Schneider Electrics Village Initiative

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 11 Preview The Ducks Arrive

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 11 Preview The Ducks Arrive

Apr 30, 2025

Latest Posts

-

Sjn Ryys Shbab Bn Jryr Tfasyl Alqdyt Kamlt

Apr 30, 2025

Sjn Ryys Shbab Bn Jryr Tfasyl Alqdyt Kamlt

Apr 30, 2025 -

Alastynaf Ward Ryys Shbab Bn Jryr Bed Sdwr Alhkm Ddh

Apr 30, 2025

Alastynaf Ward Ryys Shbab Bn Jryr Bed Sdwr Alhkm Ddh

Apr 30, 2025 -

Alqdae Almghrby Yhkm Ela Ryys Shbab Bn Jryr Balsjn

Apr 30, 2025

Alqdae Almghrby Yhkm Ela Ryys Shbab Bn Jryr Balsjn

Apr 30, 2025 -

Ryys Shbab Bn Jryr Ywajh Aledalt Tfasyl Alqdyt Walhkm Alsadr

Apr 30, 2025

Ryys Shbab Bn Jryr Ywajh Aledalt Tfasyl Alqdyt Walhkm Alsadr

Apr 30, 2025 -

Idant Ryys Shbab Bn Jryr Rdwd Alfel Walarae

Apr 30, 2025

Idant Ryys Shbab Bn Jryr Rdwd Alfel Walarae

Apr 30, 2025