Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

Understanding Federal Student Loan Refinancing

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan. This new loan typically comes from a private lender, such as a bank or credit union. The process combines your multiple loans into one, often with a new interest rate and repayment terms.

Key terms to understand:

- Refinancing: Replacing your existing loans with a new loan from a private lender.

- Interest Rate: The percentage of your loan amount you pay as interest. A lower interest rate means less interest paid over the life of the loan.

- Principal: The original amount of your loan, not including interest.

- Loan Consolidation: Combining multiple loans into a single loan, often with a new interest rate. This is different from refinancing, as consolidation can be done with the federal government, while refinancing is always with a private lender.

Key Differences:

- Refinancing vs. Consolidation: Consolidation keeps your loans under the federal government's umbrella, maintaining federal protections. Refinancing transfers your loans to a private lender, potentially losing those protections.

- Lower Monthly Payments: Refinancing can lower your monthly payment by extending the loan term or securing a lower interest rate. However, a longer loan term will often result in paying more interest overall.

- Fixed Interest Rates: Refinancing often allows you to switch from a variable interest rate to a fixed rate, providing predictability in your monthly payments.

Benefits of Refinancing Federal Student Loans

Refinancing your federal student loans can offer several significant advantages:

- Lower Monthly Payments: A lower monthly payment can significantly improve your cash flow, making budgeting easier.

- Reduced Overall Interest Paid: Securing a lower interest rate can substantially reduce the total amount of interest you pay over the life of the loan, saving you money in the long run.

- Potential for a Shorter Repayment Term: While extending the term lowers monthly payments, shortening it can help you pay off your debt faster.

- Switching to a Fixed Interest Rate: Avoid the unpredictable fluctuations of variable interest rates by switching to a fixed rate.

- Simplified Repayment: Consolidating multiple loans into one simplifies the repayment process, managing just one monthly payment.

Potential Drawbacks of Refinancing Federal Student Loans

While refinancing offers benefits, it's crucial to consider the potential downsides:

- Loss of Federal Student Loan Protections: Refinancing with a private lender means you lose access to federal loan forgiveness programs, income-driven repayment plans (IDR), and deferment/forbearance options.

- Higher Interest Rates for Borrowers with Poor Credit: Borrowers with less-than-stellar credit scores may face higher interest rates than their federal loans, negating the benefits of refinancing.

- Potential Penalties for Early Repayment: Some lenders charge penalties for paying off the loan early. Check the terms carefully.

- Difficulty Securing Refinancing with a Poor Credit History: A poor credit history can make it difficult to qualify for refinancing at all.

Who is a Good Candidate for Refinancing Federal Student Loans?

Refinancing is best suited for borrowers who meet certain criteria:

- Borrowers with Good Credit Scores: A high credit score significantly improves your chances of securing a favorable interest rate.

- Borrowers with Stable Income and Employment History: Lenders want assurance of your ability to repay the loan.

- Borrowers Who Don't Need Federal Loan Protections: If you don't rely on income-driven repayment plans or other federal benefits, refinancing might be a good fit.

- Borrowers with High Interest Rates on Existing Loans: If your current interest rates are significantly higher than what private lenders offer, refinancing could save you money.

How to Find the Best Federal Student Loan Refinancing Options

Choosing the right lender is critical. Follow these steps:

- Compare Interest Rates and Fees from Multiple Lenders: Don't settle for the first offer you receive. Shop around and compare.

- Check Lender Reviews and Ratings: See what other borrowers have to say about their experiences.

- Understand the Terms and Conditions of Each Loan Offer: Read the fine print carefully to understand all fees and requirements.

- Look for Lenders Specializing in Student Loan Refinancing: These lenders often have expertise and competitive offerings.

The Refinancing Process: A Step-by-Step Guide

Refinancing involves several key steps:

- Pre-qualify with Multiple Lenders: This allows you to compare offers without impacting your credit score.

- Gather Required Documents: You'll typically need proof of income, a credit report, and details of your existing loans.

- Complete the Application Process: Follow the lender's instructions carefully.

- Review the Loan Terms Carefully Before Signing: Ensure you understand everything before committing.

- Understand the Closing Process: This involves the finalization of the loan and the payment of your existing loans.

Conclusion

Refinancing federal student loans can offer significant financial advantages, including lower monthly payments and reduced total interest paid, but it's not always the best option for everyone. Carefully weigh the benefits against the potential loss of federal loan protections. If you have good credit and don't rely on income-driven repayment plans or other federal safeguards, refinancing your federal student loans might be a smart move to help you achieve your financial goals. Consider your individual circumstances and explore all your options before making a decision. Start exploring your federal student loan refinancing options today!

Featured Posts

-

Knicks Derrotan A Sixers 105 91 Anunoby Anota 27 Puntos En La Novena Derrota Consecutiva De Filadelfia

May 17, 2025

Knicks Derrotan A Sixers 105 91 Anunoby Anota 27 Puntos En La Novena Derrota Consecutiva De Filadelfia

May 17, 2025 -

Black Community Reactions To Trumps Student Loan Plan

May 17, 2025

Black Community Reactions To Trumps Student Loan Plan

May 17, 2025 -

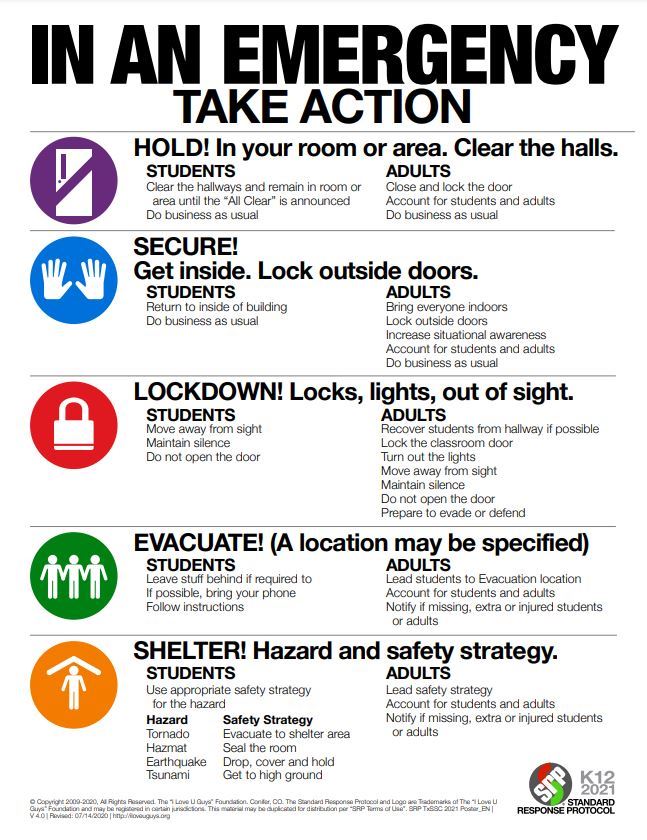

Understanding Florida School Shooter Lockdown Procedures A Generations Challenge

May 17, 2025

Understanding Florida School Shooter Lockdown Procedures A Generations Challenge

May 17, 2025 -

Fanatics Your Source For Boston Celtics Gear During Their Back To Back Finals Run

May 17, 2025

Fanatics Your Source For Boston Celtics Gear During Their Back To Back Finals Run

May 17, 2025 -

Plei Of Nba 2024 Imerominies Zeygaria Kai Plirofories

May 17, 2025

Plei Of Nba 2024 Imerominies Zeygaria Kai Plirofories

May 17, 2025