Refinancing Federal Student Loans With A Private Lender: What You Need To Know

Table of Contents

Understanding the Pros and Cons of Refinancing Federal Student Loans

Before diving into the specifics, it's crucial to understand the potential advantages and disadvantages of refinancing your federal student loans with a private lender.

H3: Potential Benefits:

- Lower Interest Rates: Private lenders may offer lower interest rates than your current federal loans, leading to significant savings over the life of the loan. This is especially true for borrowers with good credit scores.

- Reduced Monthly Payments: A lower interest rate or extending the loan term (though this increases total interest paid) can result in lower monthly payments, making your budget more manageable.

- Simplified Repayment: If you have multiple federal student loans, refinancing can consolidate them into a single, simpler loan with one monthly payment.

- Shorter Repayment Term: While increasing monthly payments, a shorter loan term can help you pay off your debt faster and reduce the total interest paid.

- Access to Various Repayment Options: Private lenders often offer a variety of repayment options, such as fixed or variable interest rates, allowing for greater flexibility.

H3: Potential Drawbacks:

- Loss of Federal Student Loan Benefits: This is a significant consideration. Refinancing with a private lender means losing access to federal benefits like income-driven repayment plans (IDR), loan forgiveness programs (e.g., Public Service Loan Forgiveness – PSLF), and deferment or forbearance options.

- Higher Interest Rates Possible: If your credit score is low, you may not qualify for the best interest rates and could even end up with a higher rate than your federal loans.

- Increased Total Interest Paid: Extending your loan term to lower monthly payments will ultimately lead to a higher total amount of interest paid over the life of the loan.

- Penalties for Default: Falling behind on payments with a private lender can lead to penalties and damage your credit score more severely than with federal loans.

- Difficulty Refinancing with Poor Credit: A low credit score significantly impacts your eligibility for refinancing with a private lender.

Eligibility Requirements for Private Student Loan Refinancing

Private lenders have specific criteria for approving loan refinancing applications. Meeting these requirements is crucial for a successful application.

H3: Credit Score and History: A good credit score (typically above 670) and a positive credit history are essential. Lenders assess your creditworthiness to determine your risk level.

H3: Income and Debt-to-Income Ratio: Lenders review your income and debt-to-income ratio (DTI) to ensure you can comfortably manage your monthly payments. A lower DTI improves your chances of approval.

H3: Loan Amount and Type: Not all loans are eligible for refinancing. Lenders may have limitations on the types and amounts of loans they will refinance. Federal student loans are often the target for refinancing.

H3: Employment Status: Stable employment is vital to demonstrate your ability to repay the loan. Lenders prefer applicants with a consistent employment history.

- Specific Requirements: Minimum credit score requirements vary by lender but often start at 660-680. Income thresholds, debt-to-income ratios, and loan-to-value ratios also play a significant role in eligibility.

Comparing Private Lenders and Choosing the Right One

The market offers numerous private lenders specializing in student loan refinancing. Careful comparison is essential to secure the best terms.

H3: Interest Rates and Fees: Compare interest rates (fixed vs. variable) and associated fees (origination fees, prepayment penalties) across multiple lenders.

H3: Repayment Terms and Options: Analyze different repayment terms (loan lengths) and options (fixed vs. variable interest rates, payment flexibility).

H3: Customer Reviews and Reputation: Research lenders' reputations through online reviews and ratings from sources like the Better Business Bureau.

H3: Transparency and Communication: Choose a lender known for clear communication and transparent processes.

- Comparison Strategies: Use online comparison tools to streamline the process. Carefully read reviews and compare offers from at least three lenders before making a decision.

The Refinancing Process: A Step-by-Step Guide

Refinancing your federal student loans involves several key steps.

H3: Check Your Credit Report: Review your credit report for accuracy and identify areas for improvement before applying.

H3: Shop Around for Lenders: Compare interest rates, fees, and repayment terms from multiple lenders.

H3: Pre-qualification and Application: Complete a pre-qualification application to get an estimate of your eligibility and interest rate without impacting your credit score. Then, submit a formal application.

H3: Documentation and Verification: Provide the necessary documentation (pay stubs, tax returns, etc.) to verify your information.

H3: Loan Closing and Disbursement: Once approved, sign the loan documents and receive the funds.

- Step-by-Step Checklist:

- Check your credit report.

- Compare lenders.

- Pre-qualify.

- Apply.

- Provide documentation.

- Review and sign documents.

- Receive loan funds.

Conclusion

Refinancing federal student loans with a private lender can offer significant benefits, such as lower interest rates and reduced monthly payments. However, it's crucial to weigh these advantages against the potential drawbacks, such as the loss of federal loan benefits. Carefully evaluate your financial situation, compare lenders thoroughly, and understand the implications before making a decision. Start your research today and find the best refinancing option for you. Remember to prioritize transparency and choose a reputable lender to ensure a smooth and successful refinancing federal student loans with a private lender process.

Featured Posts

-

Severance How To Watch All Episodes For Free Online

May 17, 2025

Severance How To Watch All Episodes For Free Online

May 17, 2025 -

Boardman And Austintown Police Blotter Crime Reports Local News Sports And Employment

May 17, 2025

Boardman And Austintown Police Blotter Crime Reports Local News Sports And Employment

May 17, 2025 -

Severance Season 3 Release Date And Confirmation

May 17, 2025

Severance Season 3 Release Date And Confirmation

May 17, 2025 -

Rossiya Trete Mesto Po Investitsiyam V Uzbekistane

May 17, 2025

Rossiya Trete Mesto Po Investitsiyam V Uzbekistane

May 17, 2025 -

Is Uber Uber Stock A Buy Sell Or Hold

May 17, 2025

Is Uber Uber Stock A Buy Sell Or Hold

May 17, 2025

Latest Posts

-

10 Best Sherlock Holmes Quotes Ranked

May 17, 2025

10 Best Sherlock Holmes Quotes Ranked

May 17, 2025 -

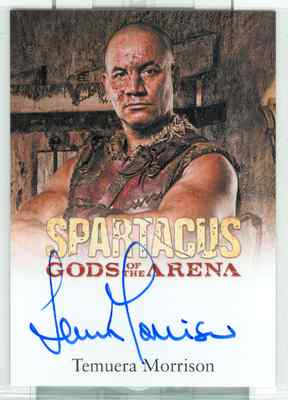

End Of The Valley A The Listener March Viewing Guide Featuring Temuera Morrison

May 17, 2025

End Of The Valley A The Listener March Viewing Guide Featuring Temuera Morrison

May 17, 2025 -

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025 -

Analysis And Insights On The La Lakers Vavel United States

May 17, 2025

Analysis And Insights On The La Lakers Vavel United States

May 17, 2025 -

La Lakers Season Preview And Predictions Vavel United States

May 17, 2025

La Lakers Season Preview And Predictions Vavel United States

May 17, 2025