Regulatory Decision On RTL-DPG Media Deal Due Within 45 Days

Table of Contents

The RTL-DPG Merger: A Closer Look

The proposed merger between RTL Group, a leading European media company, and DPG Media, a major player in the Dutch and Belgian media markets, represents a significant consolidation of power in the European media landscape. The rationale behind the deal centers on creating substantial synergies, expanding into new markets, and bolstering their combined digital media presence. This ambitious plan aims to leverage the strengths of both companies to offer a broader range of content and services to consumers. However, the merger also raises concerns about potential market dominance and its impact on competition.

- Brief history of RTL Group and DPG Media: RTL Group boasts a long history of successful television broadcasting and production, while DPG Media is a digital powerhouse known for its strong online presence and diverse portfolio of newspapers and magazines.

- Key aspects of the proposed merger agreement: The agreement involves a complex share exchange, creating a new combined entity with a significant market share across various media segments. Details on specific operational integration and cost-cutting measures remain to be fully disclosed.

- Expected market share changes post-merger: The combined entity would significantly increase its market share in several key European markets, raising questions about potential market dominance and its impact on consumers.

- Potential impact on competition within the media sector: The merger could lead to reduced competition, potentially affecting the diversity of content offered and the prices consumers pay for media services.

Regulatory Scrutiny and Antitrust Concerns

The RTL-DPG merger is facing intense scrutiny from various competition authorities, primarily focused on potential antitrust violations. These concerns stem from the potential creation of a dominant player in the media market, which could stifle innovation and harm competition. Regulatory bodies are meticulously evaluating the deal's impact on market share, consumer choice, and the overall health of the media industry. Several European countries' competition authorities, and potentially the European Commission, are actively involved in the review process. This level of regulatory scrutiny is standard for mergers of this scale, particularly in sectors with strong public interest implications like broadcasting.

- List of relevant regulatory bodies involved: This includes, but may not be limited to, national competition authorities in the relevant countries where RTL and DPG Media operate, and potentially the European Commission if the merger has significant cross-border implications.

- Specific antitrust concerns raised regarding the merger: Key concerns likely revolve around the potential reduction in competition in specific media segments, the possibility of higher prices for consumers, and the potential impact on media diversity.

- Potential penalties for non-compliance with regulations: Non-compliance could lead to significant fines or even the blocking of the merger entirely.

- Timeline of the regulatory review process: The current 45-day deadline is a crucial milestone in the process, indicating the urgency of the regulatory decision.

The 45-Day Deadline and its Implications

The 45-day deadline for a regulatory decision on the RTL-DPG media deal hangs heavy over the market. This timeframe creates considerable uncertainty, significantly impacting share prices, investor confidence, and the overall investment climate within the media sector. Approval would likely lead to a surge in RTL and DPG Media stock prices and accelerate media consolidation trends. Conversely, rejection could trigger a significant market downturn and potentially halt similar merger attempts in the future. The outcome will have broad implications for future media mergers and acquisitions, influencing the strategic decisions of companies across the industry.

- Expected date of the regulatory decision: The precise date remains fluid but falls within the 45-day timeframe from the initial announcement date.

- Potential market reactions to approval and rejection: Approval would be met with positive market reactions, while rejection could cause a significant drop in the share prices of both companies.

- Impact on RTL and DPG Media stock prices: The stock prices of both companies are highly sensitive to the regulatory outcome, reflecting the considerable market uncertainty surrounding the merger.

- Implications for future media mergers and acquisitions: The outcome will likely serve as a precedent for future media consolidation efforts, influencing the approach of companies considering similar mergers.

Conclusion

The 45-day countdown to the regulatory decision on the RTL-DPG media deal is a pivotal moment for the European media landscape. This merger, with its potential to reshape the industry, faces significant regulatory scrutiny due to potential antitrust concerns. The outcome will have substantial repercussions for competition, consumer choice, and the future direction of media consolidation. The upcoming decision will undoubtedly set a significant precedent for future media mergers and acquisitions across Europe.

To stay updated on this landmark decision and its broader implications for the media industry, make sure to follow the latest news and analysis regarding the RTL-DPG media deal. Subscribe to reputable financial news sources and industry publications for continuous coverage of this crucial development and other significant regulatory decisions affecting the media sector.

Featured Posts

-

Two Arrested After Seattle Shooting Eight Hour Standoff

May 29, 2025

Two Arrested After Seattle Shooting Eight Hour Standoff

May 29, 2025 -

Mein Schiff Relax Christening Robbie Williams Headline Performance In Malaga

May 29, 2025

Mein Schiff Relax Christening Robbie Williams Headline Performance In Malaga

May 29, 2025 -

Theaters Await Sinners Louisiana Filmed Horror Movie

May 29, 2025

Theaters Await Sinners Louisiana Filmed Horror Movie

May 29, 2025 -

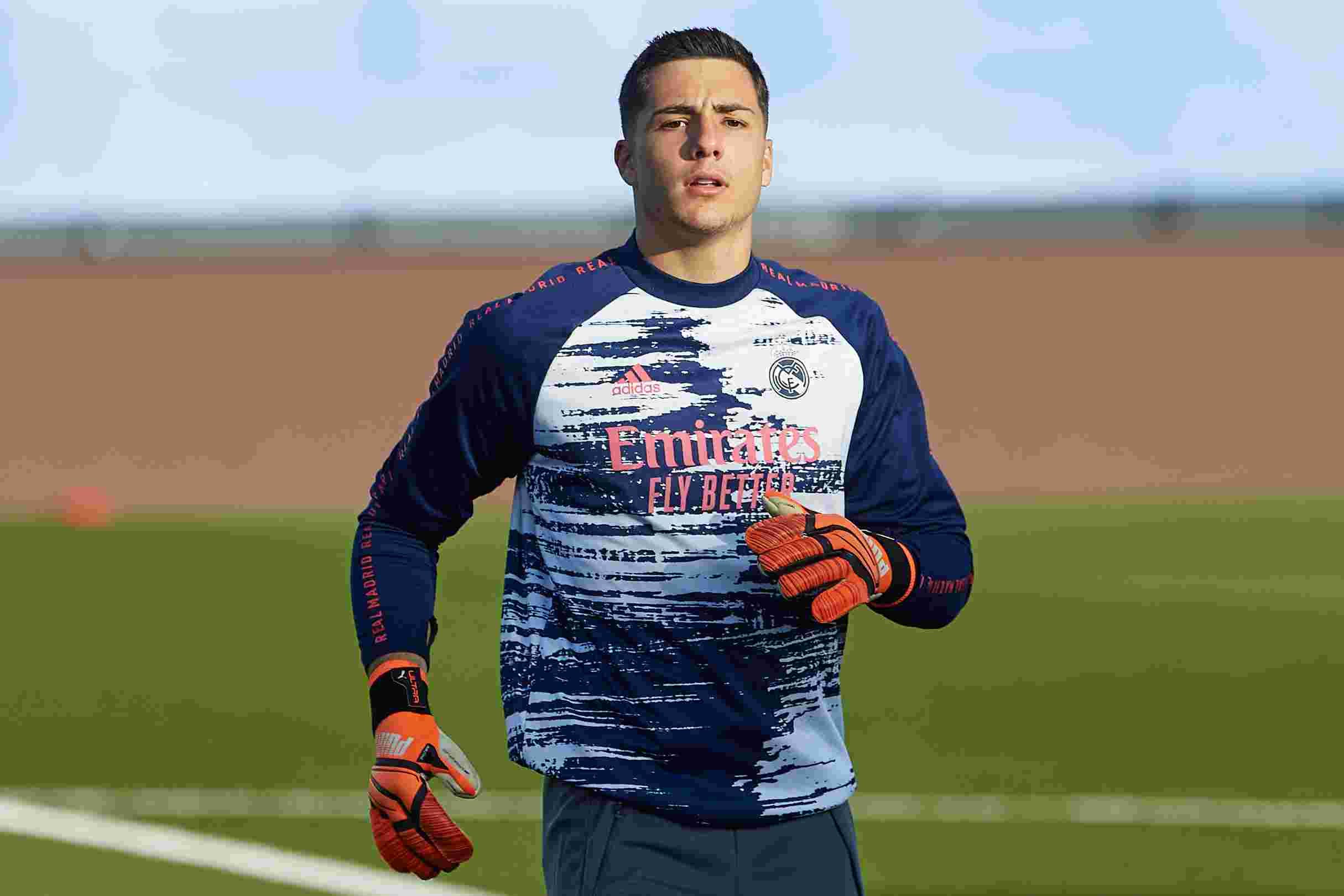

Mamardashvili Sorprende El Guardameta Que Destaca

May 29, 2025

Mamardashvili Sorprende El Guardameta Que Destaca

May 29, 2025 -

Space X Starship Launch Date Predictions Following Texas Engine Tests

May 29, 2025

Space X Starship Launch Date Predictions Following Texas Engine Tests

May 29, 2025

Latest Posts

-

Munichs Bmw Open 2025 Zverev Battles Griekspoor In Quarter Finals

May 31, 2025

Munichs Bmw Open 2025 Zverev Battles Griekspoor In Quarter Finals

May 31, 2025 -

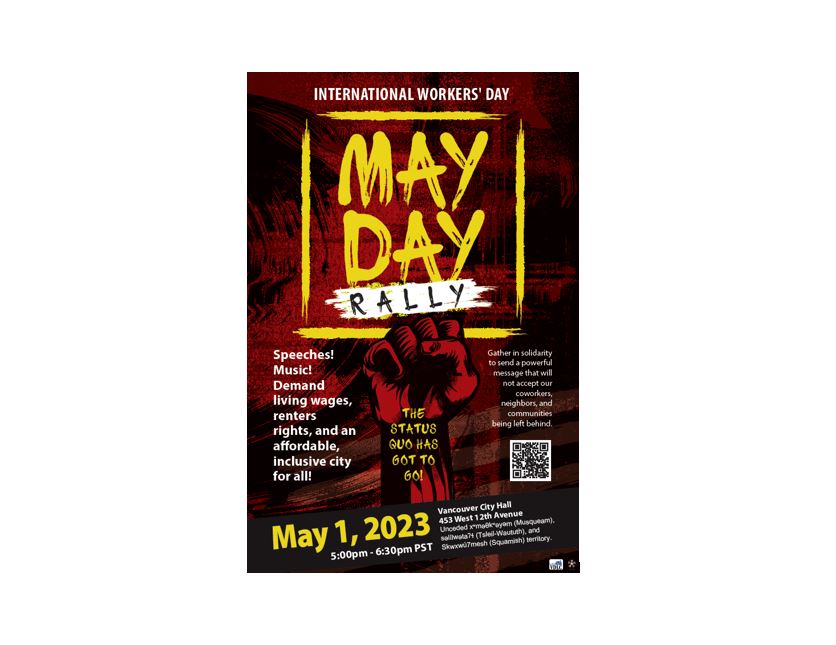

May Day Rally In Kingston Images Show Strength And Solidarity Daily Freeman

May 31, 2025

May Day Rally In Kingston Images Show Strength And Solidarity Daily Freeman

May 31, 2025 -

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025 -

Indian Wells Surprise Zverevs First Match Exit And His Honest Assessment

May 31, 2025

Indian Wells Surprise Zverevs First Match Exit And His Honest Assessment

May 31, 2025 -

Trump Administration Loses Key Advisor Elon Musks Resignation Explained

May 31, 2025

Trump Administration Loses Key Advisor Elon Musks Resignation Explained

May 31, 2025