Relaxing Bond Forward Rules: The Indian Insurance Sector's Plea

Table of Contents

The Current Constraints of Bond Forward Rules on Investment

The existing bond forward rules in India significantly restrict the investment strategies of insurance companies. These regulations, designed to manage foreign exchange risk and capital outflow, limit access to diverse asset classes and sophisticated risk management tools. This impacts the ability of Indian insurance companies to effectively diversify their portfolios and optimize returns. The constraints imposed by these rules include:

- Reduced access to international bond markets: The stringent regulations limit the ability of Indian insurers to invest in international bonds, thereby reducing diversification opportunities and limiting exposure to higher-yielding assets. This contrasts sharply with global insurance players who benefit from broader investment mandates.

- Limited hedging capabilities against currency fluctuations: The current framework restricts the use of hedging instruments, exposing insurers to significant currency risks, especially when investing in foreign assets. This increases the uncertainty and volatility inherent in their investment strategies.

- Higher investment costs due to regulatory complexities: Navigating the complex regulatory landscape associated with bond forward transactions adds significant costs and administrative burdens, making investment less attractive and potentially impacting profitability.

These limitations hamper effective Indian insurance investment and hinder the adoption of best practices prevalent in more globally integrated insurance markets. The current bond market regulations are simply not conducive to optimal risk mitigation strategies within the sector.

The Economic Benefits of Relaxing Bond Forward Rules

Relaxing bond forward rules offers substantial economic benefits to India. A more liberal regulatory environment would attract significant foreign direct investment (FDI) into the Indian insurance sector. This influx of capital would lead to:

- Increased capital inflows: Foreign insurers, drawn by a more permissive regulatory landscape, would inject much-needed capital into the sector, boosting its overall financial strength and stability.

- Improved risk management for insurance companies: Access to more sophisticated risk management tools and instruments will allow insurance companies to better manage their portfolios and reduce overall risk exposure.

- Enhanced competitiveness in the global insurance market: A more flexible regulatory framework would enable Indian insurers to compete more effectively with their global counterparts, leading to improved services and potentially lower premiums for consumers.

These changes would translate into substantial economic growth, creating jobs and bolstering the overall financial health of the Indian economy. Insurance sector reforms focused on relaxing bond forward rules will be a key driver of this positive impact.

Addressing Concerns and Potential Mitigation Strategies

While relaxing bond forward rules presents significant advantages, potential concerns regarding increased risk exposure must be addressed. A phased and carefully managed approach is crucial. This could involve:

- Strengthening regulatory frameworks: Implementing robust oversight mechanisms and monitoring systems to prevent potential abuses and ensure compliance.

- Implementing robust risk assessment methodologies: Introducing stricter risk assessment and management guidelines to mitigate potential risks associated with increased investment flexibility.

- Introducing a gradual relaxation process: A phased relaxation would allow for monitoring and adjustment, minimizing potential disruption and allowing for a smooth transition.

This balanced approach will ensure that the benefits of relaxing bond forward rules are realized while managing risks effectively. The key is strategic, measured implementation of regulatory changes.

Case Studies and Comparative Analysis

Several countries have successfully liberalized their bond forward rules, reaping significant benefits for their insurance sectors.

- Case study: The UK's relatively liberal regulatory environment for insurance investment has attracted considerable foreign investment and fostered innovation within its insurance sector.

- Comparison: A comparison between India and Singapore reveals a significant difference in regulatory approaches to bond forward transactions, highlighting the potential impact of a more liberal policy.

- Lessons learned from the US: The US experience demonstrates the importance of careful implementation and ongoing monitoring of regulatory changes in the insurance sector.

These international best practices and comparative analysis demonstrate the potential for positive outcomes resulting from careful regulatory reforms.

Conclusion: The Need for Action on Relaxing Bond Forward Rules in India

The time is now to act on relaxing bond forward rules. The current constraints significantly impede the growth and competitiveness of the Indian insurance sector. A strategic relaxation of bond forward rules will unlock significant growth, attract foreign investment, and improve risk management capabilities. We urge the government to consider a measured approach to relaxing bond forward rules, focusing on robust risk mitigation strategies and phased implementation to ensure a smooth transition and maximize the benefits for the Indian economy. This crucial step will pave the way for a stronger, more vibrant, and globally competitive Indian insurance sector.

Featured Posts

-

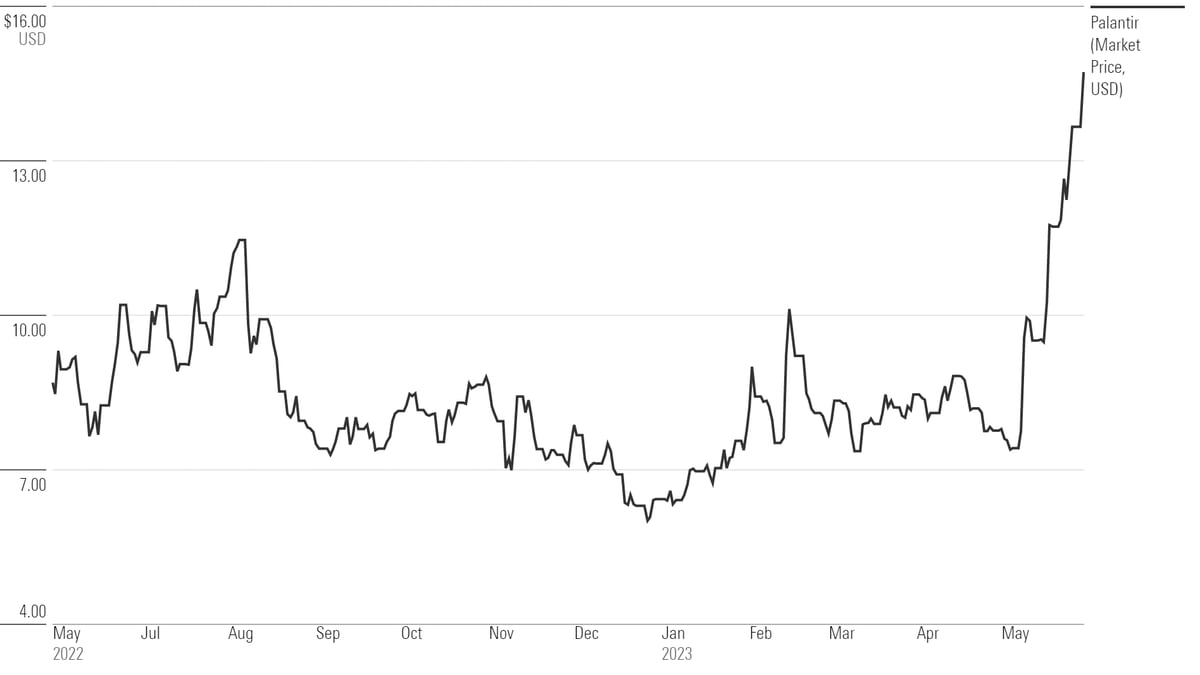

Is Palantir Stock A Smart Buy Before May 5th A Comprehensive Review

May 10, 2025

Is Palantir Stock A Smart Buy Before May 5th A Comprehensive Review

May 10, 2025 -

Dakota Johnson El Bolso Hereu La Elegancia Espanola Que Triunfa

May 10, 2025

Dakota Johnson El Bolso Hereu La Elegancia Espanola Que Triunfa

May 10, 2025 -

From Wolves To The Summit A Footballers Inspiring Success Story

May 10, 2025

From Wolves To The Summit A Footballers Inspiring Success Story

May 10, 2025 -

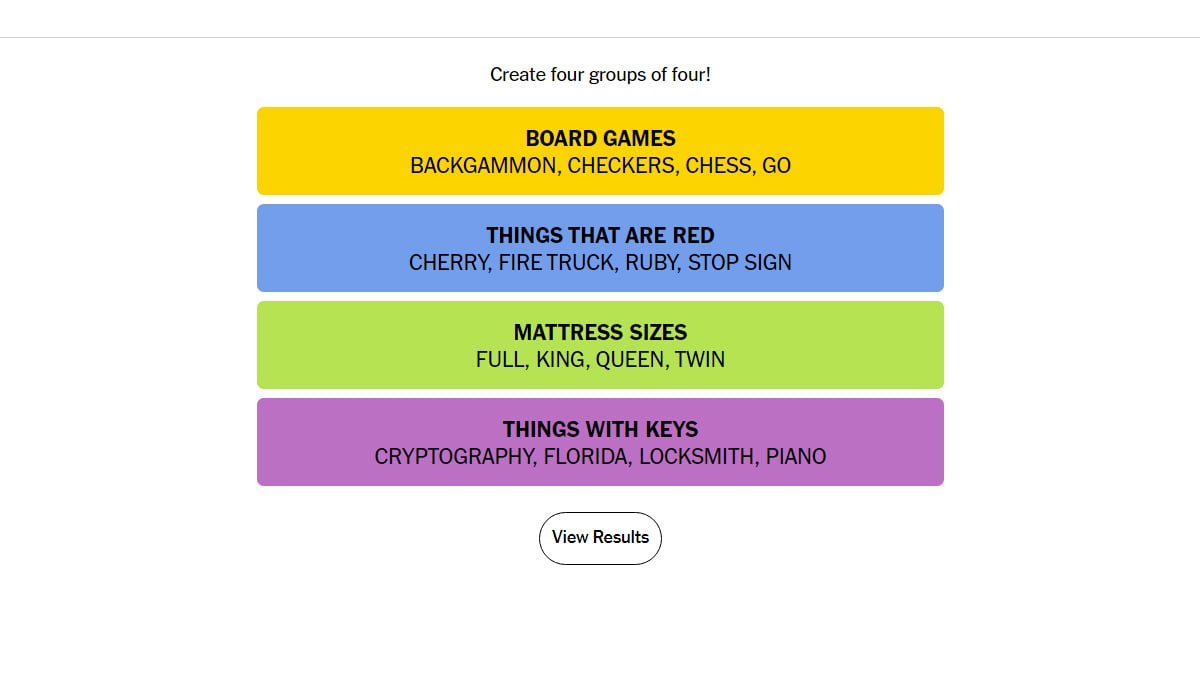

Solve Nyt Strands Game 402 Hints For Wednesday April 9

May 10, 2025

Solve Nyt Strands Game 402 Hints For Wednesday April 9

May 10, 2025 -

1078 2025

May 10, 2025

1078 2025

May 10, 2025