Republican Divisions Could Halt Trump's Tax Plan

Table of Contents

Deepening Ideological Splits Within the GOP

The Republican party is not a monolith. It encompasses various factions, each with its own distinct approach to fiscal policy and tax reform. The conflict between fiscal conservatives, social conservatives, and libertarians is creating significant friction in the debate surrounding Trump's tax plan. These groups hold vastly different views on the ideal tax structure, creating a major hurdle for the plan’s passage.

- Differing Views on Tax Cuts: While there's general agreement on the need for tax reform, the specifics are heavily contested. Some advocate for substantial cuts to corporate taxes to stimulate economic growth, while others prioritize tax cuts for individuals, particularly the middle class. The debate over the relative merits of these approaches is intense.

- The Tax Loophole Debate: The issue of tax loopholes further exacerbates the internal divisions. Some Republicans want to eliminate loopholes entirely, advocating for a simpler, flatter tax system. Others believe certain loopholes should be preserved for specific industries or groups. This disagreement complicates the process of creating a unified and acceptable tax plan.

- Prominent Figures and Their Stances: Senators like [insert names of Republican senators with differing views and their stances] represent the spectrum of opinions within the party. Their public statements and voting records highlight the significant ideological gulf within the GOP on the issue of Trump's tax plan. Statistics illustrating the level of dissent within the Republican caucus on specific aspects of the plan would further underscore the severity of the situation.

Concerns Over the National Debt and Fiscal Responsibility

A significant portion of the Republican party, particularly fiscal conservatives, expresses deep concerns about the long-term fiscal implications of Trump’s tax plan. The proposed tax cuts, coupled with the existing national debt, could lead to a substantial increase in the federal deficit. This prospect alarms many Republicans who prioritize fiscal responsibility and balanced budgets.

- Projected Debt Increases: Independent analyses suggest that Trump's tax plan could add trillions of dollars to the national debt over the next decade. These projections fuel the concerns of fiscally conservative Republicans who see the plan as fiscally unsustainable.

- Quotes from Republican Critics: [Insert quotes from prominent Republican politicians expressing concern over the plan’s potential impact on the national debt]. These voices highlight the internal struggle within the party regarding the trade-off between tax cuts and fiscal prudence.

- Expert Opinions: Economic experts offer varying perspectives on the potential impact. Some argue that the tax cuts will stimulate economic growth, offsetting the increased deficit. Others are more pessimistic, predicting long-term negative consequences for the nation’s economic stability.

The Role of Moderate Republicans and Potential Swing Votes

The success of Trump's tax plan hinges significantly on the support of moderate Republicans. These lawmakers, often more pragmatic than their more conservative colleagues, may be reluctant to support a plan perceived as overly favorable to corporations or the wealthy, or one deemed fiscally irresponsible. Their votes could prove decisive.

- Profiles of Moderate Republicans: [Insert profiles of key moderate Republicans and their potential stances on the tax plan]. Their positions on specific aspects, such as the corporate tax rate or individual tax brackets, will be crucial in determining the plan's fate.

- Bipartisan Compromise – A Possibility?: The possibility of bipartisan compromise remains slim, given the deep partisan divisions. However, the need for at least some Democratic support might encourage Republicans to moderate their approach to secure enough votes for passage.

- Political Strategies and Negotiations: The political maneuvering and negotiations within the Republican party will play a crucial role. Successfully navigating these internal challenges is essential for the plan's survival.

The Impact of Public Opinion and Potential Backlash

Public opinion plays a vital role in shaping the political landscape. Negative public reaction to the tax plan could influence Republican lawmakers to modify their positions or even abandon the plan altogether. A perception that the tax cuts primarily benefit the wealthy while leaving the middle class behind could trigger a significant political backlash.

- Polling Data: Recent polls reveal [insert polling data on public support for Trump's tax plan]. These numbers provide insight into public sentiment and potential political ramifications for the Republican party.

- Media Coverage and Its Impact: Media coverage of the tax plan and the internal Republican divisions will undoubtedly influence public opinion. Negative or critical coverage could further erode support for the plan.

- Potential Political Fallout: Failure to pass the tax plan could have significant political ramifications for the Republican party, potentially impacting upcoming elections and eroding public trust.

Conclusion: Republican Divisions Could Halt Trump's Tax Plan – A Looming Crisis?

The challenges facing Trump's tax plan are significant and largely stem from internal Republican divisions. Deep ideological splits, concerns over the national debt, the influence of moderate Republicans, and the potential for public backlash all threaten to derail the initiative. The ongoing debate surrounding tax reform and the intense Republican infighting suggest the likelihood of a significant compromise or substantial alteration to the original proposal. The outcome remains uncertain, highlighting the critical role of ongoing political negotiations and the evolving public opinion on this highly controversial issue.

Stay informed about the ongoing developments regarding Trump's tax plan and the tax reform debate. Contact your representatives to express your views on this critical piece of legislation. Your voice matters in shaping the future of the nation's fiscal policy.

Featured Posts

-

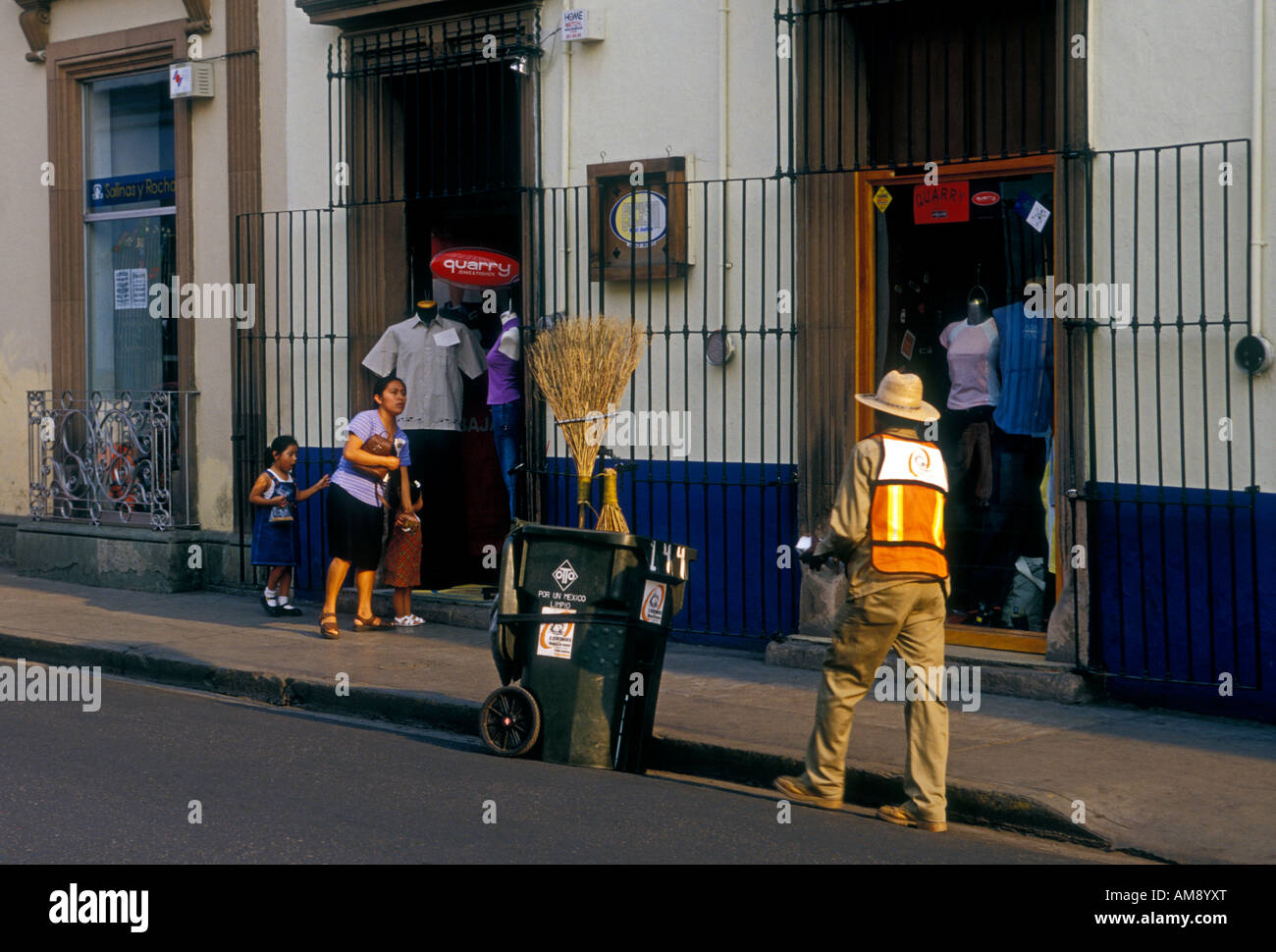

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025 -

One Dead Multiple Injured In Clearwater Ferry Collision

Apr 29, 2025

One Dead Multiple Injured In Clearwater Ferry Collision

Apr 29, 2025 -

Will Tax Credits Revitalize Minnesotas Film And Television Scene

Apr 29, 2025

Will Tax Credits Revitalize Minnesotas Film And Television Scene

Apr 29, 2025 -

Son Of Falcons Dc Apologizes For Prank Call To Browns Draft Pick Shedeur Sanders

Apr 29, 2025

Son Of Falcons Dc Apologizes For Prank Call To Browns Draft Pick Shedeur Sanders

Apr 29, 2025 -

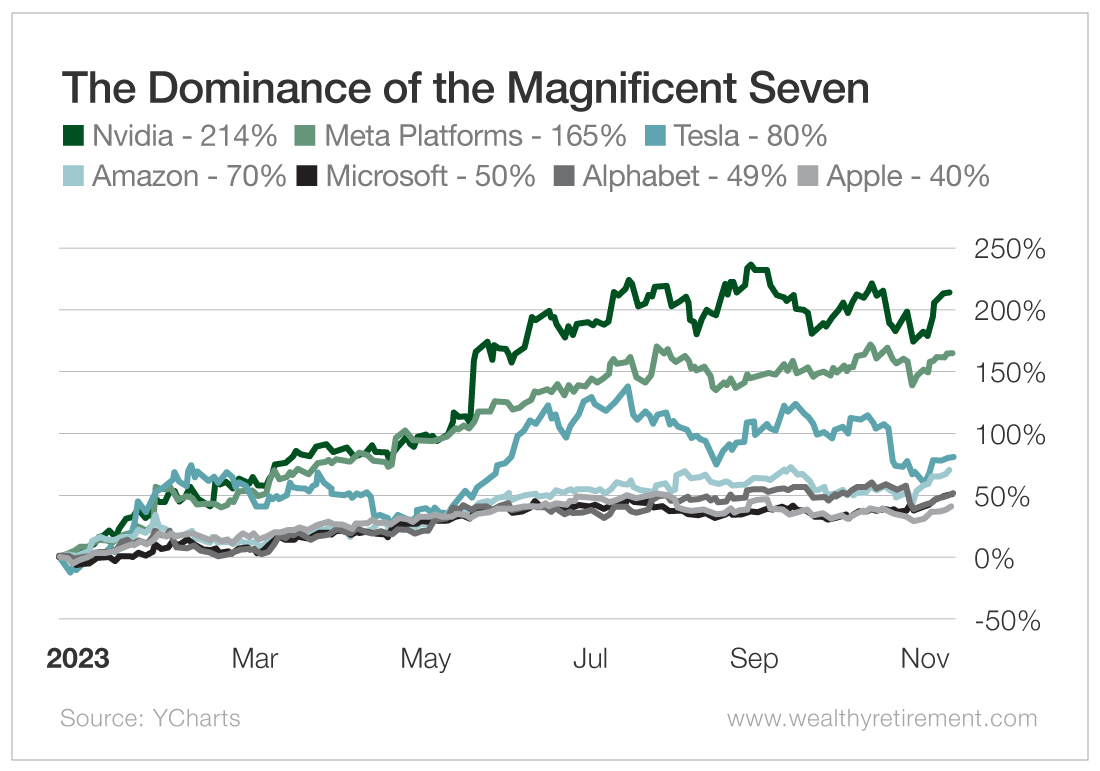

Magnificent Seven Stocks 2 5 Trillion In Lost Market Value This Year

Apr 29, 2025

Magnificent Seven Stocks 2 5 Trillion In Lost Market Value This Year

Apr 29, 2025

Latest Posts

-

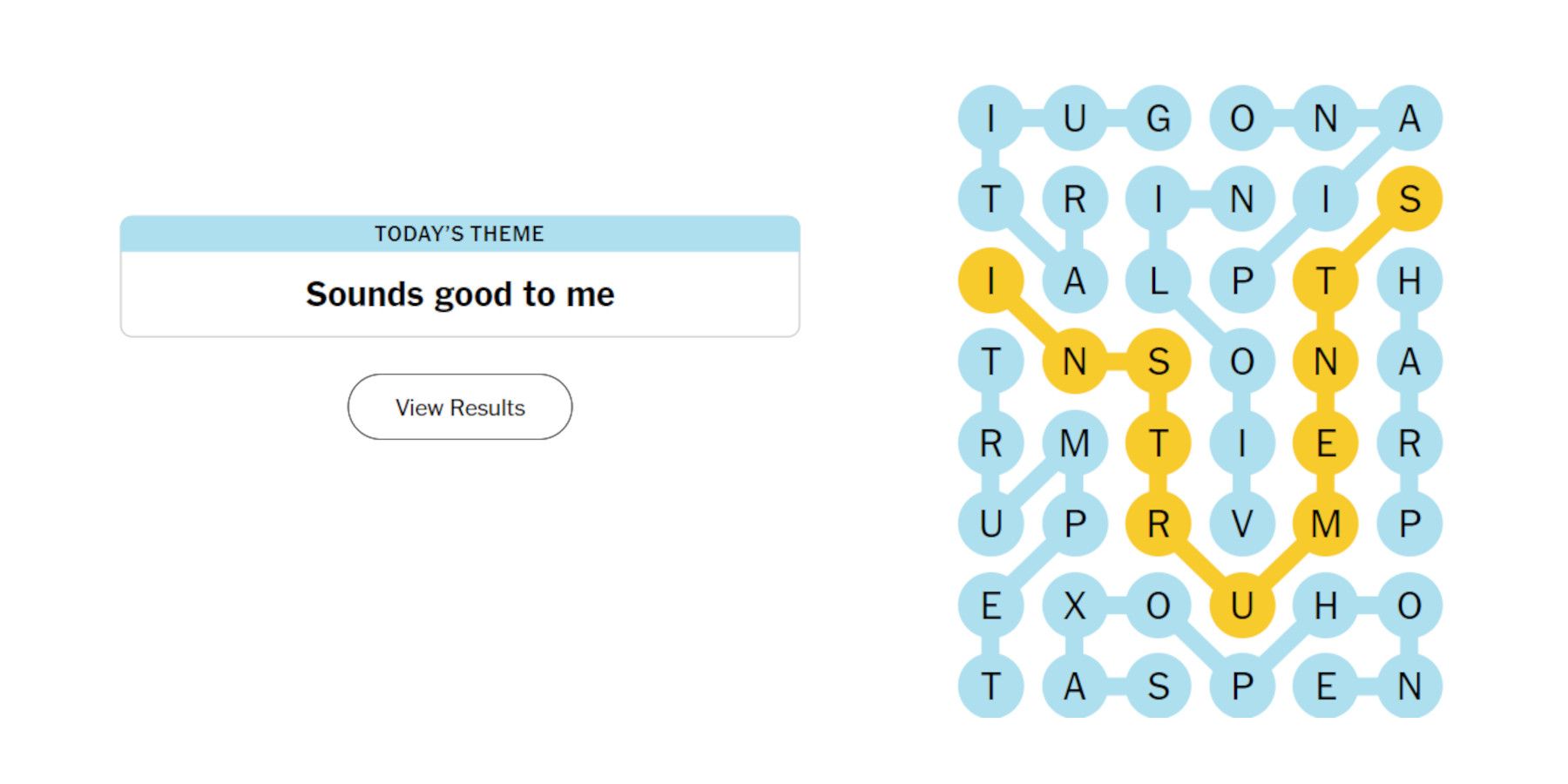

Nyt Strands Answers Monday March 31 2024 Game 393

Apr 29, 2025

Nyt Strands Answers Monday March 31 2024 Game 393

Apr 29, 2025 -

Complete Guide To Nyt Strands Hints And Answers March 3 2025

Apr 29, 2025

Complete Guide To Nyt Strands Hints And Answers March 3 2025

Apr 29, 2025 -

Nyt Strands Answers April 3 2025 Find The Spangram

Apr 29, 2025

Nyt Strands Answers April 3 2025 Find The Spangram

Apr 29, 2025 -

Nyt Strands Hints And Answers For The March 3 2025 Puzzle

Apr 29, 2025

Nyt Strands Hints And Answers For The March 3 2025 Puzzle

Apr 29, 2025 -

Solve Nyt Strands Game 393 March 31 Hints And Solutions

Apr 29, 2025

Solve Nyt Strands Game 393 March 31 Hints And Solutions

Apr 29, 2025