Republican Tax Cuts: A Fact-Check On Deficit Claims

Table of Contents

Initial Claims and Projections

Before the implementation of various Republican tax cuts, both proponents and opponents presented starkly contrasting predictions regarding their fiscal impact. Proponents, often citing supply-side economics, argued that the cuts would stimulate economic growth, leading to increased tax revenue that would offset the initial revenue loss. Conversely, opponents warned that the tax cuts would primarily benefit the wealthy, exacerbate income inequality, and significantly increase the national debt due to reduced government revenue.

-

Pro-tax cut projections: Advocates predicted a surge in economic activity, resulting in higher corporate investment, job creation, and ultimately, higher tax revenue from increased individual and corporate income. Some projections, often cited by the administration at the time, suggested a significant boost to GDP growth. These projections often lacked detailed methodologies and relied on optimistic assumptions about economic responsiveness.

-

Anti-tax cut projections: Critics, often referencing reports from the Congressional Budget Office (CBO), predicted a substantial increase in the national debt due to lower tax revenue. They emphasized the regressive nature of the cuts, arguing that they disproportionately benefited high-income earners, leading to a widening wealth gap and a smaller tax base. The CBO's projections typically included less optimistic assessments of economic growth and emphasized the potential for increased borrowing.

Economic Growth and Revenue Impacts

Following the implementation of these tax cuts, the actual economic growth experienced varied across different administrations and economic cycles. While some periods showed moderate GDP growth, it’s crucial to understand that attributing this growth solely to the tax cuts is an oversimplification. Global economic conditions, monetary policy, and other government spending programs significantly influenced economic performance.

-

GDP growth rates: Analyzing GDP growth rates before and after the tax cuts reveals a mixed picture. Some periods showed above-average growth, while others showed slower growth or even contraction. Simple correlation does not equal causation.

-

Corporate investment and job creation: The impact on corporate investment and job creation varied across sectors. While some sectors might have experienced increased investment, others might have remained unaffected or even experienced job losses. Comprehensive statistical analysis is needed to understand the full impact.

-

Tax revenue analysis: Examining tax revenue collected during the period following the tax cuts shows another mixed picture. Revenue did not always increase at the predicted rate. Factors such as changes in tax laws, economic downturns and varying levels of consumer and business confidence play significant roles.

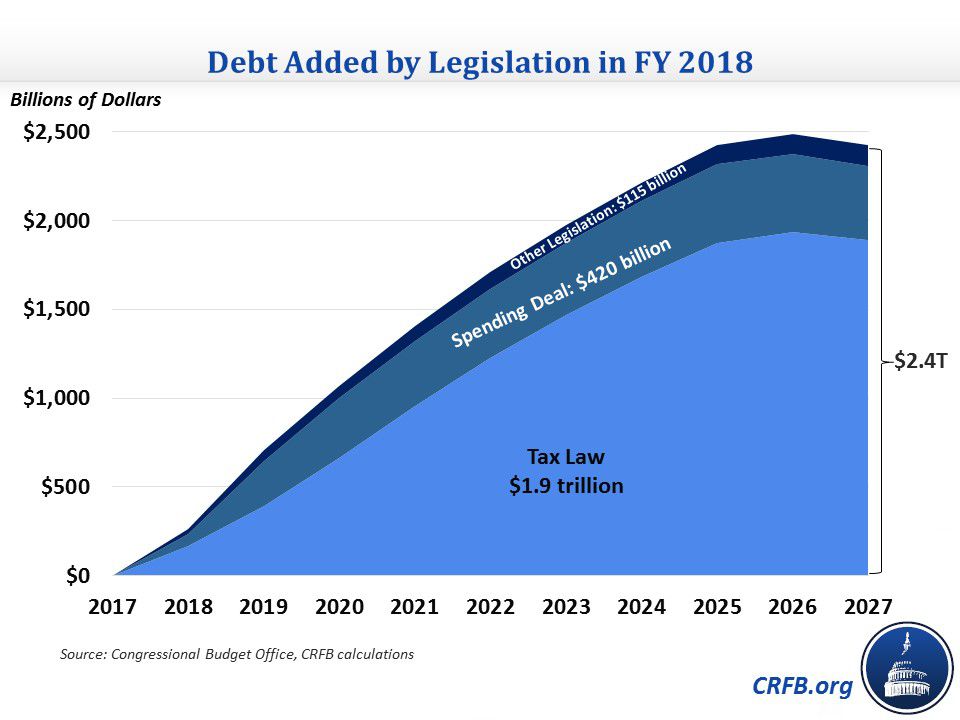

Debt and Deficit Trends

Analyzing the national debt and deficit trends before, during, and after the Republican tax cuts requires careful consideration of various economic factors. The methodology used to calculate these figures is complex, involving assumptions about future economic growth and government spending. It's crucial to acknowledge the limitations and potential biases in these calculations.

-

National debt figures: The national debt significantly increased during the periods following some Republican tax cuts, but this increase wasn't solely attributable to the tax cuts. Other government spending, economic downturns, and changing interest rates all played significant roles.

-

Budget deficit figures: Similarly, budget deficit figures reveal a complex interplay of factors. While some deficits widened following tax cuts, it's essential to compare these trends to those under previous administrations and to consider the overall economic climate.

-

Comparison with previous administrations: Comparing deficit trends under different administrations and economic conditions is necessary for a balanced perspective. Attributing changes solely to tax cuts ignores other significant factors that impact the budget.

Counterarguments and Rebuttals

Several counterarguments exist regarding the impact of Republican tax cuts on the deficit. Some argue that the long-term economic benefits outweigh the short-term cost increases, while others emphasize the distributional effects of the cuts, arguing they primarily benefit the wealthy.

-

Common misconceptions: A common misconception is that the tax cuts were solely responsible for any changes in the deficit. This ignores the multifaceted nature of government spending and economic growth.

-

Evidence-based rebuttals: Many studies have attempted to quantify the effects of tax cuts, but the results are often contested due to the difficulty in isolating the specific impact of tax policy from other economic factors.

-

Areas needing further research: Further research is needed to refine models that can accurately predict the long-term effects of such large-scale tax policies, particularly in the context of changing global economic landscapes.

Republican Tax Cuts: A Balanced Perspective on the Deficit

In conclusion, determining the precise impact of Republican tax cuts on the national deficit requires a nuanced understanding of economic theory, data analysis, and the interplay of numerous economic factors. While some Republican tax cuts have been associated with increased national debt, attributing this solely to the tax cuts without considering other significant factors would be an oversimplification. Objective analysis using reliable data sources, such as CBO reports and Treasury Department data, is crucial for evaluating the effectiveness of economic policies. The complexities involved necessitate further study and informed public discourse. We urge readers to continue researching the effects of GOP tax cuts and engage in informed discussions on the topic to better understand their broader economic and social implications. Understanding the nuances of tax cuts under Republican administrations is critical for responsible civic engagement.

Featured Posts

-

Sueper Lig Dusan Tadic 100 Maca Ulasti

May 20, 2025

Sueper Lig Dusan Tadic 100 Maca Ulasti

May 20, 2025 -

Usmc Tomahawk Cruise Missile Launching Drone Truck Army Evaluation

May 20, 2025

Usmc Tomahawk Cruise Missile Launching Drone Truck Army Evaluation

May 20, 2025 -

Radostna Novina Dzhenifr Lorns Stana Mayka Otnovo

May 20, 2025

Radostna Novina Dzhenifr Lorns Stana Mayka Otnovo

May 20, 2025 -

F1 Yeni Sezonu Takvim Degisiklikler Ve Geri Sayim

May 20, 2025

F1 Yeni Sezonu Takvim Degisiklikler Ve Geri Sayim

May 20, 2025 -

Delving Into The Cases Of Agatha Christies Poirot

May 20, 2025

Delving Into The Cases Of Agatha Christies Poirot

May 20, 2025

Latest Posts

-

Four Star Admiral Convicted A Deep Dive Into The Corruption Case

May 20, 2025

Four Star Admiral Convicted A Deep Dive Into The Corruption Case

May 20, 2025 -

Job Exchange Scheme Navys Burke Sentenced For Bribery

May 20, 2025

Job Exchange Scheme Navys Burke Sentenced For Bribery

May 20, 2025 -

Navy Officer Burke Found Guilty In Job Exchange Bribery Case

May 20, 2025

Navy Officer Burke Found Guilty In Job Exchange Bribery Case

May 20, 2025 -

Burkes Guilty Plea Navy Bribery Scandal Explained

May 20, 2025

Burkes Guilty Plea Navy Bribery Scandal Explained

May 20, 2025 -

Bribery Scandal Rocks The Navy A Retired Admirals Fall From Grace

May 20, 2025

Bribery Scandal Rocks The Navy A Retired Admirals Fall From Grace

May 20, 2025