Republican Tax Cuts And The National Deficit: A Fact-Based Assessment

Table of Contents

The Bush Tax Cuts (2001 & 2003): A Case Study

The Bush tax cuts, enacted in 2001 and 2003, significantly reduced income tax rates and increased the child tax credit. Analyzing their impact on the national deficit provides a valuable case study for understanding the potential consequences of such policies.

Initial Projections vs. Reality

Projections preceding the Bush tax cuts predicted substantial revenue gains due to anticipated economic growth spurred by supply-side economics. However, reality painted a different picture.

- Significant increase in the national debt: The national debt soared during this period, far exceeding initial projections. While there was a short-term economic boost, it wasn't sufficient to offset the revenue losses from the tax cuts.

- Short-term economic stimulus followed by slower long-term growth: While the economy experienced a temporary surge, long-term growth was comparatively sluggish compared to previous periods. This raises questions about the sustainability of tax cut-driven economic stimulus.

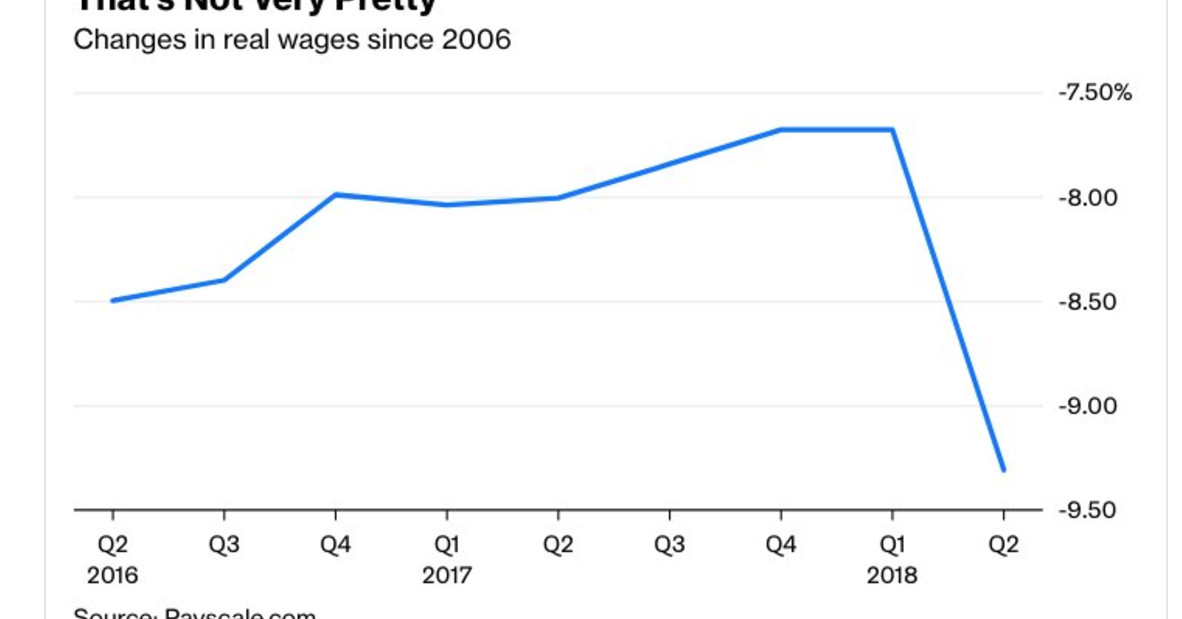

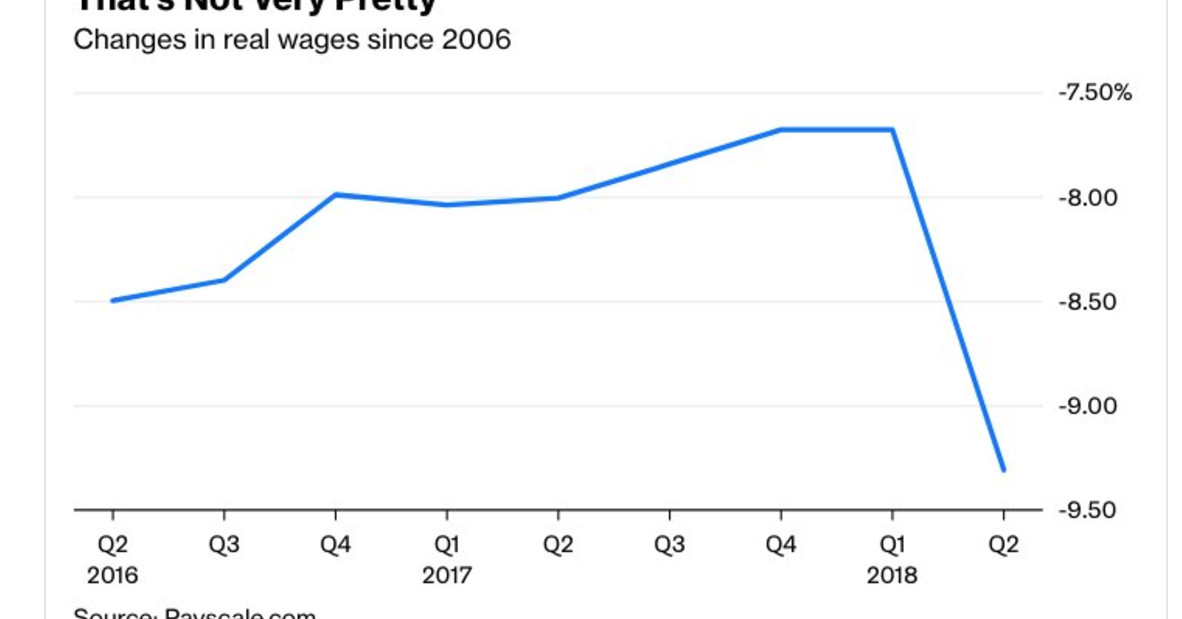

- Debate surrounding the effectiveness of supply-side economics: The Bush tax cuts fueled a renewed debate on the efficacy of supply-side economics, with critics arguing that the promised economic growth failed to materialize to the extent predicted. Empirical evidence suggests that the revenue gains were not sufficient to offset the tax cuts, leading to a significant increase in the deficit. Charts illustrating the national debt's trajectory during this period would visually reinforce this point.

Long-Term Economic Effects

The long-term consequences of the Bush tax cuts remain a subject of ongoing debate amongst economists.

- Impact on income distribution: Studies suggest the tax cuts disproportionately benefited high-income earners, exacerbating income inequality. This distribution of benefits raises questions about the equity of the policy.

- Effects on investment and job creation: While proponents argued the cuts would stimulate investment and job creation, the empirical evidence is mixed, with some studies showing only modest effects. Further research is needed to definitively assess these impacts.

- Long-term implications for government spending: The increased national debt resulting from the tax cuts placed greater strain on government finances, potentially limiting future spending on essential programs and infrastructure.

The Trump Tax Cuts (2017): An Analysis

The Tax Cuts and Jobs Act of 2017, enacted under the Trump administration, represents another significant Republican tax cut initiative. Let's analyze its provisions and impact.

Key Provisions and Intended Outcomes

The 2017 tax cuts included several key provisions aimed at boosting economic growth and job creation.

- Corporate tax rate reduction: The corporate tax rate was significantly reduced from 35% to 21%.

- Individual tax rate changes: Individual income tax rates were also adjusted, with varying effects across different income brackets.

- Changes to deductions and credits: Several deductions and credits were modified, impacting taxpayers differently. These changes aimed to simplify the tax code and encourage investment.

Economic Impact and Debt Increase

The economic impact of the 2017 tax cuts has been a subject of intense scrutiny.

- GDP growth figures: While there was a short-term increase in GDP growth, determining the direct causal link to the tax cuts remains challenging due to other concurrent economic factors.

- Job creation statistics: The impact on job creation was also modest, with analyses suggesting that it was less significant than initially predicted.

- Increase in the national debt: The tax cuts led to a substantial increase in the national debt, adding to the pre-existing fiscal challenges.

- Impact on the budget deficit: The budget deficit widened significantly in the years following the implementation of these cuts.

The Role of Economic Factors Beyond Tax Cuts

It's crucial to acknowledge that factors beyond tax cuts influence the national deficit.

Government Spending and Entitlement Programs

Government spending on various programs significantly affects the national deficit.

- Growth in entitlement spending: Spending on programs like Social Security and Medicare continues to grow, placing increasing pressure on the federal budget.

- Defense spending increases: Fluctuations in defense spending, often influenced by geopolitical events, can also significantly impact the deficit.

- Impact on the overall budget: These spending increases, irrespective of tax policy, contribute substantially to the national debt.

Global Economic Conditions and Their Influence

External economic factors play a crucial role in shaping the national deficit.

- Global economic downturns: Recessions and economic slowdowns globally can negatively affect tax revenues and increase the demand for government spending, widening the deficit.

- Trade wars and tariffs: Trade disputes and tariffs can disrupt international trade and negatively impact economic growth, affecting tax revenues and potentially leading to increased budget deficits.

- International economic pressures: Global economic instability and fluctuations in exchange rates can influence the national economy and fiscal health.

Conclusion

This fact-based assessment of Republican tax cuts and their impact on the national deficit reveals a complex relationship. While proponents argue for supply-side economics and economic growth, the data suggests a consistent trend of increased national debt following these cuts. Understanding the interplay of tax policies, government spending, and global economic conditions is crucial for informed policy discussions. Further research and analysis are necessary to fully comprehend the long-term effects of Republican tax cuts on the national deficit and the overall economic health of the nation. Continue exploring this critical issue and form your own informed opinion on the impact of Republican tax cuts national deficit and similar fiscal policies.

Featured Posts

-

Abc News Shows Future In Jeopardy After Layoffs

May 21, 2025

Abc News Shows Future In Jeopardy After Layoffs

May 21, 2025 -

Japanese Manga Sparks Travel Fears Disaster Prediction Impacts Tourism

May 21, 2025

Japanese Manga Sparks Travel Fears Disaster Prediction Impacts Tourism

May 21, 2025 -

Bp Ceo Targets Valuation Doubling Remains Committed To Current Stock Exchange Listing

May 21, 2025

Bp Ceo Targets Valuation Doubling Remains Committed To Current Stock Exchange Listing

May 21, 2025 -

Abn Amro Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 21, 2025

Abn Amro Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 21, 2025 -

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025