Republican Tax Plan: Analysis Of Trump's Proposed Changes

Table of Contents

Individual Income Tax Changes under the Republican Tax Plan

The Republican Tax Plan implemented substantial changes to the individual income tax system. These changes aimed to simplify the tax code and provide tax relief for many Americans, though the extent of this relief varied significantly depending on income level.

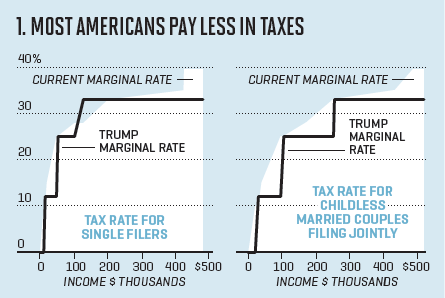

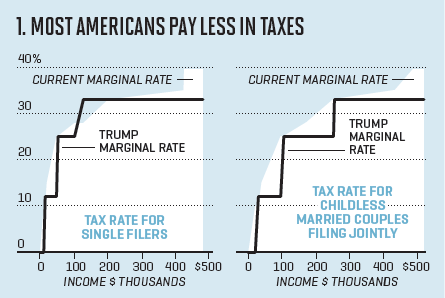

Lowering of Individual Tax Rates

The plan significantly lowered individual income tax rates. The number of tax brackets was reduced, impacting taxpayers across the board.

- Specific tax bracket changes: The top individual income tax rate was reduced from 39.6% to 37%. Lower brackets also experienced reductions, though the percentage decreases varied.

- Impact on various income groups: Higher-income individuals generally benefited most from the reduced rates, while the impact on lower- and middle-income individuals was more nuanced, influenced by other changes like the standard deduction.

- Analysis of the progressivity or regressivity of the changes: Critics argued the changes were regressive, disproportionately benefiting higher-income earners. Proponents countered that the standard deduction increases and child tax credit enhancements offset this, benefiting lower- and middle-income families.

Standard Deduction and Personal Exemptions

The Republican Tax Plan made substantial alterations to the standard deduction and personal exemptions.

- Increased standard deduction amounts: The standard deduction was significantly increased, doubling for single filers and nearly doubling for married couples.

- Elimination of personal exemptions – implications: The elimination of personal exemptions, previously claimed for each dependent, offset some of the benefits of the increased standard deduction, especially for larger families.

- Impact on families and individuals: The net effect varied depending on family size and income. While some families saw significant tax savings due to the increased standard deduction, others experienced less benefit or even a slight tax increase due to the loss of personal exemptions.

Child Tax Credit Modifications

The Child Tax Credit (CTC) also underwent modifications under the Republican Tax Plan.

- Changes to the amount of the credit: The maximum amount of the CTC was increased.

- Changes to eligibility requirements: While the credit was expanded, certain eligibility requirements remained.

- Impact on families with children: Families with children generally benefited from the expanded CTC, although the full benefit was not necessarily felt by all families.

Corporate Tax Rate Reduction in the Republican Tax Plan

A central element of the Republican Tax Plan was a dramatic reduction in the corporate tax rate.

Lowering the Corporate Tax Rate

The most significant change was the reduction of the corporate tax rate from 35% to 21%.

- Before and after corporate tax rates: This was a substantial decrease, intended to boost corporate profits and investment.

- Projected impact on corporate profits and investment: Proponents predicted increased investment, job creation, and economic growth.

- Potential consequences for job creation and economic growth: While some corporations did increase investment and hiring, the actual economic impact remains a subject of ongoing debate.

International Tax Implications

The Republican Tax Plan also introduced changes to international taxation.

- Changes to the taxation of foreign profits: The plan aimed to encourage repatriation of profits held overseas by US multinational corporations.

- Impact on multinational corporations: This aspect of the tax reform had a complex impact on multinational corporations, with varied effects depending on their specific circumstances.

- Potential effects on US competitiveness: The long-term effects on US competitiveness in the global market remain a topic of ongoing discussion and analysis.

Analysis of the Long-Term Economic Impacts of the Republican Tax Plan

The long-term economic consequences of the Republican Tax Plan are complex and multifaceted.

Projected Economic Growth

Projections regarding economic growth varied considerably.

- Government forecasts: The Trump administration initially projected significant economic growth as a result of the tax cuts.

- Independent economic analyses: Independent economic analyses offered a range of predictions, some less optimistic than the government's forecasts.

- Potential for increased national debt: Many economists warned that the tax cuts could lead to a significant increase in the national debt.

Impact on Income Inequality

The impact of the Republican Tax Plan on income inequality is hotly debated.

- Arguments for increased inequality: Critics argued the tax cuts disproportionately benefited high-income individuals and corporations, exacerbating income inequality.

- Arguments for decreased inequality: Proponents argued that the changes stimulated economic growth, benefiting all income levels.

- Data and studies supporting different viewpoints: Empirical evidence supporting either side of the argument remains inconclusive, with various studies offering conflicting findings.

Debt and Deficit Implications

The tax cuts' effect on the national debt and deficit is another area of significant concern.

- Projected increases in the national debt: The tax cuts resulted in a significant increase in the national debt, as lower tax revenues were not offset by corresponding spending cuts.

- Potential long-term consequences for the economy: The increased national debt has long-term implications for the US economy, potentially impacting interest rates and future government spending.

- Debate surrounding fiscal responsibility: The tax cuts reignited a long-standing debate surrounding fiscal responsibility and the appropriate balance between tax cuts and government spending.

Conclusion: Assessing the Legacy of the Republican Tax Plan

The Republican Tax Plan, encompassing significant Trump Tax Cuts and substantial tax reform, brought about substantial changes to the US tax code. While proponents highlighted potential economic growth and tax relief for individuals and businesses, critics raised concerns about increased income inequality and a burgeoning national debt. The long-term impacts of these changes continue to be analyzed and debated, with economists offering varying perspectives. Understanding the intricacies of this landmark legislation is crucial for comprehending the current economic landscape. Continue learning more about the impact of the Republican Tax Plan and its lasting effects on the American economy.

Featured Posts

-

Did Jill Biden And Kamala Harris Clash Examining Their Reported Feud

May 16, 2025

Did Jill Biden And Kamala Harris Clash Examining Their Reported Feud

May 16, 2025 -

La Lnh Et La Decentralisation De Son Repechage Analyse D Une Decision Controversee

May 16, 2025

La Lnh Et La Decentralisation De Son Repechage Analyse D Une Decision Controversee

May 16, 2025 -

Elon Musk And Amber Heard Twins Paternity Speculation Reignites

May 16, 2025

Elon Musk And Amber Heard Twins Paternity Speculation Reignites

May 16, 2025 -

Vont Weekend April 4 6 2025 In Pictures 97 3 Kiss Fm

May 16, 2025

Vont Weekend April 4 6 2025 In Pictures 97 3 Kiss Fm

May 16, 2025 -

The Rise Of The Apple Watch How Nhl Referees Are Leveraging Technology

May 16, 2025

The Rise Of The Apple Watch How Nhl Referees Are Leveraging Technology

May 16, 2025