Responding To Tariffs: China Lowers Interest Rates And Boosts Bank Lending

Table of Contents

The Impact of Tariffs on the Chinese Economy

The imposition of tariffs has undeniably impacted the Chinese economy, creating ripples across various sectors. The increased costs associated with exporting goods to key markets, particularly the United States, have led to a decline in export demand. This slowdown has, in turn, resulted in decreased production, factory closures, and unfortunately, job losses across various industries. The uncertainty created by the trade war has also negatively impacted investor confidence, leading to a reduction in foreign direct investment (FDI).

- Decreased export demand: Tariffs make Chinese goods more expensive in foreign markets, reducing competitiveness and shrinking export volumes. This directly affects manufacturers and related industries.

- Reduced foreign investment: The instability and uncertainty surrounding trade policies deter foreign investors, hindering economic growth and modernization efforts. This impacts long-term development plans.

- Slowdown in overall economic growth: The cumulative effect of decreased exports and FDI leads to a noticeable slowdown in GDP growth, impacting the overall economic health of the nation.

- Increased pressure on the Chinese Yuan: Reduced export demand and capital flight can exert downward pressure on the value of the Chinese currency, further complicating the economic situation.

China's Response: Lowering Interest Rates

In response to these economic challenges, the People's Bank of China (PBOC), the central bank, has implemented a series of China interest rate cuts. This involves lowering the benchmark lending rates, influencing the overall cost of borrowing for businesses and consumers. The PBOC's goal is to incentivize borrowing and investment, thereby stimulating economic activity. This monetary policy aims to counteract the negative effects of the tariffs and boost economic growth.

- Lower borrowing costs: Reduced interest rates make loans more affordable for businesses, encouraging investment in expansion, modernization, and new projects. This applies to both large corporations and small and medium-sized enterprises (SMEs).

- Increased investment: Lower borrowing costs stimulate investment in infrastructure projects, crucial for long-term economic development and job creation. This also encourages private sector investment in various industries.

- Potential for increased consumer spending: Lower interest rates can also translate into lower borrowing costs for consumers, potentially leading to increased consumer spending and stimulating domestic demand.

- Effectiveness of past interest rate cuts: While past interest rate cuts in China have shown varying degrees of effectiveness, their impact is often influenced by other factors such as credit availability and investor sentiment. The current situation presents a unique set of circumstances.

The Role of Bank Lending in Economic Stimulus

The PBOC is not only lowering interest rates but is also actively encouraging increased lending by commercial banks. This is being achieved through a combination of regulatory adjustments and government incentives. The aim is to direct credit towards sectors deemed crucial for economic growth. However, this strategy carries inherent risks, particularly the potential increase in non-performing loans (NPLs).

- Relaxation of lending regulations: Easing lending restrictions allows banks to extend credit more freely, but this needs to be carefully managed to avoid excessive risk-taking.

- Government incentives: Targeted incentives encourage banks to provide credit to specific sectors, such as infrastructure development or technology-focused companies, strategically allocating resources for maximum impact.

- Potential for increased debt levels: Increased lending could lead to a rise in overall debt levels in the economy, potentially creating long-term financial vulnerabilities if not managed prudently.

- Mitigation measures: To mitigate the risk of a banking crisis, the government is implementing measures to strengthen bank supervision and enhance risk management practices.

Global Implications of China's Monetary Policy

China's monetary policy adjustments, driven by the need to counter the impact of tariffs, have significant global implications. The increased borrowing and investment stimulated by China interest rate cuts and increased bank lending will likely increase demand for raw materials and commodities globally. This could lead to fluctuations in commodity prices and impact exporting countries. Furthermore, these actions could affect global currency exchange rates and influence the competitive landscape among various economies.

- Increased demand for raw materials: Increased industrial activity in China driven by investment will likely lead to higher demand for raw materials, potentially pushing up their prices in global markets.

- Fluctuations in global currency markets: Changes in Chinese monetary policy can create ripples in global currency markets, impacting exchange rates and influencing international trade flows.

- Impact on competing economies: China's efforts to stimulate its economy could affect competing economies, particularly those heavily reliant on exports to China or those producing similar goods.

- Global market reactions: Global market reactions to China's policy changes will depend on a variety of factors, including the overall global economic climate and the effectiveness of the implemented measures.

Conclusion

China's interest rate cuts and increased bank lending represent a strategic response to the economic challenges posed by tariffs. The primary goal is to stimulate economic growth by boosting borrowing and investment. While this strategy offers potential benefits, the risks associated with rising debt levels must be carefully managed. The global implications are significant, with potential effects on commodity prices, currency exchange rates, and the competitive landscape of international trade. Understanding the effectiveness of these measures and their broader consequences requires ongoing observation and analysis. Stay informed about the evolving economic situation in China and the global implications of its response to tariffs. Further research into the effectiveness of China interest rate cuts is crucial for understanding future economic trends. Follow reputable financial news sources for ongoing updates on China's economic policies and their impact on global markets.

Featured Posts

-

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025 -

Inter Milans Path To The Champions League Final A Victory Over Barcelona

May 08, 2025

Inter Milans Path To The Champions League Final A Victory Over Barcelona

May 08, 2025 -

Rogue Exiles Key Aspects Of Path Of Exile 2

May 08, 2025

Rogue Exiles Key Aspects Of Path Of Exile 2

May 08, 2025 -

Mike Trouts Two Hrs Cant Prevent Angels Defeat Against Giants

May 08, 2025

Mike Trouts Two Hrs Cant Prevent Angels Defeat Against Giants

May 08, 2025 -

Affordable Power The 12 Inch Microsoft Surface Pro

May 08, 2025

Affordable Power The 12 Inch Microsoft Surface Pro

May 08, 2025

Latest Posts

-

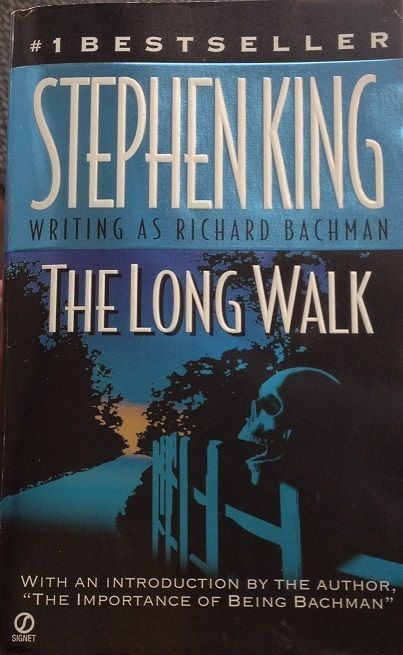

The Long Walk Trailer A Stephen King Approved Dark Thriller

May 08, 2025

The Long Walk Trailer A Stephen King Approved Dark Thriller

May 08, 2025 -

First Trailer Hunger Games Directors New Dystopian Horror Film Based On Stephen King

May 08, 2025

First Trailer Hunger Games Directors New Dystopian Horror Film Based On Stephen King

May 08, 2025 -

Dispute Erupts Between Okc Thunder And National Media

May 08, 2025

Dispute Erupts Between Okc Thunder And National Media

May 08, 2025 -

Dystopian Horror Movie Based On Stephen King Novel First Trailer Drops

May 08, 2025

Dystopian Horror Movie Based On Stephen King Novel First Trailer Drops

May 08, 2025 -

Thunder Players Heated Exchange With National Media

May 08, 2025

Thunder Players Heated Exchange With National Media

May 08, 2025