Retail Sales Growth Increases Likelihood Of Holding Bank Of Canada Rates

Table of Contents

Strong Retail Sales Indicate a Healthy Economy

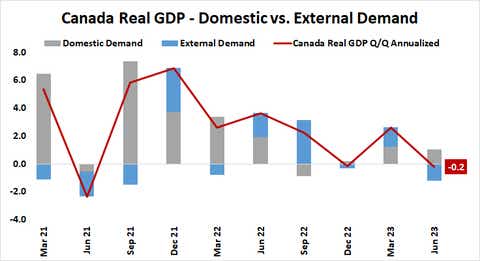

Robust retail sales figures are a powerful indicator of a healthy Canadian economy, reflecting strong consumer confidence and overall economic strength. Increased consumer spending directly translates to higher GDP growth, a key metric for economic performance. Strong sales across diverse sectors, from automotive purchases to durable goods, signal broad-based economic health and resilience.

- Increased consumer spending: Higher retail sales translate directly into increased GDP growth, fueling economic expansion.

- Broad-based economic health: Strong performance across various retail sectors indicates a robust and diversified economy, not reliant on a single industry.

- Recent data from Statistics Canada: [Insert link to relevant Statistics Canada data showcasing recent retail sales growth]. For example, recent reports have shown [insert specific data points, e.g., a 2% increase in retail sales year-over-year].

- Strong performing sectors: The automotive sector, for instance, has shown remarkable growth, indicating increased consumer confidence and willingness to make significant purchases. Similarly, sales of durable goods like furniture and appliances remain robust.

These positive indicators suggest a thriving consumer market, vital for sustained economic growth in Canada. Understanding these trends helps predict the overall health of the Canadian economy.

Inflationary Pressures and the Bank of Canada's Mandate

The Bank of Canada's primary mandate is to control inflation and maintain price stability. While strong retail sales are generally positive, they could contribute to inflationary pressures. Increased demand, fueled by robust consumer spending, can lead to potential price increases across various goods and services. This is a crucial factor the Bank of Canada carefully considers when setting interest rates.

- Increased demand: Higher consumer spending leads to increased demand for goods and services, potentially pushing prices upward.

- Bank of Canada's inflation target: The Bank of Canada targets an inflation rate of [insert current inflation target percentage]. Current inflation sits at [insert current inflation rate percentage].

- Relationship between retail sales and inflation: While not a direct correlation, sustained high retail sales growth, coupled with other inflationary pressures, can lead the Bank of Canada to consider adjusting interest rates.

The Bank of Canada must carefully analyze the relationship between retail sales data and other economic indicators to determine the appropriate course of action regarding inflation.

The Balancing Act: Growth vs. Inflation

The Bank of Canada faces a challenging balancing act: maintaining healthy economic growth while keeping inflation in check. Given the current robust retail sales data, holding interest rates steady might be the preferred approach. Raising interest rates too aggressively could significantly slow economic growth, dampening consumer spending and business investment.

- Risks of raising interest rates: Aggressive interest rate hikes can stifle economic growth, potentially leading to job losses and reduced consumer confidence.

- Benefits of maintaining current rates: Holding rates steady supports continued consumer spending and business investment, fostering economic expansion.

- Potential downside of holding rates: The risk, however, is that maintaining current rates could allow inflation to rise further, necessitating more aggressive action in the future.

The decision requires a careful assessment of the potential risks and rewards associated with each policy option.

Alternative Economic Indicators to Consider

The Bank of Canada considers a range of economic indicators beyond retail sales to inform its monetary policy decisions. Employment rates, housing market data, and manufacturing output all play crucial roles in providing a comprehensive picture of the Canadian economy. These indicators offer additional insights into the overall economic health and inform the Bank of Canada’s interest rate decisions. Understanding these different perspectives provides a more nuanced understanding of the economic landscape.

Conclusion

Strong retail sales growth significantly influences the Bank of Canada's interest rate decisions. While robust consumer spending signals a healthy economy, it also presents the risk of increased inflationary pressure. The Bank of Canada must carefully balance the need to maintain economic growth with its mandate to control inflation. Therefore, holding interest rates steady might currently be seen as the most prudent approach, given the current positive retail sales data and a need to assess other indicators. Monitoring key economic indicators like employment rates and housing market data remains crucial for understanding the evolving economic landscape.

Stay informed about the Bank of Canada's next interest rate decision and the evolving relationship between retail sales growth and Bank of Canada interest rates. Continue following economic news and analysis to understand the impact on your personal finances and investment strategies. Understanding the interplay between retail sales and the Bank of Canada’s monetary policy is essential for navigating the Canadian economic outlook.

Featured Posts

-

Nov Razgovor Me U Putin I Tramp Iz Ava Na Peskov

May 27, 2025

Nov Razgovor Me U Putin I Tramp Iz Ava Na Peskov

May 27, 2025 -

Garantii Bezopasnosti Dlya Ukrainy Podderzhka Germanii Na Puti V Nato

May 27, 2025

Garantii Bezopasnosti Dlya Ukrainy Podderzhka Germanii Na Puti V Nato

May 27, 2025 -

Nora Fatehi At Iifa 2025 A Glamorous Alexandre Vauthier Ensemble

May 27, 2025

Nora Fatehi At Iifa 2025 A Glamorous Alexandre Vauthier Ensemble

May 27, 2025 -

What Time Is Tracker Season 2 Episode 17 On

May 27, 2025

What Time Is Tracker Season 2 Episode 17 On

May 27, 2025 -

Taylor Swifts Lawsuit Against Kanye West Details Of The Explicit Lyrics Case

May 27, 2025

Taylor Swifts Lawsuit Against Kanye West Details Of The Explicit Lyrics Case

May 27, 2025

Latest Posts

-

University Of California Trumps Antisemitism Probe Expands

May 29, 2025

University Of California Trumps Antisemitism Probe Expands

May 29, 2025 -

Robinhood Desktop Trading Platform Launches In The Uk

May 29, 2025

Robinhood Desktop Trading Platform Launches In The Uk

May 29, 2025 -

Mai I Moss En Komplett Oversikt Over Arrangementer

May 29, 2025

Mai I Moss En Komplett Oversikt Over Arrangementer

May 29, 2025 -

Alt Om 17 Mai I Moss Program Og Detaljer

May 29, 2025

Alt Om 17 Mai I Moss Program Og Detaljer

May 29, 2025 -

Program For 17 Mai I Moss Overraskelser I Vente

May 29, 2025

Program For 17 Mai I Moss Overraskelser I Vente

May 29, 2025