Retail Sales Surge: Another Bank Of Canada Rate Cut Less Likely

Table of Contents

Robust Retail Sales Figures Exceed Expectations

The latest retail sales data paints a picture of unexpectedly robust consumer spending. Figures released this morning showed a [Insert Percentage]% increase in retail sales compared to the previous month and a [Insert Percentage]% increase year-over-year. This significantly surpasses analyst predictions, which had forecast a more modest increase of only [Insert Percentage]%. This strong performance indicates a higher level of consumer confidence than previously anticipated.

Key sectors driving this growth include:

- Automotive: Sales of new and used vehicles experienced a particularly strong surge, contributing significantly to the overall increase.

- Furniture and Home Furnishings: This sector also showed robust growth, potentially reflecting increased home improvements and renovations.

- Electronics and Appliances: Sales in this sector were also above expectations, suggesting strong consumer demand for durable goods.

Geographic variations in sales growth were observed, with [mention specific regions and their performance]. This highlights the uneven nature of economic recovery across the country.

Implications for the Bank of Canada's Monetary Policy

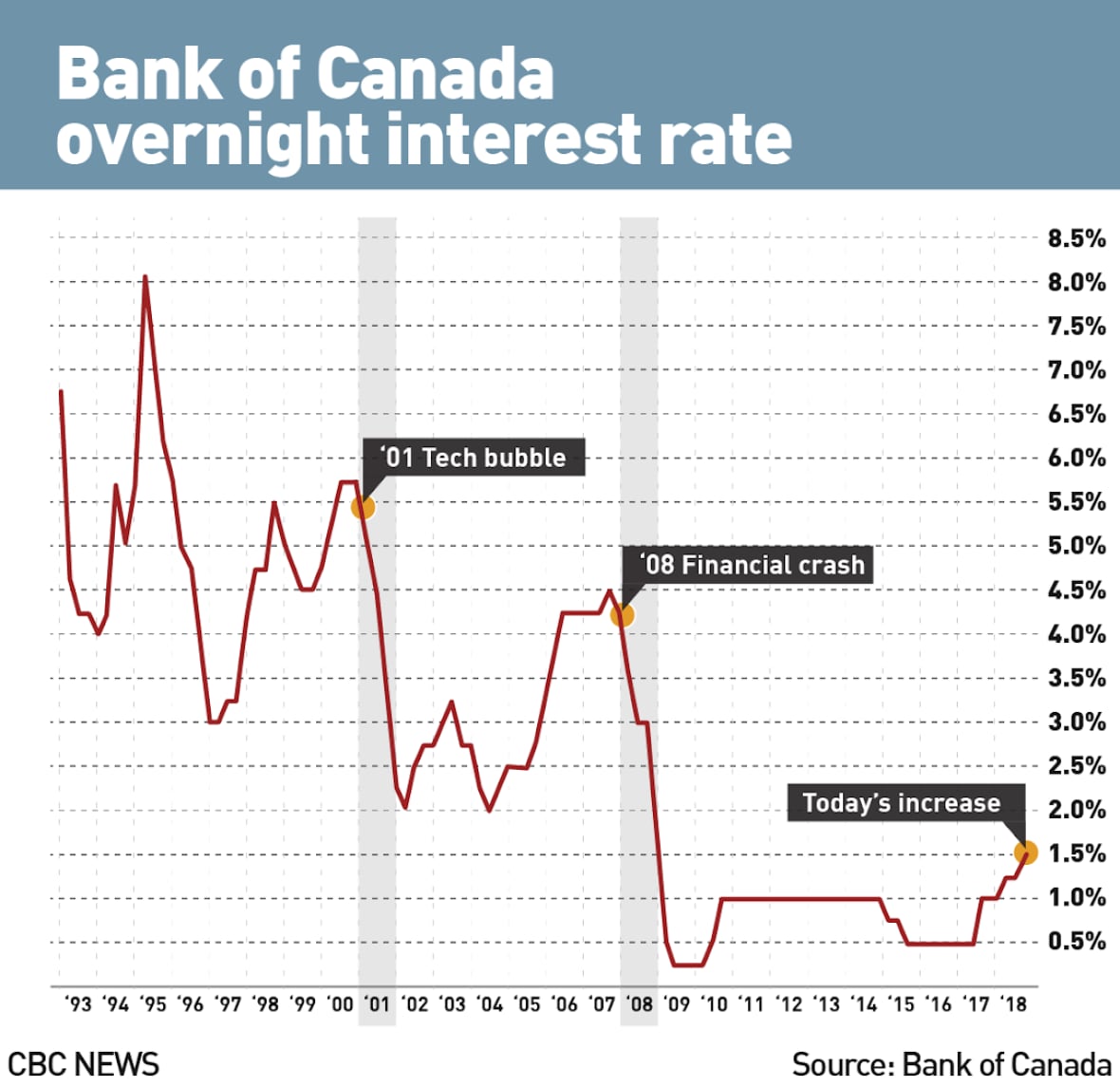

The robust retail sales figures directly contradict the rationale for further interest rate reductions by the Bank of Canada. The central bank's mandate is to maintain price stability and full employment. While previous rate cuts aimed to stimulate the economy during periods of low growth and inflation, the current surge in consumer spending suggests a stronger economic recovery than previously projected.

- Current Bank of Canada Interest Rate: [Insert current interest rate]

- Previous Rate Cuts: The Bank of Canada previously lowered interest rates [Number] times in [Time Period] primarily to counter the economic slowdown caused by [Reason].

- Potential Impact of Inflation: The strong retail sales could potentially lead to increased inflationary pressures, which could influence the Bank of Canada's future rate decisions. The central bank will need to carefully monitor inflation indicators in the coming months.

Analyzing Underlying Factors Contributing to the Sales Surge

Several factors might explain this unexpected rise in retail sales:

- Increased Consumer Confidence: Positive economic sentiment, fueled by [mention factors like job growth, government initiatives, etc.], may be boosting consumer spending.

- Pent-up Demand: Consumers may be making purchases they delayed during periods of economic uncertainty.

- Government Economic Support Programs: Government stimulus measures, such as [mention specific programs], have likely played a role in supporting consumer spending.

- Seasonal Variations: While unlikely to be the sole contributor, seasonal factors could have also influenced the sales figures.

Consumer sentiment surveys support this analysis, showing a notable increase in consumer confidence in recent months. However, it’s crucial to distinguish between temporary and long-term factors driving this growth to accurately assess the sustainability of the current trend.

Potential Risks and Uncertainties

While the current retail sales data is positive, several factors could still influence the Bank of Canada's decision on future interest rates:

- Possible Future Economic Downturns or Recessions: Global economic uncertainties remain, and the possibility of a future recession, either domestically or internationally, cannot be discounted.

- Impact of Global Economic Events on Canadian Retail: Global events, such as trade wars or geopolitical instability, can significantly impact the Canadian economy and consumer confidence.

- Uncertainties about the Sustainability of the Retail Sales Surge: The current surge may prove unsustainable if underlying factors supporting it weaken.

Conclusion

The significant surge in retail sales significantly reduces the probability of another Bank of Canada rate cut in the near term. This unexpected growth suggests robust consumer spending and a stronger-than-anticipated economic recovery. However, future economic uncertainties warrant continued monitoring of key economic indicators. The Bank of Canada will need to carefully weigh the positive retail sales data against potential risks before making any decisions on monetary policy.

Call to Action: Stay informed about the latest developments concerning the Bank of Canada's monetary policy and the impact on retail sales. Continue to follow our analysis for further insights into the evolving economic landscape and its impact on interest rates and consumer spending.

Featured Posts

-

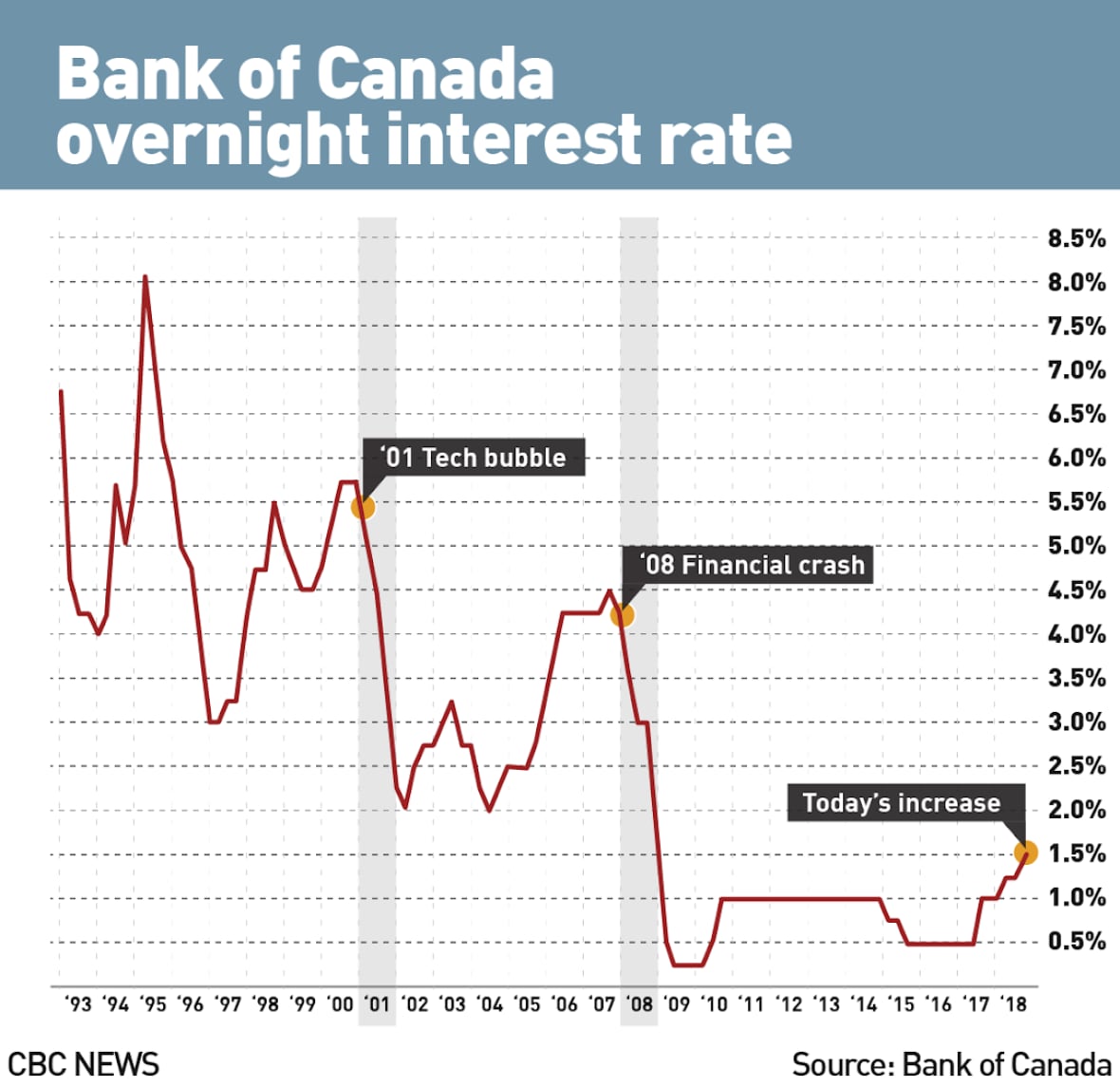

The Hells Angels Motorcycle Club History Structure And Activities

May 26, 2025

The Hells Angels Motorcycle Club History Structure And Activities

May 26, 2025 -

Understanding Flood Risks A Comprehensive Guide For Severe Weather Awareness Week Day 5

May 26, 2025

Understanding Flood Risks A Comprehensive Guide For Severe Weather Awareness Week Day 5

May 26, 2025 -

Mandarin Killings A Case Study Of Hells Angels Business Strategies

May 26, 2025

Mandarin Killings A Case Study Of Hells Angels Business Strategies

May 26, 2025 -

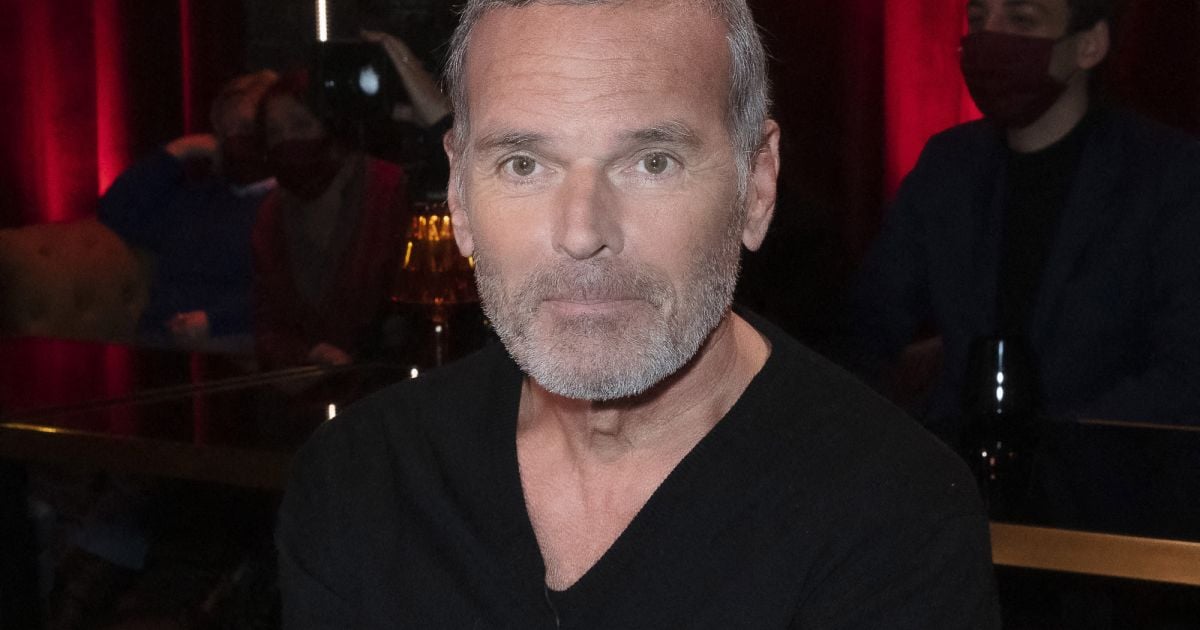

Les Blagues De Laurent Baffie Un Debat Sur Le Sexisme A La Television

May 26, 2025

Les Blagues De Laurent Baffie Un Debat Sur Le Sexisme A La Television

May 26, 2025 -

Van Der Poels Milan San Remo Triumph Overtaking Pogacar For A Double Victory

May 26, 2025

Van Der Poels Milan San Remo Triumph Overtaking Pogacar For A Double Victory

May 26, 2025