Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

Table of Contents

Robust Retail Sales Figures: A Deeper Dive

Strong Consumer Spending Fuels Economic Growth

Recent data reveals a surprisingly strong increase in retail sales, exceeding all expectations. The numbers paint a picture of robust consumer spending, contributing significantly to overall economic growth. For example, retail sales jumped by 1.5% in July (hypothetical data, replace with actual figures when available), a considerable leap from the anticipated 0.5% growth. This strong performance can be attributed to several factors:

- Increased Consumer Confidence: Positive sentiment towards the economy, potentially driven by factors like stable employment or government initiatives, has encouraged consumers to spend more freely.

- Pent-Up Demand: Following periods of economic uncertainty or restrictions, consumers may have been delaying purchases, leading to a surge in spending once conditions improved.

- Government Stimulus: Government spending or support programs could have played a role in boosting consumer spending and driving up retail sales growth.

[Insert chart/graph here illustrating retail sales growth]. This visual representation clearly shows the unexpected strength of the recent retail sales figures and their contribution to key economic indicators such as consumer spending and overall economic growth.

Sector-Specific Analysis of Retail Sales Boom

The retail sales boom wasn't uniform across all sectors. Certain areas experienced particularly strong growth:

- Automotive Sales: A significant increase in automotive sales contributed substantially to the overall rise. This could be due to pent-up demand, new vehicle releases, or government incentives.

- Furniture Retail: The furniture sector also saw impressive growth, potentially reflecting increased home improvement projects or a shift towards more comfortable home environments.

- Electronics Retail: The electronics retail sector experienced a boost, possibly driven by technological advancements, replacement cycles, or increased demand for home entertainment systems.

Analyzing sector-specific performance provides valuable insights into the drivers behind the overall retail sales growth and helps identify areas of particular strength within the economy.

Geographical Distribution of Retail Sales Increase

The geographic distribution of the retail sales increase is another crucial aspect to consider. While the national figures are impressive, it's important to understand whether this growth was evenly spread across the country or concentrated in specific regions. For example:

- Some provinces may have seen stronger growth than others due to regional economic factors, such as variations in employment rates or industry composition.

- Understanding regional disparities helps policymakers target support or address specific challenges in different parts of the country.

- Analyzing provincial retail sales data will provide a more nuanced picture of the economic landscape and the geographical distribution of consumer spending.

Implications for the Bank of Canada's Monetary Policy

Revised Inflation Projections

The higher-than-expected retail sales figures significantly impact inflation projections. Robust consumer spending can fuel demand-pull inflation, putting upward pressure on prices. This situation necessitates a careful review of the Bank of Canada's inflation targets (currently at 2%). If inflation starts to accelerate beyond the target, the central bank might reconsider its monetary policy approach.

Delayed Interest Rate Cuts

Given the robust retail sales and the potential implications for inflation, the Bank of Canada is likely to delay or even reconsider planned interest rate cuts. Maintaining higher interest rates can help curb inflation by reducing borrowing and slowing down economic growth. However, this strategy could also dampen economic activity and potentially increase unemployment. The central bank must carefully weigh the risks and benefits.

Market Reactions and Investor Sentiment

The market's response to the retail sales data has been varied, impacting investor sentiment and the Canadian dollar exchange rate. Increased consumer spending and higher-than-expected economic growth may lead to a rise in the Canadian dollar, while uncertainty surrounding the Bank of Canada's next move might lead to some market volatility. Investor confidence will be influenced by the Bank's actions and the overall economic outlook.

Looking Ahead: Future Outlook for Retail Sales and Interest Rates

Predicting Future Retail Sales Trends

Predicting future retail sales trends requires careful consideration of several factors:

- Interest Rates: Future interest rate decisions by the Bank of Canada will significantly impact borrowing costs and consumer spending.

- Consumer Confidence: Consumer sentiment plays a pivotal role in determining future retail sales.

- Global Economic Conditions: Global economic events can influence consumer spending within Canada.

Given the complexities and uncertainties inherent in economic forecasting, providing a precise prediction is challenging. A cautious outlook that acknowledges potential upside and downside risks is the most prudent approach.

Potential Scenarios for Bank of Canada's Next Move

Several scenarios are possible regarding the Bank of Canada's next move on interest rates:

- Maintaining Current Rates: The Bank might decide to maintain current interest rates to monitor the impact of the recent retail sales surge on inflation.

- Small Rate Hike: A small rate hike might be considered if inflation continues to rise above the target.

- Delayed Rate Cut: The initial plans for a rate cut could be delayed or scaled back, depending on the evolving economic data.

The Bank's decision will hinge on a careful analysis of inflation figures, consumer confidence indicators, and the broader economic outlook.

Conclusion: The Retail Sales Surge and its Impact on the Bank of Canada Rate Cut

The unexpected surge in retail sales has significantly altered the trajectory of the Bank of Canada's monetary policy. The robust consumer spending, while positive for economic growth, presents challenges in managing inflation and necessitates a reevaluation of the planned interest rate cuts. The coming months will be critical in determining the future direction of both retail sales and interest rates. To stay informed about future developments regarding the Bank of Canada rate cut and its implications for the Canadian economy, subscribe to our newsletter or follow reputable financial news sources for updates.

Featured Posts

-

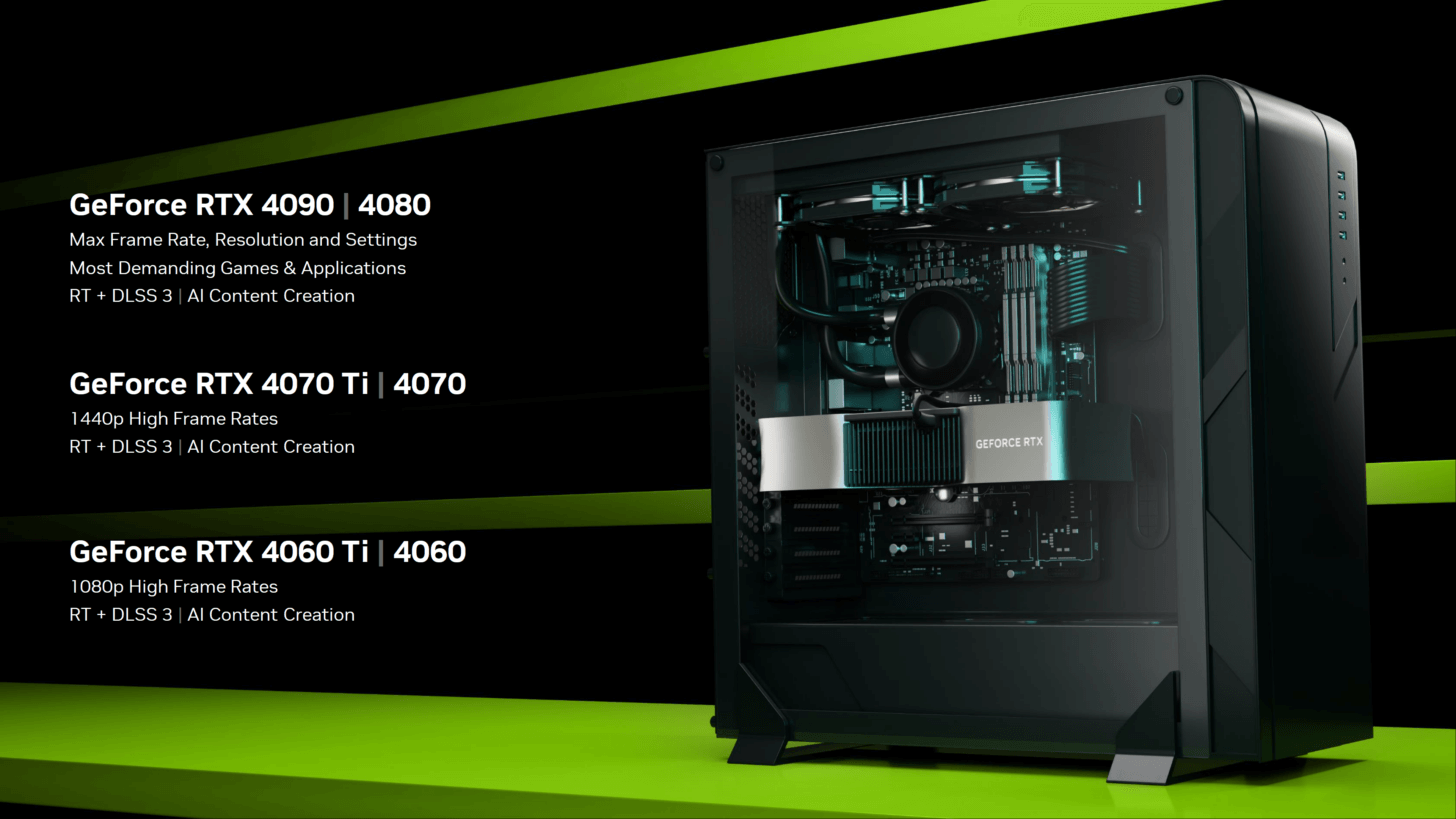

Analyzing The Nvidia Rtx 5060 A Case Study In Product Launches

May 25, 2025

Analyzing The Nvidia Rtx 5060 A Case Study In Product Launches

May 25, 2025 -

Us Band Hints At Glastonbury Performance Unconfirmed But Buzzing

May 25, 2025

Us Band Hints At Glastonbury Performance Unconfirmed But Buzzing

May 25, 2025 -

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 25, 2025

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 25, 2025 -

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets Tips For Success

May 25, 2025

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets Tips For Success

May 25, 2025 -

The Rise And Fall Or Rise Of Russell And The Typhoons A Critical Analysis

May 25, 2025

The Rise And Fall Or Rise Of Russell And The Typhoons A Critical Analysis

May 25, 2025

Latest Posts

-

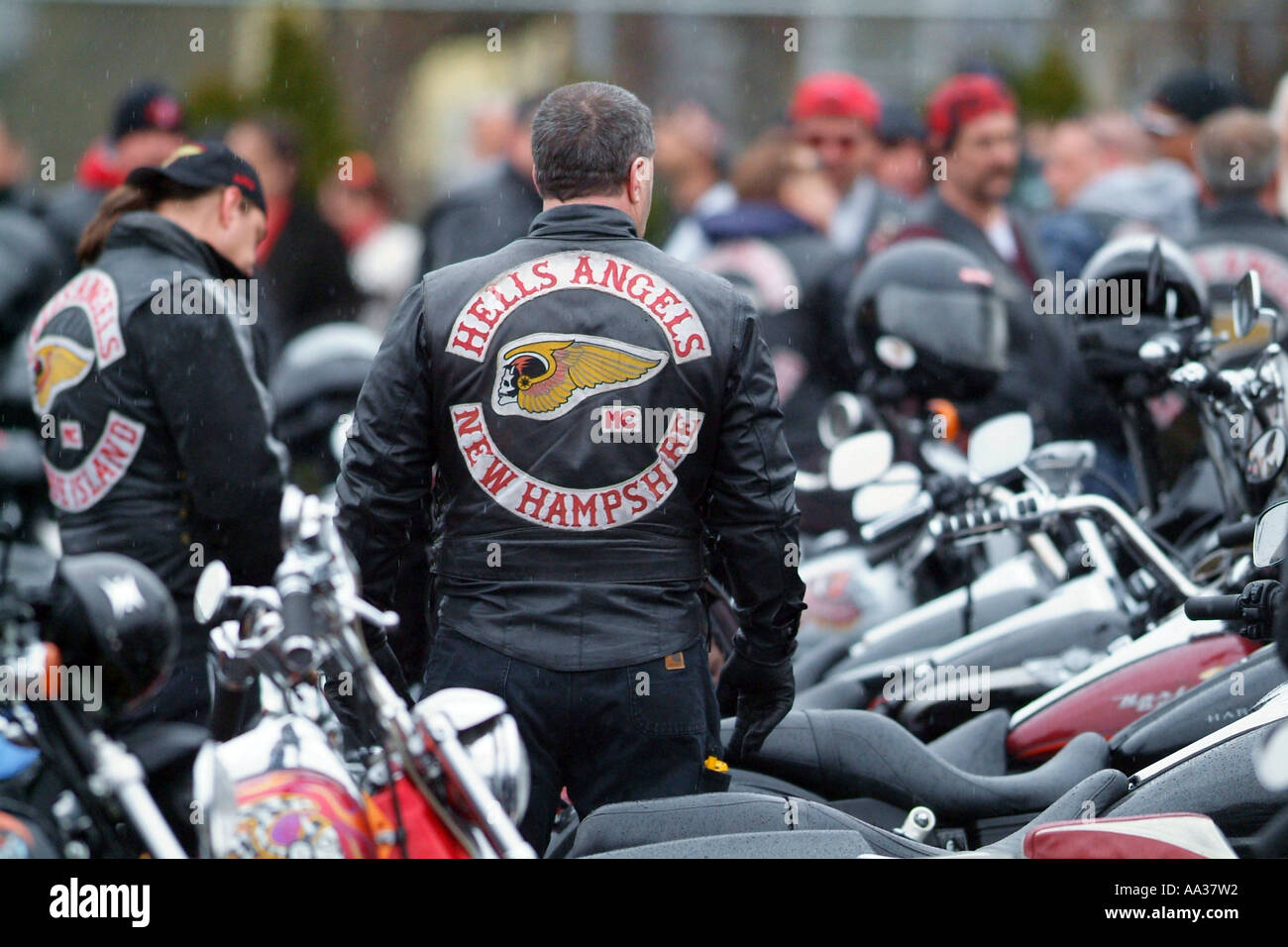

Hells Angels Members Attend Funeral Following Fatal Motorcycle Crash

May 25, 2025

Hells Angels Members Attend Funeral Following Fatal Motorcycle Crash

May 25, 2025 -

Hells Angels Pay Respects At Fallen Bikers Funeral

May 25, 2025

Hells Angels Pay Respects At Fallen Bikers Funeral

May 25, 2025 -

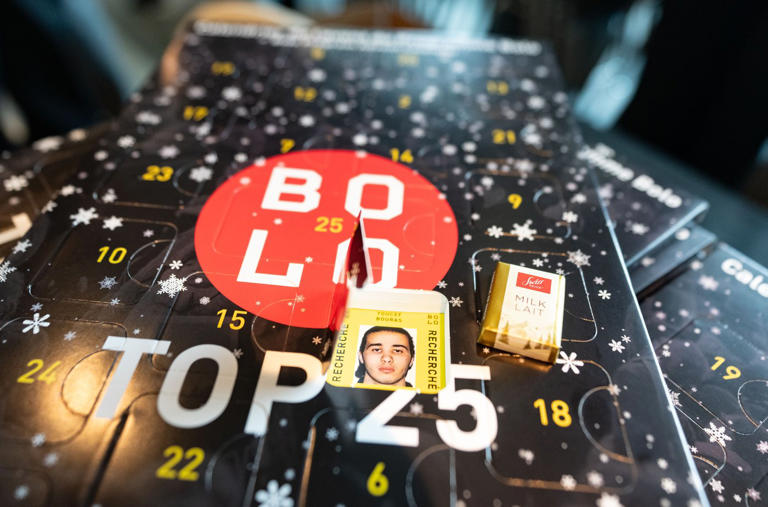

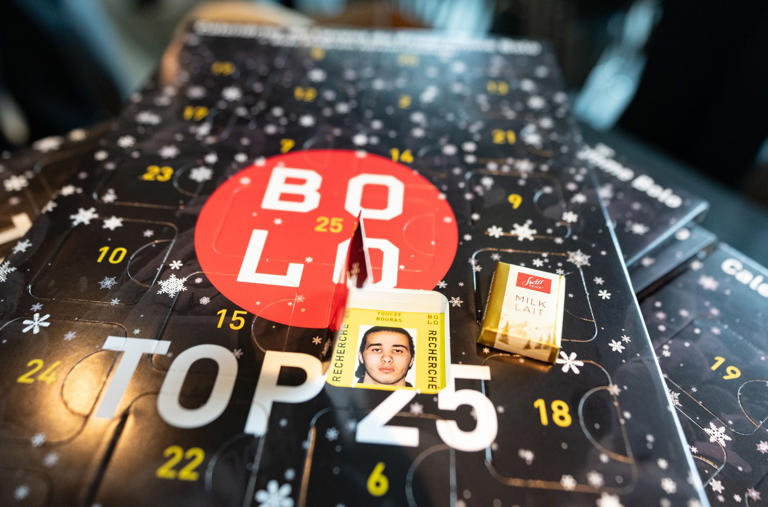

Dave Turmel Canadian Fugitive Apprehended In Italy

May 25, 2025

Dave Turmel Canadian Fugitive Apprehended In Italy

May 25, 2025 -

Canadas Most Wanted Fugitive Dave Turmel Captured In Italy

May 25, 2025

Canadas Most Wanted Fugitive Dave Turmel Captured In Italy

May 25, 2025 -

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025