Retirement Of CFP Board CEO: Implications For The Financial Planning Profession

Table of Contents

Impact on CFP Certification and Standards

The new CEO will inherit the responsibility of upholding the rigorous standards associated with the CFP certification, a mark of trust and expertise for financial advisors. This involves several key areas:

Maintaining the Integrity of the CFP Mark: The CFP mark represents a commitment to ethical conduct and professional competence. The new CEO must ensure:

- High Ethical Standards: Maintaining the high ethical standards expected of CFP professionals is paramount. This includes robust enforcement of the CFP Board's Code of Ethics and Professional Responsibility.

- Relevance and Credibility: The CFP certification must remain relevant in a dynamic financial environment. This requires continuous adaptation to address emerging financial products, technologies, and regulatory changes.

- Accessibility and Diversity: The CFP Board must actively work to improve the accessibility and diversity of the CFP certification process, ensuring representation from all backgrounds and experiences within the financial planning profession.

Evolution of the CFP Examination and Curriculum: The CFP exam and curriculum are constantly evolving to reflect changes in the field. The new CEO will likely oversee updates reflecting:

-

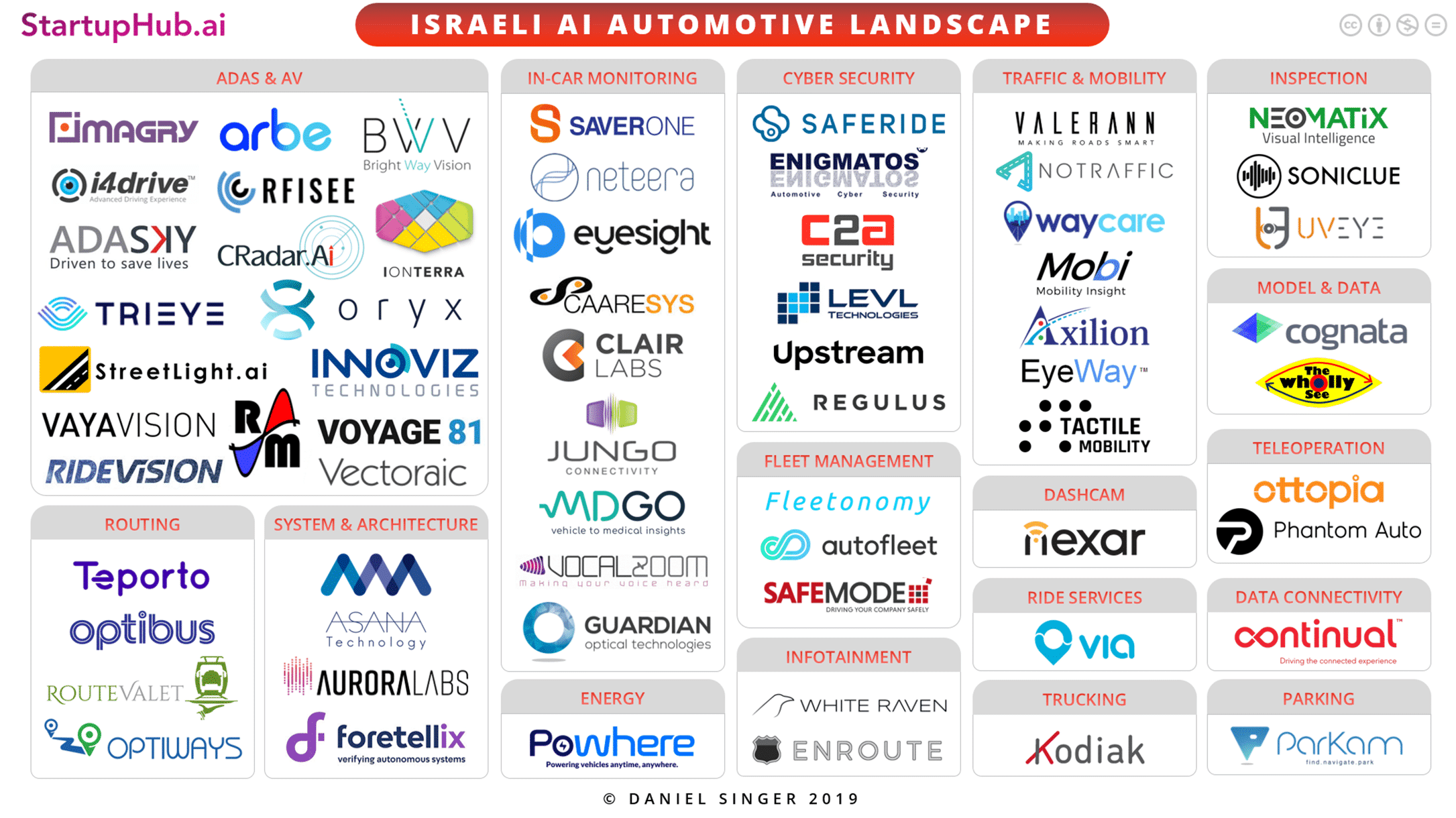

FinTech Integration: Advances in financial technology (FinTech) are transforming the financial planning landscape. The curriculum needs to integrate these advancements, preparing CFP professionals for the future.

-

Regulatory Compliance: Staying current with evolving regulatory changes and compliance requirements is crucial. The exam and curriculum must reflect these changes to ensure CFP professionals are adequately prepared.

-

Sustainable Investing and ESG: The growing importance of sustainable investing and Environmental, Social, and Governance (ESG) considerations necessitates their inclusion in the CFP curriculum.

-

Key Questions:

- Will the new CEO prioritize stricter enforcement of ethical guidelines, potentially leading to more disciplinary actions?

- What specific changes can we expect in the CFP exam content in the coming years to reflect FinTech and ESG considerations?

- How will the CFP Board actively address diversity and inclusion within the CFP professional ranks, possibly through targeted outreach programs or scholarship initiatives?

Influence on the Financial Planning Industry's Future Direction

The CFP Board plays a crucial role in shaping the regulatory landscape and resources for financial advisors. The new CEO's leadership will be pivotal in:

Navigating Regulatory Changes: The financial services industry is subject to continuous regulatory changes. The new CEO must:

- Effective Advocacy: The CFP Board needs to advocate for policies that support the profession while protecting consumers. This involves proactive engagement with regulators and policymakers.

- Adapting to Disruption: Technological disruption presents both opportunities and challenges. The CFP Board must adapt its approach to regulation to address the unique issues posed by FinTech.

- Fiduciary Duty Alignment: The CFP Board must ensure alignment with evolving fiduciary duty standards, reinforcing the commitment to acting in the best interests of clients.

Shaping Professional Development and Resources: The CFP Board provides critical resources and professional development opportunities for CFP professionals. The new CEO needs to:

-

Continuing Education: The Board needs to provide continuing education opportunities that keep CFP professionals at the forefront of industry advancements.

-

Career Advancement: Supporting the growth and career advancement of CFP professionals is vital for the long-term health of the profession.

-

Community Building: Fostering collaboration and knowledge sharing within the financial planning community strengthens the profession as a whole.

-

Key Questions:

- How will the CFP Board adapt its advocacy efforts in a changing political and regulatory climate, particularly in response to increased scrutiny of financial advisors?

- Will there be increased investment in technology and digital resources for CFP professionals to support their practices and enhance client service?

- What specific initiatives might the new CEO undertake to promote financial literacy and access to financial planning services, particularly among underserved populations?

The Search for a New CEO and the Transition Process

The selection of the new CEO is a critical process that will shape the future of the CFP Board.

The Qualities of a Successful Candidate: The ideal candidate will possess:

- Industry Expertise: A deep understanding of the financial planning industry's challenges and opportunities is essential.

- Leadership and Vision: Proven leadership experience and a strategic vision for the future of the CFP Board are crucial.

- Ethical Commitment: A strong commitment to upholding the highest ethical standards and protecting consumers is paramount.

- Organizational Management: The ability to effectively manage a large and complex organization is necessary.

Ensuring a Smooth Transition: A smooth transition is crucial to avoid disruption. This requires:

-

Transparent Communication: Clear and consistent communication with stakeholders throughout the transition process is vital.

-

Comprehensive Planning: A well-developed succession plan will help ensure a seamless handover of responsibilities.

-

Program Continuity: Maintaining existing programs and initiatives during the changeover minimizes disruption to CFP professionals.

-

Key Questions:

- What specific qualities should the CFP Board prioritize in its search for a new CEO, beyond the general qualities mentioned above?

- How can the Board ensure a seamless transition of leadership, minimizing any potential negative impact on CFP professionals and the public?

- What are the potential risks associated with a prolonged or poorly managed transition, and how can these risks be mitigated?

Conclusion:

The retirement of the CFP Board CEO represents a pivotal moment. The incoming leader will significantly influence the future of CFP certification, navigate regulatory changes, and drive innovation within the financial planning industry. The selection process and subsequent leadership will have a lasting impact. Staying informed about developments concerning the CFP Board CEO retirement is crucial for both CFP professionals and consumers seeking qualified financial advisors. Monitor the situation closely to understand the implications for your financial future. Understanding the implications of the CFP Board CEO retirement is crucial for navigating the evolving financial planning landscape.

Featured Posts

-

Doctor Whos Future Uncertain Showrunner Hints At Hiatus

May 03, 2025

Doctor Whos Future Uncertain Showrunner Hints At Hiatus

May 03, 2025 -

Cowboy Bebop Fortnite Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 03, 2025

Cowboy Bebop Fortnite Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 03, 2025 -

Fortnite Maintenance Update 34 40 Server Status And Expected Return

May 03, 2025

Fortnite Maintenance Update 34 40 Server Status And Expected Return

May 03, 2025 -

Political Analysis Examining The Nasty Party Claim Against Labour

May 03, 2025

Political Analysis Examining The Nasty Party Claim Against Labour

May 03, 2025 -

Tulsa Day Center Seeks Warm Clothing Donations Ahead Of Winter

May 03, 2025

Tulsa Day Center Seeks Warm Clothing Donations Ahead Of Winter

May 03, 2025

Latest Posts

-

Chinas Automotive Landscape A Deep Dive Into The Experiences Of Bmw And Porsche

May 04, 2025

Chinas Automotive Landscape A Deep Dive Into The Experiences Of Bmw And Porsche

May 04, 2025 -

Challenges Facing Premium Automakers In China A Look At Bmw And Porsche

May 04, 2025

Challenges Facing Premium Automakers In China A Look At Bmw And Porsche

May 04, 2025 -

How Middle Managers Drive Performance And Improve Employee Engagement

May 04, 2025

How Middle Managers Drive Performance And Improve Employee Engagement

May 04, 2025 -

The China Market Obstacles And Opportunities For Luxury Car Manufacturers

May 04, 2025

The China Market Obstacles And Opportunities For Luxury Car Manufacturers

May 04, 2025 -

Beyond Bmw And Porsche The Broader Implications Of Chinas Automotive Market

May 04, 2025

Beyond Bmw And Porsche The Broader Implications Of Chinas Automotive Market

May 04, 2025