Revised CoreWeave IPO Price: $40 Per Share

Table of Contents

Understanding the CoreWeave IPO and its Implications

CoreWeave is a rapidly growing cloud computing infrastructure provider specializing in high-performance computing tailored for AI and machine learning (ML) workloads. Its IPO marks a significant milestone, not only for the company itself but also for the broader technology market. The success of CoreWeave's IPO could signal investor confidence in the continued growth of the AI/ML sector and the demand for specialized cloud infrastructure. CoreWeave differentiates itself through its unique approach to providing scalable and cost-effective solutions, particularly for demanding AI and ML applications.

- CoreWeave's market position: CoreWeave is positioning itself as a key player in the rapidly expanding market for specialized cloud computing services.

- Key technologies utilized: CoreWeave leverages cutting-edge technologies, including GPU-powered cloud instances and optimized software stacks, to deliver superior performance.

- Target customer base: The company primarily targets businesses and researchers with high-performance computing needs, focusing on AI, ML, and high-frequency trading.

- Growth potential: The substantial growth potential in AI and ML suggests significant future opportunities for CoreWeave.

Factors Influencing the Revised CoreWeave IPO Price of $40

The decision to revise the CoreWeave IPO price to $40 per share is likely a result of several interconnected factors. Current market conditions, including overall investor sentiment and recent macroeconomic trends, undoubtedly played a significant role. The company's financial performance, competitive landscape, and potential future growth projections have also been key considerations. Any recent news or announcements concerning the company, either positive or negative, would also influence the final pricing.

- Market volatility impact: Recent market fluctuations and uncertainties could have influenced the decision to adjust the IPO price for a more stable launch.

- Investor demand analysis: Pre-IPO investor interest and anticipated demand are crucial factors shaping the final share price.

- Company financials overview: The company's financial health, including revenue projections and profitability, heavily influences the valuation.

- Competitive landscape considerations: The pricing strategy also accounts for the competitive landscape and the valuations of similar companies in the cloud computing sector.

Analyzing the $40 Share Price: Is it Overvalued or Undervalued?

Whether the $40 CoreWeave share price is attractive depends on individual investment goals and risk tolerance. A thorough analysis requires comparing CoreWeave's valuation to competitors in the cloud computing sector, examining the price-to-earnings ratio (P/E), and considering future growth projections. The inherent risks associated with investing in an IPO, particularly in a rapidly evolving sector like cloud computing, need careful consideration.

- Price-to-earnings ratio (P/E) comparison: Comparing CoreWeave's P/E ratio to those of similar companies provides a benchmark for assessing its valuation.

- Revenue growth projections: Analyzing CoreWeave's projected revenue growth helps determine the potential for future share price appreciation.

- Risk assessment: Investing in an IPO involves inherent risks, including market volatility and the possibility of underperformance. A thorough risk assessment is crucial.

- Long-term investment potential: The long-term growth potential of the cloud computing sector and CoreWeave's position within this market should be carefully evaluated.

How to Invest in CoreWeave After the Price Revision

Investing in the CoreWeave IPO involves opening a brokerage account with a reputable financial institution. Many online brokerage platforms offer access to IPOs, allowing investors to participate in the initial offering. However, it is crucial to understand the inherent risks associated with IPO investments. Diversification and risk management strategies are essential components of a sound investment plan.

- Brokerage account options: Several reputable online brokerage platforms provide access to IPO investments.

- Investment strategies: Consider your investment goals and risk tolerance when deciding on an investment strategy.

- Risk mitigation techniques: Diversifying your portfolio and avoiding overexposure to a single stock can mitigate risk.

- Long-term vs. short-term investment: Determine whether a long-term or short-term investment approach aligns with your financial objectives.

Conclusion: CoreWeave IPO at $40: Your Next Investment Move?

The revised CoreWeave IPO price of $40 per share presents both opportunities and risks for investors. Understanding the company's business model, competitive landscape, and financial projections is vital before making an investment decision. While the growth potential in the AI/ML cloud computing sector is significant, thorough due diligence and a careful risk assessment are essential. Is the $40 CoreWeave share price right for your portfolio? Research now and make informed investment decisions. Learn more about the CoreWeave IPO to determine if it aligns with your investment strategy.

Featured Posts

-

Chicago Sun Times Faces Backlash Over Ai Reporting Misconduct

May 22, 2025

Chicago Sun Times Faces Backlash Over Ai Reporting Misconduct

May 22, 2025 -

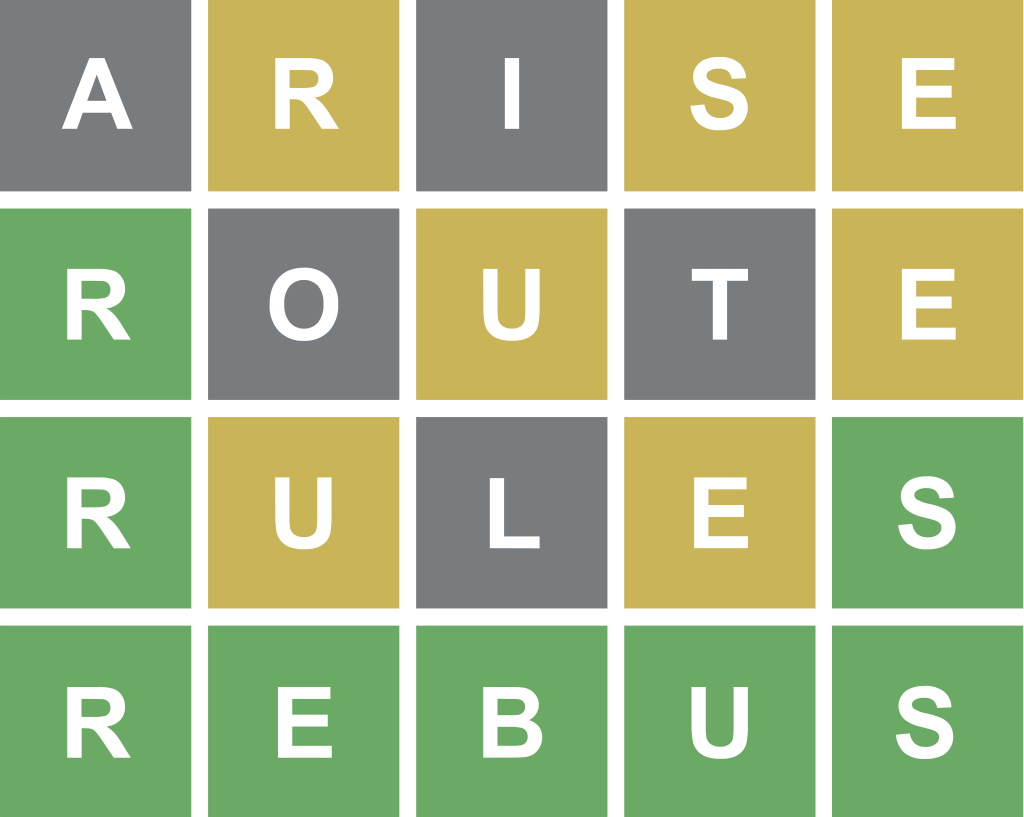

Wordle Today 1352 Hints Clues And Answer For March 2nd Sunday

May 22, 2025

Wordle Today 1352 Hints Clues And Answer For March 2nd Sunday

May 22, 2025 -

Is Core Weave Stock A Good Investment A Current Market Analysis

May 22, 2025

Is Core Weave Stock A Good Investment A Current Market Analysis

May 22, 2025 -

Blake Lively Lawyers Alleged Threat To Leak Taylor Swift Texts What We Know

May 22, 2025

Blake Lively Lawyers Alleged Threat To Leak Taylor Swift Texts What We Know

May 22, 2025 -

Wordle 363 Get The Answer For Thursday March 13th

May 22, 2025

Wordle 363 Get The Answer For Thursday March 13th

May 22, 2025