Revolut's 72% Revenue Increase: A Deep Dive Into Fintech's Global Ambitions

Table of Contents

Revolut, the challenger bank renowned for its innovative mobile banking app and international payment services, recently announced a staggering 72% increase in revenue. This impressive growth underscores the company's ambitious global expansion strategy and its undeniable dominance within the rapidly evolving fintech landscape. This article delves into the key factors driving Revolut's success and analyzes its future prospects in the competitive world of digital finance.

H2: Key Drivers of Revolut's Revenue Growth

H3: Expanding Customer Base

Revolut's phenomenal growth is largely attributed to its rapidly expanding customer base. Several factors contribute to this success:

- Aggressive Marketing Campaigns: Targeted marketing campaigns, particularly focusing on young adults and international travelers, have been instrumental in boosting user acquisition. These campaigns leverage social media, digital advertising, and influencer partnerships to reach a broad audience.

- Competitive Pricing and Fee Structures: Revolut offers competitive pricing compared to traditional banks, particularly for international transactions. The availability of free account options with attractive features is a significant draw for budget-conscious consumers.

- Seamless User Experience and Intuitive App Design: The user-friendly interface and intuitive app design have contributed significantly to user satisfaction and retention. The app's ease of use simplifies complex financial tasks, making it accessible to a wider demographic.

- Strategic Partnerships: Collaborations with businesses and organizations provide access to new customer segments and enhance the overall value proposition. These partnerships often offer exclusive benefits and promotions to Revolut users.

Revolut's user growth statistics, while not publicly released in detail, consistently indicate a significant upward trend, demonstrating the effectiveness of their customer acquisition strategies.

H3: Diversification of Revenue Streams

Revolut’s success isn't solely reliant on transaction fees. The company has strategically diversified its revenue streams, leading to substantial growth:

- Premium Subscription Tiers (Revolut Premium, Metal): The introduction of premium subscription tiers offering enhanced features and benefits has unlocked a higher-value customer segment, boosting average revenue per user (ARPU).

- Expansion into Investment Products (Stocks, Crypto): Offering investment products like stocks and cryptocurrency trading has opened up a new revenue stream and attracted a broader range of users. This diversification mitigates reliance on traditional banking services.

- Growth of Business Accounts and Services for SMEs: Catering to small and medium-sized enterprises (SMEs) with tailored business accounts and services has tapped into a significant and growing market segment.

- New Features (Budgeting Tools, Virtual Cards): The continuous introduction of innovative features like budgeting tools and virtual cards adds value for existing users and attracts new customers seeking advanced financial management capabilities.

This diversification strategy has proven incredibly effective, reducing reliance on any single revenue source and boosting overall financial stability.

H3: Global Market Penetration

Revolut's ambitious global expansion strategy has been a key driver of its revenue growth. The company has successfully navigated the complexities of international markets:

- Expansion into New Geographic Markets: Revolut's expansion beyond its initial European base into Asia, North America, and other regions has exposed its services to millions of new potential customers.

- Adaptation to Local Regulations and Preferences: The company adapts its services to comply with local regulations and caters to specific regional preferences, ensuring a smooth user experience in diverse markets.

- Localization of App and Customer Support: Offering the app and customer support in multiple languages strengthens customer engagement and enhances accessibility for international users.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships help accelerate market entry and expand the range of services offered.

Successfully navigating the regulatory landscape in various countries has been crucial to Revolut's international expansion success.

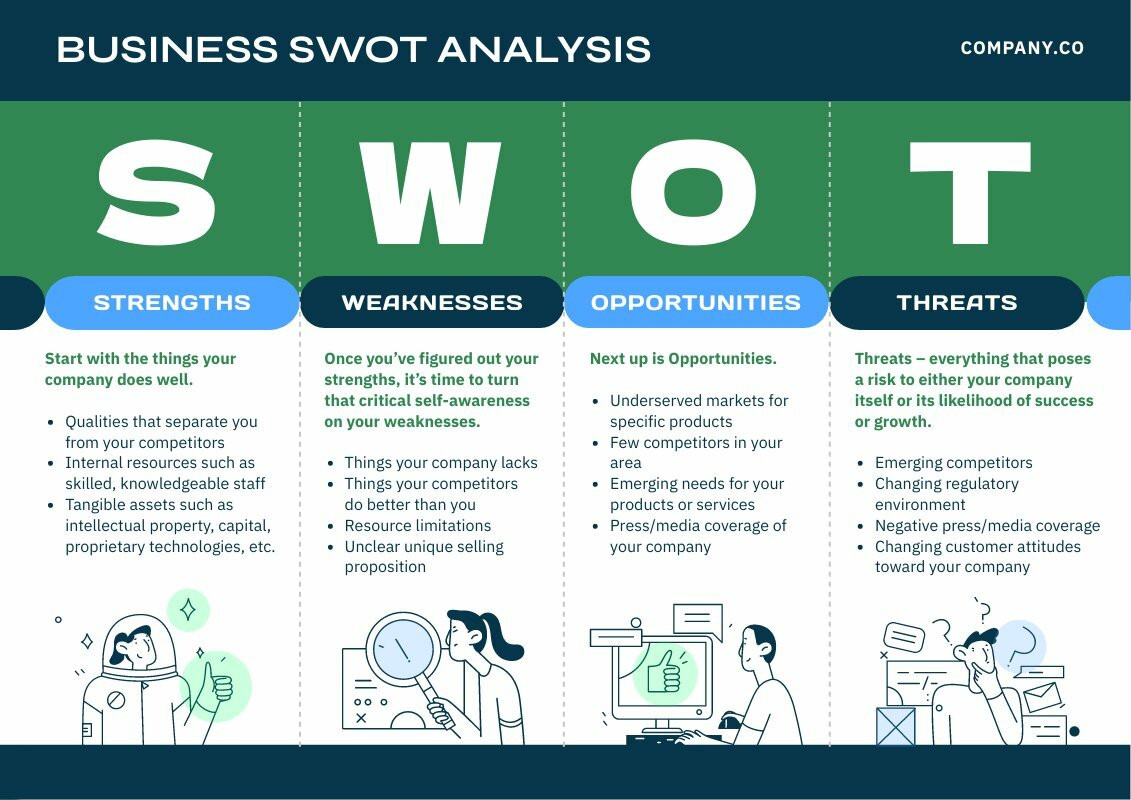

H2: Revolut's Competitive Advantages in the Fintech Sector

H3: Technological Innovation

Revolut’s technological prowess is a key differentiator. The company boasts:

- Cutting-Edge Technology Infrastructure: A robust and scalable technological infrastructure ensures reliable and fast service, even during periods of high transaction volume.

- Advanced Security Features: Implementing advanced security measures safeguards user data and funds, building trust and confidence in the platform.

- Continuous App Updates and Improvements: Regular updates and improvements based on user feedback continuously enhance the user experience.

- Focus on User Experience and Design: Revolut prioritizes user experience, ensuring a smooth and intuitive interface that sets it apart from competitors.

H3: Competitive Pricing and Value Proposition

Revolut's pricing strategy is another key competitive advantage:

- Transparent and Competitive Pricing Model: Clear and competitive pricing, especially for international transactions, attracts price-sensitive customers.

- Free Account Options with Attractive Features: The availability of free accounts with core functionalities broadens its accessibility.

- Value-Added Services Bundled in Premium Packages: Premium packages offer additional value, justifying the higher price point and encouraging upgrades.

- Focus on Cost-Effectiveness: Revolut's operational efficiency allows it to offer competitive pricing without compromising service quality.

H3: Regulatory Landscape and Compliance

Navigating the complex regulatory landscape is crucial for any fintech company. Revolut has demonstrated its ability to:

- Navigate Regulatory Hurdles in Different Jurisdictions: Revolut has successfully obtained necessary licenses and permits to operate in multiple countries.

- Maintain Compliance with International Financial Regulations: Adherence to strict financial regulations builds trust with users and regulators.

- Build Trust and Confidence with Users: Transparency and compliance reinforce user trust in the platform's security and reliability.

H2: Future Outlook and Challenges for Revolut

H3: Maintaining Growth Momentum

Sustaining Revolut's impressive growth trajectory requires:

- Continued Investment in Technology and Innovation: Continuous investment in R&D is crucial to maintain a competitive edge and introduce new innovative features.

- Expansion into New Markets and Product Lines: Exploring new markets and expanding into adjacent financial services will be key to future growth.

- Strengthening Brand and Customer Loyalty: Building strong brand recognition and fostering customer loyalty will ensure long-term sustainability.

- Managing Operational Challenges Related to Rapid Growth: Scaling operations efficiently and managing the challenges associated with rapid growth is vital.

H3: Competition and Market Dynamics

Revolut faces an increasingly competitive landscape:

- Competition from Established Banks and Other Fintech Companies: Competition from established players and emerging fintech startups necessitates continuous innovation.

- Changing Customer Preferences and Expectations: Adapting to evolving customer demands and expectations is crucial for staying relevant.

- Emerging Technological Advancements: Keeping pace with rapid technological advancements and adopting new technologies will be vital.

- Potential Regulatory Changes: Navigating potential changes in financial regulations will continue to be a key challenge.

H3: Profitability and Sustainability

Achieving long-term profitability and sustainable growth requires:

- Balancing Growth with Profitability: Finding the right balance between aggressive expansion and profitability is crucial.

- Managing Operational Costs: Optimizing operational efficiency and reducing costs are essential for improving profitability.

- Optimizing Revenue Streams: Continuously evaluating and optimizing existing revenue streams and exploring new opportunities is vital.

- Long-Term Financial Sustainability: Ensuring long-term financial health and stability will be crucial for sustained success.

3. Conclusion:

Revolut's 72% revenue increase is a remarkable achievement, demonstrating its innovative approach to mobile banking and its highly effective global expansion strategy. By leveraging technology, diversifying revenue streams, and strategically targeting new markets, Revolut has solidified its position as a major player in the fintech sector. However, sustaining this impressive growth demands continuous investment in innovation, adept navigation of regulatory complexities, and proactive adaptation to the ever-evolving competitive landscape. To stay abreast of Revolut's ongoing progress and the future of fintech, keep checking back for updates on the company's performance and its latest advancements. Dive deeper into the impact of Revolut and its rivals in the dynamic world of digital banking by searching for more articles on Revolut's global expansion and its future prospects.

Featured Posts

-

New Business Hot Spots A National Map And Analysis

Apr 25, 2025

New Business Hot Spots A National Map And Analysis

Apr 25, 2025 -

Investment Banking Bbvas Long Term Vision And Strategic Push

Apr 25, 2025

Investment Banking Bbvas Long Term Vision And Strategic Push

Apr 25, 2025 -

Road Conditions In Okc Icy Roads Cause Multiple Crashes Watch

Apr 25, 2025

Road Conditions In Okc Icy Roads Cause Multiple Crashes Watch

Apr 25, 2025 -

Boosting Conference Networking The Power Of Rented I Pads

Apr 25, 2025

Boosting Conference Networking The Power Of Rented I Pads

Apr 25, 2025 -

The Next Godzilla X Kong Movie A New Hero Emerges

Apr 25, 2025

The Next Godzilla X Kong Movie A New Hero Emerges

Apr 25, 2025

Latest Posts

-

The Police Accountability Review A Critical Assessment By Campaigners

Apr 30, 2025

The Police Accountability Review A Critical Assessment By Campaigners

Apr 30, 2025 -

Campaigners Urgent Call For Police Accountability Review Reform

Apr 30, 2025

Campaigners Urgent Call For Police Accountability Review Reform

Apr 30, 2025 -

Review Of Police Accountability Campaigners Concerns Unheeded

Apr 30, 2025

Review Of Police Accountability Campaigners Concerns Unheeded

Apr 30, 2025 -

Coronation Street Fan Favourites Dramatic Exit Confirmed

Apr 30, 2025

Coronation Street Fan Favourites Dramatic Exit Confirmed

Apr 30, 2025 -

Police Accountability Under Scrutiny Campaigners Express Deep Concern

Apr 30, 2025

Police Accountability Under Scrutiny Campaigners Express Deep Concern

Apr 30, 2025