Revolut's Financial Success: 72% Revenue Growth And Global Expansion Plans

Table of Contents

72% Revenue Growth: A Deep Dive into Revolut's Financial Performance

Revolut's 72% year-on-year revenue growth is a testament to its successful business model and strong market position within the competitive fintech landscape. While precise revenue figures aren't always publicly released by private companies like Revolut, the reported growth signifies a significant increase in profitability and user engagement.

-

Contributing Factors to Growth: This impressive growth can be attributed to several key factors:

- Increased User Base: Revolut has consistently attracted a large and growing number of users globally, drawn by its user-friendly mobile banking app and competitive offerings.

- Premium Subscription Adoption: The uptake of Revolut's premium subscription tiers, offering enhanced features and benefits, has significantly contributed to increased revenue streams. This demonstrates the value proposition of Revolut's premium services.

- Expansion into New Markets: Strategic expansion into new geographical regions has broadened Revolut's customer base and revenue sources. This international strategy is a core element of their growth.

- Effective Marketing and Brand Building: Revolut's marketing campaigns have successfully positioned the brand as a modern and innovative alternative to traditional banking, attracting a younger demographic.

-

Profitability and Sustainability: While Revolut's path to overall profitability is an ongoing journey for any rapidly scaling fintech, the substantial revenue growth indicates progress towards long-term financial sustainability. The company is clearly demonstrating its ability to generate significant income and manage costs effectively.

-

Comparison to Competitors: Revolut's performance compares favorably to many competitors in the fintech space. Its rapid growth and market share gains highlight its competitive advantage within the neobank sector.

Global Expansion Strategy: New Markets and Target Demographics

Revolut's global expansion strategy is a key driver of its financial success. The company is actively targeting new markets across multiple continents, employing localized strategies to enhance market penetration.

-

Key Expansion Regions: Revolut continues to expand into key regions in Europe, Asia, and the Americas, focusing on markets with high mobile penetration and a demand for innovative financial services. This includes both established and emerging economies.

-

Market Penetration Strategies: Revolut leverages several strategies for successful market penetration, including:

- Localization: Adapting its app and services to meet local needs and regulations.

- Strategic Partnerships: Collaborating with local businesses and financial institutions to broaden reach.

- Targeted Marketing Campaigns: Utilizing tailored marketing efforts to resonate with specific demographics in each region.

-

Target Demographics: Revolut primarily targets millennials and Gen Z, demographics known for their tech-savviness and preference for digital financial solutions. However, its expanding feature set is attracting a broader age range.

-

Challenges of International Expansion: Navigating regulatory hurdles and adapting to different cultural contexts are significant challenges inherent in global expansion. These challenges are actively being addressed by Revolut's experienced international team.

Revolut's Product Innovation and Competitive Advantage

Revolut's success is built upon a foundation of product innovation and a superior user experience. The company consistently adds new features and improves its existing offerings to maintain its competitive edge.

-

Key Differentiating Features: Several features set Revolut apart from the competition:

- Low-cost international money transfers: Revolut offers competitive exchange rates and low fees, making it attractive for international travelers and expats.

- Comprehensive budgeting tools: The app provides sophisticated budgeting and expense tracking features, aiding users in managing their finances.

- Virtual and physical cards: Revolut provides both virtual and physical cards, catering to different user preferences and needs.

-

User Experience (UX): Revolut's intuitive and user-friendly mobile app is a key differentiator. Its seamless design and functionality contribute significantly to user satisfaction and retention.

-

Recent Product Innovations: Revolut frequently introduces new features and services, demonstrating its commitment to innovation and staying ahead of the curve in the fintech sector. This includes expanding premium features and integrating with other financial services.

-

Competitive Landscape: While the competitive landscape is intense, Revolut's consistent innovation and focus on user experience help it maintain its position as a market leader.

Challenges and Risks Facing Revolut's Future Growth

Despite its remarkable success, Revolut faces several challenges and risks that could impact its future growth.

-

Regulatory Hurdles: Navigating the complex regulatory landscape in different countries presents a significant challenge. Compliance with varying financial regulations is crucial for sustained operations.

-

Intense Competition: The fintech industry is highly competitive, with numerous established players and emerging startups vying for market share. Maintaining its competitive edge requires ongoing innovation and strategic adaptation.

-

Scaling Challenges: Rapid expansion necessitates efficient scaling of operations, technology, and customer support. Managing this growth effectively is critical to avoid operational issues.

-

Financial Risks: Fluctuations in exchange rates and broader economic downturns can impact revenue and profitability. Managing these risks is a crucial element of Revolut's financial strategy.

Conclusion

Revolut's 72% revenue growth and ambitious global expansion plans demonstrate its remarkable success in the competitive fintech market. Its innovative products, strategic expansion, and strong user base position it for continued growth, despite facing challenges in regulation and competition. The company's commitment to product innovation and user experience will be crucial in navigating the complexities of the ever-evolving global financial technology landscape.

Call to Action: Learn more about Revolut's innovative financial solutions and its impact on the global fintech landscape. Explore how Revolut's services can benefit you and experience the future of mobile banking. Visit the Revolut website today!

Featured Posts

-

China And Canada Exploring A Joint Front Against Us Pressure

Apr 25, 2025

China And Canada Exploring A Joint Front Against Us Pressure

Apr 25, 2025 -

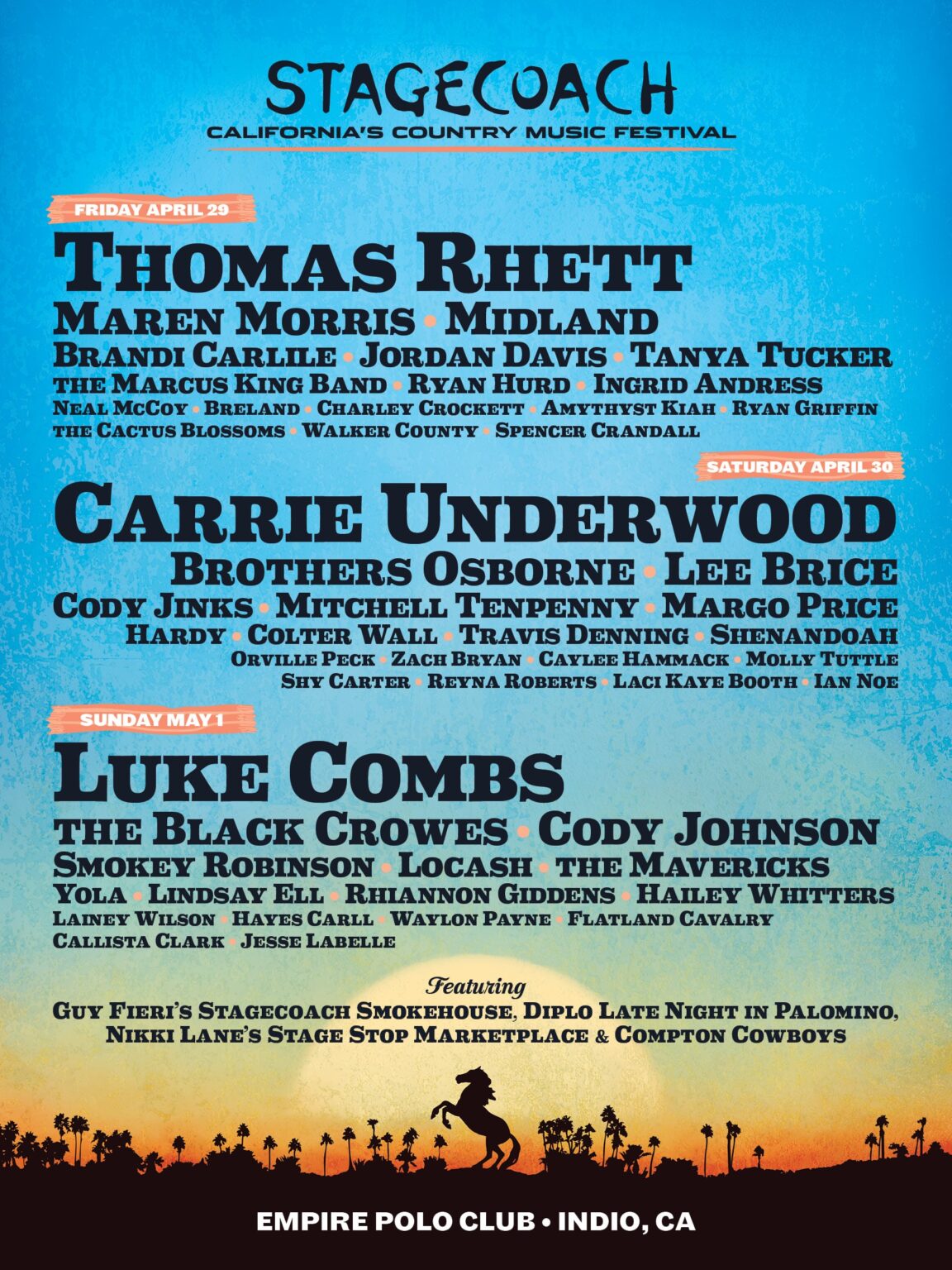

Stagecoach Country Music Festival 2025 Complete Guide To Lineup And Tickets

Apr 25, 2025

Stagecoach Country Music Festival 2025 Complete Guide To Lineup And Tickets

Apr 25, 2025 -

2025 Scale The Strat Raises Over 230 000 For The American Lung Association

Apr 25, 2025

2025 Scale The Strat Raises Over 230 000 For The American Lung Association

Apr 25, 2025 -

Politicheskie Posledstviya Vizita Kota Kelloga V Ukrainu 20 Fevralya

Apr 25, 2025

Politicheskie Posledstviya Vizita Kota Kelloga V Ukrainu 20 Fevralya

Apr 25, 2025 -

Eurovision 2025 Analysing The Leading Artists

Apr 25, 2025

Eurovision 2025 Analysing The Leading Artists

Apr 25, 2025

Latest Posts

-

2025 12

Apr 30, 2025

2025 12

Apr 30, 2025 -

23 2025 12

Apr 30, 2025

23 2025 12

Apr 30, 2025 -

Police Leader Investigated Over Chris Rock Tweet Free Speech Concerns

Apr 30, 2025

Police Leader Investigated Over Chris Rock Tweet Free Speech Concerns

Apr 30, 2025 -

23 2025

Apr 30, 2025

23 2025

Apr 30, 2025 -

6 2025

Apr 30, 2025

6 2025

Apr 30, 2025