Rigetti (RGTI) And IonQ: Top Quantum Stock Performers Of 2025?

Table of Contents

Analyzing Rigetti Computing (RGTI) Stock Potential

Rigetti Computing, a prominent player in the quantum computing arena, is attracting significant attention. Let's examine the factors that could contribute to its stock performance in the coming years.

RGTI's Technological Advantages and Challenges

Rigetti distinguishes itself through its unique multi-chip architecture, a strategy aiming for greater scalability than some competitors. This approach, while promising, also presents challenges. Maintaining qubit coherence across multiple chips is a significant hurdle. Furthermore, the company's success hinges on its ability to overcome technological hurdles and deliver on its ambitious roadmap. Crucial partnerships and collaborations will also play a vital role in RGTI's future. Competition in the quantum computing sector is fierce, and RGTI must continue innovating to maintain its edge.

- Achievements: Successful fabrication of multi-chip quantum processors.

- Milestones: Reaching specific qubit counts and demonstrating improved coherence times.

- Future Goals: Developing fault-tolerant quantum computers and securing key industry partnerships.

RGTI's Financial Performance and Market Outlook

Analyzing RGTI's financial reports is essential for assessing its investment potential. Investors will be scrutinizing revenue growth, profitability, and the company's overall financial stability. The company's valuation and potential for future returns will heavily influence its stock price. Market sentiment, investor confidence, and broader macroeconomic conditions will also significantly impact RGTI's stock performance.

- Key Financial Metrics: Revenue growth, operating expenses, cash flow.

- Analyst Ratings: Tracking ratings from financial analysts offers insights into market expectations.

- Predictions for Future Performance: Forecasting RGTI's financial performance based on current trends and technological advancements.

Evaluating IonQ's Stock Performance Potential

IonQ, another significant player in the quantum computing landscape, employs a trapped-ion technology approach. This method presents distinct advantages and disadvantages compared to other quantum computing architectures.

IonQ's Technological Differentiation and Competitive Landscape

IonQ's trapped-ion technology boasts several key advantages, including high qubit coherence times and potential for scalability. However, it also faces challenges in terms of qubit count and overall processing speed compared to some superconducting qubit approaches. Strategic partnerships and collaborations are crucial for IonQ’s advancement and market penetration.

- Key Technological Achievements: Demonstrating high-fidelity qubit operations and increasing qubit count.

- Comparisons with Competitors: Benchmarking IonQ's technology against other quantum computing platforms.

- Future Roadmap: IonQ's plans for scaling its technology and developing applications for its quantum computers.

IonQ's Financial Health and Investment Appeal

Similar to RGTI, IonQ's financial performance and market capitalization are key factors influencing its stock price. Investors will closely monitor the company's revenue streams, expenses, and overall profitability. Understanding the factors driving IonQ's stock price and the associated investment risks is crucial for informed decision-making.

- Key Financial Figures: Revenue, operating margin, net income.

- Market Analysis: Understanding IonQ's market position and competitive landscape.

- Potential Risks and Rewards: Analyzing the potential upside and downside of investing in IonQ.

Comparing Rigetti (RGTI) and IonQ: Key Differences and Similarities

| Feature | Rigetti (RGTI) | IonQ |

|---|---|---|

| Technology | Multi-chip superconducting qubit architecture | Trapped-ion technology |

| Scalability | Potential for high scalability, but challenges | High potential for scalability |

| Qubit Coherence | Moderate to high, depending on chip design | High |

| Financial Status | (Analyze and insert current financial data) | (Analyze and insert current financial data) |

| Market Position | (Analyze and insert current market position) | (Analyze and insert current market position) |

Both companies boast strong technological foundations but face different challenges in scaling and achieving commercial viability. Rigetti's multi-chip approach offers scalability but demands superior control. IonQ's trapped-ion approach shows promise but may face limitations in qubit density.

The Broader Quantum Computing Market and Investment Strategies

The quantum computing market presents substantial long-term growth potential, driven by increasing government investment and private sector funding. However, regulatory landscapes and technological advancements will shape this sector's trajectory. Investment strategies should consider factors such as risk tolerance and time horizons – whether it's a short-term or long-term investment approach. Other prominent players like Google, IBM, and Microsoft are also actively involved in the quantum computing space.

- Market Size Predictions: Analyzing future market size projections for the quantum computing industry.

- Investment Advice: Providing risk-adjusted investment strategies for quantum computing stocks.

- Risk Assessment: Evaluating the inherent risks associated with investing in a relatively nascent technology sector.

Conclusion: Investing in the Future of Quantum Computing: RGTI and IonQ

Rigetti (RGTI) and IonQ represent exciting opportunities within the rapidly evolving quantum computing sector. While both show promise, their approaches, technological challenges, and financial performances differ significantly. Thorough due diligence, including understanding the associated risks, is crucial before investing in any quantum computing stock. Will Rigetti (RGTI) and IonQ be your top quantum stock picks for 2025? Do your research and decide!

Featured Posts

-

Collins Aerospace Confirms Job Cuts In Cedar Rapids

May 21, 2025

Collins Aerospace Confirms Job Cuts In Cedar Rapids

May 21, 2025 -

China Faces Swiss Condemnation For Military Drills

May 21, 2025

China Faces Swiss Condemnation For Military Drills

May 21, 2025 -

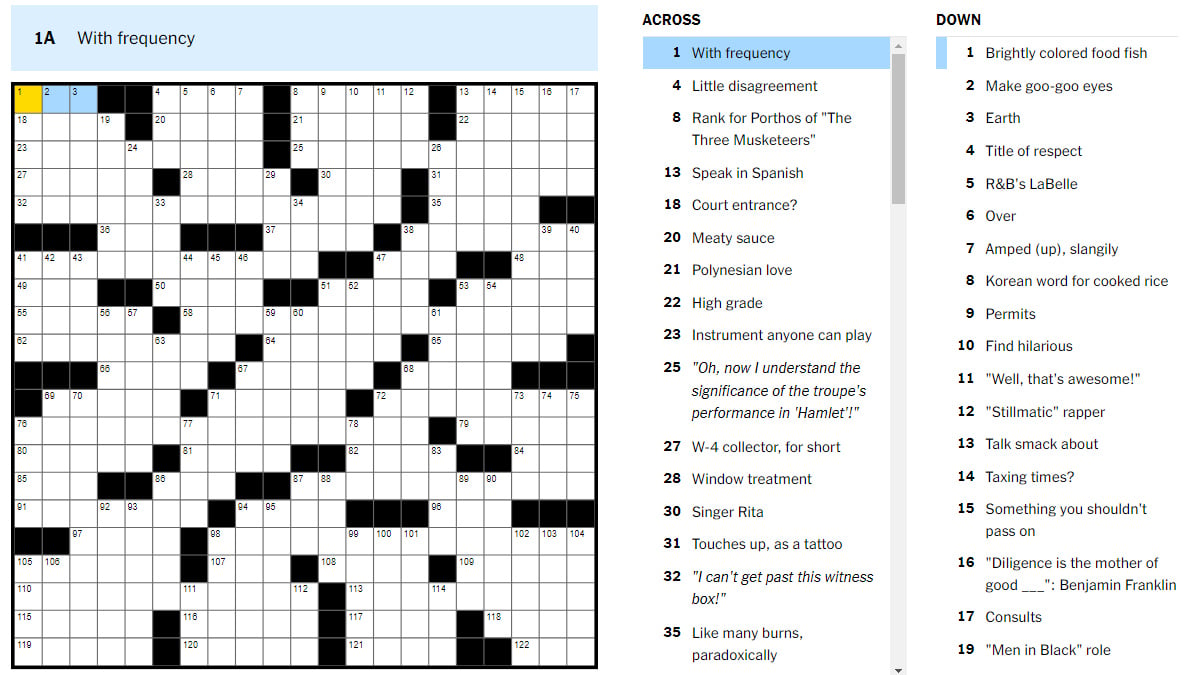

Nyt Mini Crossword Solutions March 26 2025

May 21, 2025

Nyt Mini Crossword Solutions March 26 2025

May 21, 2025 -

Real Madrid Manager Search Klopps Agent Speaks Out

May 21, 2025

Real Madrid Manager Search Klopps Agent Speaks Out

May 21, 2025 -

Self Guided Walking Holiday In Provence Mountains To The Sea

May 21, 2025

Self Guided Walking Holiday In Provence Mountains To The Sea

May 21, 2025