Rio Tinto Defends Dual Listing Against Activist Investor Pressure

Table of Contents

Rio Tinto's Justification for its Dual Listing

Rio Tinto's rationale for maintaining a dual listing on both the LSE and ASX rests on several key pillars: enhanced investor access, strong ties to crucial markets, and a legacy of successful operation under this structure.

Access to Broader Investor Base

A dual listing provides Rio Tinto access to a significantly wider pool of potential investors. This expanded reach encompasses both the UK and Australian markets, leading to several crucial advantages:

- Wider range of potential investors: Attracting investors from diverse geographical locations and investment profiles.

- Enhanced market capitalization: A larger and more diversified investor base can potentially lead to a higher overall market capitalization.

- Diversification of shareholder base: Reducing reliance on any single investor group and mitigating potential risks.

- Improved access to capital: Easier access to financing through a broader range of potential equity and debt investors. This can lead to a lower cost of capital for the company.

Maintaining Strong Ties to Key Markets

Maintaining listings on both exchanges is strategically important for Rio Tinto, considering its substantial operational footprint in both the UK and Australia. This dual presence offers:

- Proximity to major operational hubs: Facilitating smoother communication and stronger relationships with local stakeholders.

- Stronger relationships with local stakeholders: Building trust and fostering collaboration with local communities and governments.

- Regulatory compliance in respective jurisdictions: Ensuring adherence to all relevant regulations and maintaining a strong reputation.

- Improved investor relations: Direct access to investors in key markets, facilitating better communication and understanding.

Historical Context and Legacy

Rio Tinto's dual listing isn't a recent decision; it's a long-standing strategy. The company has a long and successful history operating under this structure. This legacy offers:

- Established market presence: Years of established relationships with both exchanges, building trust and credibility.

- Long-standing relationships with exchanges: Facilitating smoother operations and regulatory compliance.

- Consistent performance history under the dual listing structure: Demonstrating the efficacy of this structure over time.

Activist Investor Arguments Against the Dual Listing

Despite Rio Tinto's arguments, activist investors are pushing for a change, citing concerns about inefficiency and a potential negative impact on shareholder value.

Allegations of Inefficiency and Complexity

Critics argue that a dual listing introduces unnecessary administrative complexities and costs:

- Higher compliance costs: Meeting the regulatory requirements of two different exchanges increases compliance burdens and associated expenses.

- Potential for conflicting regulations: Navigating the complexities of two distinct regulatory frameworks can create operational challenges.

- Increased reporting burdens: Preparing and filing reports for two exchanges increases workload and associated costs.

- Administrative overhead: Managing a dual listing requires additional resources and personnel, increasing administrative overhead.

Concerns over Shareholder Value

The core argument against the dual listing centers on the potential for improved shareholder value with a single listing. Proponents suggest:

- Potential for higher share price: Streamlined operations and reduced complexities could potentially lead to a higher share price.

- Improved trading liquidity in a single market: Consolidating trading activity into a single market could increase liquidity.

- Reduced regulatory complexity: Simplifying the regulatory landscape could lead to greater operational efficiency.

- Streamlined corporate governance: A single listing may simplify corporate governance procedures and enhance transparency.

Calls for a Primary Listing in One Market

Activist investors aren't just expressing concerns; they are proposing concrete solutions, primarily advocating for a primary listing in either London or Australia. Their demands often include:

- Specific proposals from investors: Detailed plans outlining the transition to a single listing and the associated benefits.

- Reasons behind their preferred listing location: Justifications based on factors like market access, regulatory environment, and investor base.

- Potential impact on shareholders: Analysis of how a single listing would affect various shareholder groups.

Rio Tinto's Response and Future Outlook

Rio Tinto has actively defended its current dual listing structure, while also acknowledging the ongoing dialogue with shareholders.

Management's Defense of the Current Structure

Rio Tinto's management continues to emphasize the long-term benefits of the dual listing, directly addressing criticisms:

- Reiteration of benefits mentioned earlier: Reinforcing the arguments surrounding broader investor access, strong market ties, and historical success.

- Emphasis on shareholder value in the long term: Highlighting that the dual listing ultimately contributes to maximizing shareholder value over time.

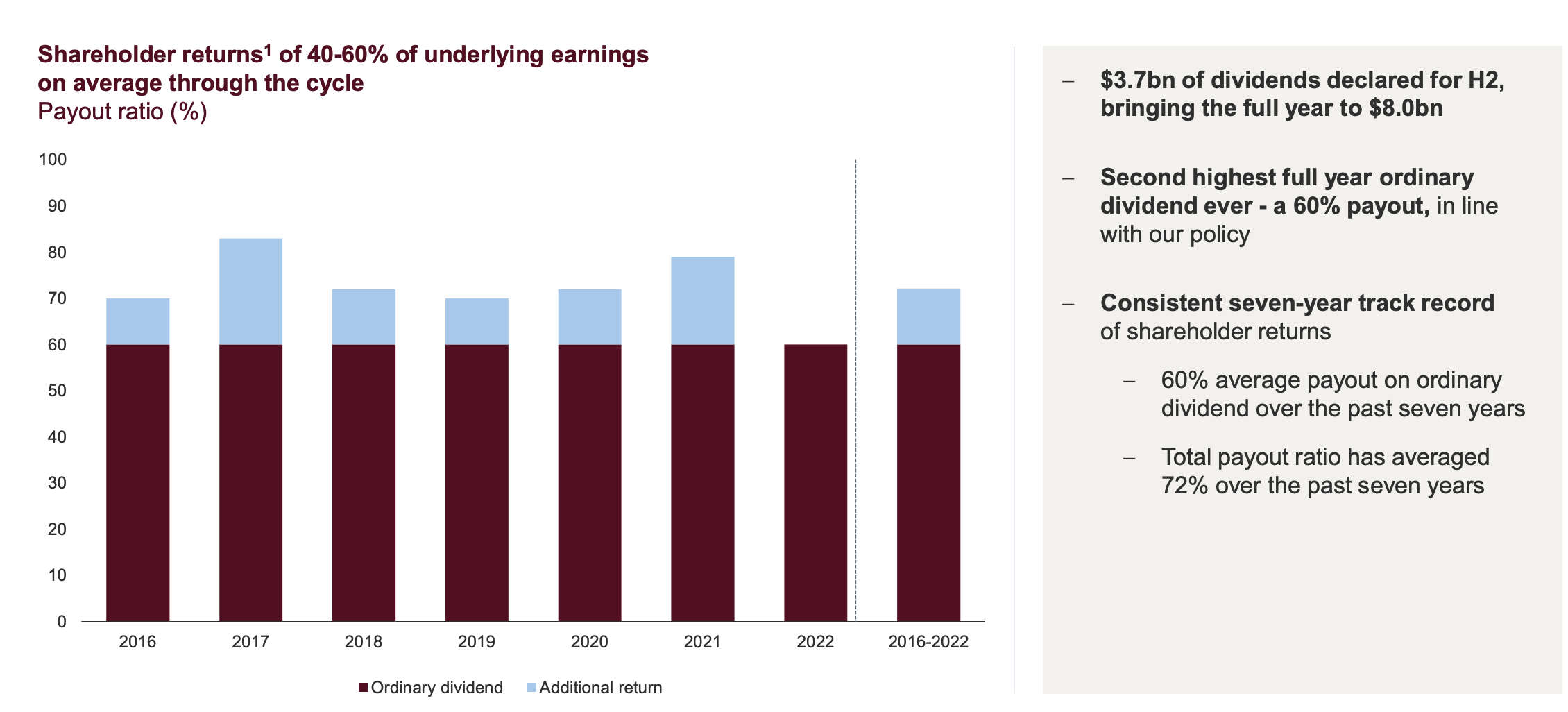

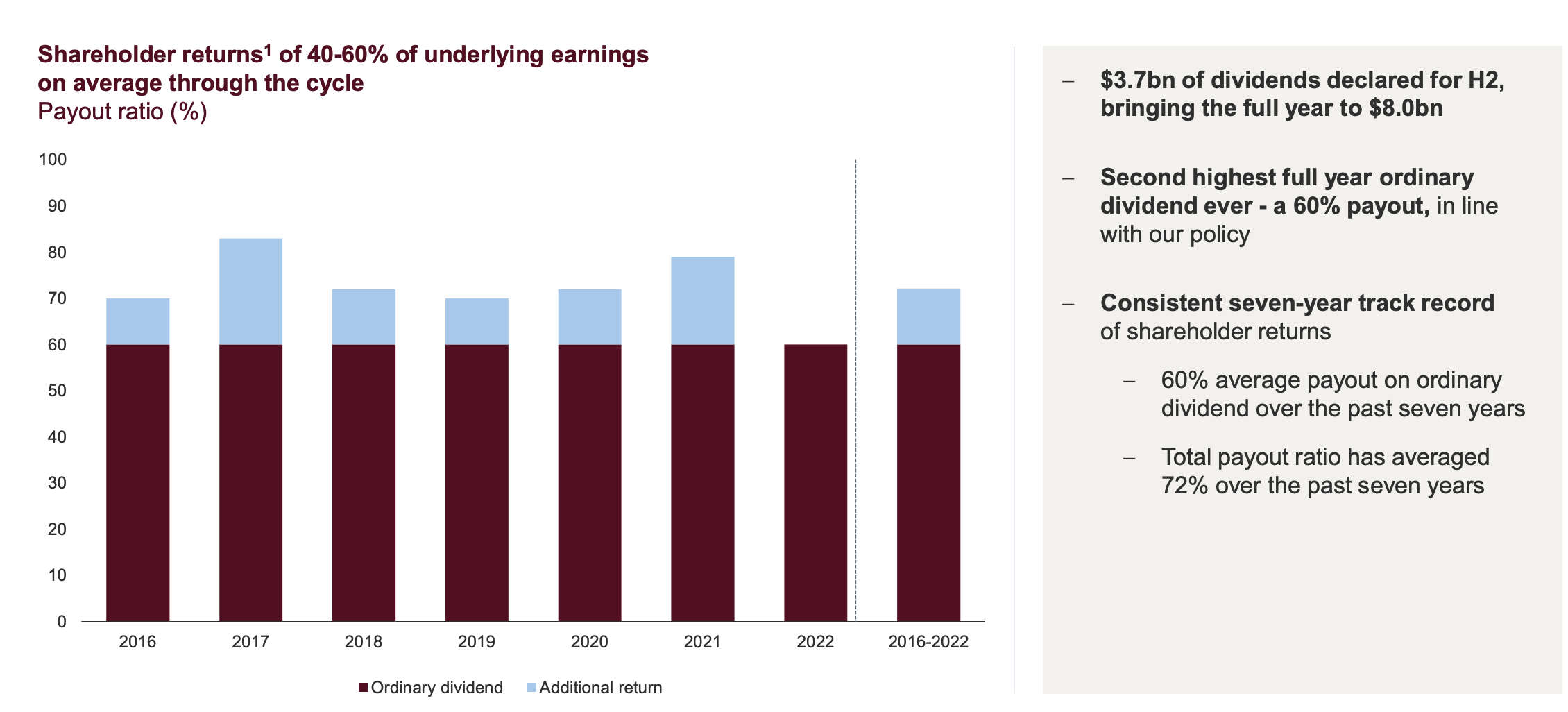

- Addressing concerns of inefficiency directly: Presenting data and evidence to refute claims of excessive costs and complexities.

Potential for Future Changes

While Rio Tinto maintains its current stance, the possibility of future changes remains. The company might reassess its position based on evolving market dynamics and ongoing shareholder pressure.

- Ongoing evaluation of the dual listing structure: A continuous review process to assess the ongoing effectiveness of the current setup.

- Potential future review processes: Scheduled reviews or shareholder meetings to discuss the listing structure and potential adjustments.

- Any upcoming shareholder meetings or announcements: Keeping a close eye on any communication from Rio Tinto regarding the future of its dual listing.

Conclusion

The debate surrounding Rio Tinto's dual listing highlights the complex interplay between shareholder expectations, corporate governance, and strategic decision-making in a globalized market. While the company has articulated a strong defense of its current strategy, the persistent pressure from activist investors underscores the importance of ongoing engagement and a thorough reassessment of the long-term implications. The arguments for and against a dual listing both present compelling points, emphasizing the complexities involved in balancing investor demands with operational efficiencies. Further analysis of the situation and close monitoring of Rio Tinto's response are crucial to understanding the ultimate implications of this shareholder pressure on the future of Rio Tinto’s dual listing. Stay tuned for updates on this evolving situation regarding Rio Tinto’s dual listing and the broader implications for corporate governance in the mining sector.

Featured Posts

-

Boj Growth Forecast Slash Trade Wars Impact On Japanese Economy

May 02, 2025

Boj Growth Forecast Slash Trade Wars Impact On Japanese Economy

May 02, 2025 -

Directorial Change Understanding Chris Columbuss Departure From The Harry Potter Franchise Part 3

May 02, 2025

Directorial Change Understanding Chris Columbuss Departure From The Harry Potter Franchise Part 3

May 02, 2025 -

2024s Underrated Game Lands On Ps Plus This Month

May 02, 2025

2024s Underrated Game Lands On Ps Plus This Month

May 02, 2025 -

Daisy May Coopers Sparkling Engagement Ring Confirmation After Weeks Of Speculation

May 02, 2025

Daisy May Coopers Sparkling Engagement Ring Confirmation After Weeks Of Speculation

May 02, 2025 -

Thes Dansants Et Numerique Optimisez Votre Evenement Grace A Un Accompagnement Personnalise

May 02, 2025

Thes Dansants Et Numerique Optimisez Votre Evenement Grace A Un Accompagnement Personnalise

May 02, 2025

Latest Posts

-

Bbcs 1bn Income Slump Unprecedented Difficulties Ahead

May 02, 2025

Bbcs 1bn Income Slump Unprecedented Difficulties Ahead

May 02, 2025 -

Bbc Faces Unprecedented Challenges Following 1bn Income Drop

May 02, 2025

Bbc Faces Unprecedented Challenges Following 1bn Income Drop

May 02, 2025 -

Newsround Viewing Information Bbc Two Hd

May 02, 2025

Newsround Viewing Information Bbc Two Hd

May 02, 2025 -

Bbc Two Hd Programming Newsround Showtimes

May 02, 2025

Bbc Two Hd Programming Newsround Showtimes

May 02, 2025 -

Your Guide To Newsround On Bbc Two Hd

May 02, 2025

Your Guide To Newsround On Bbc Two Hd

May 02, 2025