Riot Platforms (RIOT) Stock Dips: Analyzing The Recent Decline

Table of Contents

Market-Wide Crypto Volatility and its Impact on RIOT Stock

The correlation between the overall cryptocurrency market and RIOT's stock performance is undeniable. The price of Bitcoin, the primary asset mined by Riot Platforms, significantly influences the company's profitability and, consequently, its stock valuation. Recent negative trends in the Bitcoin price, often referred to as a "crypto market crash" or simply "Bitcoin price" decline, have directly impacted Riot's revenue and investor sentiment.

- Bitcoin Price Correlation: A decrease in Bitcoin's value directly reduces the value of the Bitcoin mined by Riot, impacting their revenue and profitability.

- Regulatory Uncertainty: Changes in cryptocurrency regulation, both domestically and internationally, contribute to market uncertainty and can trigger sell-offs. News regarding stricter regulations often causes a "crypto market crash" fear among investors.

- Market Sentiment: Negative news about the broader crypto market, even unrelated to Riot itself, can lead to a sell-off in RIOT stock.

[Insert chart or graph here illustrating the correlation between Bitcoin price and RIOT stock price]

Riot Platforms' Financial Performance and Operational Challenges

Analyzing Riot Platforms' recent financial reports reveals several key factors contributing to the recent stock dip. While the company's mining hash rate – a key indicator of mining capacity – has generally increased, rising operating costs have squeezed profit margins.

- Revenue Fluctuations: Revenue is directly tied to Bitcoin's price and the efficiency of mining operations. Fluctuations in both impact revenue generation.

- High Operating Costs: Energy costs represent a significant portion of Riot's operating expenses. Increases in energy prices directly impact profitability. "Bitcoin mining profitability" is heavily reliant on efficient energy consumption.

- Equipment Upgrades and Maintenance: Maintaining and upgrading mining equipment is costly. Unexpected delays or increased costs for these upgrades can strain finances.

- Competition: The Bitcoin mining industry is competitive. Increased competition can put downward pressure on profitability.

Key Financial Data Summary: (Insert bullet points summarizing key financial data from recent reports, citing sources).

Investor Sentiment and Market Speculation

Investor sentiment plays a crucial role in driving stock prices. Negative news, even unsubstantiated rumors, can trigger a sell-off. Recent market speculation surrounding Riot Platforms has likely contributed to the stock dip.

- Analyst Ratings: A shift in analyst ratings from "buy" to "hold" or "sell" can influence investor confidence.

- Short Selling Activity: Increased short selling activity indicates a bearish outlook and can exacerbate downward pressure on the stock price.

- News and Events: Negative news, whether factual or perceived, contributes to negative investor sentiment.

Energy Costs and Their Influence on Riot's Profitability

Rising energy costs pose a significant challenge to Riot Platforms and the entire Bitcoin mining industry. The energy-intensive nature of Bitcoin mining means that fluctuating energy prices have a substantial impact on profitability.

- Impact on Profitability: High energy costs directly reduce the profitability of Bitcoin mining, impacting Riot's bottom line.

- Renewable Energy Strategies: Riot is investing in renewable energy sources to mitigate the impact of high energy prices. The success of these strategies is crucial for long-term profitability. Keywords: "renewable energy," "Bitcoin mining energy consumption."

- Energy Price Volatility: Unpredictable energy prices add another layer of risk to Riot's operations and impact investor confidence.

Conclusion: Navigating the Riot Platforms (RIOT) Stock Dip

The recent Riot Platforms (RIOT) stock dip is a result of a confluence of factors, including market-wide crypto volatility, challenges in Riot's financial performance, negative investor sentiment, and escalating energy costs. While the challenges are significant, Riot Platforms continues to invest in expanding its mining capacity and exploring strategies to mitigate the impact of high energy prices. The future outlook for RIOT stock remains uncertain, dependent on factors such as Bitcoin's price trajectory, the overall crypto market sentiment, and Riot's ability to manage its operational challenges. Stay informed about the evolving situation with Riot Platforms (RIOT) stock and make informed investment decisions. Remember to conduct thorough research before investing in any cryptocurrency-related stock.

Featured Posts

-

Epic Games Faces Massive Lawsuit Over Deceptive Practices

May 03, 2025

Epic Games Faces Massive Lawsuit Over Deceptive Practices

May 03, 2025 -

Local Elections 2024 Assessing The Reform Partys Prospects Under Farage

May 03, 2025

Local Elections 2024 Assessing The Reform Partys Prospects Under Farage

May 03, 2025 -

Leaked Whats App Messages Expose Reform Party Rift Farages Integrity Questioned

May 03, 2025

Leaked Whats App Messages Expose Reform Party Rift Farages Integrity Questioned

May 03, 2025 -

England Womens Nations League Kelly Called Up Following Injuries

May 03, 2025

England Womens Nations League Kelly Called Up Following Injuries

May 03, 2025 -

Christina Aguileras Photoshopped Images Spark Debate Among Fans

May 03, 2025

Christina Aguileras Photoshopped Images Spark Debate Among Fans

May 03, 2025

Latest Posts

-

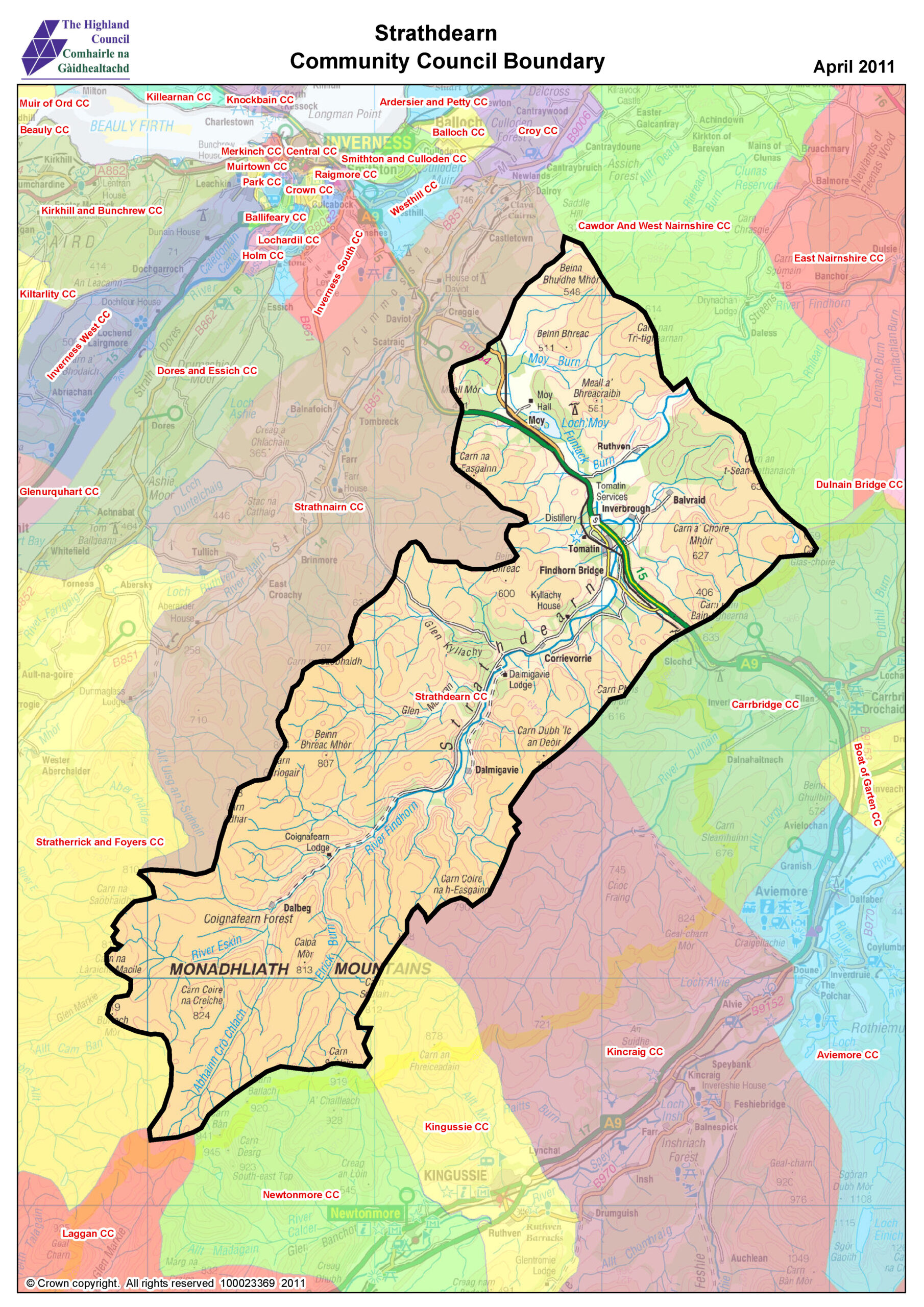

Tomatin Pupils Celebrate Groundbreaking Of New Affordable Housing In Strathdearn

May 04, 2025

Tomatin Pupils Celebrate Groundbreaking Of New Affordable Housing In Strathdearn

May 04, 2025 -

Netherlands Considers Bringing Back Ow Subsidies To Stimulate Competition

May 04, 2025

Netherlands Considers Bringing Back Ow Subsidies To Stimulate Competition

May 04, 2025 -

Strathdearn Community Project Reaches Milestone Tomatin Affordable Housing

May 04, 2025

Strathdearn Community Project Reaches Milestone Tomatin Affordable Housing

May 04, 2025 -

Reintroduction Of Ow Subsidies In The Netherlands A Potential Bidder Incentive

May 04, 2025

Reintroduction Of Ow Subsidies In The Netherlands A Potential Bidder Incentive

May 04, 2025 -

Dutch Government Explores Ow Subsidy Revival To Attract Bidders

May 04, 2025

Dutch Government Explores Ow Subsidy Revival To Attract Bidders

May 04, 2025