Riot Platforms Stock Near 52-Week Low: What's Happening?

Table of Contents

The Impact of the Bear Market on Cryptocurrency Mining Stocks

The current bear market in the cryptocurrency sector is significantly impacting Bitcoin mining stocks like Riot Platforms. Several factors contribute to this negative trend.

Declining Bitcoin Price

The recent fall in Bitcoin's price is the most direct factor affecting the profitability of Bitcoin mining companies.

- Decreased revenue per Bitcoin mined: A lower Bitcoin price means less revenue generated for each Bitcoin mined, directly impacting the company's bottom line.

- Increased operational costs outweighing revenue: The fixed costs of mining, including electricity and equipment maintenance, remain relatively constant. When Bitcoin's price drops, these operational costs can easily outweigh the revenue generated, leading to losses.

- Impact on profit margins: The shrinking difference between revenue and operational costs severely impacts profit margins, making it challenging for mining companies to remain profitable.

Increased Energy Costs and Regulations

Rising energy costs and stricter environmental regulations are further squeezing the profitability of the Bitcoin mining industry.

- Higher electricity bills: Bitcoin mining is energy-intensive. Increases in electricity prices directly translate to higher operational costs for Riot Platforms and other miners.

- Potential penalties for non-compliance: Growing environmental concerns are leading to stricter regulations on energy consumption. Non-compliance can result in hefty penalties, further impacting profitability.

- Impact on mining operations: Some mining operations might become unsustainable due to the combined pressure of high energy costs and stringent regulations, forcing companies to scale back or even shut down.

Competition in the Bitcoin Mining Market

The Bitcoin mining sector is becoming increasingly competitive, putting pressure on market share and profitability.

- New entrants: New players are constantly entering the market, increasing the competition for limited resources and market share.

- Established players expanding capacity: Existing players are also expanding their mining operations, further intensifying the competition.

- Price wars: In a bid to maintain market share, companies might engage in price wars, further reducing profitability.

Riot Platforms' Specific Challenges and Strategies

Beyond the broader market challenges, Riot Platforms faces its own specific hurdles and is implementing certain strategies to navigate the bear market.

Recent Financial Performance and Announcements

Riot Platforms' recent financial reports reveal some key trends that may be contributing to the stock price decline.

- Quarterly earnings reports: Analyzing the quarterly earnings reports will reveal the company's financial performance and identify any negative trends.

- Any debt issuances: Increased debt levels can negatively impact a company's stock price, particularly during times of economic uncertainty.

- Expansion plans or delays: Delays in expansion projects or scaling back plans can signal financial strain and impact investor confidence.

Hashrate and Mining Efficiency

Riot Platforms' hashrate (mining power) and mining efficiency are crucial indicators of its profitability.

- Hashrate growth or decline: A declining hashrate suggests a reduction in mining capacity, potentially due to cost-cutting measures or equipment failures.

- Energy consumption per TH/s: Monitoring energy consumption per terahash per second (TH/s) reveals the company's efficiency in mining Bitcoin. Higher efficiency translates to lower operational costs.

- Comparison to competitors: Comparing Riot Platforms' hashrate and efficiency to its competitors provides valuable insights into its competitive position.

Company's Response to the Market Conditions

Riot Platforms is implementing several strategies to counter the adverse market conditions.

- Cost reduction strategies: The company is likely focusing on cost-cutting measures to improve its profitability.

- Exploration of new revenue streams: Diversification into other areas related to the cryptocurrency industry can reduce reliance on Bitcoin mining alone.

- Expansion plans in different regions: Expanding operations to regions with lower energy costs or more favorable regulatory environments can improve profitability.

Analyst Opinions and Future Outlook for Riot Platforms Stock

Understanding the views of financial analysts provides further insight into the potential future of Riot Platforms stock.

Analyst Ratings and Price Targets

Financial analysts offer ratings (buy, sell, hold) and price targets for Riot Platforms stock.

- Quotes from reputable analysts: Tracking what leading analysts say about Riot Platforms provides valuable perspective on investor sentiment.

- Consensus rating: The overall consensus rating from multiple analysts offers a summarized view of the market's outlook.

- Range of price targets: The range of price targets indicates the variation in analyst expectations for the future stock price.

Potential Catalysts for Stock Price Recovery

Several factors could trigger a rebound in Riot Platforms' stock price.

- A Bitcoin price surge: A significant increase in Bitcoin's price would directly improve the profitability of Bitcoin mining, boosting Riot Platforms' stock.

- Successful cost-cutting measures: Successful implementation of cost-cutting strategies would increase profit margins and potentially boost investor confidence.

- New partnerships or technological advancements: Strategic partnerships or technological breakthroughs could lead to increased efficiency and revenue, positively impacting the stock price.

Risks and Uncertainties

Investing in Riot Platforms stock involves significant risks due to the volatility of the cryptocurrency market.

- Regulatory risks: Changes in cryptocurrency regulations can significantly impact the profitability of Bitcoin mining companies.

- Technological risks: Technological advancements could render current mining equipment obsolete, impacting profitability.

- Market sentiment: Negative market sentiment towards cryptocurrencies can negatively impact the stock price.

- Competition: Intense competition in the Bitcoin mining sector remains a significant risk factor.

Conclusion

Several factors contribute to Riot Platforms stock currently trading near its 52-week low, including the bear market in cryptocurrencies, increased energy costs, rising competition, and the company's own financial challenges. Understanding these factors and the broader cryptocurrency market conditions is crucial for evaluating Riot Platforms stock. While potential catalysts for recovery exist, significant risks and uncertainties remain. Before making any investment decisions related to Riot Platforms stock, thorough research and consultation with a financial advisor are strongly recommended. Further research into Riot Platforms stock and the cryptocurrency market is essential for informed decision-making.

Featured Posts

-

Avrupa Is Birliginin Ekonomik Boyutu Kazan Kazan Senaryolari

May 03, 2025

Avrupa Is Birliginin Ekonomik Boyutu Kazan Kazan Senaryolari

May 03, 2025 -

The Growing Trend Of Men Shaving Their Eyelashes

May 03, 2025

The Growing Trend Of Men Shaving Their Eyelashes

May 03, 2025 -

Annual Donkey Roundup Rocks Southern California

May 03, 2025

Annual Donkey Roundup Rocks Southern California

May 03, 2025 -

Highly Demanded Fortnite Skins Re Released In Item Shop

May 03, 2025

Highly Demanded Fortnite Skins Re Released In Item Shop

May 03, 2025 -

Epanidrysi Toy Kratoys I Antimetopisi Tis Diafthoras Stis Poleodomies

May 03, 2025

Epanidrysi Toy Kratoys I Antimetopisi Tis Diafthoras Stis Poleodomies

May 03, 2025

Latest Posts

-

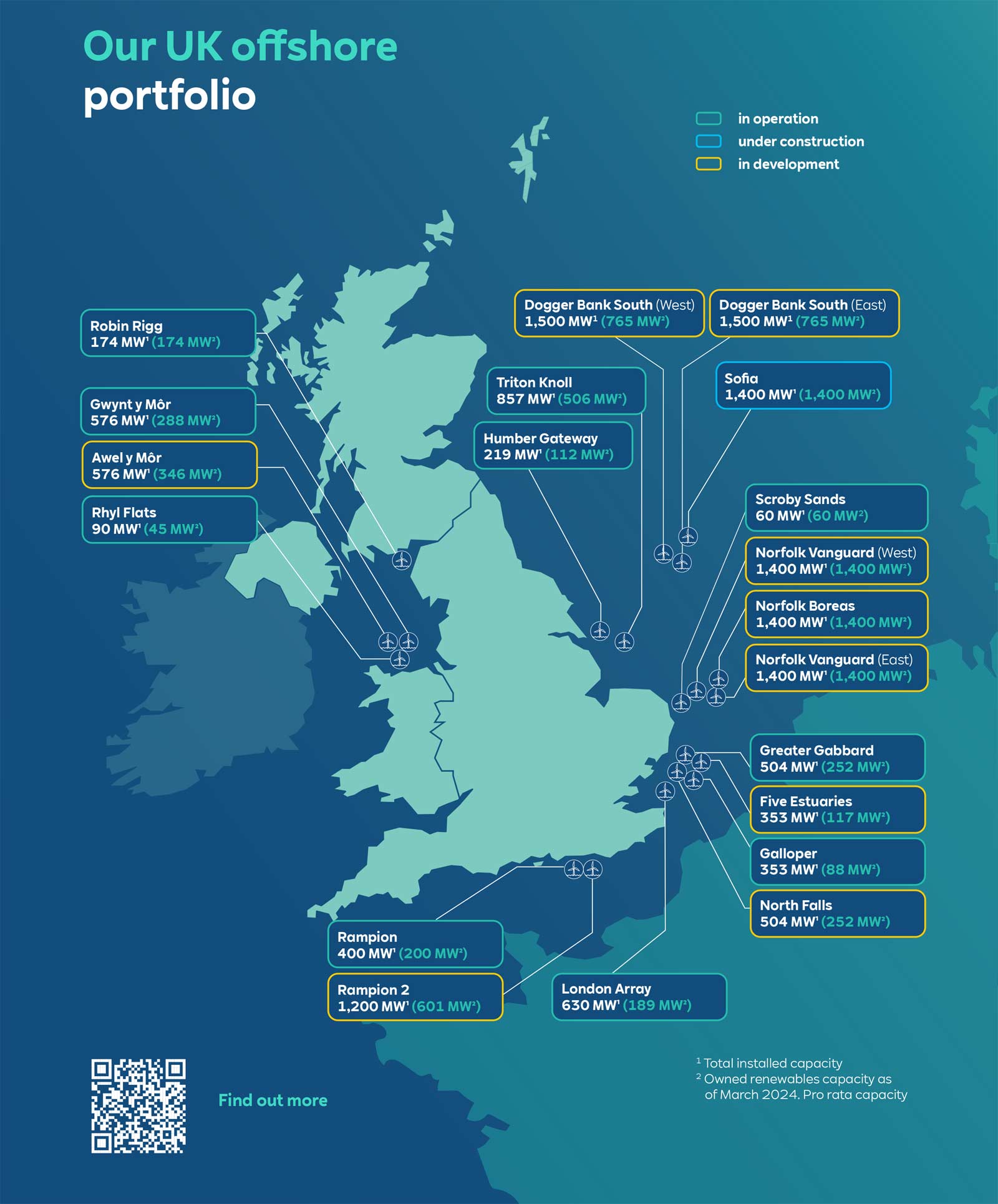

The Future Of Expensive Offshore Wind Energy Projects

May 04, 2025

The Future Of Expensive Offshore Wind Energy Projects

May 04, 2025 -

Rising Costs Jeopardize Offshore Wind Farm Investments

May 04, 2025

Rising Costs Jeopardize Offshore Wind Farm Investments

May 04, 2025 -

Offshore Wind Farm Economics A Turning Point For The Industry

May 04, 2025

Offshore Wind Farm Economics A Turning Point For The Industry

May 04, 2025 -

The High Cost Of Offshore Wind Why Energy Firms Are Reconsidering

May 04, 2025

The High Cost Of Offshore Wind Why Energy Firms Are Reconsidering

May 04, 2025 -

Expensive Offshore Wind Farms A Shift In Industry Favor

May 04, 2025

Expensive Offshore Wind Farms A Shift In Industry Favor

May 04, 2025