Ripple And The SEC: XRP Classification And Settlement Negotiations

Table of Contents

The SEC's Case Against Ripple: A Deep Dive into the Allegations

The SEC alleges that Ripple Labs engaged in an unregistered securities offering by selling billions of XRP to the public. Their central argument hinges on the "Howey Test," a legal framework used to determine whether an investment contract exists. The Howey Test considers four key elements: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived primarily from the efforts of others.

The SEC argues that Ripple's sales of XRP met all four criteria. They claim that purchasers of XRP invested money with a reasonable expectation of profit, driven largely by Ripple's efforts to promote and develop the XRP ecosystem. The SEC also points to Ripple's control over XRP's distribution and its marketing activities as evidence of a centralized, securities-like structure.

- SEC's definition of an investment contract: The SEC emphasizes the expectation of profit derived from Ripple's efforts, not just from the inherent value or utility of XRP.

- Analysis of Ripple's sales of XRP: The SEC scrutinizes the timing and methods of XRP sales, arguing they constitute an ongoing securities offering.

- Examination of the "reasonable expectation of profit" argument: The SEC focuses on statements made by Ripple executives and marketing materials, claiming they fueled investor expectations of XRP price appreciation.

Ripple's Defense: Arguments and Strategies

Ripple vehemently denies the SEC's accusations. Their defense rests on the argument that XRP is a decentralized, functional cryptocurrency, not a security. They contend that XRP's primary purpose is as a bridge currency for facilitating cross-border payments on their network, not as an investment vehicle. Ripple emphasizes XRP's widespread adoption and use outside of Ripple's direct control.

Ripple's legal strategy incorporates various arguments, including presenting evidence of XRP's decentralized nature and arguing that the SEC's application of the Howey Test is inappropriately broad in the context of cryptocurrencies. They have also employed numerous expert witnesses to bolster their claims.

- Ripple's arguments regarding XRP's decentralized nature: Ripple highlights the independent validators and distributed ledger technology supporting XRP.

- Evidence presented by Ripple to support its claims: This includes demonstrating widespread use of XRP in various payment systems and exchanges independent of Ripple's direct control.

- Ripple's legal team and their approach: Ripple's legal team is employing a robust defense strategy, engaging in extensive discovery and presenting expert testimony to challenge the SEC’s claims.

The Ongoing Settlement Negotiations: Potential Outcomes and Implications

Settlement negotiations between Ripple and the SEC are ongoing. Various scenarios are possible, ranging from a complete dismissal of the case to a significant financial settlement with potentially restrictive conditions on Ripple's future operations. A favorable settlement for Ripple could involve a consent decree without admitting wrongdoing, potentially clarifying the regulatory status of XRP. An unfavorable settlement could involve substantial fines and restrictions, potentially damaging Ripple's reputation and future prospects.

- Potential financial penalties for Ripple: This could range from millions to billions of dollars, depending on the outcome of the negotiations.

- Implications for future XRP trading and regulatory compliance: A settlement could clarify regulatory expectations for other cryptocurrencies, potentially impacting their trading and use.

- Effect on the broader cryptocurrency regulatory landscape: The outcome will have a significant impact on the regulatory environment for cryptocurrencies in the US and globally.

Impact on XRP Price and Investor Sentiment

The Ripple-SEC lawsuit has significantly impacted XRP's price and investor sentiment. Periods of positive news have often led to price increases, while negative developments have resulted in price drops. The uncertainty surrounding the case has also created volatility in XRP trading.

- Historical XRP price fluctuations: A correlation is evident between legal developments in the case and XRP's price movements.

- Correlation between legal developments and XRP price: Positive developments tend to drive up the price while negative news causes declines.

- Analysis of investor confidence and trading volume: Investor confidence has been directly correlated with the perceived likelihood of a favorable outcome for Ripple.

Conclusion: The Future of Ripple and XRP After the SEC Lawsuit

The Ripple and SEC XRP case is a landmark legal battle with significant implications for the cryptocurrency industry. The outcome will influence how future cryptocurrency projects navigate regulatory compliance and how securities laws apply in the rapidly evolving digital asset space. The SEC's interpretation of the Howey Test, Ripple's defense, and the eventual settlement or verdict will shape the regulatory landscape for years to come. Staying informed about the latest developments is crucial for anyone with investments in XRP or a stake in the future of the cryptocurrency market.

Call to action: Stay informed about the latest developments in the Ripple and SEC XRP case to make informed investment decisions. Continue monitoring the Ripple and SEC XRP situation for updates. Understand the XRP classification implications for your portfolio.

Featured Posts

-

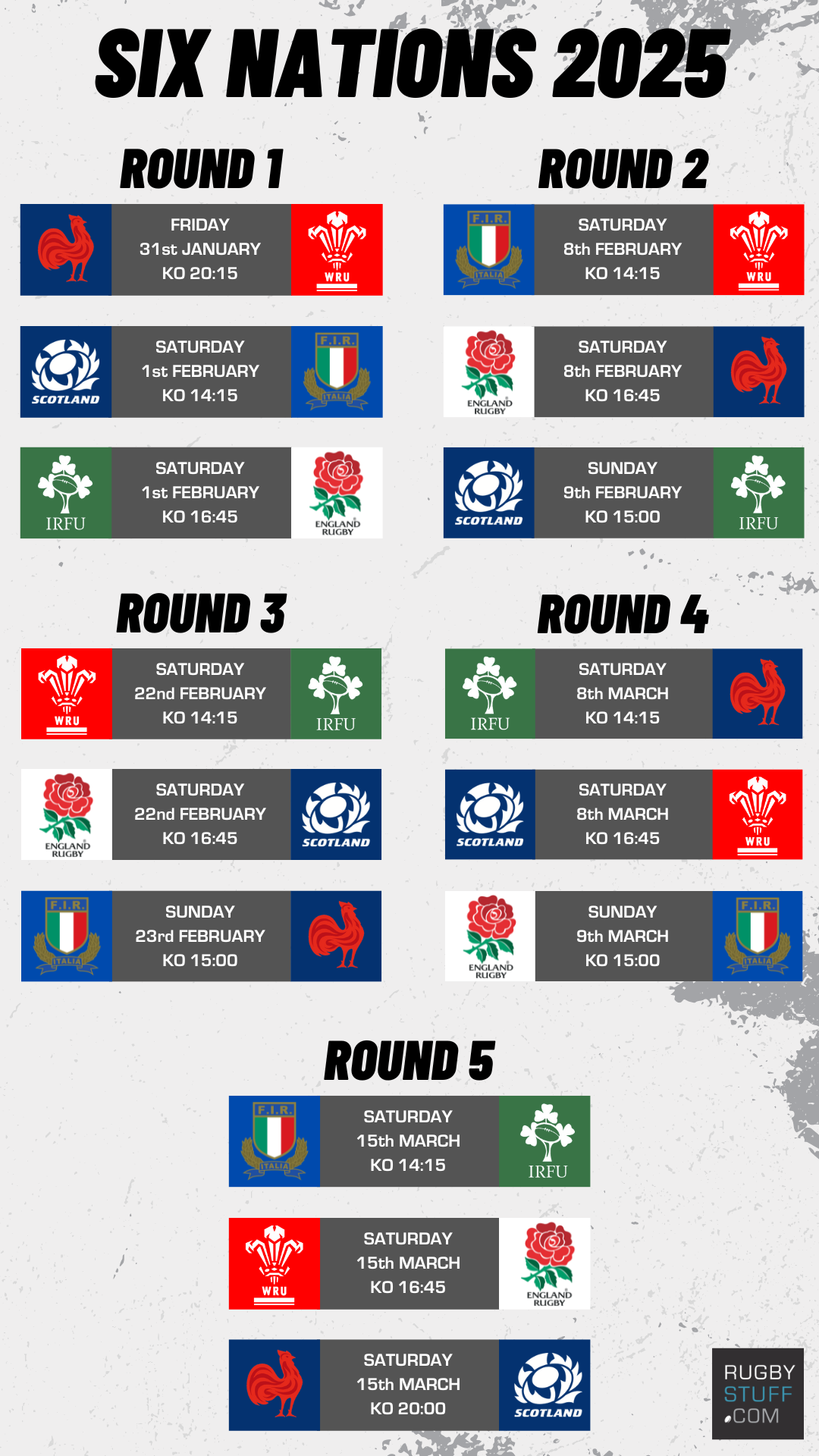

Post Italy Victory Frances Six Nations Warning To Ireland

May 02, 2025

Post Italy Victory Frances Six Nations Warning To Ireland

May 02, 2025 -

Dlyl Shaml Play Station 6 Kl Ma Thtaj Lmerfth

May 02, 2025

Dlyl Shaml Play Station 6 Kl Ma Thtaj Lmerfth

May 02, 2025 -

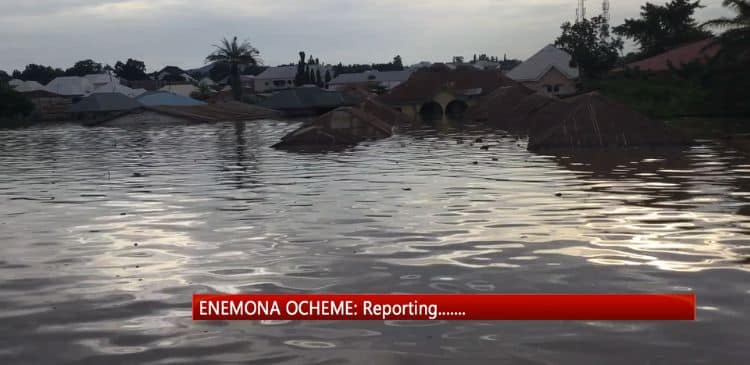

Hundreds Stranded In Kogi Following Train Failure

May 02, 2025

Hundreds Stranded In Kogi Following Train Failure

May 02, 2025 -

England Womens World Cup Final Preview Tactical Analysis And Lineup Predictions Vs Spain

May 02, 2025

England Womens World Cup Final Preview Tactical Analysis And Lineup Predictions Vs Spain

May 02, 2025 -

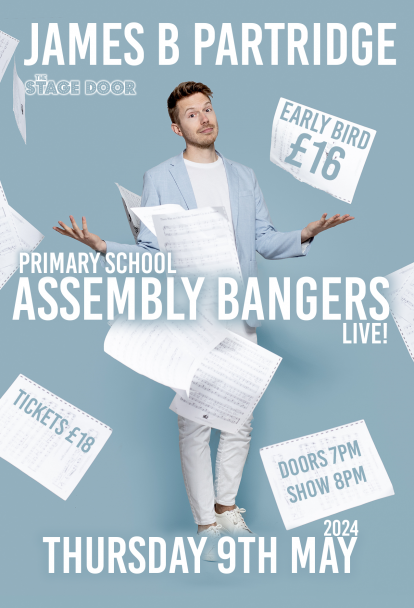

Stroud And Cheltenham Catch James B Partridge Live

May 02, 2025

Stroud And Cheltenham Catch James B Partridge Live

May 02, 2025

Latest Posts

-

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025 -

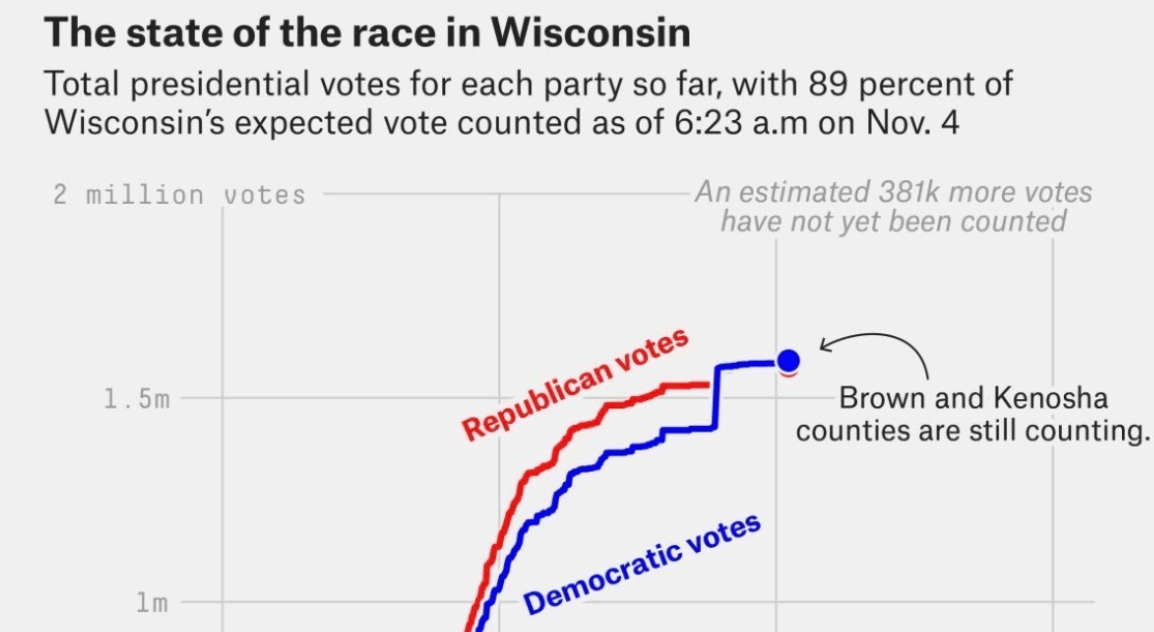

The 2024 Election And Beyond Lessons From Florida And Wisconsin Voter Turnout

May 02, 2025

The 2024 Election And Beyond Lessons From Florida And Wisconsin Voter Turnout

May 02, 2025 -

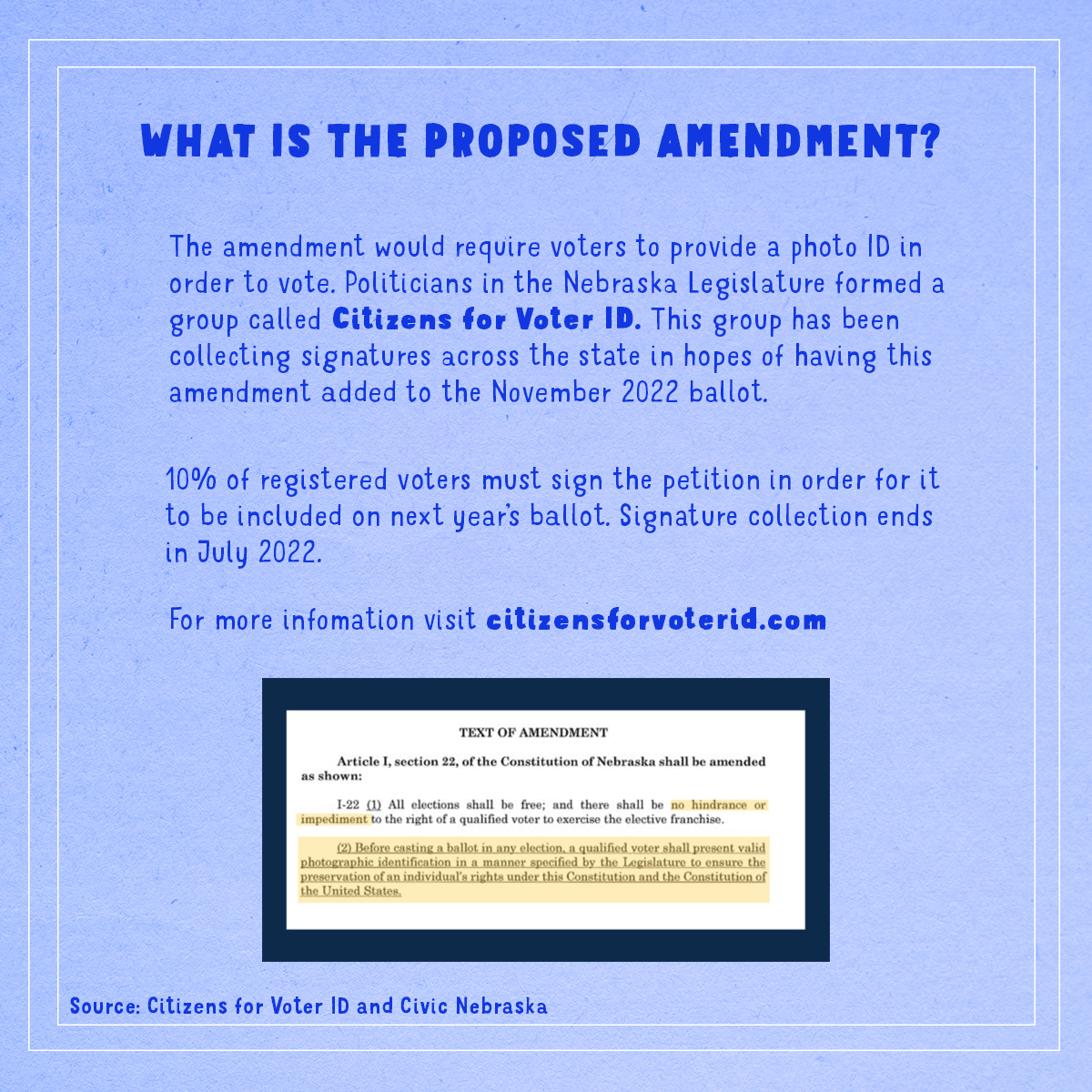

Nebraska Voter Id Campaign Best Practices And National Award

May 02, 2025

Nebraska Voter Id Campaign Best Practices And National Award

May 02, 2025 -

Decoding Ap Decision Notes The Minnesota House Special Election

May 02, 2025

Decoding Ap Decision Notes The Minnesota House Special Election

May 02, 2025 -

Analyzing Voter Turnout Insights From Florida And Wisconsin Elections

May 02, 2025

Analyzing Voter Turnout Insights From Florida And Wisconsin Elections

May 02, 2025