Ripple Vs. SEC: Settlement Imminent? XRP's Future As A Commodity

Table of Contents

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has captivated the cryptocurrency world. The SEC's claim that XRP, Ripple's native token, is an unregistered security has created significant uncertainty for investors and the broader crypto market. With settlement talks frequently rumored, the question on everyone's mind is: what will happen to XRP, and will it ultimately be classified as a commodity or a security? This article delves into the potential implications of a settlement and explores XRP's future prospects.

The Core of the SEC vs. Ripple Lawsuit

The SEC's Argument

The SEC's case against Ripple centers on the assertion that XRP sales constituted unregistered securities offerings, violating federal securities laws. Their argument hinges on the application of the Howey Test, a four-pronged test used to determine whether an investment is a security.

-

The Howey Test: The SEC argues that XRP meets all four prongs of the Howey Test:

- Investment of money: Investors purchased XRP with the expectation of profit.

- Common enterprise: Investors were part of a collective investment scheme involving Ripple's distribution of XRP.

- Expectation of profits: Investors anticipated profits derived from Ripple's efforts and the growth of the XRP network.

- Efforts of others: Investors relied on Ripple's efforts to develop and promote XRP, expecting value appreciation.

-

Ripple's XRP Distribution: The SEC points to Ripple's significant sales of XRP, including programmatic sales and sales to institutional investors, as evidence of a securities offering. They allege that these sales were not conducted in a manner compliant with federal securities laws.

Ripple's Defense

Ripple counters that XRP is a decentralized digital asset, a cryptocurrency with utility akin to Bitcoin or Ethereum, and therefore not a security. They argue that the Howey Test does not apply.

- Decentralized Nature of XRP: Ripple emphasizes the decentralized nature of the XRP Ledger, highlighting its open-source code, distributed network, and lack of central control.

- Utility of XRP: Ripple points to XRP's use in cross-border payments as evidence of its utility, arguing that it functions as a medium of exchange, not an investment contract.

- Programmatic Sales: Ripple argues that their programmatic sales were similar to the way many other cryptocurrencies are sold, emphasizing that investors weren't relying on Ripple’s efforts for profit.

- Expert Witnesses: Ripple has presented expert witnesses and extensive evidence to support their claims, challenging the SEC's interpretation of the Howey Test and the nature of XRP.

Potential Outcomes of a Settlement

A Favorable Settlement for Ripple

A favorable settlement could see XRP recognized as a digital asset or utility token, rather than a security. This outcome would likely:

- Positive Price Impact: Lead to significant price appreciation for XRP, as uncertainty would be removed.

- Increased Adoption: Boost XRP's adoption among businesses and institutions, encouraging further integration into payment systems.

- Regulatory Clarity: Provide much-needed regulatory clarity for the cryptocurrency industry, potentially influencing the classification of other digital assets.

An Unfavorable Settlement for Ripple

Conversely, an unfavorable settlement could result in penalties for Ripple and potentially restrictions on the use or sale of XRP. This scenario might involve:

- Financial Penalties: Significant fines levied against Ripple, impacting its financial health and potentially causing a downturn in XRP price.

- Operational Restrictions: Limitations placed on Ripple's operations, potentially restricting its ability to conduct business.

- Negative Market Sentiment: Reduce investor confidence in XRP, negatively impacting its market capitalization and trading volume.

XRP's Future as a Commodity (or not): Analyzing the Implications

Commodity Classification

If XRP is classified as a commodity, it would fall under the regulatory purview of the Commodity Futures Trading Commission (CFTC), rather than the SEC. This would have several implications:

- Regulatory Oversight: The CFTC's regulations differ from the SEC's, potentially leading to less stringent requirements for XRP trading and issuance.

- Taxation Implications: Taxation of XRP transactions could change, depending on the specific regulations implemented by relevant tax authorities.

- Market Impact: Commodity classification might increase liquidity and broaden XRP's appeal to institutional investors.

Continued Legal Uncertainty

Even after a settlement, legal uncertainty could linger. Future legal challenges or regulatory actions are possible:

- Future Litigation: Other jurisdictions could pursue legal action against Ripple or XRP, creating ongoing uncertainty.

- Regulatory Scrutiny: Increased scrutiny from regulatory bodies worldwide could negatively impact the adoption of XRP.

- Price Volatility: Continued uncertainty could result in high price volatility for XRP, making it a riskier investment.

Conclusion

The Ripple vs. SEC case has far-reaching consequences for the cryptocurrency industry. The ultimate classification of XRP—as a security or a commodity—will significantly impact its future and the broader crypto landscape. While a settlement seems increasingly possible, the exact terms and their consequences remain uncertain. Understanding the potential outcomes and their implications is crucial for investors and businesses involved in the crypto market. Stay informed about further developments in the case and continue to monitor XRP’s progress. Stay tuned for updates on the Ripple vs. SEC case and its effect on the future of XRP as a commodity or digital asset.

Featured Posts

-

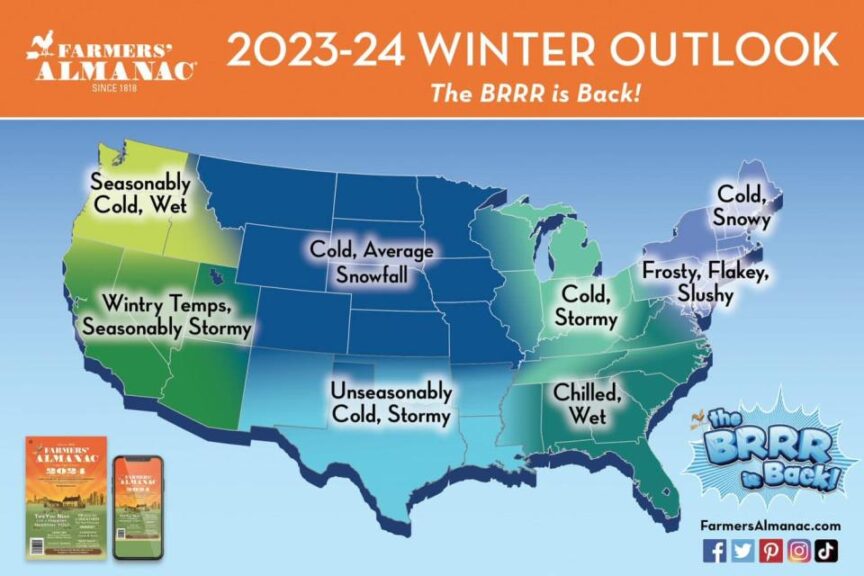

Tulsas Winter 2024 A Numerical Look At The Seasons Weather

May 02, 2025

Tulsas Winter 2024 A Numerical Look At The Seasons Weather

May 02, 2025 -

Ps Plus February 2024 Underrated Gem Joins The Lineup

May 02, 2025

Ps Plus February 2024 Underrated Gem Joins The Lineup

May 02, 2025 -

Ripple Xrp Update Sbi Holdings Xrp Shareholder Reward Program

May 02, 2025

Ripple Xrp Update Sbi Holdings Xrp Shareholder Reward Program

May 02, 2025 -

Fortnite Cowboy Bebop Collaboration Free Items Available For A Short Time

May 02, 2025

Fortnite Cowboy Bebop Collaboration Free Items Available For A Short Time

May 02, 2025 -

Dallas Icon Passes Away At 100 Years Old

May 02, 2025

Dallas Icon Passes Away At 100 Years Old

May 02, 2025

Latest Posts

-

Fotos Laura Keller De Biquini Em Retiro Espiritual De Tantra Yoga

May 02, 2025

Fotos Laura Keller De Biquini Em Retiro Espiritual De Tantra Yoga

May 02, 2025 -

Milk And Honeys Electronic Music Division Gains New Head Andrew Goldstone

May 02, 2025

Milk And Honeys Electronic Music Division Gains New Head Andrew Goldstone

May 02, 2025 -

Ukraine Receives Continued Backing From Swiss President

May 02, 2025

Ukraine Receives Continued Backing From Swiss President

May 02, 2025 -

Christina Aguilera New Photoshoot Sparks Debate Over Excessive Photo Editing

May 02, 2025

Christina Aguilera New Photoshoot Sparks Debate Over Excessive Photo Editing

May 02, 2025 -

The Changing Face Of Christina Aguilera Fan Reactions And Analysis

May 02, 2025

The Changing Face Of Christina Aguilera Fan Reactions And Analysis

May 02, 2025