Ripple's Position As Fourth Largest Crypto: Is XRP's 15,000% Growth Sustainable?

Table of Contents

Factors Contributing to XRP's Explosive Growth

Several key elements have contributed to XRP's remarkable rise. These can be broadly categorized into institutional adoption, technological advantages, and, despite the controversies, the overall regulatory landscape.

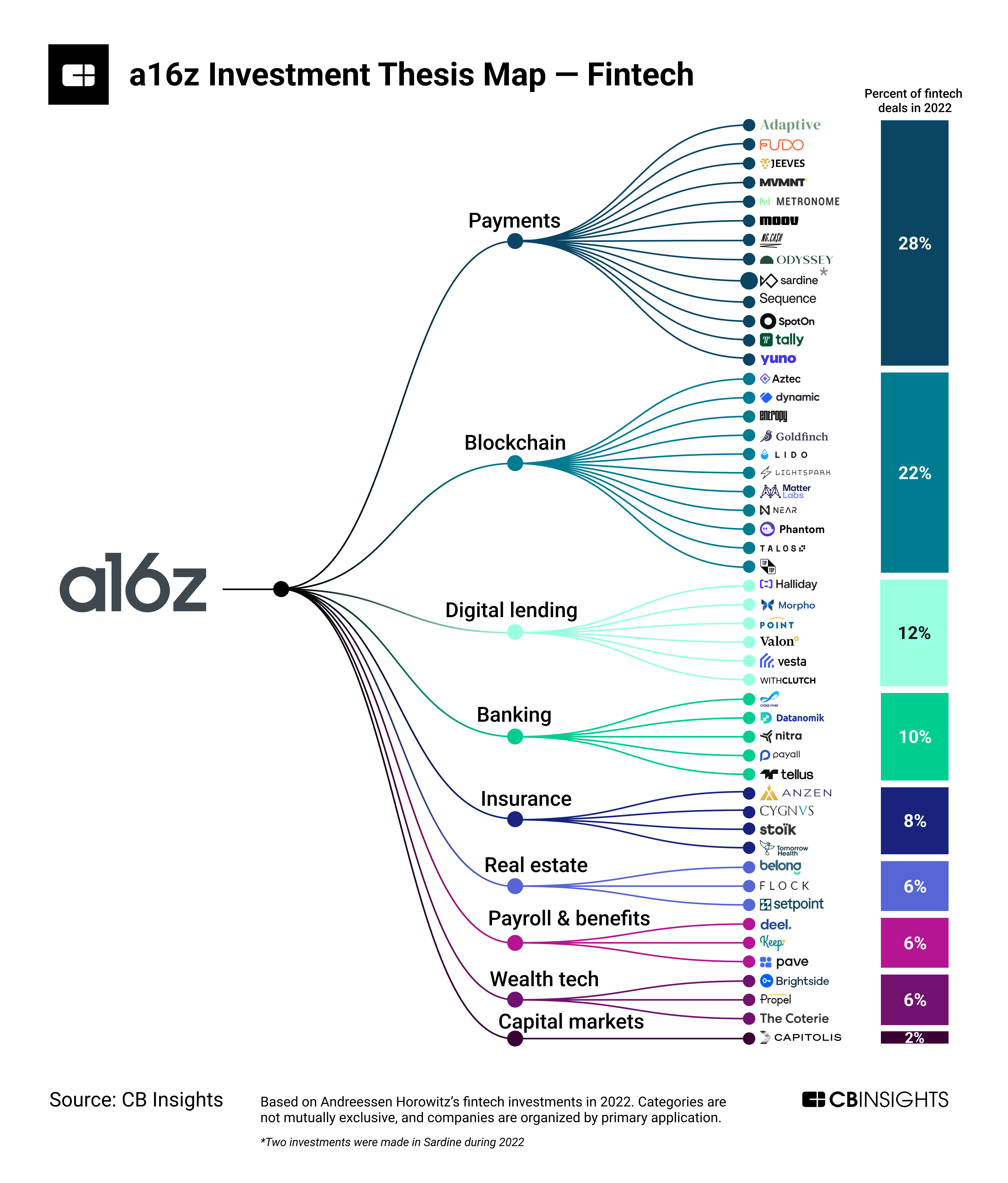

Adoption by Financial Institutions

Ripple's success is significantly tied to its strategic partnerships with major financial institutions globally. RippleNet, its payment solution, offers a faster, cheaper, and more transparent alternative to traditional SWIFT cross-border payment systems.

- Faster Transactions: RippleNet drastically reduces transaction processing times, often settling payments within seconds, compared to days with traditional methods.

- Lower Costs: Reduced transaction fees make international remittances more affordable, especially beneficial for individuals and businesses sending money across borders.

- Increased Transparency: The blockchain's inherent transparency provides a more auditable and secure process, building trust among financial institutions.

- Successful Implementations: Numerous banks and financial institutions worldwide have successfully integrated RippleNet into their operations, solidifying its position in the market. Examples include Santander, MoneyGram, and SBI Remit. This widespread adoption directly fuels demand and price appreciation for XRP.

Technological Advantages of XRP

XRP's technological features differentiate it from other cryptocurrencies. Its core strengths lie in speed and efficiency.

- Speed and Scalability: XRP boasts significantly faster transaction speeds compared to Bitcoin or Ethereum, enabling quicker settlements and higher throughput.

- Energy Efficiency: Unlike Bitcoin's energy-intensive mining process, XRP uses a consensus mechanism that requires significantly less energy, making it more environmentally friendly.

- Low Transaction Fees: The low cost of transactions further enhances XRP's appeal to financial institutions and individual users.

- Unique Features: XRP's unique features, such as its focus on bridging different currencies and its role in facilitating instant settlements, strengthen its position in the payment processing space.

Regulatory Landscape and Legal Battles

Ripple's journey hasn't been without its hurdles. The ongoing legal battle with the Securities and Exchange Commission (SEC) significantly impacts its future.

- SEC Lawsuit: The SEC alleges that XRP is an unregistered security, casting uncertainty on its future regulatory status. A positive resolution would significantly boost XRP's price and adoption. A negative outcome could severely impact its market position.

- Regulatory Developments: The evolving regulatory landscape surrounding cryptocurrencies is a double-edged sword. Clear and favorable regulations could boost XRP's legitimacy and adoption, while stringent or unfavorable regulations could hamper its growth.

- Global Regulatory Scrutiny: The regulatory scrutiny faced by XRP is mirrored across the cryptocurrency space. Navigating the complexities of various jurisdictions remains a challenge.

Challenges and Risks to XRP's Continued Growth

While XRP's growth has been remarkable, several significant challenges threaten its sustainability.

Market Volatility and Crypto Market Sentiment

The cryptocurrency market is inherently volatile. The price of XRP, like other cryptocurrencies, is susceptible to significant fluctuations.

- Bitcoin's Influence: Bitcoin's price movements often influence the entire crypto market, including XRP. A downturn in Bitcoin can trigger a sell-off across the market.

- Market Sentiment: Investor sentiment and broader market trends heavily influence XRP's price. Fear, uncertainty, and doubt (FUD) can lead to sharp price drops.

- Overall Market Conditions: Macroeconomic factors, such as inflation and interest rates, can also impact the cryptocurrency market, affecting XRP's value.

Competition from other Cryptocurrencies

XRP faces intense competition from other cryptocurrencies aiming to disrupt the cross-border payment sector.

- Stellar Lumens (XLM): Stellar Lumens is a direct competitor to XRP, offering similar functionalities.

- Other Stablecoins: Various stablecoins also compete for market share in the payment processing space.

- Technological Innovation: The emergence of new technologies and innovative solutions could challenge XRP's dominance.

Regulatory Uncertainty

The SEC lawsuit remains a significant source of uncertainty for XRP.

- Legal Outcome: The outcome of the lawsuit will significantly impact XRP's price and future adoption.

- Regulatory Clarity: Lack of regulatory clarity creates uncertainty for investors and hinders wider adoption.

- Jurisdictional Differences: Navigating the complex and often conflicting regulatory frameworks across different jurisdictions presents a significant challenge.

Is XRP's 15,000% Growth Sustainable? A Realistic Assessment

Assessing the sustainability of XRP's growth requires a balanced perspective. While its technological advantages and institutional adoption are significant positives, the regulatory uncertainty and market volatility pose considerable risks.

- Arguments for Sustainability: Widespread adoption by financial institutions, technological superiority, and potential for broader use cases suggest a degree of long-term potential.

- Arguments against Sustainability: The SEC lawsuit, intense competition, and inherent market volatility could lead to significant price corrections.

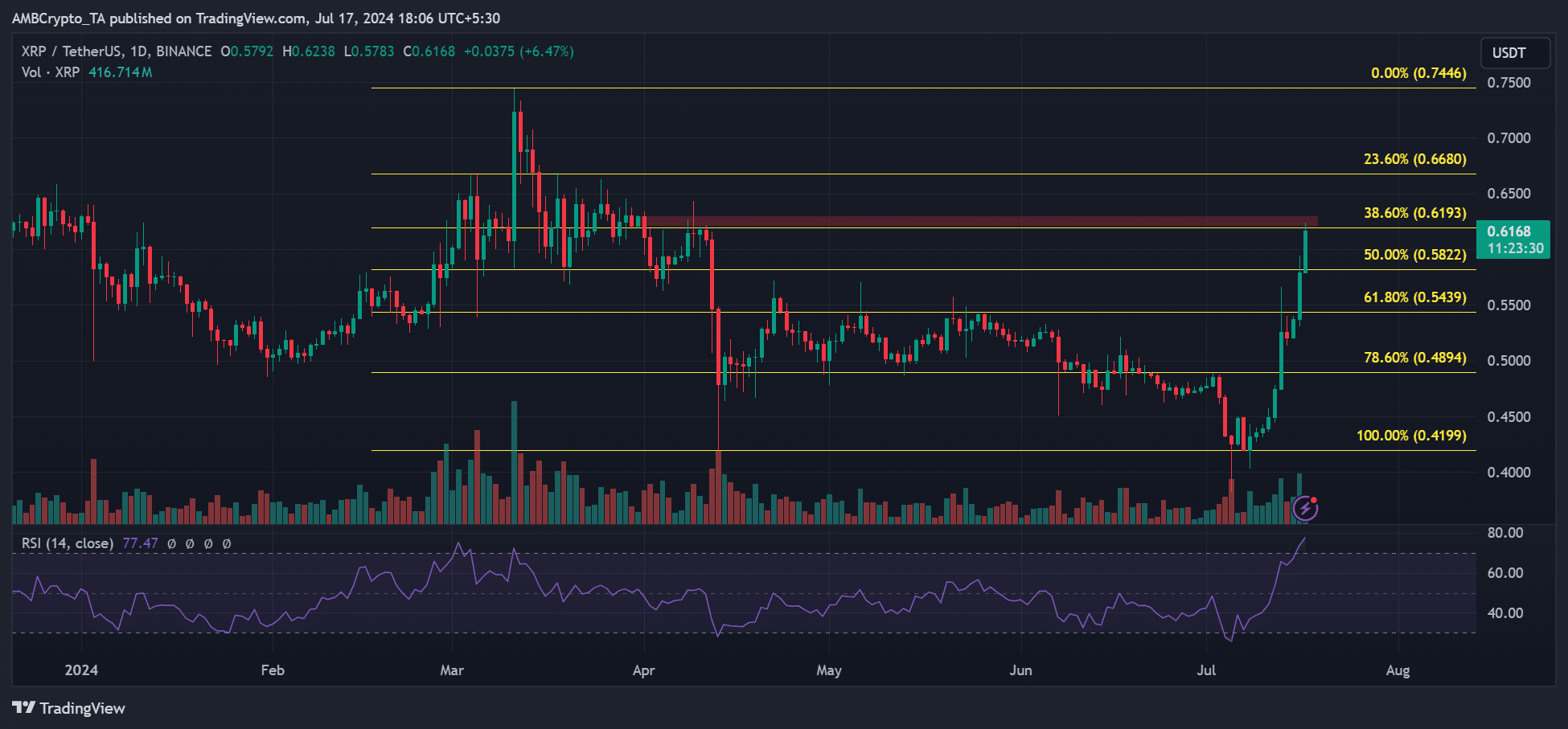

- Data and Statistics: Analyzing XRP's price history, transaction volume, and market capitalization alongside relevant regulatory developments and competitor analysis is crucial for a comprehensive assessment. (Include relevant data and charts here – this section requires factual data and links to reliable sources)

Considering these factors, a realistic assessment suggests that while XRP has demonstrated impressive growth, its sustainability is far from guaranteed. The ongoing legal battle and general market volatility present major risks.

Conclusion: The Future of XRP and Investment Considerations

The future of XRP remains uncertain. Its success hinges on a favorable resolution to the SEC lawsuit, continued adoption by financial institutions, and its ability to navigate the competitive landscape. While its technology shows promise, the inherent volatility of the cryptocurrency market and regulatory risks cannot be overlooked.

Before investing in XRP or any cryptocurrency, it's crucial to conduct thorough research and understand the risks involved. The potential for significant gains is matched by the potential for substantial losses. Consider your own risk tolerance and consult with a financial advisor before making any investment decisions. Remember that informed decision-making is paramount when considering Ripple's XRP.

Featured Posts

-

Xrp Breaks Key Resistance Fueling Speculation Of A 10 Price Prediction

May 01, 2025

Xrp Breaks Key Resistance Fueling Speculation Of A 10 Price Prediction

May 01, 2025 -

Is A Ripple Settlement Imminent Xrp Commodity Status In Focus

May 01, 2025

Is A Ripple Settlement Imminent Xrp Commodity Status In Focus

May 01, 2025 -

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 01, 2025

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 01, 2025 -

900 People Receive Debt Relief Thanks To Michael Sheens 1 Million Donation

May 01, 2025

900 People Receive Debt Relief Thanks To Michael Sheens 1 Million Donation

May 01, 2025 -

Sdr Azad Kshmyr Brtanwy Parlymnt Ky Kshmyr Ky Hmayt Pr Ahm Byan

May 01, 2025

Sdr Azad Kshmyr Brtanwy Parlymnt Ky Kshmyr Ky Hmayt Pr Ahm Byan

May 01, 2025

Latest Posts

-

Merck To Build 1 Billion Factory For Blockbuster Drug In The Us

May 01, 2025

Merck To Build 1 Billion Factory For Blockbuster Drug In The Us

May 01, 2025 -

Canadian Federal Election Poilievres Seat In Question

May 01, 2025

Canadian Federal Election Poilievres Seat In Question

May 01, 2025 -

Analysis Pierre Poilievres Electoral Setback In Canada

May 01, 2025

Analysis Pierre Poilievres Electoral Setback In Canada

May 01, 2025 -

China Lifes Successful Investment Strategy Higher Profits

May 01, 2025

China Lifes Successful Investment Strategy Higher Profits

May 01, 2025 -

Canada Election Results Poilievres Unexpected Loss

May 01, 2025

Canada Election Results Poilievres Unexpected Loss

May 01, 2025